To regular readers, it’s no surprise that I’m bullish on ecosystems. I’ve long advocated that platform ecosystems solve many of the challenges of an ever-changing, highly-diversified martech landscape. It’s also what I focus on at HubSpot, with the company’s ecosystem of technology partners. (So, yes, I’m biased. But that doesn’t mean I’m wrong.)

In my post earlier this month, I explained why platform ecosystems are powerful as an engine of innovation. Today, I’d like to highlight the remarkable impact ecosystems can have on a company’s go-to-market performance.

But first, I want to emphasize that I’m not just talking about software platform ecosystems. When it comes to go-to-market opportunities, many different kinds of businesses have an ecosystem of complementary products and services that are related to their business. Anything that influences your customers in how or why they select, use, or get value out of your own offerings is potentially part of the ecosystem around your business — whether you acknowledge it and actively manage it, or not.

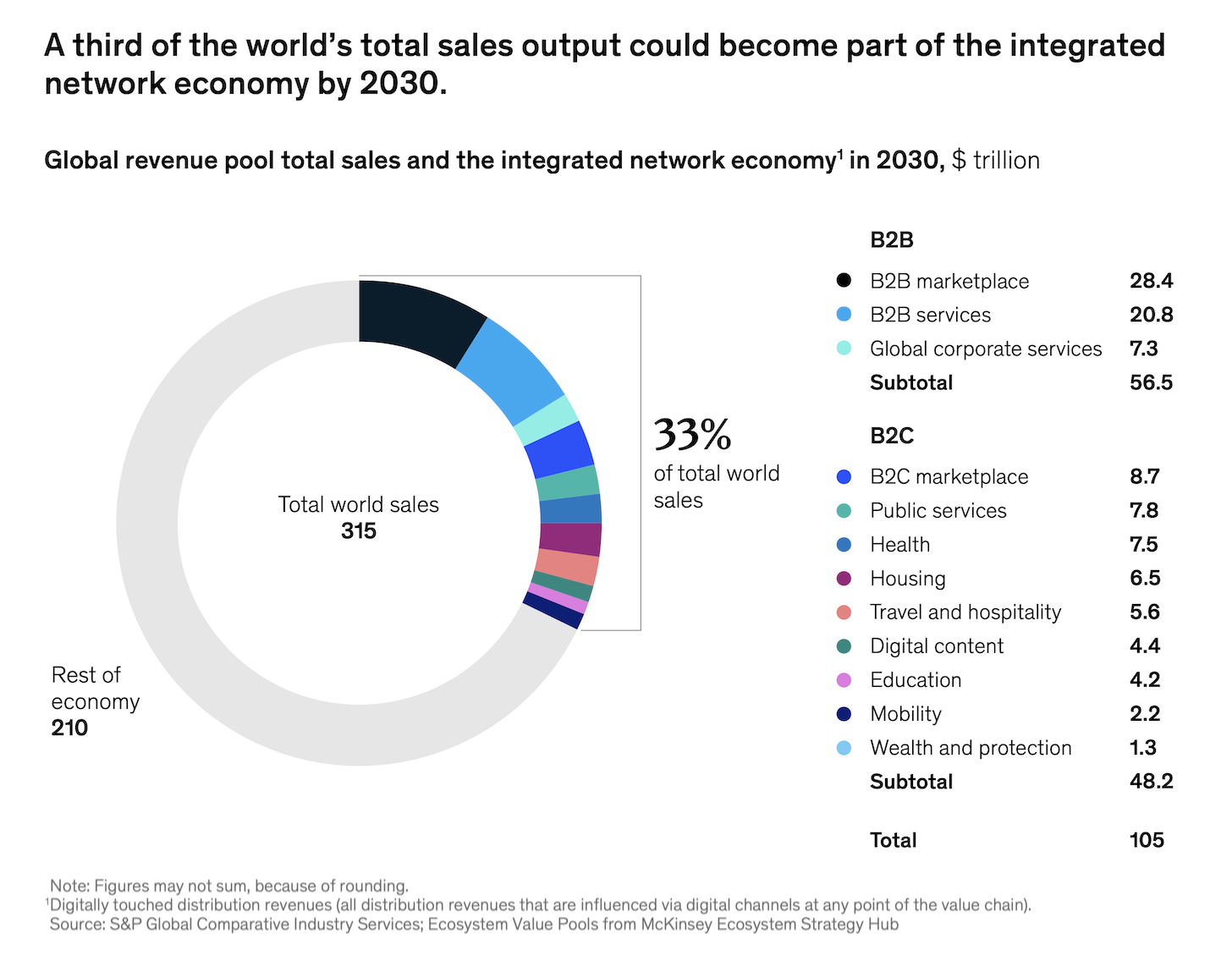

McKinsey, who studies these things at the macroeconomic scale, estimates that a full 1/3 of the world’s economy will be driven by “integrated networks” of related businesses — to the tune of $105 trillion (that’s trillion with a t) — by 2030.

It’s worth contemplating just how broad your own unearthed ecosystem may be.

Activating other companies in your ecosystem is usually done through partnerships. Classically, the majority of these are sales “channel” partnerships. But as Jay McBain — the world’s leading analyst in this domain — has pointed out, there are often many other potential partners who assist and influence sales and customer success, beyond the one partner who executes the purchase transaction.

All of them have potential to be harnessed in ecosystem sales and marketing motions.

HubSpot, Partnerships Leaders, and Pavilion just released a joint report on The State of Partner Led Growth, surveying over 200 marketing and sales leaders about how they leverage partnerships in their go-to-market and the performance impact they see from it. The results are pretty eye-opening.

