Pop quiz! Write down the names of three multi-billion companies who either provide a “marketing cloud” today — or are potential contenders in that space over the next few years.

Done?

I’ll bet you a beer at MarTech that there was one company who wasn’t on your list: Google. (Okay, be honest: they wouldn’t have been on your list if you weren’t reading an article titled “Could Google be the ultimate marketing cloud company?”)

Google? A marketing cloud company?

Google’s expansive portfolio of marketing software

The thought struck me as I was writing about tag management as marketing middleware. Tag management systems sit at the crossroads of a lot of other marketing software and have the potential to strategically leverage an immense amount of data that passes within their view.

I noted that Google now offers their own tag management software, for free, which presents a competitive challenge to the rest of the field. After all, Google thoroughly disrupted web analytics with Google Analytics. Could it do the same with tag management? It certainly gives them another piece in the marketing technology stack…

And then it hit me. Consider the wide range of software that Google offers marketers today:

- Analytics and attribution with Google Analytics. This is the de facto choice for web analytics. According to the latest trend data from BuiltWith, 67.8% of the top 100,000 sites on the Internet use Google Analytics. They also offer Google Analytics Premium, a more enterprise scale solution, for $150,000 per year.

- Display and search advertising DSP. The DoubleClick platform is a giant of a demand-side platform (DSP) — one that combines search and display campaign management. Of course, there’s also the company’s AdWords platform as well.

- Social media marketing with Wildfire — which may be being disbanded as its own application, but the team and technology are being integrated into the DoubleClick platform.

- Team collaboration with Google Apps for Business — especially with documents, spreadsheets, and slides. Their spreadsheet feature isn’t as sophisticated as Excel, but it will almost certainly continue to encroach on Excel’s territory, arguably the most widespread “app” in marketing operations.

- Content creation, albeit at a very basic level, with Blogger and Google Sites — and the 800-pound gorilla of video content, YouTube. Google Cloud Platform is a strong platform-as-a-service (PaaS) offering for marketing apps and mobile back-ends.

- Webinars and videoconferencing with Google+ Hangouts — in fact, with Hangouts On Air, you can essentially broadcast events to the world for free.

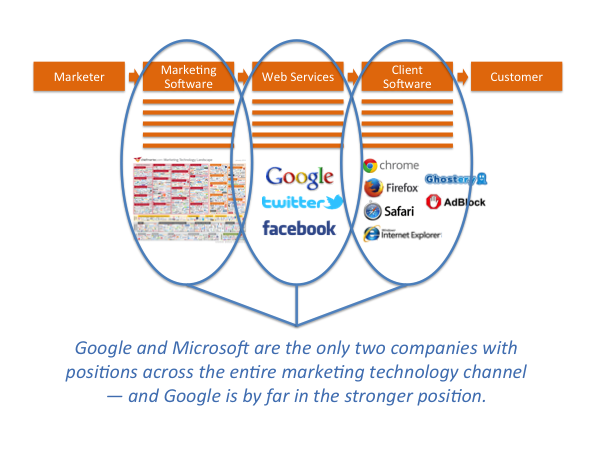

Each of these are major markets unto themselves — analytics, DSPs, online events, etc. — in which Google is competing against major adtech and martech players. So a piece of their business is squarely in the realm of providing marketing software, the first stage of the marketing technology channel — the software-mediated pipeline between marketers and customers in the digital domain, as illustrated in the diagram at the top of this post.

But what makes Google so powerful, of course, is that they absolutely dominate the next two stages of this pipeline.

Channel integration from the marketer to the customer

In web services, Google has a near-monopoly with the world’s #1 search engine (“google” is a verb synonym for search), the world’s #1 video site (YouTube), the world’s #1 email service (Gmail), and the world’s #1 map service (Google Maps). While we could debate the ranking of Google+ in social media — it depends on the metrics you use — it’s clearly one of the top five social networks in the world.

In client software, Google has the world’s #1 mobile operating system (Android) and the world’s #2 web browser (Chrome).

