I’m sorry. I know a lot of people wish that the marketing technology merry-go-round would slow down and consolidate. And I fully appreciate why that’s desirable.

Unfortunately, the evidence I keep encountering says we’re not there yet.

Here are a few points on the curve that I’ve recently come across that suggest that marketing software remains a sector of frothy innovation:

1. Social Relationship Platforms (SRP). We’ve come a long way from simple social media monitoring. Social media marketing and management has become more complex, larger in scale, and more important than ever for brands to get right. Tackling that mission, many of the leading products in that space — such as Hootsuite, Percolate, Spredfast, and Sprinklr — have advanced tremendously over the past couple of years.

I debated with Jeremy Epstein of Sprinklr a year or so ago whether they were offering a product or a platform. He insisted on the latter, but I remained skeptical. It didn’t feel like a platform to me the way I was thinking of the major “marketing clouds” that were being positioned as the core systems of record for marketing and developing ISV ecosystems.

However, as Sprinklr has made an expansive set of acquisitions and combined them into an overarching architecture that they call an “Experience Cloud,” I have to admit, they’re looking more like a platform. (Memo to Sprinklr: ISV ecosystem.) It’s a very different kind of platform than those that emerged from the CRM, CMS, and marketing automation vendors. But when you look at how marketing is changing, it makes sense that there could — and should — be very different approaches.

Jeff Dachis, an advisor to Sprinklr, published an article on TechCrunch Why Marketing Clouds Make No Sense, that outlines their vision of how these social relationship platforms could become the center of gravity for a brand’s marketing technology. Admittedly, the title is a bit click-baity, as for the visible future, SRPs won’t replace MAPs, CRMs, or CMSs. But they may be equal peers — and it’s quite possible that the SRPs could take the lead in being marketing’s primary coordination system. It’s not coincidental that Spinklr was just valued at over $1 billion (another unicorn!) in their latest fund-raising.

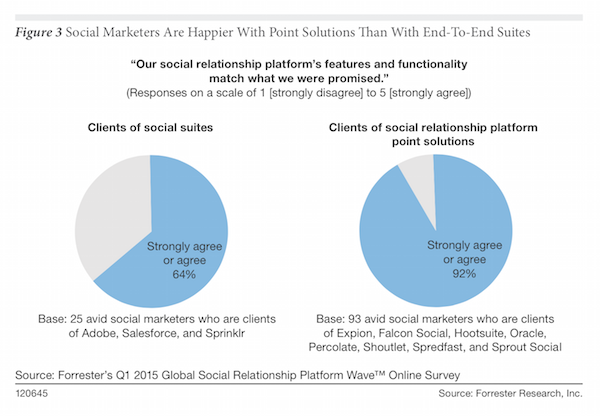

Of course, the major marketing clouds themselves are also building or buying social marketing technology into their offerings. But the latest Forrester Wave report on Social Relationship Platforms concluded that the “point solutions” — their words, not mine, Jeremy — had beat out the suites. Percolate, Spredfast, and Sprinklr were all rated “leaders” while Adobe, Oracle, and Salesforce were merely “contenders.” A gulf of “strong performers” separated them.

I found the above graph in Forrester’s report to be particularly interesting in this regard — that marketers using point solutions were happier with their features and functionality than those who had the suites. Is this a phenomenon that’s unique to SRPs? I suspect not.

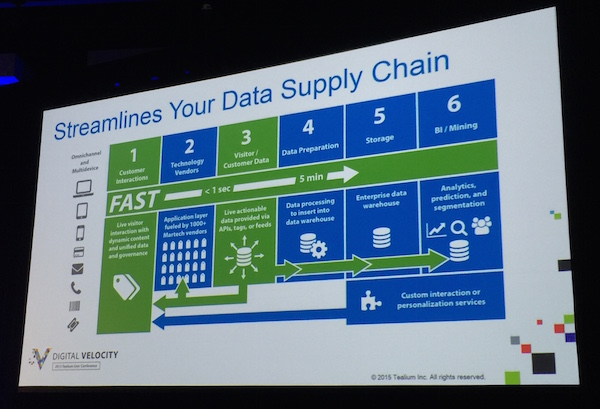

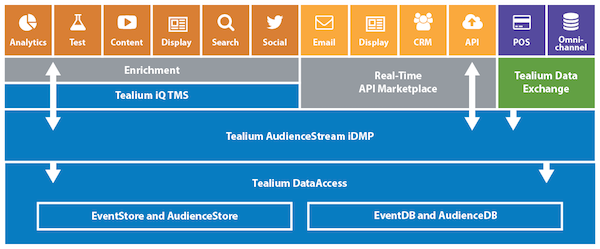

2. Tag Management Evolves to a Data Supply Chain. Last summer, I wrote a post describing how some of the leading tag management vendors were innovating as a new kind of marketing middleware. That metamorphosis has only accelerated. Last week, I was at Tealium’s user conference — disclosure: I was a keynote speaker at the event — and I was fascinated by how much they’ve advanced their architecture and product portfolio to become a grand “data supply chain” of marketing data of all kinds.

Just as the SRPs were built around a vision of social activity of all kinds as a first-class citizen of modern marketing’s core customer experience capabilities, this next generation of tag management is driven by the vision of heterogeneous data pipelining — of all kinds, from a multitude of sources — as a first-class citizen of modern marketing operations. Tealium now supports over 750 turnkey integrations with a massively diverse set of other marketing technologies across affiliate marketing, analytics, display advertising, search marketing, email, personalization, social media, and so on.

Two things that I find particularly interesting here.

