A friend forwarded me a report, titled “Software Is Eating the CMO Suite,” that was shared by Morgan Stanley at the Ascendant Network event for digital marketers in New York earlier this month.

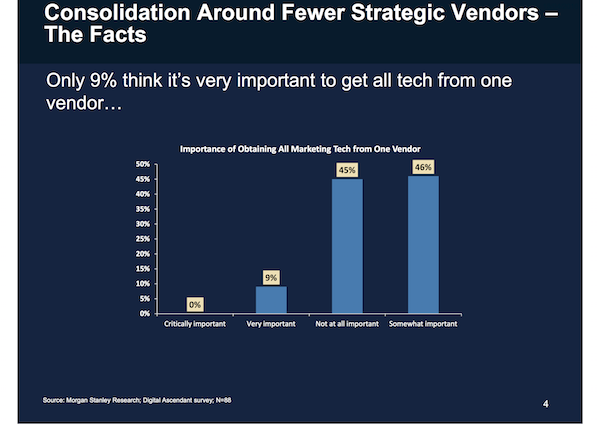

The most striking piece of data in the report, at least to me, was the chart above.

Out of the 88 participants in this survey conducted by Digital Ascendant — which I’m assuming is drawn from their network of CMOs and senior digital marketing leaders at major brands — 0% said it was critically important and only 9% said it was very important to obtain all their marketing technology from a single vendor.

In sharp contrast, 45% said it was not at all important.

Take a moment to let that sink in: top marketing leaders today are 5X more likely to think that acquiring their marketing technology from a single vendor — the grand marketing suite vision that has been promoted by a number of public companies in this sector — is “not at all important” than to think that it is “very important.”

And none think it’s “critically important.”

Granted, the remaining 46% of the participants said it was “somewhat important” — which given the much stronger wording of the other choices seems like it could be a catch-all for positions as varied as “we see pros and cons to both sides,” “we’re open to considering it,” or “we’re not sure.” I suspect some Likert-scale-like central tendency bias is at play here too.

But out of those participants who are confident — is a single-vendor approach to marketing technology important or not important, yes or no — the answer is clearly: no.

That may not come as a big surprise to regular readers of this blog, but still, that’s a powerful statement coming from one of Wall Street’s largest investment banks.

Interestingly, the very next page in their report attempts to mitigate the impact of that dramatic conclusion, although in a somewhat bizarre manner:

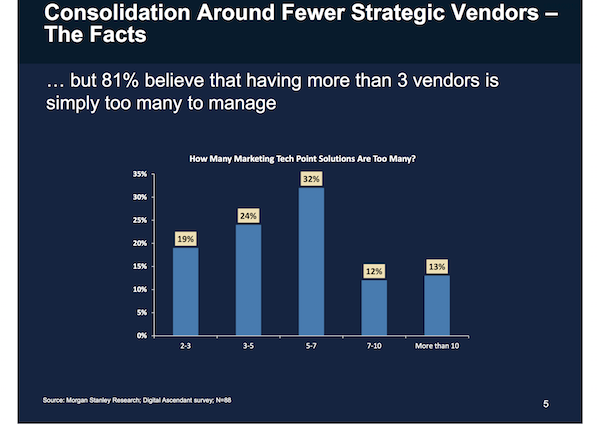

Morgan Stanley claims that 81% of these senior marketers believe that having more than 3 vendors is simply too many to manage. “Okay, maybe the single vendor suite is dead, but a select 2-3 strategic vendors will prevail” seems to be their narrative.

It’s a nice narrative for their “consolidation around fewer strategic vendors” thesis, but oddly the data they present as evidence doesn’t match that narrative at all.

As far as I can tell from the graph of their data, the opposite is true: only 19% of marketers think 2-3 marketing tech point solutions are too many. 81% have a higher tolerance level for more vendors.

But this graph is a little weird. For one thing, the overlapping boundaries in the categories make it hard to calculate exactly where respondents hit their limit. Next time, I’d humbly propose surveying with categories like 2-3, 4-5, 6-7, 8-10, and more than 10.

