For 13 years of the ever-expanding martech landscape, conventional wisdom has predicted that our industry would consolidate.

That conventional wisdom has failed spectacularly.

Or more accurately, the conventional wisdom of the software industry from 10, 20, 30 years ago has been disrupted by new dynamics, in a new environment. The barriers to creating software are a fraction of what they once were — and are rapidly shrinking further with AI. The barriers to distributing software have collapsed (albeit while the costs of marketing and selling software at scale have risen as competition has multiplied). Even the thorny barriers to integration are steadily falling as an open data layer, APIs, and platform ecosystem standards proliferate in the everything-is-adjacent cloud.

It’s by no means a perfect environment. There are still plenty of challenges, including a raft of new, undesirable side effects from this Cambrian explosion of apps. But it is a different environment than the software industry of yesteryear. It’s one where pure consolidation strategies among vendors have been unable to keep pace.

I usually discuss the implications this has for marketers and marketing operations teams. How should they adapt to this environment? (I humbly suggest the New Rules of Marketing Technology & Operations as one helpful framing, as well as a perspective on aggregation within tech stacks, both horizontal and vertical.)

But today I’d like to propose a model for how martech businesses could be aggregated.

We need a new path for successful “long tail” apps

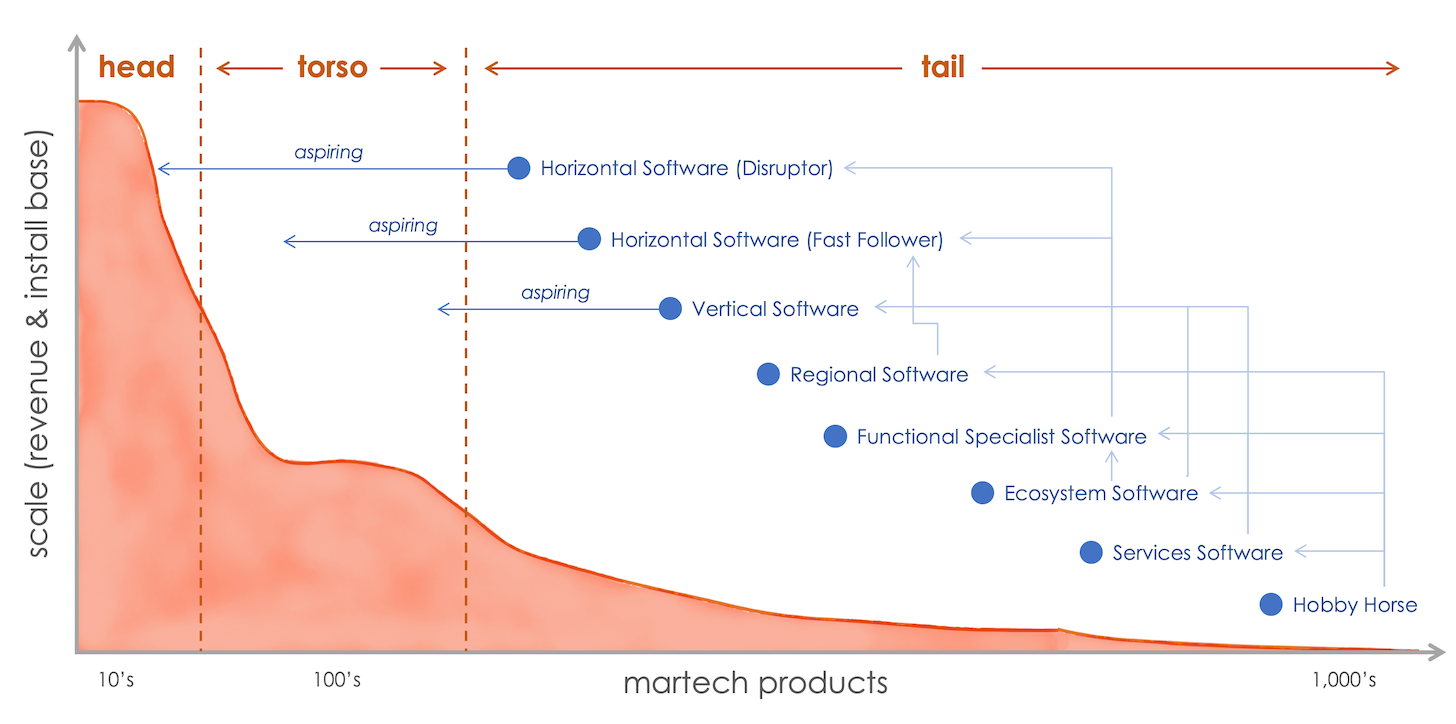

