How is it even possible to have 2,000 marketing technology vendors? Surely, this space must consolidate. It’s not even conceivable that it would continue to grow, right? A bubble ready to burst?

Well, maybe.

Consolidation is the easy answer. And, hey, it may be the right one. Certainly there are powerful consolidation forces in this sector. But I’m hesitant to declare that outcome is imminent with the same conviction that others do. It seems more complex to me — and empirically, the number of marketing technology companies I keep finding year-over-year continues to grow.

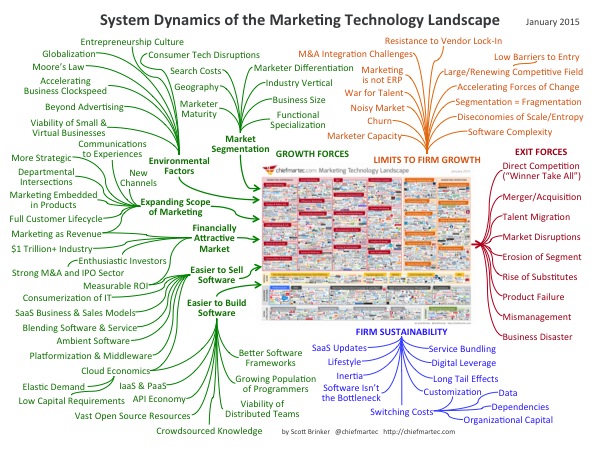

Although competition is intense and acquisitions are common — the key mechanisms of consolidation — there are also many other fascinating forces at work in the marketing technology space. I’ve written about some of them previously (e.g., my post last year about what if 1,000+ marketing technology vendors were the new normal). But in the spirit of the landscape itself, I thought it might be helpful to try to visualize them on a single slide.

So the graphic above — here’s a larger version and a PDF if you prefer — is an attempt to illustrate the system dynamics of the marketing technology landscape:

- growth forces that motivate and enable firms to enter and grow in this space

- firm sustainability factors that allow many of these firms to persist over time

- limits to firm growth that prevent a few big companies from owning it all

- exit forces that cause businesses to leave the landscape (some happy, most not)

I’m not claiming that all of these different factors are equal. I’m sure this is incomplete — and I welcome your additions in the comments. My point is simply that this is a complex market, with all these waves colliding in incalculable interference patterns. It doesn’t have an obvious precedent, and it’s still evolving. While we can concoct useful hypotheses about its evolution — and hedge our bets against several alternatives — I am skeptical of overly confident, cowboy-swagger predictions. Complexity deserves a little more respect.

This market may consolidate into a small number of companies, an oligopoly. I can imagine scenarios by which that would happen. Personally, I think it’s more likely that we’ll see an oligopoly of marketing platforms, where the ISV ecosystems around those platforms contain hundreds — or thousands — of more specialized software vendors and hybrid software/service providers. The evidence today seems to fit that theory.

But there are many other possibilities. The Internet giants (Google, Facebook, LinkedIn) may become a middle-tier oligopoly (some would argue that they already are). An open source movement could standardize the platform layer completely for free. The age of algorithmic, data-driven markets could expand to include all software and services, creating a world of perfect competition. Doc Searls’ vision of the intention economy could be realized and all the power could shift to vendor relationship management, ending marketing as we know it.

Some of these seem more far-fetched — or at least further into the future — than others. But we live in a world where the far-fetched has an increasing likelihood of coming true. With a nod to Jon Evans of TechCrunch and his post on why the tech industry is completely ridiculous, I love this quote from Marc Andreessen for some perspective:

From "only nerds will use the Internet" to "everyone stares at their smartphones all day long!" in 20 years. Not bad, team :-).

— Marc Andreessen (@pmarca) January 16, 2015

So how should we strategize and operate in such a complex environment? My high-level advice to marketers (and product managers, investors, etc.):

- Design for change.

- Value optionality.

- Keep an open mind and never stop learning.

- Allocate a portion of your portfolio to experimental alternatives.

- Balance focus with peripheral vision (they’re not mutually exclusive).

- Develop the organizational agility to act and react swiftly.

Those are kind of six ways of saying the same thing, eh? Be adaptable. It’s that important.