Marketing software has to go through such web services and client software to reach its audience. And there are only two companies in the world who have well-established positions in all three stages of the marketing technology channel: Google and Microsoft. Microsoft has:

- Microsoft Dynamics and Office in marketing software

- Bing and Hotmail in web services

- Internet Explorer and the Windows operating system in all its various incarnations in client software

Both companies are remarkable for their channel-wide coverage — although I think Google has the upper-hand, particularly with search and Android. But Internet Explorer is the #1 web browser in the world. Hotmail is the #2 email service, and Bing is the #2 search engine. Microsoft Dynamics is well-established in the CRM space. And Excel and PowerPoint are still probably the most widely used software tools in marketing.

Think about the enormous leverage this gives these companies.

At one level, they have the potential to vertically integrate across this pipeline. Even if you just consider passive data sharing, the real-time, high-fidelity, first-party insights this could give them into the dynamics between marketing activities and customer behaviors is staggering in scope and value.

Yes, there are anti-trust and other consumer protection implications here. I don’t know enough about the laws involved to have an assessment of when or how those constraints may come into play. But pragmatically, by the time anti-trust and consumer protection become front-page issues, these companies will have already leveraged vertical advantage.

Even if they don’t vertically integrate, they could dramatically alter the balance of power in vertical competition between the different stages. Think of marketing dollars spent as a fixed pie. They could, for instance, work to shift the percentage of those dollars captured by the highly-competitive “marketing software” stage of the pipeline into the “web services” stage, where they face less competition in key services (e.g., Google search).

Giving software like Google Analytics and Google Tag Manager away for free — while charging for advertising at the next stage of the pipeline — devalues marketing software and increases the value capture available to web services. That’s vertical competition.

What would it take for Google to have a true “marketing cloud?”

You might be tempted to dismiss this as farfetched. After all, Google doesn’t have even the most basic foundations of what we think of as a “marketing cloud” today: email marketing, marketing automation, customer data management, personalization.

But that could change overnight with a single acquisition.

Consider that Google Ventures has an investment in HubSpot. If they acquired them — “Google Apps for Marketing” — that would change the landscape instantly. Crazy? The two companies seem quite philosophically aligned to me: HubSpot has been encouraging and enabling marketers to feed great content into search (google.com) and social (Google+) for years. They both love disrupting old school marketing.

While you’re thinking about the implications of that, refer back to the power of vertical integration, and consider what happens when the world’s #1 email service also becomes the world’s #1 email marketing platform.

Browse through some of the other “enterprise and data” portfolio investments that Google Ventures has made in the marketing software space: Nimble (social CRM), Yesware (sales enablement), and Optimizely (A/B testing). What if those stopped being investments and became wholly owned assets?

You might protest, “That’s not the business Google is in.” But they weren’t in the business of home automation a year ago either, and then they bought Nest — note: a previous Google Ventures investment — for $3.2 billion. Google has the resources and the moxie to move fast when they choose. (As an aside, consider that Nest, Android Auto, Google Glass, etc., all stand to bolster Google’s ownership of the “last mile” of interface to users.)

It’s not that far of a stretch. Would a “marketing” section in this Google Enterprise microsite seem terribly out of place?

Whoever owns the audience owns the marketing

All the major Internet platforms — Google, Facebook, Twitter, etc. — generate the vast majority of their revenue by selling marketing services. It doesn’t do them justice to refer to their offerings as mere “advertising.” They own experiences with users that are completely unlike media in the traditional sense — it’s been said that they’re more like “utilities.” The marketing vehicles they’re able to offer, leveraging a treasure drove of proprietary user data, far surpass plain old display advertising (PODA).

This isn’t just a consumer-oriented phenomenon either. Consider LinkedIn’s evolution — such as their recent acquisition of Bizo — and how this can apply equally, if not more so, in B2B.

At the core of these strategies is a simple truth: whoever owns the audience owns the marketing. You have to go through these companies to reach your audience in an increasing number of the contexts of modern life.