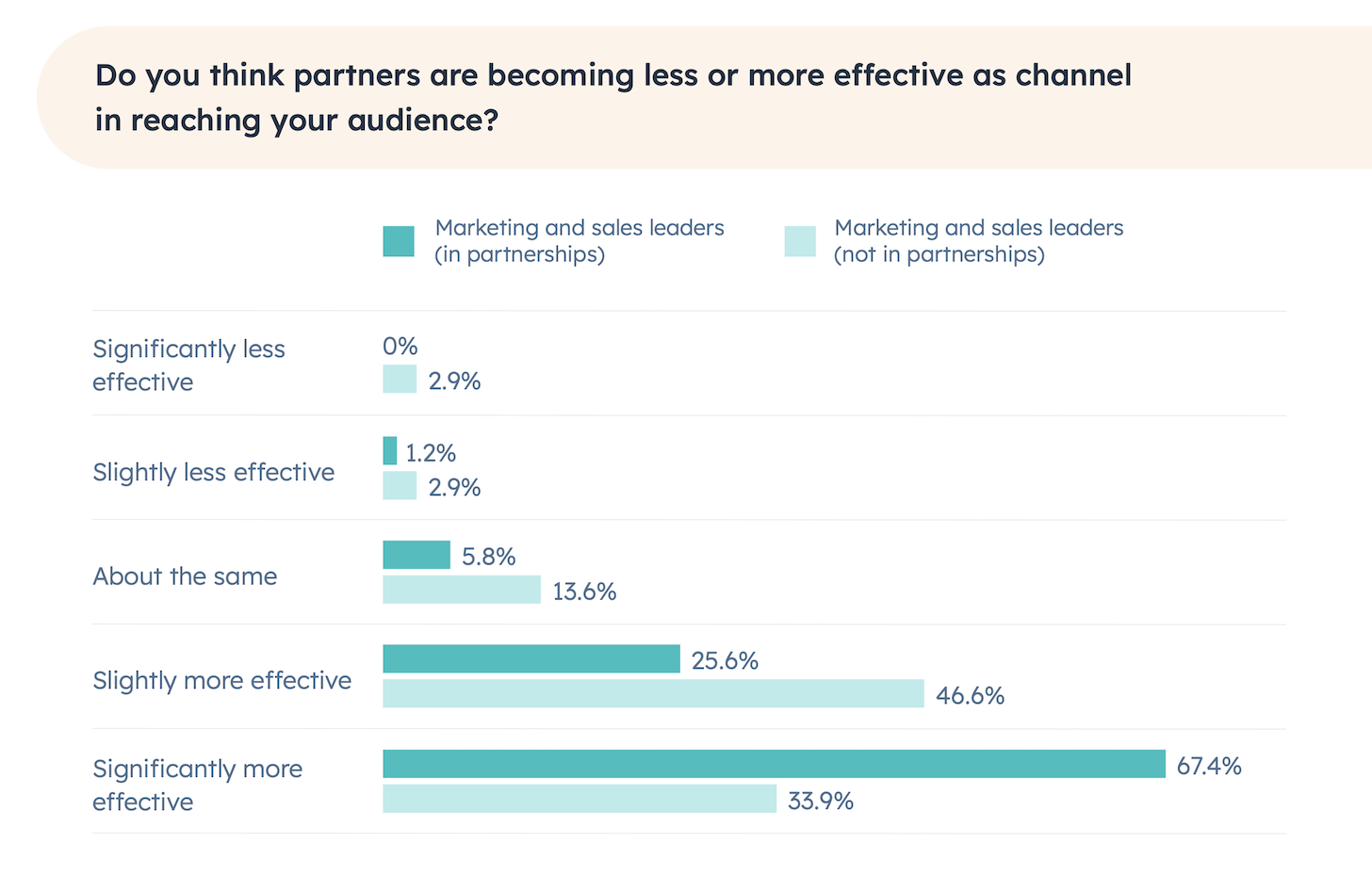

The chart at the top of this post has the key takeaway: 80.5% of marketing and sales leaders who aren’t directly in partnerships themselves (the light teal bars) report that partners are becoming a more effective channel in reaching their audience.

A full third of them (33.9%) said partners were becoming significantly more effective.

That’s remarkable because most marketing and sales channels are fighting noise and entropy that make them less effective. From demand generation in marketing to outbound prospecting in sales, the hill keeps getting harder to climb. So to have a go-to-market channel that is accelerating in its performance is noteworthy.

By the way, on the dark teal vs. light teal bars. Many partnership teams report into sales or marketing or the broader revenue org. So we segmented the responses from those leaders directly owning partnerships vs. those who don’t. As you’d expect, partnerships people tend to report a more optimistic view. The non-partnerships leaders bring a more objective lens, so I view their responses as closer to the ground truth. (That said, it is interesting to see where and by how much the two segments diverge in their opinions.)

Let’s look at a few other data points as to why partners are seen as more effective.