Growth Forces of the Marketing Technology Landscape

I’d like to provide a little more explanation for the forces noted in short-hand on the above graphic. I included 40 growth forces that motivate companies to enter the marketing technology space and enable them to carve out an opportunity. To provide a little structure, I clustered them into six categories:

- Market Segmentation

- Environmental Factors

- Expanding Scope of Marketing

- Financially Attractive Market

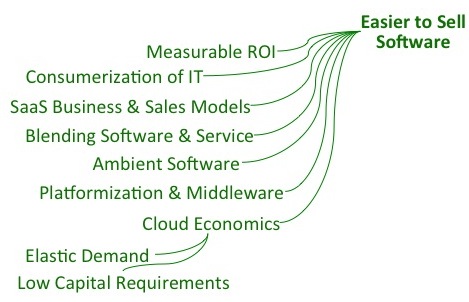

- Easier to Sell Software

- Easier to Build Software

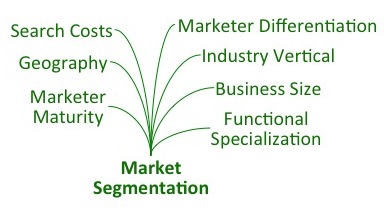

Market Segmentation forces are the many different ways companies divide the world of marketers and specialize in one or more specific segments. The most common one we think of is Business Size: SMB vs. enterprise solutions. But there are also Industry Vertical segments, e.g., marketing software for medical practices, law practices, restaurants, retailers, and so on. There’s Functional Specialization, which I will dub the “Optimizely effect” — Optimizely is so incredibly good at A/B testing web pages, a very narrow function, that even marketers who already have A/B testing features built into the rest of their marketing software will “redundantly” add Optimizely on top of it.

Marketer Maturity is a powerful segmentation axis: some marketers want simpler software, easier to use with less features, while others prefer solutions that give them more advanced capabilities. And we can inherently segment by Marketer Differentiation — marketers who seek more unique software to help them distinguish the experiences they deliver to their audience.

Even though we live in a world of globalization (actually, another growth force), there’s still evidence that Geography can be a defensible segment. The software can be tailored for local language, culture, and regulation, and the relationships naturally run deeper. A related kind of segmentation is through Search Costs. There is no universal way to perfectly match buyers and sellers in this space — Google is helpful, but only once you know what you’re looking for by name. Companies that can uniquely reach a set of marketers that other competitors can’t — agencies and marketing service providers of all flavors, I’m looking right at you — have a potential segment opportunity.

You can also combine these different kinds of segments — say, marketing software for small winemakers in Italy. Of course, not every conceivable segment will be a winner, and most will have limited scale. But small can be beautiful — beloved by their customers, whom they live and breathe, and difficult to dislodge with a more generic solution.

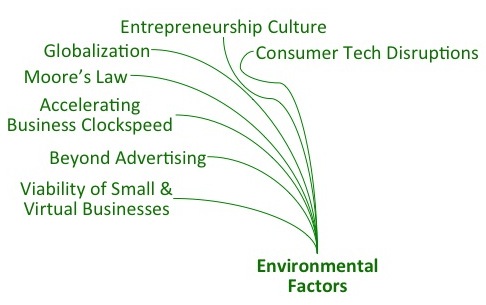

Environmental Factors are the big picture forces at work in our lives. They effect marketing, but they also transcend it. Entire books have been written about each one of these, so I’ll just provide a sliver of context for them here.

Every time there are Consumer Tech Disruptions, new opportunities arise for marketing — and therefore marketing technology to support it. Look at the upending of markets and marketing that mobile is causing. The Internet of Things will be even more cataclysmic in how it changes the dynamics between companies and customers. Moore’s Law is causing the rate of these disruptions to accelerate, and Globalization helps them spread far, fast.

The Accelerating Business Clockspeed directly creates new opportunities — how to manage marketing in our high-speed world. But it also indirectly supports marketing technology innovation, as businesses increasingly have the ability to experiment with and adopt new technologies without months (or years!) of deliberation.

Entrepreneurship Culture inspires more people to start their own businesses, and the Viability of Small & Virtual Businesses — largely enabled by digital technologies — makes it easier than ever for them to launch and compete against larger firms.