The scale of companies in the martech landscape has a long tail distribution. There are a couple dozen large, public companies in the head. A few hundred best-in-class leaders in the torso. And then thousands of small ventures in the tail. Approximating their orders of magnitude in revenue, the head are $1+ billion businesses, the toroso are $100+ million, and the long tail are typically $10 million or less.

In the traditional model of expected consolidation, every company aspired to climb up that hill to greater and greater revenue. Ambitious startups on the far end of the tail aspired to become juggernauts in the head one day — and many raised eye-watering sums of money from VCs to achieve that goal.

Of course, few ever reached the rarified air of that highest echelon in the head. A few did, which — thanks to the delusion of survivorship bias — egged on more startups and their VC enablers to attempt the ascent. Others took the short-cut of being acquired by a larger company in the head or torso. Those exits were less exciting than a big, fat IPO. But they were more common, typically 100-200 per year. And they could be lucrative enough exits for founders and their investors that this path became the dominant exit strategy for most funded martech ventures.

But that’s still a small number of exits relative to the total population of martech companies. What about the rest? Some simply went out of business or were sold for scrap. Others hit a revenue ceiling and, well, kinda got stuck there. Some made peace with that natural limit to their scale. That was often easier if they didn’t have VC investors banging on the table and “Uzi-ing execs in the parking lot”, as the colorful metaphor goes. But in the absence of a viable exit on the horizon, many slipped into a gray state known as the walking dead. Alive, but in a shambling sort of way.