Also, aside from greater precision with quantifying the categories, I’d like to see greater precision in the definition of the terms “strategic vendor” and “point solution.” In my mind, these are not the same thing.

I’m actually a believer in the benefits of a marketing team standardizing around a relatively small number of true marketing technology platforms — systems that can serve as the foundation of common customer data and common digital assets. To me, those are the most strategic marketing technology vendor relationships that a company must manage.

But a huge benefit of true platforms is that they can be augmented by more specialized third-party capabilities — or “point solutions” if you prefer that term.

Let’s say that your “360-degree view of the customer” strategic vendor platform is a CRM, a marketing automation platform (MAP), a customer data platform (CDP), or a data management platform (DMP). I know, those are different kinds of systems, but they are the most well-known ones vying for such a 360-degree view.

Why does that 360-degree view system need to natively have the best A/B testing functionality for your website? Or the best SEO auditing? Or why does it need to be best at hosting an online community? Or running a webinar? Or managing video advertising on YouTube? Or finding key influencers on social media? Or building groovy interactive content? Or running your agile marketing Kanban board? Or dozens of other specialized tasks in modern marketing.

It doesn’t.

And it’s folly to expect that any one vendor would be the best at all of those things, not to mention all of the new innovations that we can’t even yet imagine coming in the years ahead.

Yes, with a number of these point solutions you’d want to pull some data from the 360-degree view system — or add some data to it — but in most cases, we’re talking about extremely lightweight data. We want to recognize someone we already know, and we want to note that they had a particular touchpoint with us. These are pretty simply APIs. And it’s why a true platform strategy in marketing technology is so viable.

Most of these point solutions aren’t “strategic vendors.” That’s overstating — and vastly overcomplicating — their role. They’re just great software products, mostly offered as on-demand services in the cloud.

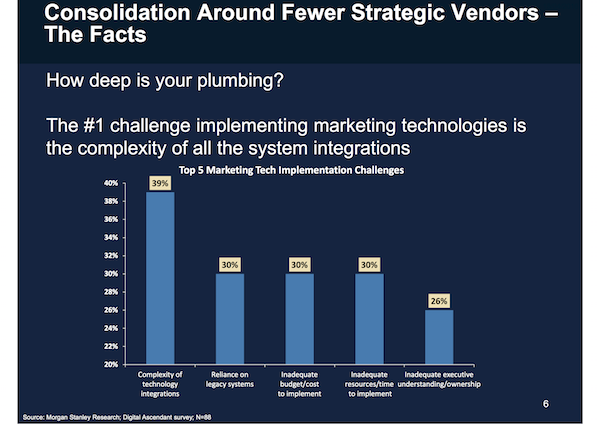

Which brings me to one last graph from that Morgan Stanley report:

Here again, they have a narrative they want to tell — that the #1 challenge implementing marketing technology is the complexity of all the system integrations. This time, the data they share does correspond to that conclusion, but they present it with a misleading truncated graph — note that the y-axis starts at 20% instead of 0%.

The result is that it looks like “complexity of technology integrations” is nearly 2X more of a challenge than “reliance on legacy systems,” “inadequate budget/cost to implement,” and “inadequate resources/time to implement.” But in truth, the complexity of integrations was a challenge for 39% of the participants — while each of those other three difficulties were challenges for 30%.

Stating that integration complexity is only 9% more frequent of a challenge than wrangling legacy systems, inadequate budgets, and inadequate time and resources does put it in a more modest context.

My impression is that Morgan Stanley is advocating for “Big Martech” — albeit no longer as a single-vendor suite — which makes sense, as those are generally the companies that are public or soon-to-be-public. But to me, the data seems to suggest that the multi-vendor marketing technology stack is winning — and that will continue to motivate support for a more open and heterogeneous martech environment ahead.

P.S. Since someone sent me this report second-hand, I’m not able to post the full document here. However, if Morgan Stanley makes the report available on a public website, I’ll be happy to update this post with a link.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.