And the Renaissance of the whole field of marketing Beyond Advertising — new modes and mechanisms for connecting companies and their customers — creates an amazing variety of opportunities for innovative products and services. Poetically, it also helps new marketing technology companies find and influence their own prospects.

The Expanding Scope of Marketing is the cluster of forces that’s growing the conceptual space of marketing software. Marketing is becoming More Strategic, which creates multiple layers in an organization in which software tools may help. It also generates more interest among — and more funding from — senior executives to use new marketing technologies competitively. As marketing expands, it also has more Departmental Intersections with finance, sales, legal, customer service, IT, R&D, etc. Each one of those junctions has opportunities for software innovation.

Marketing’s epic shift from Communications to Experiences — it’s not just about crafting and delivering messages, but designing and orchestrating functional experiences — now spans the Full Customer Lifecycle across a myriad of New Channels. The diverse array of potential touchpoints between companies and their customers here is massive — and still growing. Increasingly, this includes Marketing Embedded in Products themselves. Every single one of these touchpoints offers opportunities for marketing software to create or mediate them, individually and collectively. The whole new field of marketing automation for mobile apps is one example of these dynamics birthing a new marketing technology category.

The recasting of Marketing as Revenue — and not merely an expense — by being able to better attribute marketing investments to business growth, provides greater incentive for marketers and other stakeholders to pursue new software-powered marketing capabilities.

Marketing as Revenue is also one of the reasons that this is a Financially Attractive Market for vendors to enter. Cost centers are, well, all about minimizing expense — and since vendors in such markets are an expense themselves, it can trigger a competitive race-to-the-bottom. By aligning with revenue, marketing technology companies can attract customers for their ability to affect top line growth, not merely bottom line belt-tightening. It provides vendors with a larger spectrum of business opportunities. The data-driven Measurable ROI of many marketing technologies — albeit often “local” ROI, around specific tasks or objectives — enables performance-based value propositions that can be quite lucrative.

According to the CMO Council, more than $1.5 trillion is spent every year on marketing and communications worldwide. A $1 Trillion+ Industry that is in the throes of reinvention is an irresistible magnet for entrepreneurship. Given that nearly $600 billion is still spent on advertising alone — a model of reaching and influencing customers that is under disruptive assault from multiple directions simultaneously — the headroom for innovation remains enormous.

Investment in marketing technology simply follows Sutton’s Law: it’s where the money is. Combined with the liquidity events of a Strong M&A and IPO Sector, marketing technology attracts Enthusiastic Investors. In turn, this entices more entrepreneurs, and a reinforcing virtuous cycle ensues. It only becomes a “bubble” at the point when enthusiasm outstrips real potential — and we don’t seem to be at that threshold yet.

