The following is a guest post by the remarkable David Raab, principal at Raab Associates, author of the Customer Experience Matrix blog, advisory baord member for MarTech Conference in San Francisco, and now head of the CDP Institute. You can download the latest CDP Industry Profile report from their site.

Customer Data Platforms are having a moment — a category that was named just three years ago now has more than two dozen vendors with over $300 million revenue, $700 million funding, and better than 50% annual growth.

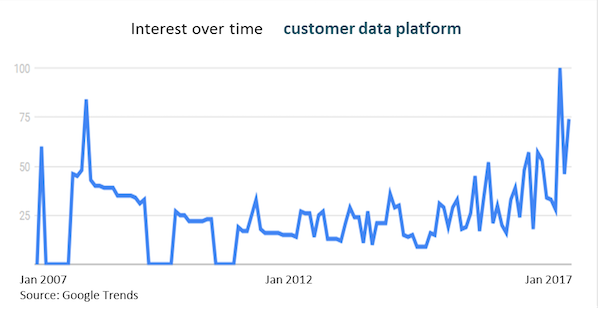

Buzz is growing too: CDPs made their first appearance on a Gartner Hype Cycle report last July and Google Trends shows a sharp increase in interest. There’s even a CDP Institute (which I happen to run) that publishes CDP-related news, best practices, use cases, buyer’s guides, and more.

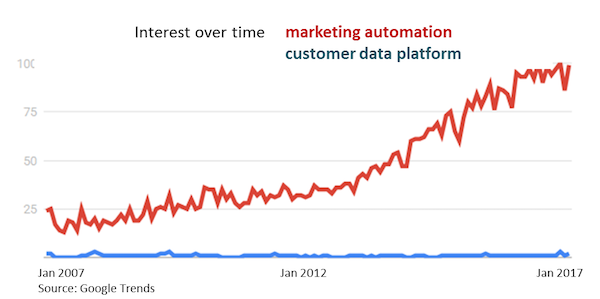

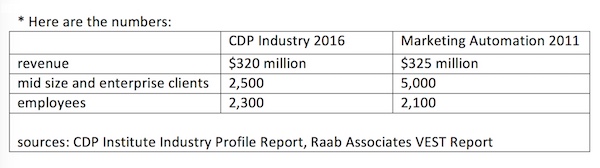

But let’s not get too excited. Although the CDP industry today is roughly the same size as the B2B marketing automation industry in 2011*, it has vastly lower awareness. Simply put: the vast majority of marketers and marketing technologists don’t realize that CDPs exist.

That’s a pity, because CDPs have a great deal to offer. They solve a critical problem facing marketers today: the need for unified, accessible customer data. If you’re not already familiar with CDPs, the important points to know are:

- They are software or software-as-a-service products that ingest customer data from many source systems and combine it into a unified customer database — also known as the Single Customer View. That’s important because effective personalization, analytics, and coordinated customer experiences all require unified data.

- They are designed to be run by marketing departments with little or no support from corporate IT. That’s important because IT groups often don’t have the resources or understanding to do what marketing needs as quickly as they need it. Of course, an IT department can also run a CDP. In fact, the efficiency of CDPs makes it a huge time-saver for them.

- They make their data available to all external systems. That’s important because marketers today have so many different systems that need complete customer data to deliver the best results. Marketing automation products and marketing clouds rarely give other vendors’ products complete access to the data they assemble. (To be fair, most marketing clouds also struggle to share data among their own components.)

In short, CDPs solve a big problem (the need for unified customer data) and they solve it better than many other solutions (which can’t easily add new data, don’t put marketers in control, and don’t allow easy external access).

Is that everything you need to know?

Of course not. There are substantial differences among CDP products — much greater than among marketing automation systems, which quickly converged on a standard feature set. Key differences among CDP systems include the types of data they ingest, how they unify customer identities, support for real-time updates and queries, and ancillary capabilities such as machine learning, segmentation, message selection, and campaign management.

There are also non-technical differences in pricing, support services, and industry expertise. Marketers need to understand what those issues are and how they relate to each company’s own needs. The Evaluation section of the CDP Institute Library contains detailed information on those topics if you want to explore them further.

But this is the chiefmartec blog, so I can’t just write a post that describes CDPs. You expect Deep Thoughts. I’ll do my best. Let’s try a bit of self-interviewing.

Why are CDPs suddenly getting so much attention?

Several reasons. First, technology is now available that makes it easier to accommodate new data sources without complicated integration. Nearly all CDPs use a NoSQL database like MongoDB or Hadoop that can easily ingest new data without building a detailed data model. We’re also seeing increased use of artificial intelligence to help assess and integrate new data sources. Easier integration is what lets CDPs build databases without the technical effort that slowed deployment and increased cost of traditional customer database projects.

Easier integration is what lets CDPs build databases without the technical effort that slowed deployment and increased cost of traditional customer database projects.

