Welcome to 2025! It’ll be the Year of AI Agents in martech, in word and deed. Here’s what I think that means…

From the moment there was more than one software product in a company’s tech stack, there’s been jockeying to determine who was boss.

If the tech stack were an orchestra, which product would be the conductor?

Whichever one directed the flow of data among apps and determined which function in which app was called when — literally orchestrating the tech stack — would wield a position of great power.

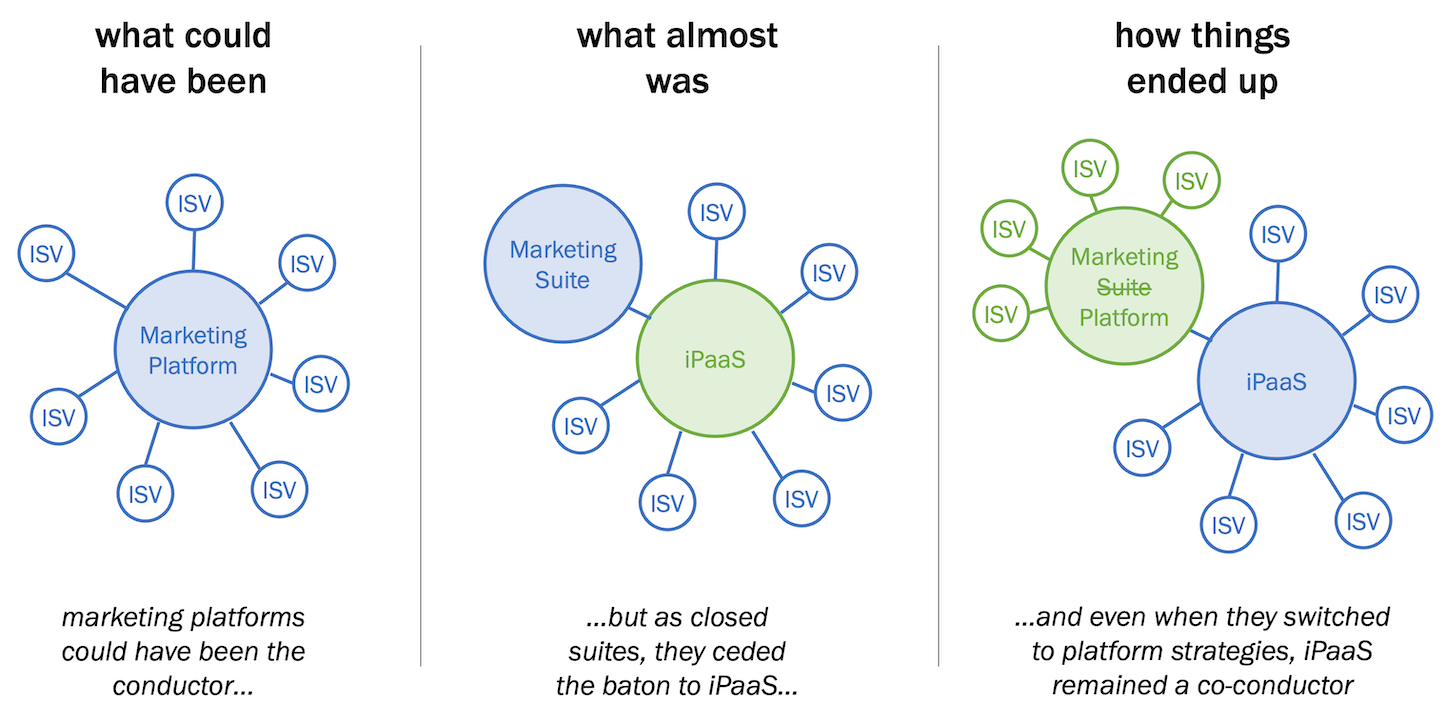

This is why it was a strategic error for marketing suites of the early 2010’s to downplay integrations with other products in the burgeoning martech landscape. They pretended other products weren’t necessary or important. To have strived to be the conductor would have been to acknowledge the value of those other apps. They didn’t want to concede that point.