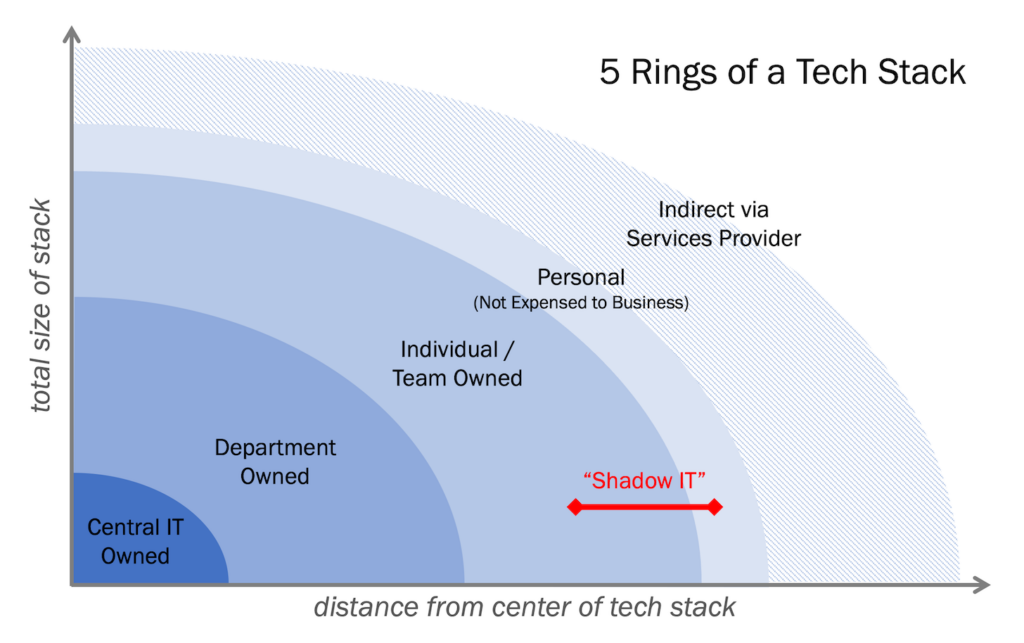

The next two clusters are symbiotically linked. While a few of the dynamics I’ve highlighted in them are particular to marketing technology, most are part of a larger transformation in business: almost any company can, to some degree, be a software company. And in a digital world, perhaps most should be. The boundaries are growing fuzzier by the day.

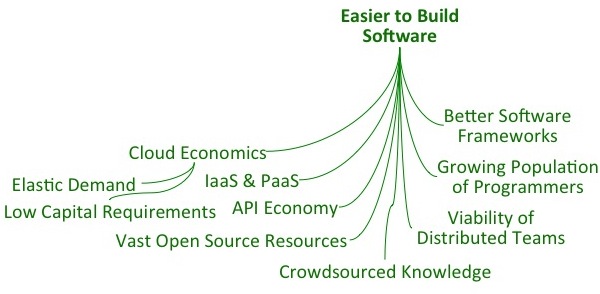

First, it’s Easier to Build Software than ever before. Infrastructure-as-a-Service and Platform-as-a-Serivce offerings — IaaS & PaaS — from Amazon, Microsoft, Google, IBM, Rackspace, etc., let any entrepreneur in a coffee shop spin up enterprise-grade cloud infrastructure in a matter of minutes, for pennies per hour. Cloud Economics for software companies have Low Capital Requirements (an understatement!) and the near effortless ability to adapt to Elastic Demand — pay only for what you (or your customers) eat.

Today, massively scalable, reliable, and high-performance computing and storage effectively present no entry barriers to any software market. Pause to consider how game-changing that is.

Similarly, the Vast Open Source Resources available to software developers today enable entrepreneurs to harness world-class software for databases, big data processing, web application frameworks, machine learning, data mining, front-end user experiences, and more — essentially for free. Every new software application built today has the benefit of starting out on the shoulders of giants. Really big giants. The API Economy offers an even wider selection of capabilities — often cheap, if not free — that can be tapped to augment applications in powerful ways with relatively simple digital handshakes.

And while demand still exceeds supply for great software developers, there is a Growing Population of Programmers out in the world. The increasing Viability of Distributed Teams — thanks to screen sharing, video conferencing, distributed source code management, and a cornucopia of cloud collaboration products for developers — makes such talent accessible from around the globe. And Crowdsourced Knowledge on technical issues of every kind, instantly available from Google to StackOverflow, dramatically reduces the friction of software development, no matter where you live.

Add to that Better Software Frameworks — and better frameworks for managing the process of software development too — and you realize that we’re truly living in the Golden Age of Software Development. More people can build more software, better software, faster. The inevitable consequence: there’s going to be a shipload more software in the world.

But that’s just half the equation of the software-ization of the world. It’s also Easier to Sell Software now too. SaaS Business & Sales Models have eliminated many of the barriers of old on-premise software sales. It’s much easier for companies to try out software in pilot programs — and it’s often affordable for vendors to offer such trials free or at low-cost. Freemium business models are popular, as are land-and-expand strategies, including those where distributed bottom-up users adopt long before needing global top-down purchasing approvals.

Cloud Economics make this feasible: you can start small and scale up as you demonstrate value. There’s little or no need to hassle with capital budgeting. Customers don’t necessarily need IT to purchase or operate many of these solutions (although that depends highly on the customer and the solution). Updates and customer support are easier to manage from centralized vendor control. Analytics of customer activity let vendors proactively identify at-risk customers and minimize churn. SaaS gives vendors more visibility and levers to affect retention and in-account growth.

This is the Consumerization of IT — it’s accessible to a much broader swath of professionals across the enterprise. Closely related to that is the notion of Ambient Software: services that we use on the web that technically-speaking are software, but we don’t even consciously think of them as such — they’re merely handy web services. (See: Marketers regularly use over 100 software programs.)

