It’s been said that the explosion of software vendors in marketing is an anomaly. Certainly if you compare that with enterprise software markets as we knew them ten years ago, that’s true. People look at my landscape of nearly 1,000 marketing technology vendors — which is only a representative sample — and shake their heads in disbelief.

I’ve made the case for why I think 1,000-plus marketing software vendors could be the new normal. Yet many still consider it a market fluke, a freakish evolutionary mutation that is clearly not sustainable.

But here’s one more reason it’s probably not a fluke: it’s not just happening to marketing.

I live and breathe marketing software. But as a result of that obsession, I’ve paid little attention to most other software markets. So in my narrow view, even I assumed that this proliferation of software companies was unique to marketing.

Not so, actually.

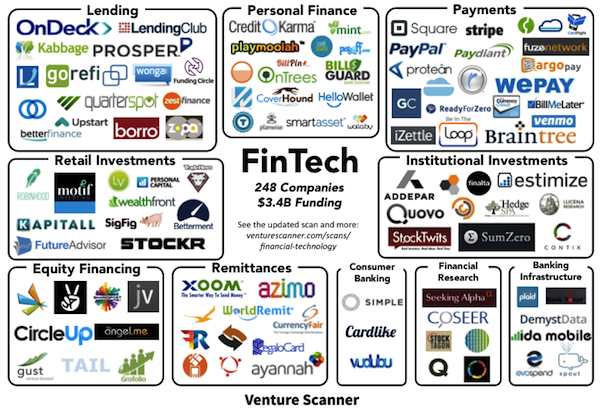

The graphic at the top of this post was made by Wayne Wong, an analyst with Venture Scanner, who tracks financial technology companies — colloquially known as “fintech.” Wayne has identified 1,012 fintech companies in 17 categories (the graphic is just a partial set). Over $12.7 billion has been raised by ventures in that sector. Wayne provides an excellent overview in a blog post on making sense of the fintech startup ecosystem.

Here’s another view of the fintech space by American Banker magazine — the AdAge of U.S. banking? — on the Top 100 Companies in FinTech.

And it’s not just finance either.

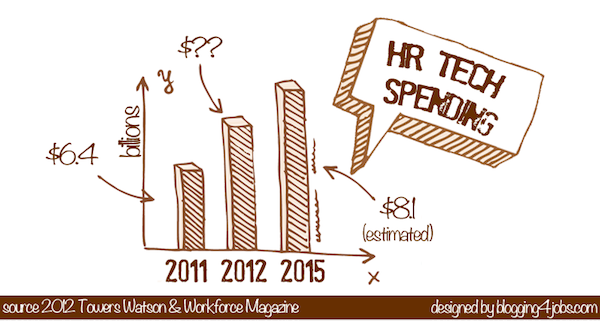

Last week, the HR Technology Conference had over 300 exhibitors offering human resource technology solutions. That’s just vendors who bought a booth at the Las Vegas show. There’s a big European HR Tech conference too, with a somewhat different set of companies. And while there are some really big vendors in the space — including Oracle and IBM, whom we know for their marketing clouds — most of the vendors are relatively small and entrepreneurial.

To put that in a context that we marketers can appreciate, Dreamforce, our industry’s largest conference, which I’ll be speaking at later today, has around 350 exhibitors — across both marketing and sales. That makes them almost equivalent in the size of their exhibitor ecosystems.

According to TowersWatson and Workforce Magazine, over $8.1 billion will be spent on HR tech in 2015. This is a market on fire.

But wait, there’s more.

A friend of mine in the legal profession has been insisting to me for the past year that she’s seeing the same software explosion in legal tech that I’ve seen in martech. She’s been thinking of sketching out a landscape like mine to chart the space. In the meantime, a quick Google search found a whole LegalTech conference that will have over 100 exhibitors at their next event in February.

We’re preparing for up to 40 exhibitors at the next MarTech conference in the spring, which will be big — but we’d have to grow by an additional 150% on top of that to catch up with LegalTech.

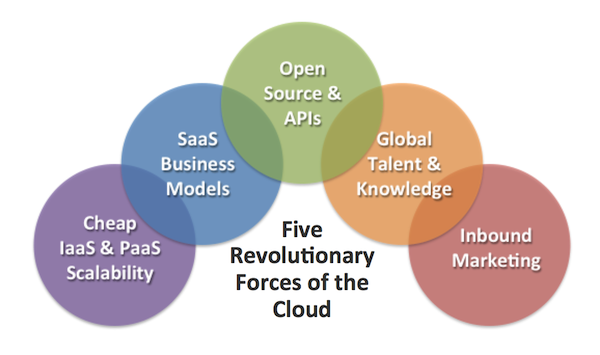

As my eyes have been opened to all these different software companies across all these different professions, one thing becomes clear: we’re not just living in a Golden Age of Marketing Software. This is a Golden Age of Software in general. The five forces of the cloud, which I described in my 1,000+ marketing technology vendors post, are just as applicable to any other industry.

Marketing software may be the largest of its peers, but it’s definitely not an anomaly.