As Julia Roberts’ character in Pretty Woman chided, “Big mistake. Big. Huge!”

Suites’ failure to seize the baton created an opening for a whole new category of products known as “iPaaS” — integration-platform-as-a-service — to step up to the podium and build multi-billion dollar companies, such as Mulesoft, Workato, and Zapier. iPaaS embraced the diversity of tech stacks and empowered people to automate digital operations at a level above individual products.

The suites finally realized that they were becoming a spoke on the edge of the stack graph instead of the hub at its center. Many switched to platform strategies and pursued building app ecosystems. Those who didn’t slipped into irrelevance. Salesforce acquired Mulesoft. HubSpot acquired PieSync.

But the barn door had already been open, and the cows never fully came home. To this day, iPaaS products — many of which have evolved into “enterprise automation platforms” — retain a strong presence in most marketing tech stacks. They’re co-conductors of the orchestra. For some use cases, the marketing platform calls the shots. For others, the enterprise automation platform née iPaaS does.

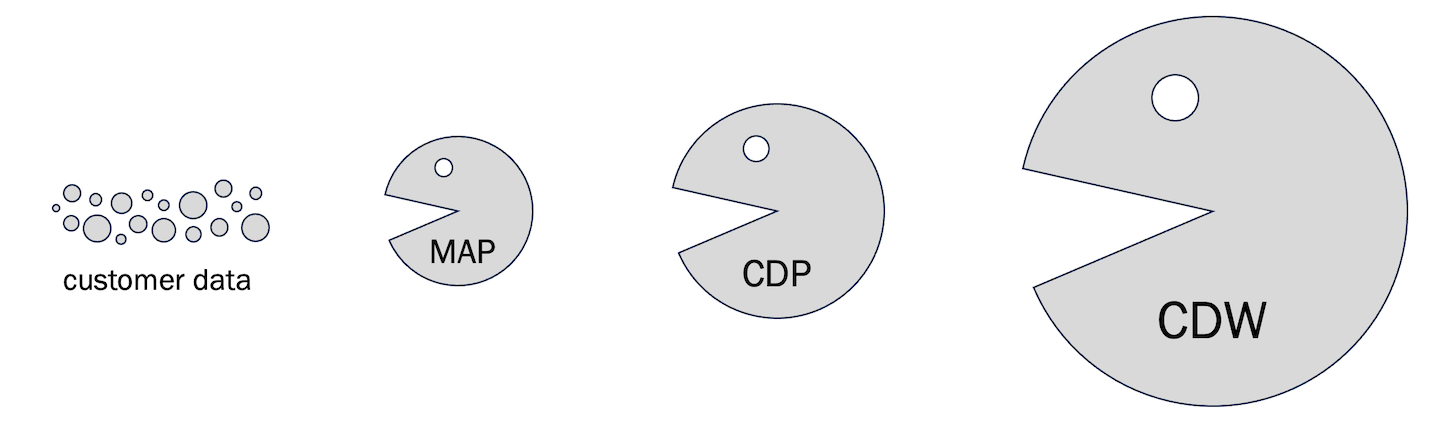

Ironically, history nearly repeated itself a few years later. CDPs — customer data platforms — arose between 2015-2020 because most marketing suites/platforms were still not open enough or flexible enough with their data models. This gave CDPs an iPaaS-like opening, and they stampeded through it.

But the marketing suites/platforms weren’t as resistant to respond this time. Most acquired a CDP or built CDP-like capabilities by the 2020’s. (Some overcompensated by purchasing or building multiple CDPs, but that’s a little inside baseball.) Meanwhile, in a surprise twist, cloud data warehouses/lakehouses disrupted the whole CDP landscape. That’s a story for another day though.