Blending Software & Services — putting more service in the software-as-a-service model — also opens up many different paths to account development. This approach can be particularly valuable to marketers who are more constrained by staff more than money or are still developing the internal skills to harness new technologies. Historically, marketers have been more comfortable buying services than tools. Paired with the Measurable ROI of most digital marketing programs, service-oriented vendors can sell concrete deliverables and results, not merely the tools to facilitate them. Picks and shovels are helpful; gold is more tempting. Higher-level “marketing-as-a-service” models are on the rise, either directly from technology vendors or in partnership with agencies and other marketing service providers.

Last but not least, blossoming Platformization & Middleware in marketing technology are solving the integration challenges that have been the biggest technical hurdles in such a diverse landscape. This makes it easier for marketers to plug in ISV (also known as “third-party”) products into their core marketing infrastructure. This gives them the best of both worlds: (1) a centralized switchboard for unified customer data and marketing program orchestration and (2) a very wide selection of specialized capabilities and cutting-edge innovations. While these dynamics probably favor consolidation among platforms — or the establishment of open platform standards — that could actually encourage more ISVs to enter the market. Strong platforms attract vibrant ISV communities, which can become a reinforcing loop.

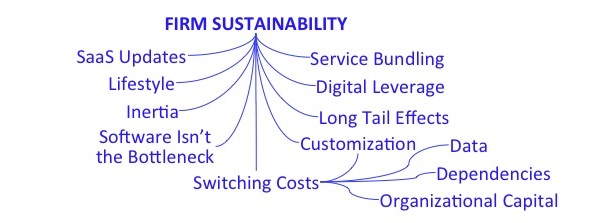

Firm Sustainability: Marketing Technology’s Ability to Persist

So we’ve covered a bunch of reasons why firms enter the marketing technology space. But how do so many of them manage to stay in it? Of course, not all of them do — which we’ll address at the end with a summary of the strong Exit Forces that are definitely present.

Nonetheless, there are a lot of small to mid-sized marketing software companies that seem to stick around longer than traditional thinking about software markets would suggest. Now, let me disclaim right up front: some of the factors that support this are going to be highly unappealing to venture capitalists. Many of the forces that permit small businesses in this space to adapt and survive run contrary to the scalable-to-billions-of-dollars model of VC-backed software. But frankly, most businesses in the world don’t fit the VC model, yet many are still quite attractive to their owners, employees, and customers.

Don’t get me wrong. Venture capital works really well for certain kinds of businesses, and there are surely many great “unicorn” companies in marketing technology that are ideal for the VC model. But there are also a lot of great companies that will operate outside of it too.

Some sustainability factors benefit all software providers, VC-backed or not. At the top of the list are Switching Costs — once marketers have adopted a solution, it can be expensive in time, money, and opportunity costs to migrate to another solution. It’s not just about the Data, that either must be moved or abandoned. It’s also about any Dependencies with other associated software tools or service providers, as well as the Organizational Capital of skills and processes developed around it.

Some of this is simply Inertia — once an organization has momentum with a particular solution, a body in motion tends to stay in motion. It’s also worth noting that Software Isn’t the Bottleneck in most cases of lackluster digital marketing. A company may want to switch to a different product to get better results — but in a lot of scenarios, they could probably just use their existing software in better ways.

SaaS Updates that can be automatically distributed to all customers provide an evergreen mechanism for products to evolve over time, adapting to changing customer needs without the discontinuities of “buy the update and install it, or take this opportunity to switch to another product” moments-of-truth.

But now we get into factors that depart from the standard VC playbook. Since there is always demand for services in marketing, creative Service Bundling lets vendors sustain relationships with customers that transcends their core software capabilities. That can be taken a step further by offering Customization of their software for individual customers. While customization can be a two-edged sword, it also further raises the ramparts of switching costs.

Long Tail Effects provide a nearly infinite set of opportunities for businesses — as long as you’re comfortable with the fact that the scalability of any one of those opportunities may be quite limited. But thanks to Digital Leverage, even small companies living in the Long Tail can provide the level of service and sophistication that customers would typically associate with much larger vendors.