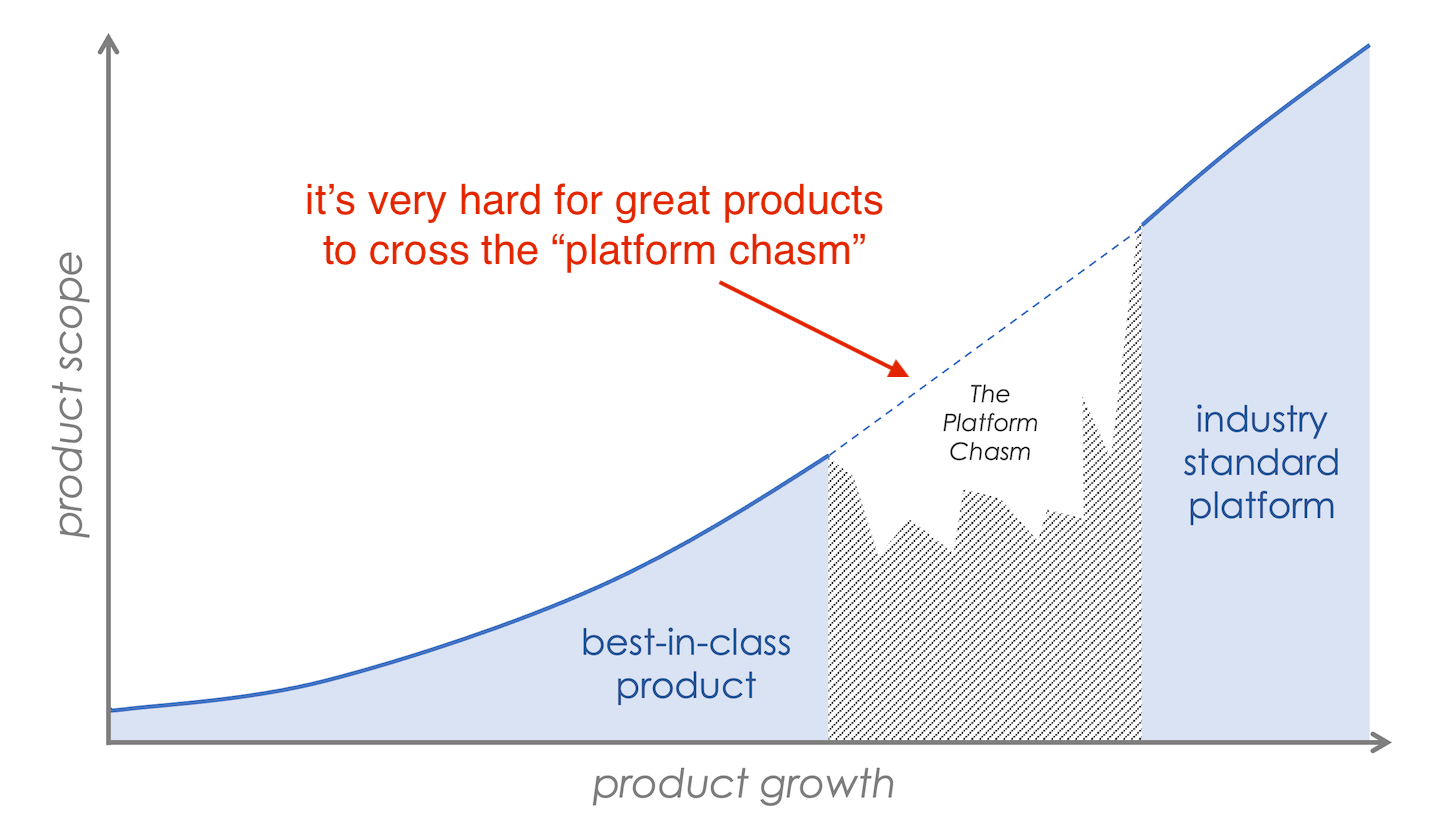

That can be a real shame, because in many cases, these are great products with happy customers. Their specialization — the core mission they lovingly obsessed over — was their strength. They did X better than anyone else did X. It’s just that there was a limit to the total addressable market for X. And trying to move beyond X rarely succeeded at porting over the same advantages of focus, expertise, passion, and imagination that they’d had with X. Many long to become platforms, but most are unable cross that chasm.

