Is marketing technology consolidating or diversifying?

Every few weeks it seems like we see a new round of marketing technology acquisitions, especially from Oracle, Adobe, IBM, Salesforce.com, Google. For example, Google’s recent acquisition of Wildfire. There are certainly plenty of anecdotes to support the narrative that marketing technology is consolidating.

At the same time, however, the pages of TechCrunch, VentureBeat, PandoDaily, GigaOm, etc., are constantly pumping out announcements of new ventures launching in this space. For instance, this recent article on GoodData. And while not all start-ups make it past the embryonic stage, enough of them gather enough momentum to achieve escape velocity and become real companies.

So, which is it? Is the inflow greater than the outflow, or the other way around?

Working on my updated marketing technology landscape for this year, I’ve come to the conclusion that the answer is both. Once you start breaking down marketing technologies into subcategories — email marketing, marketing automation, testing & optimization, etc. — you can see which are growing and which are contracting.

Some subcategories of marketing technology have clearly consolidated. CRM is fairly mature, with Salesforce.com, Oracle, and only a handful of other contenders. Web analytics — as a subset of technologies within a broader analytics category — is also relatively mature, with Google, Adobe, IBM, and Webtrends holding the strongest leads. And, more recently, PPC bid management software has narrowed, with Adobe, Marin, Acquisio, and Kenshoo. Consolidation has happened both via acquisitions and organic attrition of ventures that didn’t make the cut.

Other subcategories, however, are diversifying at an explosive rate. Take, for example, social media marketing products and platforms. In spite of major deals such as Google’s acquisition of Wildfire, Oracle’s acquisition of Vitrue, and Salesforce.com’s acquisition of Radian6, the number of new and growing ventures in the space is staggering. Check out Awareness, Attensity, awe.sm, Actionly, ArgyleSocial — and that’s just a few that begin with “a.”

And just when you think a category is locked up, shifts in the overall landscape of marketing crack open fresh opportunities. So the CRM market might be mature, but the emerging concept of social CRMs has given new players such as Nimble and SpoutSocial a foot in the door.

Forces driving consolidation vs. diversification

There are lots of reasons why the marketing technology landscape is continuing to expand and diversify. First, there is the opportunity, which is measured in billions and is still largely greenfield:

- The migration from traditional to digital marketing still has hundreds of billions of dollars on the table. This isn’t just a shift from TV ads to web banner ads; it’s a shift in what constitutes marketing beyond old-school advertising tactics.

- The digital vehicles in which marketing operates are still being invented and shaped — even major players such as Facebook and Twitter are still experimenting with their offerings to marketers on which their businesses are (theoretically) based.

- Buyer behavior patterns are changing in both B2B and B2C — evolving mobile interactions as one example. Consider the BYOD (bring your own device) movement in companies, which has powerful implications on how prospects are reached and engaged in B2B marketing.

- Most companies are still facing enormous challenges in operationalizing their marketing engines in this new environment and are seeking solutions. (See everything is marketing, everyone must be agile.)

- Products that specialize in a particular “point solution” can often out-innovate more general-purpose products that are covering too wide of a swath of the broad marketing technology landscape.

- The next new thing in the digital world — digital environments in our cars? NFC interactions with mobile devices? the next-generation of TV? wearable computing? Internet-connected home appliances? a whole new kind of social network? — can appear at any moment, and with it, alter the entire field of marketing again. The only thing constant in marketing these days is change.

Then there are the enablers to chase those opportunities, which have lowered the barriers to entry:

- Small teams can produce amazing software quickly. Thanks to great open source frameworks and platforms, along with cloud computing architectures, it has never been easier, cheaper, or faster to create compelling software. If you have an idea, you can make it real.

- The lean start-up movement has established a business framework for launching such ideas quickly and effectively.

- Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS) providers give start-up companies the ability to deploy robust and highly-scalable solutions on-demand. You don’t have to build out your own datacenter.

- Capital is readily available and actively chasing these opportunities in the marketing space.

- Every time there is a change in the marketing environment, the incumbent vendors are at risk — the larger they are, the harder it is to adapt their businesses and their platforms to quickly address the new requirement. This gives new start-ups a window of opportunity.

- Digital marketing, ironically, makes it easier for start-ups to reach a laser-focused target audience.

- The world economy is increasingly encouraging entrepreneurship (with carrots and sticks).

But what about consolidation? In many ways, the forces at work in marketing technology consolidation are the same forces that drive consolidation in almost any industry:

- If a certain subcategory of marketing technology stabilizes — as, say, search PPC bid management has — then it becomes harder for products to differentiate, and the field narrows; one product can substitute for another more readily, encouraging eat-and-convert acquisitions.

- Investors eventually want an exit, which provides pressure to sell to a larger company or go public and buy up smaller companies.

- Other things being equal, buyers would prefer to deal with fewer vendors.

- Other things being equal, buyers don’t like to swap out implemented solutions; with a finite number of buyers, a certain subcategory will eventually become saturated.

- Platform providers — Salesforce.com is a great example, and some marketing automation products seem headed this way — thrive by having other developers build on top of their foundation. But developers, who become the lifeblood of a platform, are only able to cater to a limited number of platforms. System dynamics push to settle on a few dominant platforms.

I think there’s another factor in consolidation that influences the marketing technology space: the more a subcategory’s data has long-term value, the more the market seeks consolidation.