In fact, that’s where their competitive battles with each other are. In their rivalry, they will naturally pull more advanced logic for managing marketing in their environments into their own cloud-based software, as a way to outdo each other in better serving marketers (i.e., their real customers). But in the process, that will move the center of gravity from the “marketing software” stage of the pipeline to the “web services” stage.

Take a peek through some of the research and flat-out content marketing that Google is targeting to marketers on their Think with Google site. It’s not that hard to imagine their ambitions for remaking marketing for the 21st century — and dominating it.

Hi Scott,

I lost the bet! Forget about my list, Google was not even in my thoughts.

You gave me a brand new way to think at the marketing technology practice as I never used to include the client software and who owns the customer into the overall equation. As the field of marketing technology consolidates and solidifies it may not be surprise anymore to see companies like Google and Microsoft be the biggest players.

A question comes in my mind related to statement “whoever owns the audience owns the marketing.” If that happens more and more companies will try to rush into owning the end customer. Will this create more and more silos for customer, inefficiencies for marketers & eventually a disaster for web?

I think there will always be value in independent companies at the “marketing software” stage for the exact reason you mention — aggregating, correlating, and coordinating customer data across disparate providers at the “web services” and “client software” stages.

I think there will be pressure to share a reasonable amount of data, even for Google and LinkedIn, by their marketer customers. So it’s not that the data in those services will be completely walled off (although it certainly won’t be completely open either).

By “owning the audience,” I mostly mean that those services will be the primary interface through which marketers reach customers. Basically, few people reach your website without going through search or social — and they spend a far larger portion of their lives interacting with those “utility” providers than they will on any one company’s website.

Of course, this is all pretty hypothetical, but it may not necessarily be a bad thing for marketers. However, I think it could be highly disruptive to marketing software companies that have no leverage in the web services or client software stages of the pipeline.

Scott, great debate to start! I just got off the phone with one of the most innovative CPG marketers and asked what they are doing with the marketing cloud. “What’s that?” was the reply. We’re at the early stage of “the next big thing” in marketing and few companies are ready for it. It would not surprise me to see Google and Microsoft join the “arms race” for marketing technology by being highly acquisitive. Thanks for posing the possibility.

I look forward to continuing the debate next week in person at Martech.

Love the post, Scott. Really interesting to think about the possibilities here for Microsoft and Google.

One thought running through my head as I mulled over the implications–Google in particular (but probably Microsoft, too) runs the risk of becoming the Comcast of the marketing cloud. In numerous closed door sessions with brand-side marketing leaders over the past 12-24 months, I hear the same kind of griping about Google that I myself hear over beers with my firends about Comcast. How long before marketers start recording their conversations with Google account reps? 🙂

It’s all very much in keeping with the Google as a utility theme. Those with enormous market power can easily put their own profit ahead of value for customers…which will open them up to disruptive alternatives over time. Will be fascinating to see how this all plays out. Thanks for the post, and looking forward to the shindig in Boston next week.

Thanks for a very thought provoking article Scott, and I love the marketing software > web services > client software = marketing cloud thinking.

I can see how easy it would be for Google to join the dots and provide an ultimate marketing tool. They have the data. They have the capability.

Which begs the question ‘Why haven’t they already?’

I think from the customer side we accept that companies such as Google through our click-streams have deep understanding of us, our preferences our routines with the understanding that it is anonymous and aggregated.

From the marketer’s side we use CRM and marketing automation software to ‘de-cloak’ identify and then personalise our conversations to sell.

I really don’t think there is a technical barrier for companies such as Google, but I do believe there is a moral one.

http://en.wikipedia.org/wiki/Don't_be_evil :

“Don’t be evil” is the formal corporate motto (or slogan) of Google.[1] While there have been unsourced allegations that Google dropped this motto, particularly in light of privacy violations, [2] it remains at the very head of Google’s Code of Conduct.

Given the scale and value of their business I guess it’s whether the benefits outweigh the risks.

And of course it’s whether they should as much as whether they could.