Turning roll-ups from graveyards into gardens

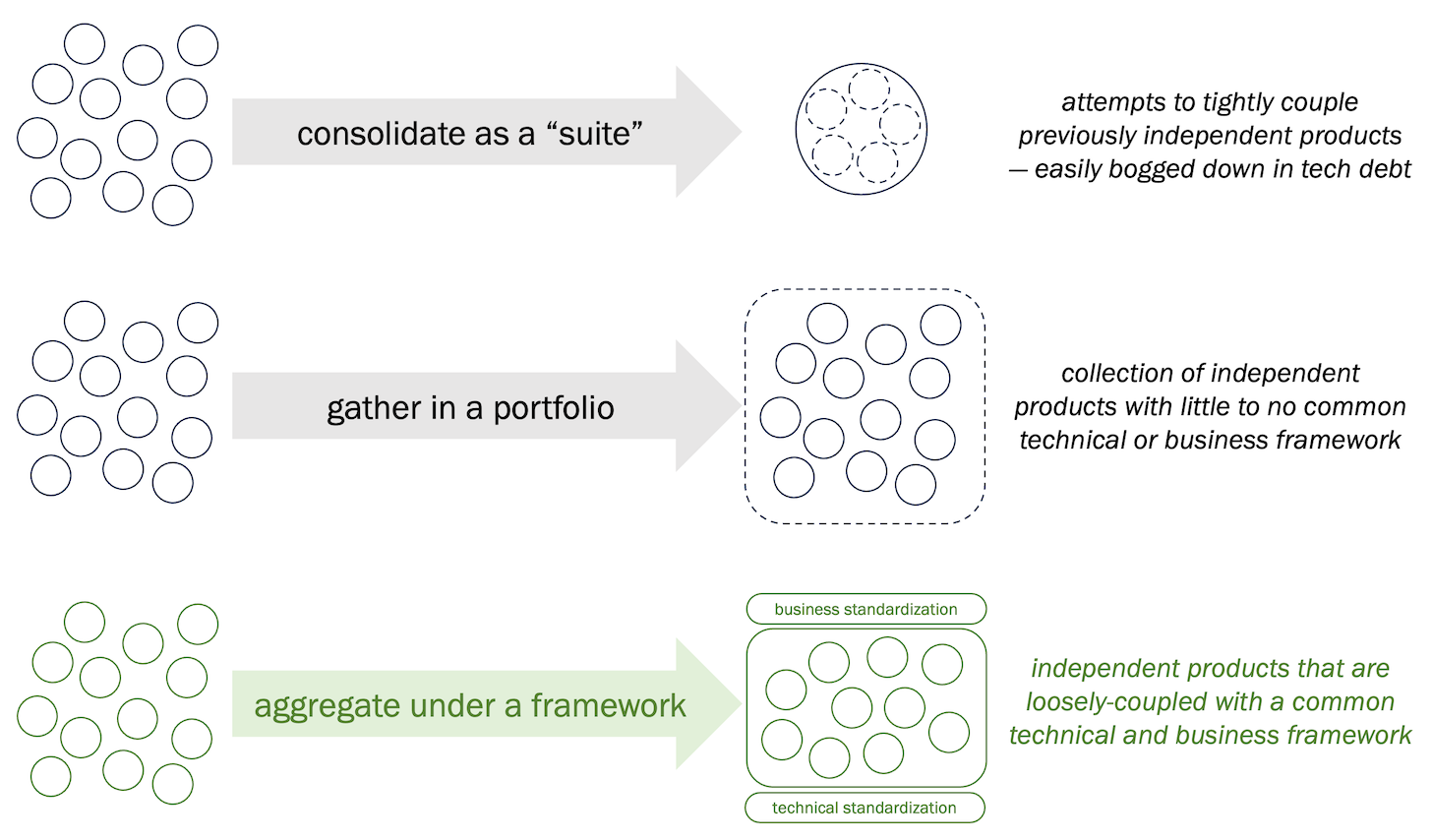

There is another path known as the “roll-up.” A heavily financed company or even a private equity (PE) firm itself may buy up a bunch of martech products — often at a bargain rate from that cohort of the walking dead — and either stick them together as a “suite” or simply try to squeeze costs and customers to make them profitable as a portfolio.

Frankly, there aren’t a lot of stellar success stories on this path. Roll-up “suites” rarely had enough cohesion outside of a PowerPoint slide diagram. And roll-up portfolios often had little synergy among their products. They were usually more about harvesting than planting, if you get my drift.

However, I believe there’s a better approach. Let’s call it a “martech aggregator company.”