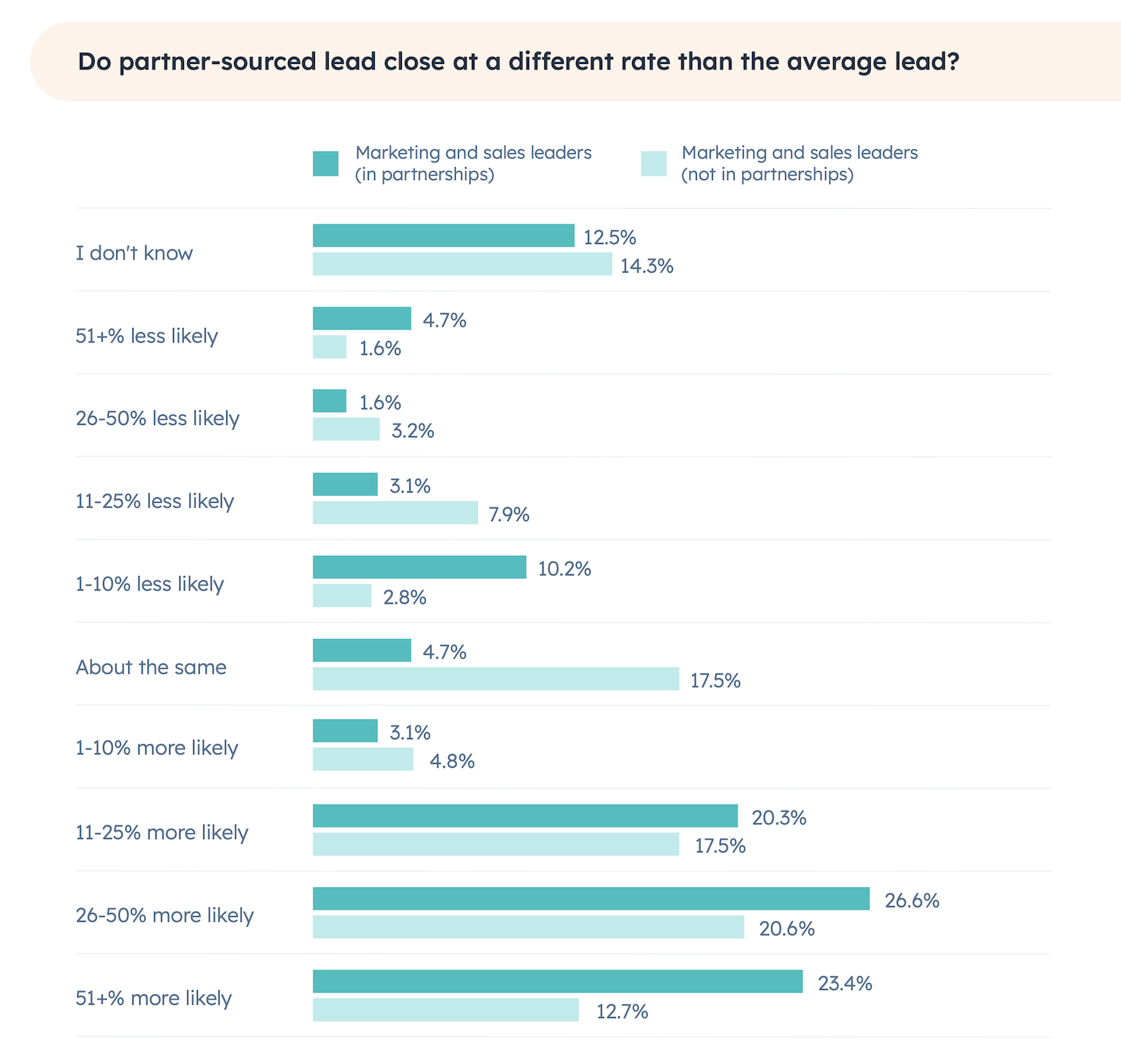

Quality leads are the bloodstream of B2B marketing, where “quality” is in the eyes of the sales org by their close rate. The majority (55.6%) of non-partnerships marketing and sales leaders say that partner-sourced leads close at a higher rate than the average lead. A third (33.3%) reported that partner-sourced leaders are significantly (26% higher or more) likely to close.

