Apologies for that metaphor — admittedly wrong on so many levels. But bear with me.

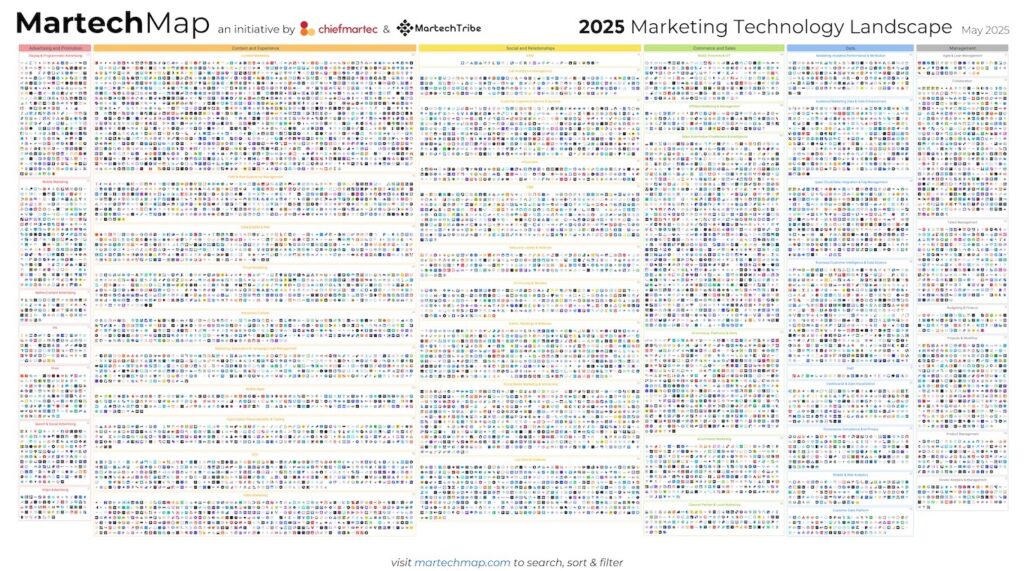

Last week, Forrester announced their “wave” report for enterprise-class marketing clouds. Officially, it was a report on enterprise marketing software suites (EMSS). But since at least half of the vendors evaluated refer to their offering as a “marketing cloud,” it is popularly framed as part of the epic of our time, Star Wars: Episode VII — The Marketing Cloud Wars.

Congratulations to Adobe and Salesforce.com, who were ranked as leaders in the field. SAS, Oracle, Teradata, and IBM were noted as strong performers. And Marketo and SAP were identified as contenders.

I confess though, I have mixed reactions to the report.

On one hand, it’s terrific to see this category — marketing clouds are officially a category now — receive more attention and impartial analyst review. Forrester’s methodology, which involves vendor briefings, product demos, and customer reference calls and surveys does a good job of identifying some of the common architectural traits among the contestants, er, vendors, and the major trends for the category.

At the same time, there’s something about boiling these massive, multifaceted suites down to a single wave graphic that feels a little oversimplified to me.

I don’t mean to pick on Forrester here — I could easily see this same kind of report with a magical quadrant from another analyst firm. I don’t mean to downplay Adobe or Salesforce either, who have both built and assembled amazing solutions. They are unquestionably leaders in the space. But having seen very sophisticated and successful implementations of almost all of these vendors in the field, I think the “right” solution is still highly dependent on the context of the specific buyer.

For example, Forrester notes that some vendors received lower marks for their B2B ancestry — which is not necessarily conducive for large B2C implementations. But if you’re a B2B enterprise, that’s a feature, not a bug.

There’s a lot of nuance in choosing large-scale marketing software these days.

As an example of such nuance, I recently saw a different wave report from Forrester on cross-channel campaign management. To me, if you’re in B2C enterprise marketing, cross-channel campaigns — or omnichannel marketing, in its ideal incarnation — are right at the center of what’s important to you. Yet in that “wave,” the leaders were Adobe, SAS, Infor, and RedPoint Global. With the exception of Adobe, that’s a different set of leaders.

Granted, that research was conducted a little earlier — Q1 of this year, in comparison with Q2 for the broader marketing clouds wave. A more specific study would also naturally have different dynamics than a broader one. Cross-channel campaigns are just a piece of the puzzle. But the fact that Infor and RedPoint are leaders there, yet are not in the running for EMSS, demonstrates that best-of-breed choices are still very much on the table, even in Forrester’s own analysis portfolio.