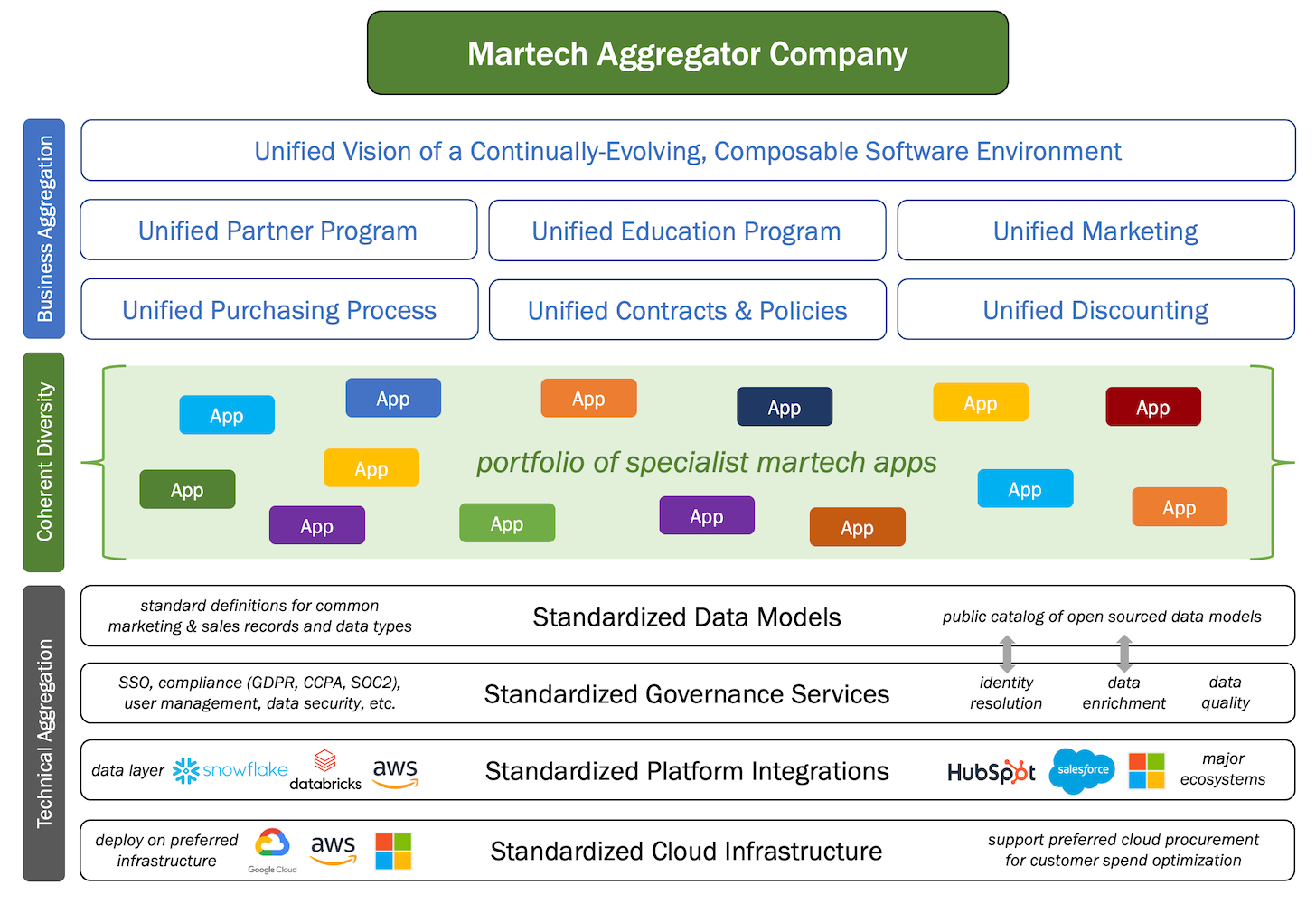

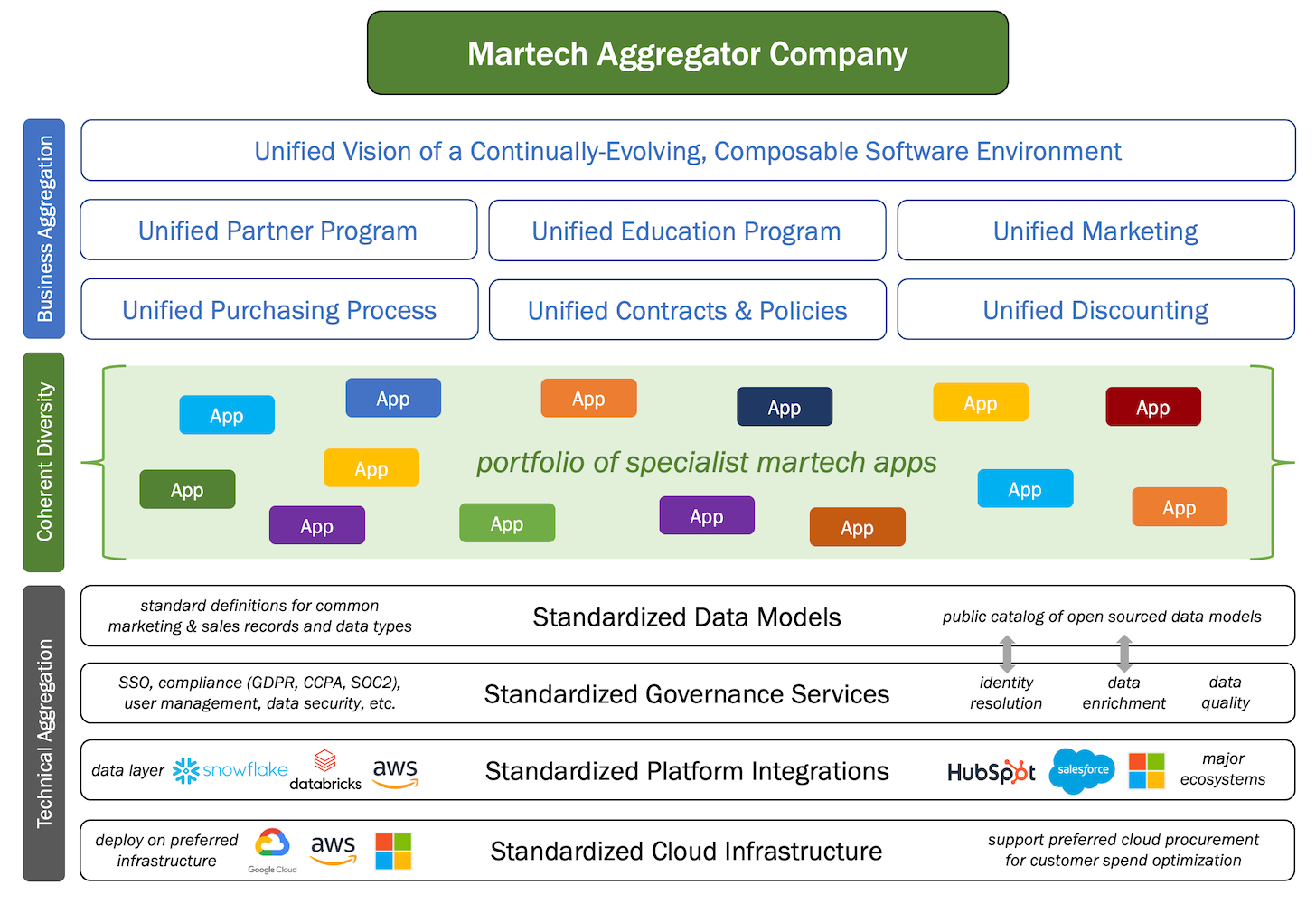

It assembles a collection of best-in-class apps across different categories. It keeps those products mostly independent — there’s no attempt to mash them into a Frankensuite. But there are a set of common technical standards that each product must implement, mostly to facilitate smooth integration with the rest of a customer’s tech stack and assure them of all necessary compliance requirements.

Purchasing can also be mostly standardized to make things easier for buyers, with unified contracts and discounting. Buyers aren’t forced to buy multiple products from the portfolio, but there are incentives when they do. There are also a set of shared business programs for partnerships, education and training, and cross-product marketing to gain some legit synergistic economies of scale.

The key is that this aggreator company is not run as a once-and-done consolidation or an end-of-life milk factory. It’s closer in nature to the major agency holding companies — WPP, Publicis, IPG, Omnicom — that are structured to continually evolve as leaders in the field. Some products in the portfolio will fade over time. New ones will be added. The aggregator provides continuity across a constantly shifting martech landscape for both customers and investors. It is a respected brand that contains respected brands.

Blueprint for a martech aggregator holding company

Let’s consider what the structure of such a martech aggregator company could look like…

The heart of the company is its portfolio of specialist martech apps. These should not be also-rans. They should be among the very best in their category. The reputation of the aggregator — and its family of apps — rests on the premise that these are all great products. The aggregator should be seen as the champion of great products, assuring buyers that their favorite apps will not be assimilated into an amphorous suite or milked dry as a dead-end asset.

Will it cost a lot to buy these best-in-class apps? Absolutely. The financing required to execute this concept would be sizable. To make this work, the aggregator must become a leading brand in the industry, on a scale worth billions. Premium products at premium prices that deliver premium experiences and premium outcomes.

The aggregator would not be a competitor to current public marketing clouds. Although there will be some overlap, its portfolio should more frequently complement those platforms. Indeed, playing nice in those ecosystems is one of the core principles of the aggregator’s portfolio. But it should strive to be a brand among those giants. Just as Adobe, HubSpot, Microsoft, Salesforce, etc., are premium platforms in martech, this aggregator should be a premium portfolio. Again, think the equivalent of Publicis or WPP from the agency world.