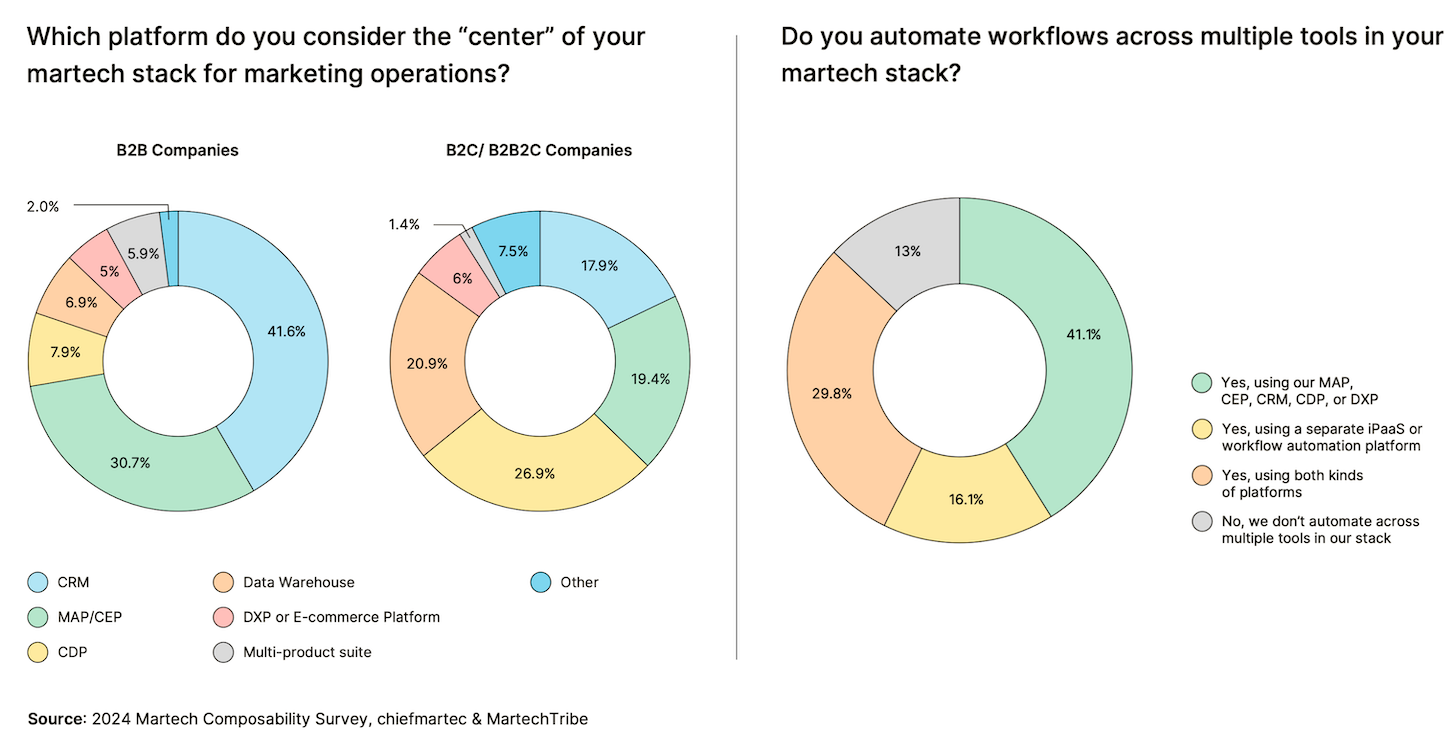

Which brings us to 2025. The modern martech stack has multiple platforms vying to be the conductor at the “center” of it all. Many marketing ops teams try to standardize on one to automate workflows across their toolset, although which platform they choose — CRM, MAP, CDP, CDW, etc. — varies from company to company. But nearly 1/3 also use an iPaaS/enterprise automation platform too.

Complex? Somewhat. Manageable? More or less.

But brace yourself. It’s about to get waaaay more complex with — drum roll — AI agents.