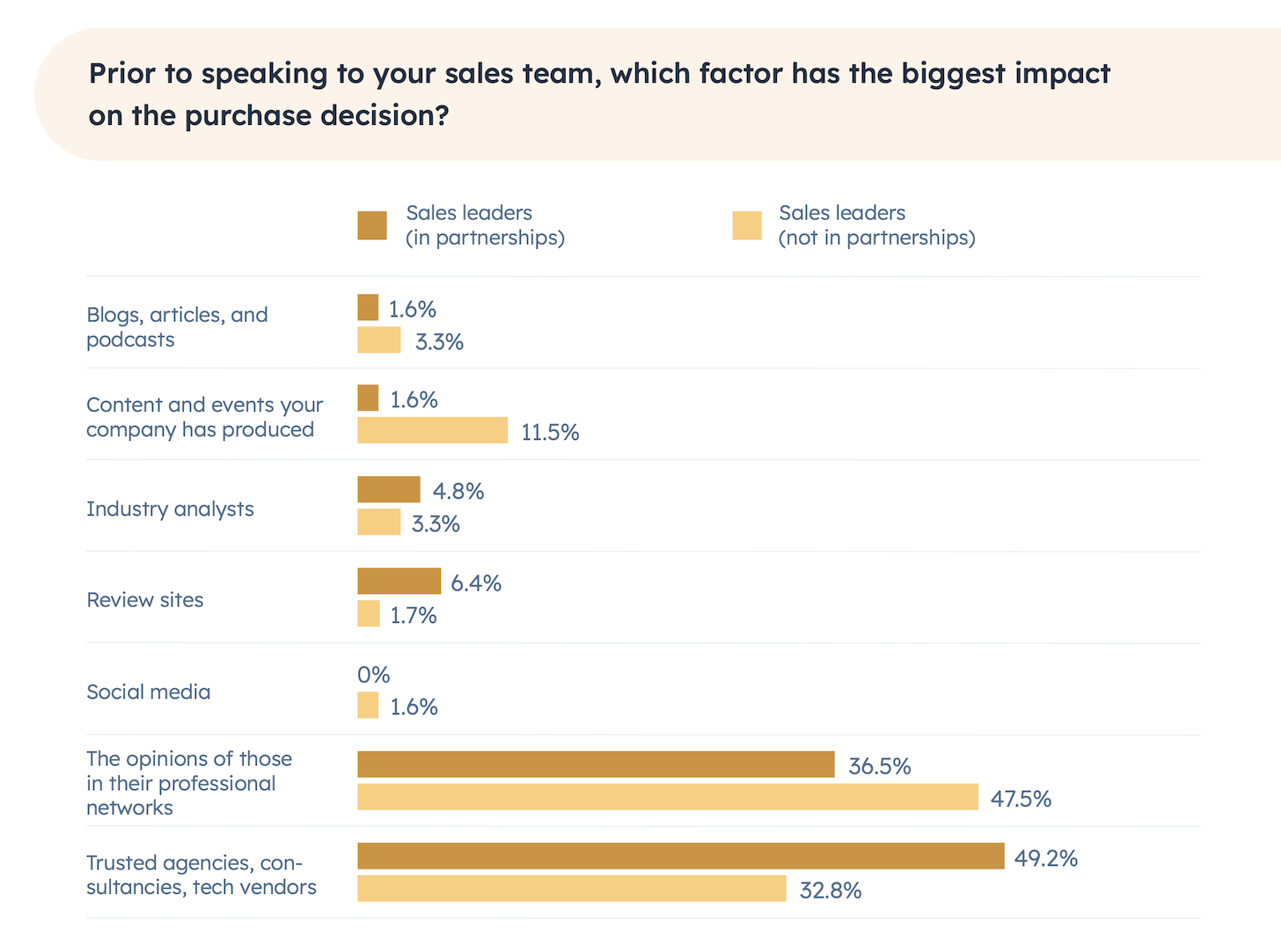

This goes beyond just sourced leads to also influenced leads. When non-partnerships sales leaders were asked which factor has the biggest impact on a prospect’s purchase decision, prior to speaking to the sales team, trusted agencies, consultancies, and tech vendors were ranked #2, only behind opinions of people in the buyer’s own professional network.

Given this data, it would make sense for marketing to look for opportunities to bring more partner-sourced or partner-influenced leads. One way to do that is through co-marketing programs and campaigns.