Companies operating outside the cyclone of VC-backed growth can also find that Lifestyle is one of their greatest assets. Work/life balance and the freedom to choose what they do and whom they do it for, without the pressure of demonstrating hockey-stick growth, can be very appealing. Again, I’m not knocking the VC, run-for-the-billions model. I’m just pointing out that there are alternatives that are suitable for a much broader range of businesses.

In an adjacent space — and with the blending of software and services, I suspect it may be an analogous space, or possibly even a converging one — consider how many agencies and marketing services providers there are in the world. Thousands. They completely dwarf the marketing technology landscape. A year ago, Chick Foxgrover of the 4A’s did a little research for me (thank you!) and found that there were 13,269 agencies in the US in 2011 and that accordingly to last year’s AdAge Agency Rankings, 539 agencies in the US had revenues of $10 million or greater. That’s just in the US. Maybe two or three times that worldwide? Maybe more?

How do marketers choose among these firms? How do they differentiate? How do they survive (at least in aggregate)? How do they get the money to launch and grow — because very few of them have VC investors? The answers to those questions may offer hints as to how the marketing technology landscape could remain large and diverse as well.

Limits to Firm Growth: An Unlikely Monopoly

On the other side of the spectrum, what prevents really large companies, with billions of dollars at their disposal, from completely dominating this space? Could there even be a marketing technology monopoly?

While I believe there will be a number of giants in the marketing technology landscape — most of them likely in the platform and middleware layers — I also think that there are a number of dynamics that impose limits on just how big any one of them can become. Even smaller and mid-sized marketing technology companies find themselves constrained by these forces. They can grow rapidly to a point, and then they face increasing headwinds.

The downside of market segmentation is that Segmentation = Fragmentation. There’s only so much available business in any one particular segment. But when you start aggregating segments, you have to wrestle with a Pareto trade-off between the benefits of broader scale and the benefits of segment specialization. There are a lot of creative points along that curve, but it’s impossible to have both. I’ve said it many times: Marketing is not ERP. It’s hard to boil everything down into universal solutions. The bucket of marketing standardization leaks like a sieve.

Large companies have economies of scale, yes, but they also have Diseconomies of Scale as the administrative overhead and cost of coordinating thousands of employees grows. Some of that cost comes through the loss of agility. In a market with Accelerating Forces of Change that can be particularly frustrating.

Some of the diseconomies of scale are specific to Software Complexity. The larger a software product becomes, the more complex it is. For the software engineers working on it, it’s more complex to make changes or add new features, particularly when one has to maintain backwards compatibility. Debugging and tracking down weird interaction effects becomes more difficult. All this creates drag on the ongoing evolution of the product — which is painful when the market is in the throes of accelerating change. Look at the history of the Windows operating system for an instructive case study in challenges in moving a large-scale, legacy code base forward.

And that’s just the technical side of this complexity. For the marketers working with the software, the usability of an ever larger and more complex product can quickly become a drag on their productivity. They crave simpler tools for more specialized needs. (Again, witness the Optimizely effect.)

Complexity can be even more of an issue for companies who have built their scale by acquiring many different firms. M&A Integration Challenges include everything from different software architectures at the low level to different visions of design at the high level. I’m a firm believer that code is a creative medium, and that software is a tangible expression of the culture of the company that creates it. Merging cultures, even compatible ones, is a very difficult management challenge.

Regardless of a vendor’s size, however, they all face a set of common challenges. It’s a Noisy Market, so getting your message to marketers — and piercing the cacophony of content that assaults them daily — is no small feat. And thanks to accelerating change again, you have to fight this battle continuously.

Due to Low Barriers to Entry — and all the dynamics of growth we discussed earlier — it’s a Large/Renewing Competitive Field. Even if you succeed in eliminating a set of existing competitors, others can easily pop up behind them. And more marketers (and especially their IT brethren) have Resistance to Vendor Lock-In that would shut out those competitors. This means you have to constantly address Churn among existing customers.

There’s also the War for Talent that every technology company is embroiled in. Consider that many of the major acquisitions in the marketing technology space have resulted in the entrepreneurs of those acquired companies taking their sacks of cash, leaving their acquisitor, and going off to launch a new generation of marketing technology companies. For many of the brightest engineers and marketers, these new start-ups hold more appeal than working in a big company.