While there’s lots of debate about what qualifies as a “true” AI agent — especially around how much decision-making autonomy it has — one characteristic that almost all agents share: tool use. They can interact with other software, either through APIs or by simulating a human user’s clicks and typing, in an RPA-like fashion. They apply such tool use to read or write data from different sources, take actions in other apps, or even make requests to other agents. The latter is the vision of multi-agent networks.

AI agents can take on tasks, processes, or even more open-ended goals. They automate digital operations across different products in your tech stack in an integrated fashion.

Except for the goal-seeking twist, that sounds familiar, no?

AI agents reverberate with the echoes of iPaaS and workflow automation platforms. In fact, many of the vendors in those categories have transformed into AI agent building platforms. The difference? Workflow automations ran according to deterministic rules and steps that were programmed by a human. AI agents apply their own intelligence to decide which tools to call when — without an explicit plan dictated to them by humans.

Existing martech SaaS platforms aren’t dragging their feet to the AI agent party either. Salesforce has swung their narrative pendulum all the way to Agentforce. HubSpot has its Breeze AI agents, and co-founder Dharmesh Shah launched agent.ai, “the professional network for AI agents.” Microsoft has incorporated Copilot Studio for building AI agents in Dynamics. Braze, Bloomreach, and Zeta have announced their own AI agents too.

Now, if we were simply dealing with existing iPaaS/automation vendors and ecosystem-oriented SaaS platforms morphing into AI agent platforms, that would be challenging enough. In the short term, digital ops will become a tangle of old deterministic workflow automations intermingled with new intelligent agent automations. We’ll have to migrate to new ways of architecting marketing operations processes accordingly. But we’ll get the upside of agents doing more work autonomously, reducing the reams of rules maintained by hand. (Hallelujah, right?)