Second, more marketing systems are designed to easily export and import data through things like APIs and microservices (as Scott recently pointed out).

Third, there are many more marketing systems in use, making the need for unified customer data more obvious and more pressing.

Fourth, most companies now have marketing technologists who are formally charged with creating a coherent martech plan — and once people start doing that, the need for a CDP becomes obvious. Underlying it all are customer expectations for relevant, coordinated treatments, which is why the unified data is needed in first place.

What’s the significance of CDPs for the larger martech ecosystem?

CDPs are a key enabling technology for the continued growth of martech. As we just discussed, they make it easier to assemble unified customer data and to make that data accessible. This lets marketers more easily deploy new martech applications that need the data.

CDPs reduce the work that martech application developers need to put into data management capabilities. It’s the same logic that makes it easier to build for the Salesforce App Exchange: developers can focus their effort on what’s unique about their product, not on replicating common functions that the platform provides.

If the marketing clouds and similar platforms were truly open, then CDPs might not be needed. But in practice, marketers who want to use tools from different sources will need an application-neutral unified data store. That’s a CDP.

What near-term changes do you see in the CDP industry?

I do expect some convergence in features. These are now wildly divergent, mostly because the CDP systems evolved from different ancestors (tag managers, campaign managers, etc.). But the need for convergence is somewhat reduced because of the openness of the CDP systems: for example, CDP developers can use external identity resolution services rather than building their own identity resolution from scratch.

Similarly, many CDPs include things like predictive models and campaign management (or its smarter younger brother, journey orchestration). These give the CDP buyer a way to get immediate return on her investment, instead of first building the unified database and then connecting it to some other application. But as connecting to those other applications becomes easier, it becomes less important to have them within the CDP itself.

CDPs don’t need to physically copy all customer data into their data store. There’s a lot of data that it doesn’t make sense to load in advance.

Also somewhat related to openness, I see continued recognition that CDPs don’t need to physically copy all customer data into their data store. There’s a lot of data that it doesn’t make sense to load in advance because it changes quickly and you only need it for a few individuals at rare moments. Examples include purchase intent, local weather, and stock portfolio values. Rather than storing it, CDPs need to be able to read and integrate that data from internal or external sources on demand.

We can also expect the sorts of things that happen to all sectors as they mature: more vertical products; more products for smaller businesses; better user interfaces and analytics. We see some of those changes happening already but they’ll accelerate. (I should point out that CDPs descended from tag managers also serve a large number of small businesses.)

A larger industry will attract competition from adjacent spaces, such as data management platforms (DMPs) and integration hubs, such as Jitterbit, Mulesoft, Zapier, Snaplogic, etc. And we’ll see execution and analytical applications building up their data management capabilities to offer CDP-type services. Again, these are already happening to some degree.

Eventually, we’ll see industry consolidation: leaders will emerge and the big enterprise software vendors will buy them. Oracle/BlueKai and Salesforce/Krux could be early examples although both products were built as DMPs. The real question about consolidation is when. I don’t think it will be any time soon, but it’s probably inevitable in the long run.

Where will CDPs fit into the long-term changes in martech?

If martech consolidates around a few core platforms (Salesforce, Adobe, etc.), then CDPs will be built into those platforms and demand for independent CDPs will drop. In theory, that shouldn’t happen because marketers strongly to pick best-of-breed components. But other segments have gone through this process, and we’ve always seen a sort of gravitational pull towards buying fewer systems that have more features.

I’ve modestly named that “Raab’s Law”, which states that multi-function suites always displace best-of-breed specialists. It starts at smaller firms, who have the simplest needs and can least afford integration costs. As the suites get better over time, fewer companies have needs that are only met by best-of-breed products. This sets up a vicious cycle, since the market for best-of-breed systems shrinks, which deprives the best-of-breed vendors of resources needed to maintain product superiority. So, Raab’s Law predicts that CDPs will become features of marketing suites.

Expanding scope makes it much harder for a single suite to do everything.

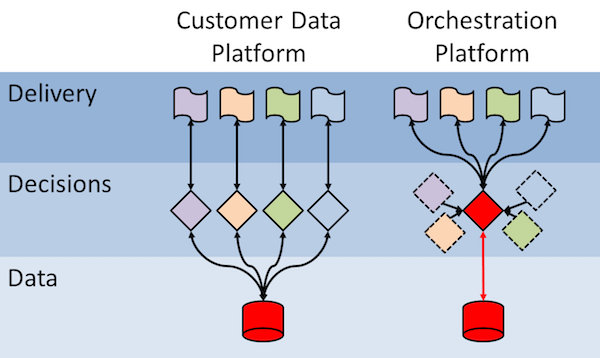

But this assumes that the features of the martech stack are roughly stable. In fact, those features are shifting as martech increasingly overlaps with adtech and with other customer experience systems (sales, customer service, point of sale, Internet of Things, etc.). Expanding scope makes it much harder for a single suite to do everything. So I expect a continued division between systems that deliver experiences, which will remain separate and diverse, and systems that decide about experiences, which will be unified.

