Man, people sure do find anecdotes more persuasive than data. (As an aside, this is why machine learning can be so helpful in applying true data-driven marketing — our human biases really skew our perception of reality.)

We most recently released the 2018 marketing technology landscape with the data showing nearly 7,000 martech-related vendors. I then followed up with a post — intentionally a little provocative — proposing that the myth of martech consolidation is dead. Because, seriously, after 8 years of the landscape growing, despite continuous predictions from people that year-over-year that it couldn’t, shouldn’t, wouldn’t… you have to acknowledge that the dynamics of software today are probably different than the market models of the 1980’s and 1990’s.

But, over the past few weeks, we had a handful of martech consolidation headlines in the news. Marketo acquired Bizible. Seismic acquired SAVO. Klout was shut down.

So, of course, I get a bunch of emails from people saying, “How do you explain that, Mr. Crazy Martech Landscape? Clearly, it’s all consolidating now!”

I sigh, because the other firehose of emails I’m receiving at the exact same time is a flood of requests from dozens of martech companies either disappointed or outright angry that we failed to include them on the landscape.

The ratio is approximately 10-to-1: the number of new martech companies I hear about compared to the number of martech exit events I hear about. The quantitive data suggests that, as far as the total number of martech-related vendors in the world goes, we’ve still got expansionary dynamics in play.

But here’s why this expanding/consolidating argument is so frustrating to both sides.

Martech is always consolidating. Businesses come and go. I’ve acknowledged many times that the distribution of vendor scale in the martech industry is a long tail — a small number of giant companies at the head and an immense diversity of small ventures stretching far into the tail. Consolidation is what gives us the head of that tail.

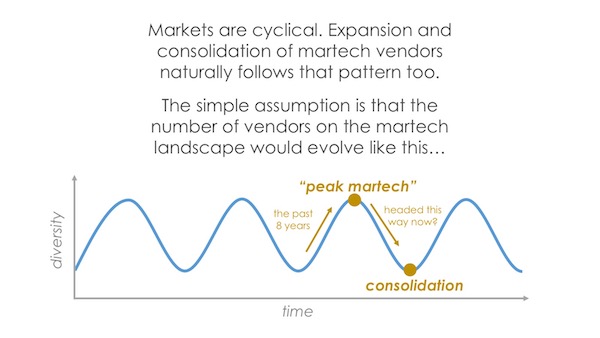

It’s a near universal truth: markets and businesses exhibit a cyclical pattern of expansion and consolidation. But there are other forces at play here too.

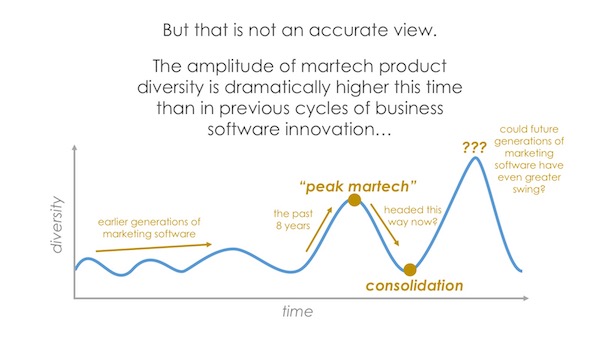

But the simple view of that cycle, illustrated in the graph at the top of this post, doesn’t capture the full model of what’s happening in our industry. A somewhat more accurate view of consolidation cycles in marketing software — over decades — might look more like this:

If nothing else, you have to acknowledge that the amplitude of this expansion cycle is much greater than any that have come before.

There are a lot of supply-side and demand-side reasons for that. But it’s worth noting that many of those reasons are “net new.” For instance, the dynamics of the cloud, open source software, microservice architectures, the API economy, digital everything, etc., weren’t present in the expand-and-consolidate cycles of marketing software in previous eras.

The world has fundamentally changed. Software is everywhere. And all indications are that the diversity of software in general will be expanding for the foreseeable future. (As Jay McBain of Forrester wrote last year, there could be 1,000,000 software companies in the world by 2027.)

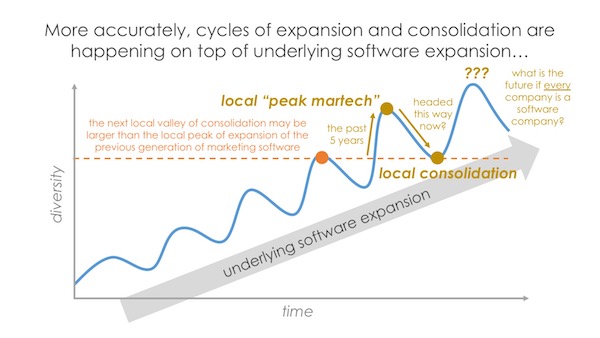

So a more accurate view of martech consolidation cycles is that they are indeed happening — but they are happening on top of a wave of underlying software expansion:

That underlying wave of software expansion seems to be overtaking the natural business consolidation dynamics that are absolutely still happening at the same time.

This F. Scott Fitzgerald quote comes to mind:

The test of a first-rate intelligence is the ability to hold two opposed ideas in mind at the same time and still retain the ability to function.

How far will The Great Software Expansion go? I don’t know. But I’m pretty sure it’s not out of steam yet. Because, well, that’s what the data shows.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.