This would explain why three generations of CRMs have tended to converge to a few players. The CRM has become the de facto “system of record” for tracking marketing’s relationship with customers over years. In contrast, social media marketing is ephemeral — the half-life of insight from social media monitoring may be measured in days or weeks, but not years. Companies can switch to a new social media monitoring product with less concern about historical data.

The case for consolidated platforms and diversified ecosystems

Question: Is the app store on Apple (a) consolidating and shrinking or (b) diversifying and expanding?

With over 650,000 apps and growing (“there’s an app for that”), the answer is obviously (b). Sure, there are some rock stars such as the Angry Birds franchise, and certainly lots of apps that fade away after their first release. But in between those two extremes are many solid, successful apps that address the needs and desires of specific target audiences.

You don’t hear massive clamoring for app consolidation. What Apple has done — Android too, and Microsoft hopefully — is create an ecosystem where diversification is a feature, not a problem. Of course, that’s only made possible by consolidation of the underlying platforms: the three horse (?) race of Apple, Android, and Microsoft’s Windows Phone 8.

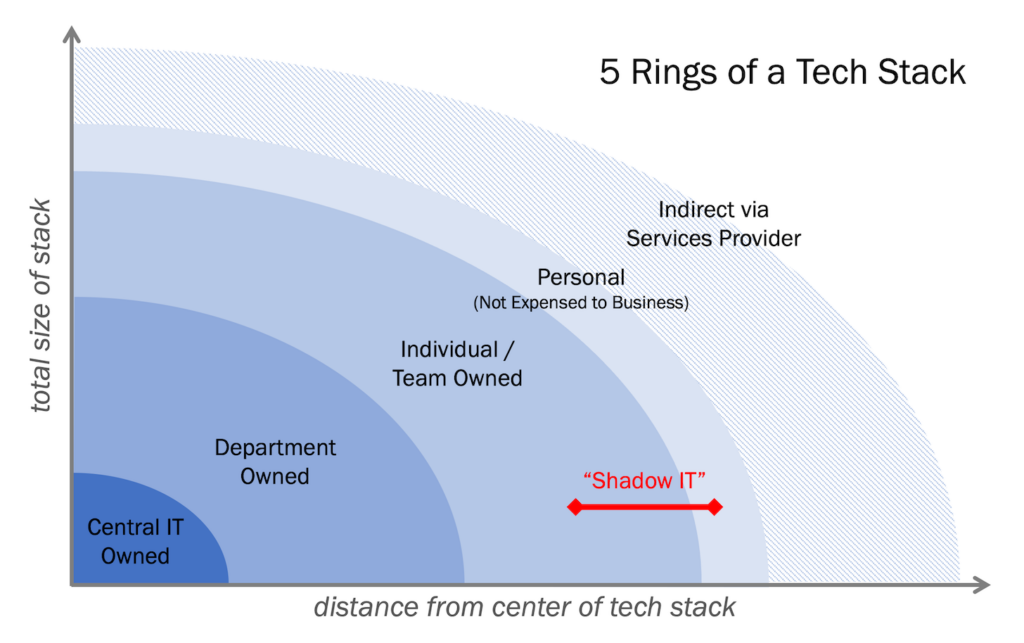

Marketing technology doesn’t have to take it to that extreme to harness some of the same dynamics. As I discussed in my post comparing suite, platform, and portfolio strategies in marketing technology, a platform offers a good balance of consistency in fundamental data and processes with flexibility in plugging in more specialized capabilities.

Despite the reasons for consolidation (“other things being equal”), I believe marketers will need some strategy to address diversification for two key reasons:

- The marketing landscape is going to be in flux for the foreseeable future.

- Marketers must continually seek ways to differentiate their brands and experiences.

A small number of fundamental platforms — Brian Halligan of HubSpot has called them marketing operating systems, furthering the iOS analogy — supporting a diverse ecosystem of specialized applications offers the best of both worlds. Ironically, such consolidation of platforms would encourage more diversification of applications that could build on top of those foundations.

These applications may not be as tightly bound to their respective platforms as they are with iOS, but rather may be more loosely coupled, exchanging key data and events via APIs. Services such as Zapier hint at the possibilities of a configurable fabric of different applications.

Consolidation of platforms would not only encourage diversification of other commercial marketing technology offerings, but it would enable companies (and, interestingly, agencies) to develop more custom components and “creative technology” experiences connected into these marketing backbones. As Jon Miller of Marketo recently said, “When marketing departments and lead generation agencies share common technology, the leads and information can be synced in real time.”

Which subcategories of marketing technologies will emerge as these platforms? CRMs such as Salesforce.com probably have the strongest position today, but marketing automation systems such as Eloqua, Marketo, HubSpot, Aprimo, Act-On, Pardot, Infusionsoft, etc., hold much promise to serve as the backbone of many marketing processes. Other contenders may emerge from multi-channel marketing solutions, web experience management systems, and a new generation of big data/business intelligence/analytics products.

Potentially, some service providers may evolve into a kind of virtualized platform themselves — Axciom, Experian, Epsilon, Accenture, Infosys, and possibly the next generation of large agencies may provide a service layer wrapped around a technology backbone. Ventures such as Fabric and Code illustrate some of the possibilities of that approach. But that’s a post for another day.