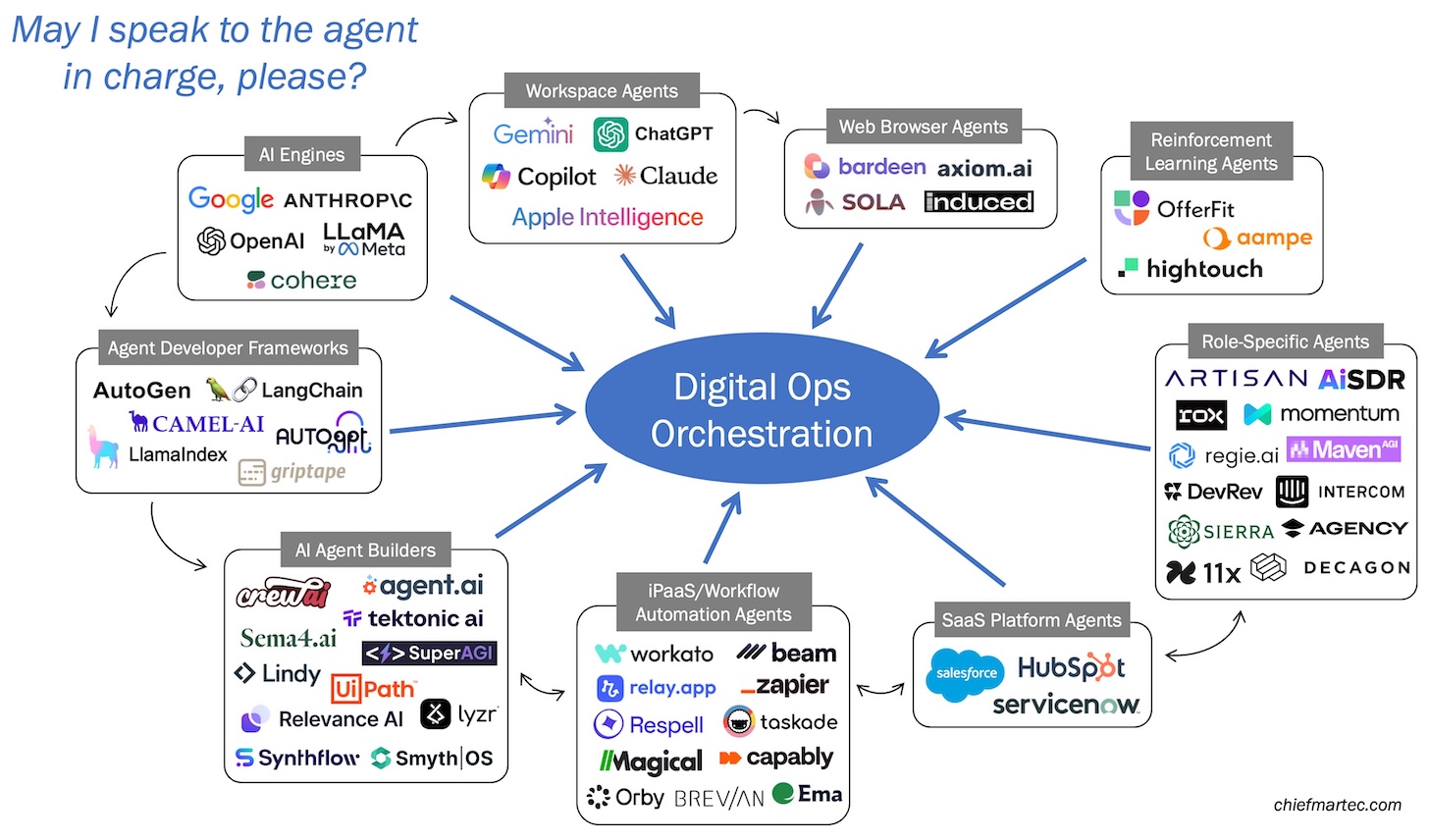

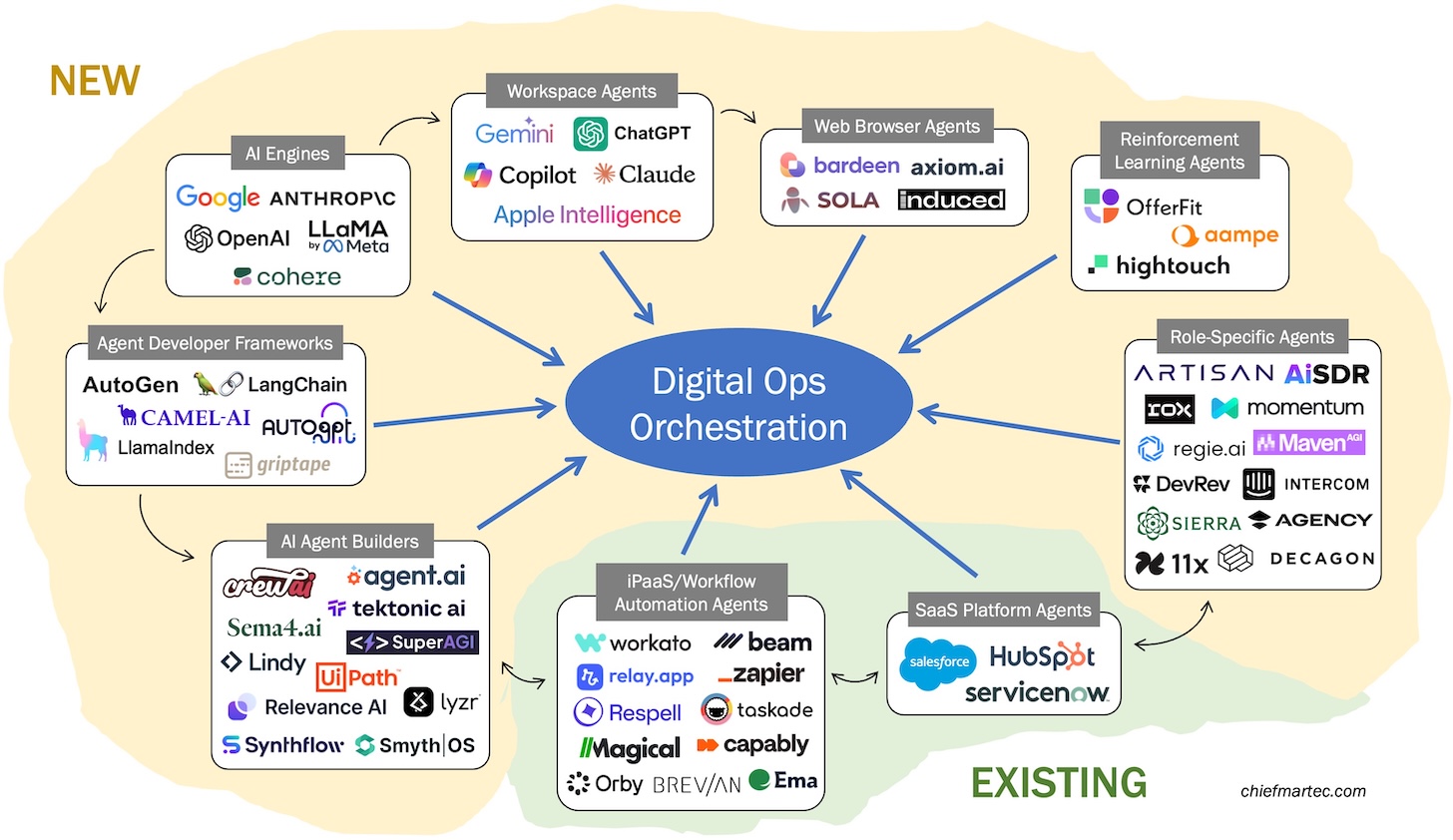

However, existing SaaS and iPaaS/automation companies are not the only players in the pit. Multiple new categories of AI agents have joined in, each bringing their own take on intelligent orchestration of individual productivity and/or organizational process automation.

Here’s a quick tour of the other agent contributors in the map above…

The core AI engines from Anthropic, Google, Meta, OpenAI, et al., all support agent development, with “function calling” for tool use as a basic primitive. Anthropic’s recently announced “computer use” capability and Model Context Protocol are exciting steps forward in foundational AI agent capabilities.

Agent developer frameworks such as Autogen, AutoGPT, Camel AI, Griptape, LangChain, and LlamaIndex all help facilitate companies building their own custom agents. If you can code with APIs — and with AI-powered developer tools such as Cursor.so, GitHub Copilot, and Replit, increasingly anyone can code — you can build your own tailored AI agents in a matter of days or hours.

Want even more help in building your own AI agents? There’s a whole new category of no-code/low-code agent builders: CrewAI, Lindy, Relevance.AI, Sema4.ai, SmythOS, and Tektonic.AI, to name just a few. The boundary between these and evolved iPaaS/workflow automation platforms is extremely fuzzy. I’d merge them, except it’s worth pointing out how many new native AI agent builder platforms have emerged in this category.

On the far other end of the spectrum, Anthropic, Google, Microsoft, and OpenAI are all incorporating tool use in their end-user products such as Claude, ChatGPT, Copilot, and Gemini. Increasingly, using Gemini inside Google Workspace or Copilot in Microsoft 365 products such as Excel and Teams will perform agent-like automations for individuals. There will be increasing overlap between personal productivity and business process automation.

Independent browser-based AI automation tools such as Bardeen and Axiom.ai will be a part of the mix as well. Whatever web-based software a user has access to, they can create AI agents (or pseudo-agents) to automate their work with those apps — even if the vendors of those products have done nothing expressly to enable that.

There’s a special category of agents that have emerged to leverage reinforcement learning — a sub-branch of machine learning — to autonomously optimize personalized marketing campaigns and programs. OfferFit is a pioneer in this space (disclosure: I have been an advisor to them). Aampe and composable CDP Hightouch have also entered the category, which is coming to be known as “AI Decisioning.”