First, Tealium is making a big deal about giving marketers ownership of their own data. With Tealium’s customer data platform, you can define where the data lives. They’ll host it for you if you want. But they’ve also made it easy for you to host it on other cloud-based infrastructure that you own (or rent) independently. That’s a powerful statement, in a world where marketers are becoming aware of how valuable their data is — and how dependent they are on some of their vendors for the control of it. I think this will be a disruptive issue in the years ahead.

Second, as with SRPs, many of the major marketing clouds include their own tag management. But most of their tag management capabilities have not evolved very much in the past couple years — certainly not to the degree of the leading tag management “point solutions.” (I put that in quotes because, quite frankly, this data supply chain now looks a lot like a platform too — although again, a very different kind of platform from the marketing clouds.) Tag management used to be just a feature. It was built or acquired, and the box was checked. But outside of the suites, tag management has continued to morph into something else.

3. Account-Based Marketing Rising. Another category of marketing technologies that has been blossoming lately is software for account-based marketing, where a vendor targets very specific companies for their marketing and sales efforts. Now, account-based marketing isn’t particularly new — it’s a strategy that formally emerged in the 1990’s. But the wealth of data and programmatic targeting capabilities that are now available to support it are inspiring a new wave of innovation.

Companies like Demandbase and Bizo (which was acquired by LinkedIn and synthesized into LinkedIn Business Solutions) were some of the martech pioneers to power account-based marketing practices. But a new generation of start-ups has recently appeared, including Engagio (founded by Jon Miller, previously a co-founder of Marketo) and Terminus (funded by one of the co-founders of Pardot).

Here’s what’s particularly interesting about this. You can certainly use existing marketing clouds to do account-based marketing — but most of them weren’t designed with that as their primary use-case. Talking with some of these new start-ups, it’s fascinating to see how they’re designing their entire architecture around that mission. And that has big implications on their underlying data model and their user experience (UX). Will these products be a “feature” that adds on to existing marketing clouds? At first, yes. But could they grow into first-class citizen platforms of their own, especially for companies who predominately rely on account-based marketing?

Maybe.

And if you consider the incredible evolution of social media monitoring and tag management, it would seem unwise to underestimate the potential for new marketing platform models.

4. Amazon Machine-Learning-as-a-Service. The last point on the curve that I came across these past couple of weeks was the announcement by Amazon that they are now offering a machine-learning-as-a-service API, as part of their growing smorgasbord of web services.

You can almost hear the sound of a dozen predictive analytics vendors groaning.

Amazon’s new service lets programmers, with a few lines of code, bring to bear state-of-the-art machine learning and predictive analytics algorithms on large-scale data sets — all stored and easily scaleable within the cloud. Some of the use cases that Amazon highlights as examples include:

- Content personalization

- Propensity modeling for marketing campaigns

- Customer churn prediction

Hard not to read that and wonder, “Is Amazon a marketing technology vendor?” For more technically advanced marketing teams — I’m thinking of Tony Ralph’s ad operations group at Netflix — yes, services like this can be consumed directly. Data science teams working under marketing would also probably find this accessible.

But the bigger disruption is that this now enables any entrepreneurial martech start-up to incorporate these capabilities into their product with very little effort. It democratizes a whole set of functionality that other companies used to consider a proprietary competitive advantage because they had invested months or years in developing it. That competitive advantage based on just brute-force predictive analytics computing just went “poof.”

The new competitive advantage will be in how these machine learning capabilities are applied. That will be the real value proposition for marketing predictive analytics companies. Their challenge is that, now, any entrepreneur with a better idea of how to apply machine learning power can create a working prototype with a fraction of the resources previously required.

And it’s not just Amazon. For another example of the kind of API-accessible power that marketing technology teams can take advantage of on-demand, check out Diffbot, which could best be described as automated computer vision for the web.

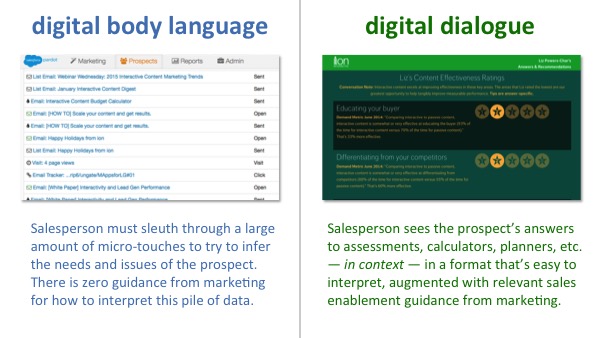

5. Multi-sided Interactive Content. I can’t resist a nod to my last post on 2-sided interactive content — app-like content that includes a “buy-side” that prospects interact with and a “sell-side” that salespeople work with.

I won’t rehash the whole post, but the conclusion at the end — that instead of just shipping data back-and-forth across the enterprise, we can pass adaptive experiences among multiple stakeholders, inside and outside of an organization — strikes me as the seed for another kind of marketing platform architecture. But I’m biased on this last one.

What does this all mean?!?

If your head is spinning, you’re not alone. Mine is too.

For marketers and marketing technology companies, this is an exciting yet challenging time. Marketers have the benefit of having thousands of the world’s smartest minds working on ways to give them superpowers that weren’t even imaginable a few years ago. But they wrestle with which technologies to adopt when, how, and in what combination. Marketing technology vendors have an amazing opportunity to shape this future — but face tremendous competition and continued disruptions to their carefully laid plans.

The high-level advice I’d offer to both? Design for change.

The evolution of marketing technology is not winding down. It’s heating up.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.