There will likely be some competitive overlap within the aggregator’s portfolio. In any given category there may be an SMB solution and an enterprise solution. Some may specialize in particular verticals or geographic regions, in useful tension with more global horizontal apps. The aggregator should seek to minimize direct competition and redundancies within its portfolio. But a little internal competition can be healthy. Even though the analogy isn’t exactly the same, note that WPP has under its umbrella multiple creative agencies such as AKQA, Ogilvy, and VML.

The best of both differentiation and standardization

Each product in the aggregator’s portfolio is mostly independent in the way it’s designed and engineered. It has its own code base. Its own user experience. The core thesis of the aggregator is that differentiation is better than homogenization for best-in-class capabilities. New acquisitions don’t have to be “replatformed.”

But there is a layer of technical standardization that every app must support, and this is the magic that makes the whole of the aggregator greater than the sum of its parts. Almost all of these standardization requirements can be achieved via APIs or data mappings or with infrastructure options that sit far below app-level functionality. They should not disrupt the nature of what makes each app special and unique.

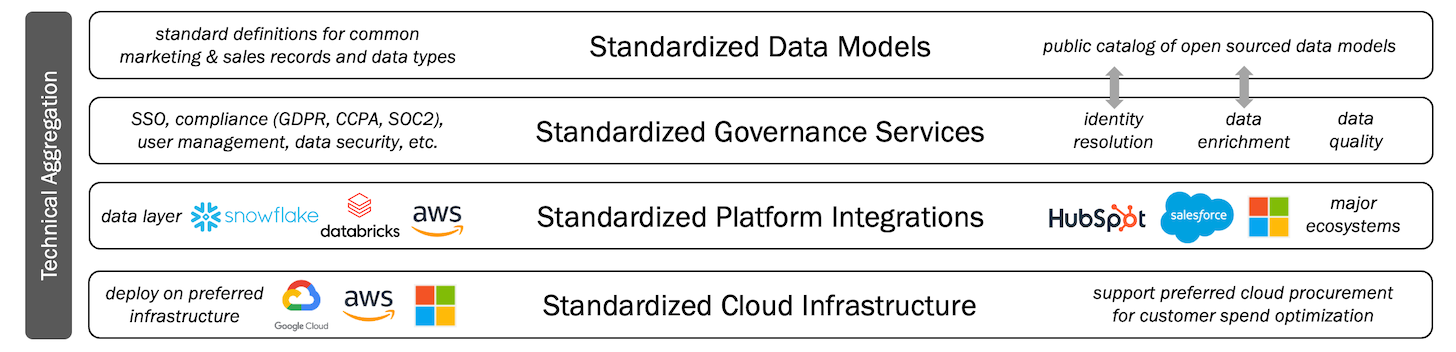

The first should be a push to standardize common data definitions. It’s actually crazy that record types such as accounts, contacts, leads, deals, campaigns, etc. — or at least their core fields — aren’t standardized in our industry yet. It’s part of what makes integrations and migrations so difficult. The aggregator should establish these standards, ideally as an open source catalog. At the very least, it can assure the products in its portfolio converge on these standards, even if it’s through a data mapping service.

The second should be standardization of key governance capabilities for all its products. This includes guaranteed compliance with all relevant regulations GDPR, CCPA, SOC2, HIPPA, etc., so that a buyer can be assured that any app in the portfolio meets those requirements. Standard SSO login options with multi-factor authentication. A layer of world-class cybersecurity mechanisms and monitoring would be wrapped around all apps. User management and permissioning APIs are required for each product, so that admins can see users across apps and easily manage onboarding/offboarding. (The aggregator might acquire its own SaaS Management Platform for this, but it would certainly integrate with all of the other popular ones.) Other shared services for identity resolution, data enrichment, and data quality management can provide further data-level cohesion, in a universally compliant manner.

The third should be integrations with cloud data platforms and major martech platforms. Every app in the portfolio must have an open data model and a high degree of API coverage that enables automation and orchestration through iPaaS, workflow automation, and AI agent platforms — as well as any custom development or integration a customer wants. A buyer should be guaranteed that they can get any of the data from any of these apps into or out of data platforms such as Snowflake, Databricks, BigQuery. And, where relevant, apps should have excellent integrations into platforms such as HubSpot and Salesforce. “You’re a HubSpot shop? Great! Here’s how our products integrate and add value.” By integrating into multiple ecosystems, it can also give buyers the option to migrate platforms without any interruption to their specialist apps.

