When it comes to valuations, the marketing technology landscape seems to follow, more or less, a power law distribution. A few companies are worth a tremendous amount of money, the so-called “fat head” of such a distribution. And then there’s a “long tail” of ever smaller niche companies that trail behind them as far as the eye can see.

Most of the excitement in the market is naturally around the fat head — as Willie Sutton (never) said, “That’s where the money is.” I’m perhaps a bit of an outlier for my fascination with the long tail of these thousands of smaller marketing technology companies.

To me, such a long tail is unique in the history of business software — although we are seeing this in other functions today aside from just marketing. It also represents a phenomenal opportunity for platforms that make the long tail more accessible to marketers. Can the major marketing clouds do for smaller martech developers what Amazon did for niche authors? In aggreggate, that long tail has the potential to wag the dog.

But I also love spelunking in the long tail because that’s where many of the latest innovations in marketing are being incubated — it is a dazzling star foundry — and from where the next generation of fat head successes will emerge.

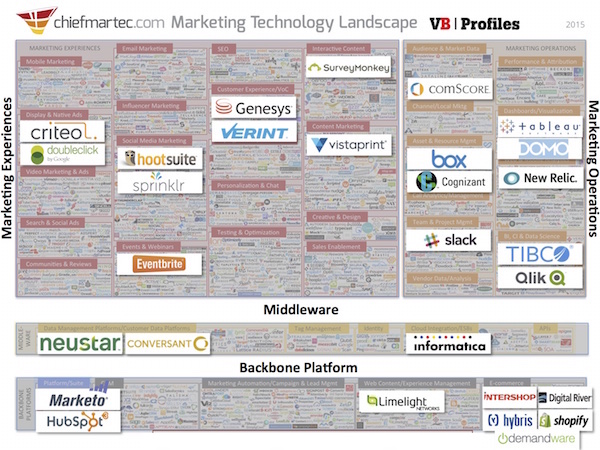

The popular name for those stars who break out from the pack are “unicorns.” Definitions vary, but the folks at VBProfiles consider a company to be a unicorn if they have a valuation of more than $1 billion and were created less than 25 years ago. Using that criteria, they analyzed my marketing technology landscape — but excluding the more generic categories of “Internet” and “infrastructure” companies — and identified 29 martech unicorns.

That’s pretty amazing when you think about it.

Of course, the boundaries are fuzzy because, well, my landscape is fuzzy. Should tools like Slack, Box, and Tableau be included? They’re certainly used by marketers, and are indeed very valuable to marketing operations teams, but they’re also used by plenty of other departments and professionals. Should e-commerce platforms really be under the marketing technology umbrella, or considered a universe of their own? (I think “both” — but we’ve already established that I’m an outlier.)

But even taken with a big grain of salt, 29 $1billion+ software companies that in some way touch modern marketing is impressive.

And in truth, this underrepresents the scale of marketing technology innovation that has risen up to the fat head. I generally eliminate companies from my landscape once they’ve been acquired — ExactTarget by Salesforce, Eloqua by Oracle, Omniture by Adobe, etc. VBProfiles’ unicorn definition eliminates companies that are older than 25 years. So many of the biggest players in the fat head — Adobe, HP, IBM, Microsoft, Oracle, SAP, SAS, Teradata, and all their respective martech acquisitions — aren’t included here.

By the way, Salesforce should have been included as a unicorn. The VBProfiles team and I just realized that today, even after looking at earlier drafts of their research for the past several weeks. Salesforce is just such a giant in this space — and all its peers are more than 25 years old — that it’s apparently easy to forget that they are still a relatively young company.

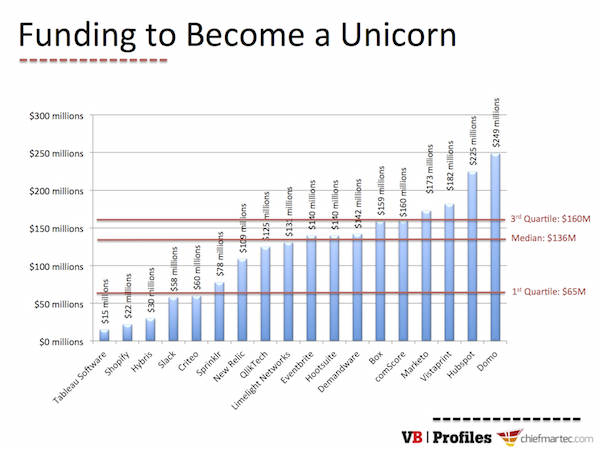

I’m sure there are other mistakes here too, so feel free to chime in below. But all of the above is largely a disclaimer to the real point of this post — which was to let you know that you could pick up a free copy of VBProfiles’ Marketing Tech Unicorns report. It includes some very interesting analysis of these 29 unicorns, such as this graph of their relative funding:

Really interesting – thank you!