One last limit to growth to keep in mind: Marketer Capacity. There’s only so much marketing technology — and ever more sophisticated marketing technology — that marketers can absorb at any one time. This is ultimately the paradox of Martec’s Law: technology changes exponentially, but organizations change logarithmically. With all the other forces competing here, this arguably becomes the biggest barrier to growth that vendors run up against.

Exit Forces: No Suspension of the Laws of Nature

While the Growth Forces and Firm Sustainability dynamics of this landscape are powerful and fascinating, they are not omnipotent. Marketing technology ventures don’t have any guarantee of survival. Depending on what they’re doing, and how they’re doing it, they may have better odds of survival than software ventures in other industries. (Although the dynamics of software in many other industries are now in flux as well.) But it’s definitely not easy, and Exit Forces do take them out.

However, they don’t necessarily exit due to Direct Competition (“Winner Take All”) or Merger/Acquisition events. Those are the headlines of consolidation. But many exits happen for far less heroic reasons: Mismanagement, Product Failure, or Business Disaster.

Marketing technology companies are not immune from Market Disruptions either — in fact, they’re in a field that’s at the very vortex of accelerating change, so they probably have greater risk of that than most. This allows the Rise of Substitutes, not so much direct competitors, to take away business.

Since market segmentation is usually one of the chief drivers behind a marketing technology company’s opportunity, any Erosion of Segment can cut deep too. (My overarching advice to marketing technology start-ups: pick your segments carefully and consider how you’re going to defend them in an ever-shifting environment.)

Finally, in a business driven by intellectual capital, Talent Migration is an existential threat. It’s important to note, however, that this isn’t just about key employees leaving. It can be the owners and executives of the business itself, who may decide to pivot to something different. The Growth Forces that brought them into their current venture may seduce them to another.

I’m sure there are hundreds of other ways for a firm to exit — although we could lump the scenario of a giant asteroid crashing into Earth as a “business disaster.” This certainly isn’t an exhaustive list. But it demonstrates that deaths are as much a part of the dynamics of the marketing technology landscape as births.

Conclusion: Marketing Technology Is a Complex System

Have I convinced you that the marketing technology landscape is a complex system? Are you open to considering different ways in which it may evolve as all these forces interact? If so, then my main objective with this post has been achieved.

Hopefully, by being aware of these different forces intermingling, it will also help you better navigate this landscape — even if you aren’t able to fully predict all the interaction effects. And remember:

- Design for change.

- Value optionality.

- Keep an open mind and never stop learning.

- Allocate a portion of your portfolio to experimental alternatives.

- Balance focus with peripheral vision (they’re not mutually exclusive).

- Develop the organizational agility to act and react swiftly.

And, of course, come to the MarTech Conference, March 31 – April 1 in San Francisco, where we’ll dive into a more thorough view of how to manage this landscape and extract value from it as a marketer or a marketing technologist.

Great post, Scott! I think there is also room in the space for platforms that tie together this ever-expanding array of point solutions. It will take collaboration between the makers of the point solution platforms and the platforms that tie them together. However, I believe doing so will drive greater adoption of all point solutions and increase the overall adoption of MarTech as a whole.

Scott – this is awesome! This is a guidepost that every #Enterprise #marketeer should learn and be tested on!! Know your #marketing Know your #solutions Know your #MarTech landscape!

This isn’t a blog post, it’s a textbook. Many of your points resonated with my experience as part of the “landscape,” especially the idea that non-VC backed, privately held companies can thrive alongside the powerhouses.

Holy cow: you’re a one-man analyst firm.

This is the best analysis of the marketing tech landscape I’ve ever read.

It feels to me like this will go the way of many tech markets, with 3-5 platform winners and lots of best-of-breed specialists (but nowhere near as many as today). But maybe, as you say, software is changing and this pattern will be replaced by an open ecosystem connected by APIs.

Either way, if Martec’s Law prevails, we’re gonna see a shake-out.

Coming late to the party, but the way I am seeing things in 2017 is that the consolidation has already happened at the upper level. Google has started making lot of marketing tools which will invariably kill others as Google has best in class engineering and they are virtually free for SME. Apple is consolidating via its lockin mechanism of iOS. All advertisers have to play on Apple terms. Amazon has breadth of tools on AWS which are scalable and cheap, its no more IAAS but a layer above it.