But perhaps most interesting of all was that Forrester identifies one of the primary sources of this dissonance in their survey of customers for the EMSS report. According to Forrester, “[Buyers] want best-in-class solutions for specific marketing objectives, while they also want end-to-end integration across these solutions to deliver more consistent brand experiences to customers.”

[Buyers] want best-in-class solutions for specific marketing objectives, while they also want end-to-end integration.

They add, “Vendors claim to provide both category-leading point solutions and an integrated suite across their products, but they overstate how desperate marketers are to streamline their marketing technology stacks.”

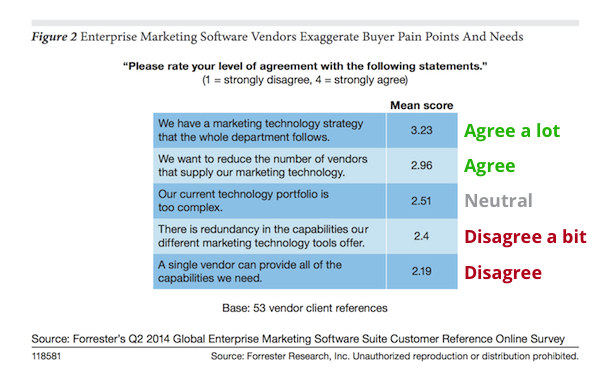

In summarizing buyer sentiments toward the “pain points” that vendors claim they have — which I’ve annotated below to highlight where buyers agree or disagree with vendor statements — Forrester reports that marketers do want to reduce the number of vendors they work with, but they don’t believe that a single vendor can provide all of the capabilities they need.

Forrester characterizes buyers as primarily seeking integration above all else. Good integration options make best-of-breed capabilities considerably more attractive.

The good news is that most of marketing cloud providers are galloping in this direction. Many of them have made huge strides forward in providing more open APIs and expanding their official ISV ecosystems. And from some of the R&D work that a few of these vendors have shared with me, I can confidently predict that the ease and power of these plug-and-play integrations will be pretty astounding over the next year.

That will permanently change the dynamics of this space. It won’t be about who has the best of everything built-in — simply an impossible quest in a world of such rampant innovation and change in marketing — but who has the best platform ecosystem upon which a marketer can craft an integrated stack that is ideally suited to their specific needs.

I previously tried to goad David Raab into doing an analysis of marketing cloud “platformality.” That only served to get devil’s horns painted on my portrait.

But perhaps I can nudge Forrester in that direction? While I’m skeptical of a single wave to cover all of marketing, I do think “platformality” is a more finite axis by which to evaluate the vendors in this field.

P.S. To partially make amends for my inappropriate opening metaphor, I leave you with this takedown of the Miss America beauty pageant by the brilliant John Oliver:

As all good analysts should know, making the prediction is less valuable then the importance of the timing.

Appreciate the metaphor, Scott. Very apt.

Agree completely that one size does not fit all; there are significant differences from both a technical and marketing perspective, depending on industry, business and marketing strategy being pursued, existing technology base, to name a few. Glad you are calling this out.

I also agree that raising the idea of ‘Platformality’ is important and should be a more active consideration for all MarTech architects… you can readily evaluate and discern how committed each of these vendors are to building a platform ecosystem around there model — which has significant implications long term. While a full evaluation and assessment has yet to be completed, conducting this as high level exercise when selecting a platform direction is still valuable and actionable.

Biasing toward solutions with ‘High Platformality’ should be pursued where possible (generally speaking). I don’t often see this in people’s thinking, but agree that it should be there! Keep pushing this!

Great points as usual, Scott. I confess that I had some similar confusion while reading this report.

I think that Forrester’s research methodology is particularly well suited for focus on a specific solution area – like campaign management, digital analytics, lead management, etc. (where we see many of these same vendors). But in broadening the scope to essentially the entire sweep of “martech” suites, this research misses the specific strengths that define each platform.

There are big differences between the marketing platforms offered by Adobe, IBM and Salesforce, for example, but at least I understand why they’re reviewed in comparison with one another. But SAP? SAS? Marketo? Each have adjacent or pure-play solutions in particular areas (some quite strong!), but are not fully integrated marketing suites per se. Someone’s being included in the wrong peer group here.

I disagree with some of the methodology and rankings here too, but that’s a separate criticism (after all, everyone inevitably does after research like this comes out, and obviously I’m not impartial). The immediate point, though, is that I don’t think we’re quite at the point yet where all the “enterprise marketing clouds” are actually apples-to-apples comparators yet.