This fits the three-level data / decision / delivery model I’ve used for years. The decision layer contains advertising and email campaigns, real-time interactions on websites, call centers, and mobile devices, predictive and other analytics, content management (which becomes vastly more complex and important, although that’s a topic for another day), and general marketing planning and management.

Since our goal is to orchestrate treatments across all delivery systems, a single orchestration system makes sense. The chief orchestrator might connect with other specialized systems, although these will probably collapse into a single product (Raab’s Law again). If there is a central orchestration system, it would make much sense for it to have a unified database. Indeed, many CDPs already include an orchestration capability. We can be pretty confident this trend will continue.

But this still assumes that marketing remains pretty much as it is today. There’s a good chance we’ll see a far more radical change.

A handful of companies are taking increased control over access to customers. The near-term version of this is growth of the “walled gardens” created by Facebook, Google, Amazon, and Microsoft (something Scott also recently discussed under the heading of “vertical competition”). Taken to extreme, the result could be that one company controls nearly the entire life experience of each individual (even though different companies could serve tribes of different individuals). I’ve written about this as “personal reality” and can’t say I like the implications.

Taken to extreme, the result could be that one company controls nearly the entire life experience of each individual.

Even if we limit ourselves to the milder walled garden scenario, the result for martech is there’s much less data escaping from the owner’s gardens and much less control of the customer experience by marketers outside the garden. Martech itself then withers away as fewer marketers are in a position to use it effectively.

It’s true that other martech could emerge to help outside marketers get the most from the garden owners — in the way that search engine optimization tools help companies “market” to search algorithms. But there would still probably be much less for martech outside of the gardens themselves.

CDPs would still have a role in this new world. If nothing else, they’d manage data related to operational interactions with customers, which will remain beyond the grasp of the garden owners. But their importance will shrink with the rest of the marketing stack.

Are you really that pessimistic?

Well, no. The future is vastly less predictable than we like to imagine and I’m a cheery optimist by nature. The more unpleasant scenarios would take a long time to mature and plenty can happen to disrupt them.

Martech in general and CDPs in particular have an exciting future ahead.

In the meantime, martech in general and CDPs in particular have an exciting future ahead. So my best advice for right now is to see what a Customer Data Platform can do for you and take advantage of it. And join the CDP Institute.

Thanks, David!

Readers: don’t miss the opportunity to hear David share his latest insights on customer data platforms at the MarTech Conference in San Francisco, May 9-11. There’s a rumor that he may even have a musical number in his presentation. This year MarTech, next year Broadway. Register now for the lowest “alpha” rate on tickets to guarantee your seat.

Hi David – great article, what striked me as particularly interesting was “Raab’s Law”, which seems to state that customers tend to lean more towards suite solutions over time.

This seems to be not a black or white thing, but depends on what we’re actually looking at, and how multi-function suites are defined. I think it definitely would be true for a good portion small/medium size market and current wave of large enterprise martech solutions. For example, a suite like Marketo makes complete sense for most small businesses due to its affordability and extent of multi-function integration (more cost effective than combining multiple point solutions).

Adobe/Oracle’s marketing cloud suites aren’t doing too bad market-share wise due to the manner they grow their suites (acquisitions), but we already see them starting to get disrupted by new agile data hub-like solutions such as Tealium, Ensighten, or Agilone that are much faster growing, which enables much lower cost solutions for building a customized “marketing cloud”. Their business models are also more scalable in nature.

The “marketing automation” wave has slowed, and we will see more CDP and Customer Data Hub-like solutions grow as a result of their ability to have platform-like scalable value creation. (ActionIQ is one of such companies to watch out for!)

Hi Jimmy,

It’s true that smaller businesses are most sensitive to integration costs and therefore most likely to prefer integrated suites over a collection of best-of-breed tools. But large organizations have other factors that push them in the same direction — notably IT departments that want to work with as few vendors as possible. I suspect that marketing technology groups will have a similar attitude. Research shows there’s a substantial portion of marketers have or prefer a single vendor solution: see this survey by Walker Sands and ChiefMartech http://www.walkersands.com/State-of-Martech , this survey by the CDP Institute http://www.cdpinstitute.org/DL277-CDP-Industry-Profile, and this one by TFM Insights https://tfmainsights.com/marketing-technology-support-in-2017-download/.

CDPs are intended to lower integration costs and thereby make it easier for marketers to use separate products instead of suites. (Tealium, Ensighten and AgilOne are all CDPs, incidentally, and in fact are all valued sponsors of the CDP Institute). Moreover, even the suites don’t provide complete solutions, so marketers must do some integration even if they do buy a suite. Whether CDPs create an exception to Raab’s Law remains to be seen. Even if suites do eventually triumph, I believe CDPs will offer great value to many marketers for a long time before that happens.

If the enterprise is leaning towards assembling best of breed set of solutions, a CDP seems like it is a must