Last but definitely not least, there’s a massive wave of role-specific AI agent tools, especially for sales and customer service. Representative AI agents for sales include 11x, AISDR, Artisan, Momentum, regie.ai, and Rox. Customer success AI agents include Decagon, MavenAGI, and Sierra.ai. Of course, existing SaaS platforms are competing with their own role-specific agents, such as those from HubSpot, Intercom, Salesforce, and Zendesk.

The thing all these different AI agents have in common?

They’re all automating interactions — increasingly autonomously — with the products and platforms in your stack. Each thinks it’s orchestrating its piece of the symphony. But will there be one conductor that sees across the entire orchestra and harmonizes all these players? Expect intense vendor competition for that position.

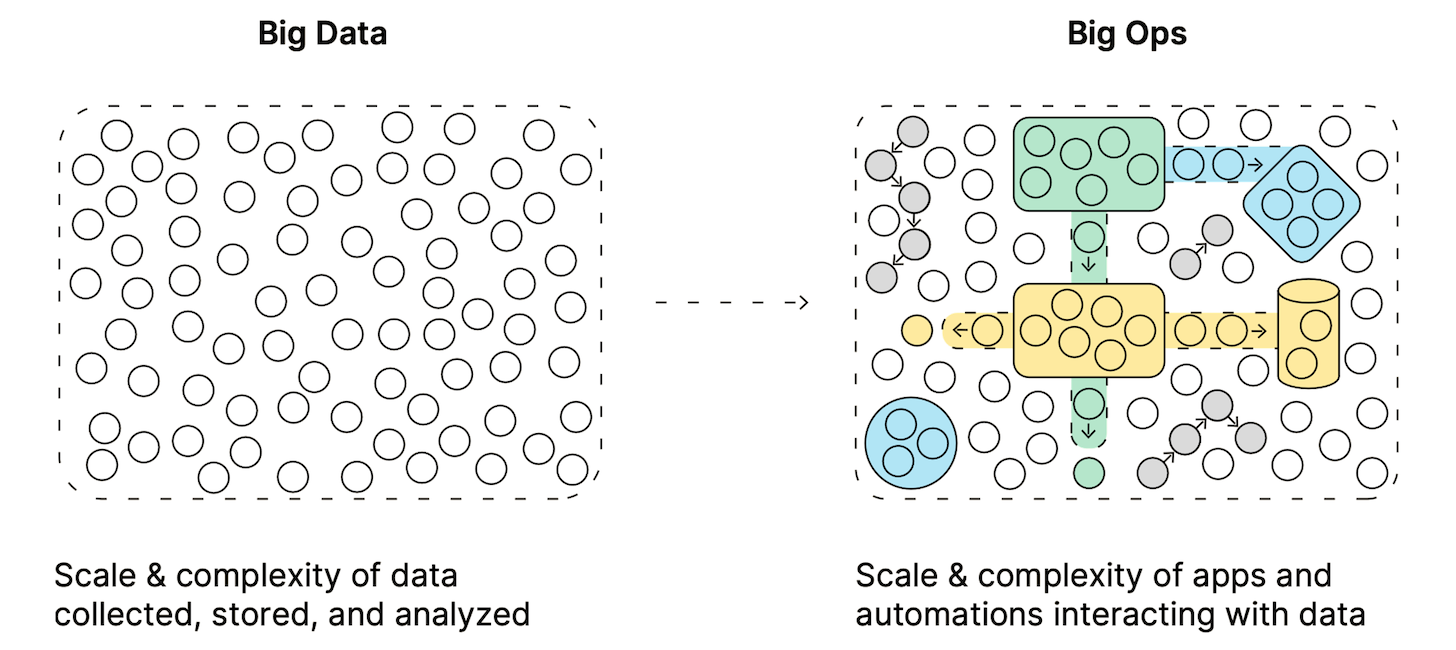

In the meantime, orchestrating the orchestrators will be the big challenge of Big Ops, in 2025… and for the rest of the decade ahead.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.