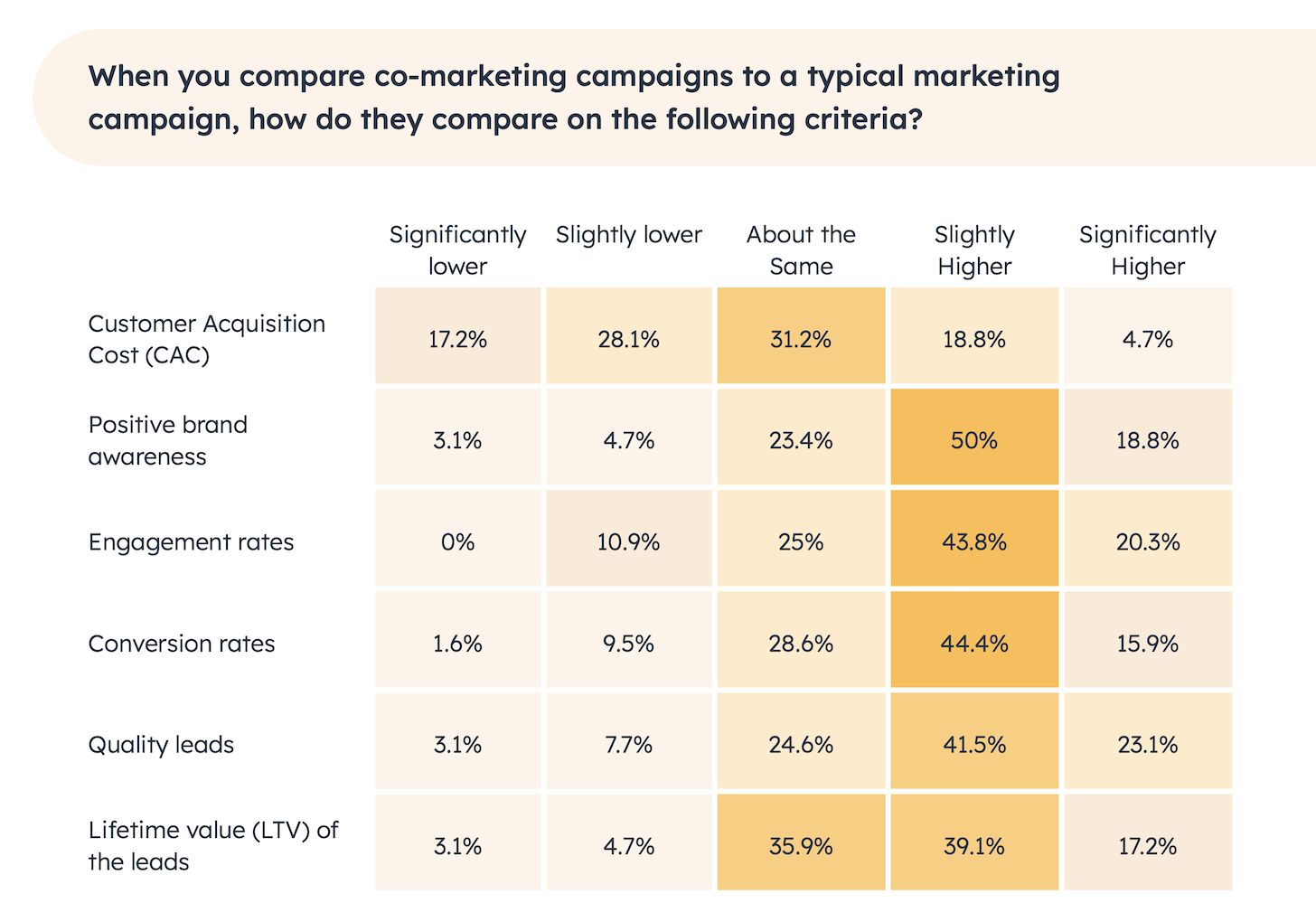

While co-marketing motions aren’t as common — for reasons we’ll dig into in a moment — the data suggests that they are more effective on a number of important dimensions:

For brand awareness, engagement rates, conversion rates, lead quality, and the lifetime value (LTV) of those leads, co-marketing campaigns outperform the typical marketing campaign.

The one criteria on which they don’t is customer acquisition costs (CAC). In some of the qualitative interviews conducted as part of this report, the concern of a “planning tax” was raised as a reason why co-marketing is less frequently pursued and view as more costly (in time and effort as much as hard costs).

This makes sense. Coordinating inside one’s organization can be challenging enough. Coordinating across multiple organizations even more so. But this is where I see an opportunity for marketing operations and a growing field of partner-oriented marketing technology to help systematize and optimize more ecosystem marketing motions. The space around 2nd-party data martech is evolving rapidly, and given the statistics in this report, the opportunities for leveraging it effectively are quite promising.

There’s a bunch more data in this report, which you can download for free, as well as fascinating interviews with CROs, CMOs, VCs, and GTM-experts from BCG — whew, that’s a string of acronyms — on different facets of running effective partner-led growth.