It’s a composable world, with overlapping ecosystems all the way down. A pillar principle of this martech aggregator is that openness and integration are how individual best-in-class products win. The aggregator’s brand is built on this promise to buyers. (Such ecosystem integrations are probably the biggest lift for apps in the portfolio to “standardize” on. This can either be a criteria for evaluating apps to acquire or, in some cases, an expected investment post-acquisition.)

Of course, apps within the portfolio can integrate directly with each other too. But only where it makes sense.

Finally, essentially every SaaS product is built on the cloud infrastructure of AWS, Google Cloud, or Microsoft Azure. In recent years, all of these have created marketplaces where apps that are built on their infrastructure can be purchased and applied towards their cloud spend commitments (which are tied to their discount levels). It is advantageous for buyers, especially enterprise buyers, to purchase through these marketplaces. Therefore, the aggregator company can offer a significant benefit by having all of its apps available in one or more of these marketplaces.

It’s more work, but in an ideal scenario, all of the apps would be “multi-cloud” — able to be deployed on any of the major cloud infrastructures. The aggregator could then let buyers choose whichever one is best aligned to their technical or procurement preferences.

A few, key cohesive business programs and processes

Each app in the portfolio should run as its own P&L business, with a healthy amount of operational freedom to match its significant independence in product management and engineering. However, there are certainly shared corporate services that can provide efficiencies without too much constraint: accounting, legal, workforce benefits, etc.

But there’s also opportunity to unify certain facets of go-to-market for the apps and the aggregator as a whole where it either amplifies collective impact or improves the buyer’s experience.

While each app may have its own sales team — they know their product inside and out, they’re passionate about it, it has a reasonable scope for them to learn and master — and/or a product-led growth (PLG) motion, the actual purchase process itself should have a fair amount of standardization. Buyers should have the option to manage multiple apps from the portfolio on a single bill. Contracts and policies (terms of service, privacy policies, et al.) should be standardized, so that once a buyer vets the purchase of one app, adding additional ones incurs minimal procurement overhead.

Another pain point for many martech buyers is opaque, Byzantine discounting practices by vendors. This is an opportunity for the aggregator to set a standard of clear, fair pricing. And while each app works beautifully on its own — no one has to sign up for a larger bundle of things they don’t really want or need, i.e., suite-shoveled shelfware — there should be discounting incentives for buyers who adopt multiple products from the portfolio.

Additional opportunities for unified go-to-market capabilities include partner programs, education and training programs, and a certain amount of aggregator-level marketing. Each app should still have its own marketing team, even if they leverage shared services for things like adtech (the portfolio is an incredible “2nd-party” network of targetable account profiles and buyer intent signals!), event production, SEO (LLMO?) expertise, etc. But the aggregator brand itself could also have formidable marketing capabilities for promoting the benefits of its overall portfolio. At scale, it could run its own martech conference, combining all the specialized expertise from its app brands under one roof.

A shared partner program that spans the portfolio also has great potential. It’s often hard for specialist apps to develop a deep bench of channel and services partners. There’s just not enough scale. But collectively, under the aggregator’s brand, there could be significant opportunity for partners. Not every partner needs to sell or service every app. But as with buyers, there can be incentives for those who engage across the portfolio. Because the aggregator is inherently aligned with one or more major martech platforms, it could lean into existing partners from those ecosystems who are looking to expand and deepen their solution offerings.

(A question to consider at another time is whether the aggregator should also develop a complementary portfolio of services companies under its own umbrella.)

While the individual apps should each have strong, opinionated leaders — again, their relative independence is a source of their strength — the leadership of the aggregator would steer the cross-app strategy and operations of the whole. This would include setting the common technical standards and running the shared business programs and capabilities. They would decide how investment was allocated across the portfolio for existing apps and when to acquire new apps.

Above all, they would be the champions of a new model for a world-class martech “holding company” that harnesses the innovative engine of a diverse martech landscape instead of swimming against it. Aggregation over consolidation in an environment of composability, ecosystems, and constant evolution.

Would you like to work with a company like that?

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.