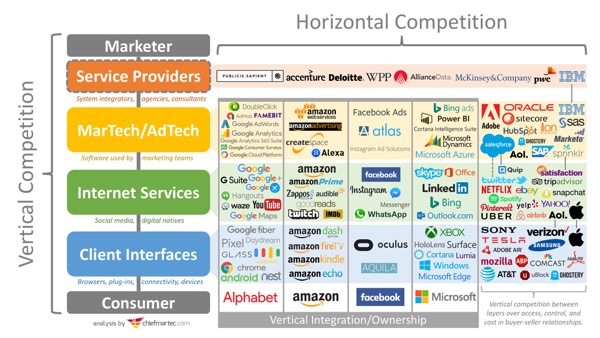

Click the image above for a larger version of the illustration.

This is Part 3 of a 5-part series on 5 Disruptions to Marketing (you can start with Part 1 and Part 2 if you haven’t already):

- Digital transformation redefines “marketing” beyond the marketing department.

- Microservices & APIs (and open source) form the fabric of marketing infrastructure.

- Vertical competition presents a greater strategic threat than horizontal competition.

- AR, MR, VR, IoT, wearables, conversational interfaces, etc. give us digital everything.

- Artificial intelligence multiplies the operational complexity of marketing & business.

3. VERTICAL COMPETITION

Most of the time when we think of “competition,” we’re thinking of horizontal competition: competitors who are offering substitute products or services similar to what we offer.

However, there is another kind of competition known as vertical competition. Vertical competition happens along a channel or a value chain, where each stage of the channel or each contributor to the value chain takes a slice of the revenue pie — or extracts some other benefit for themselves — from the delivery of the final product or service to the consumer. Vertical competitors compete on how much they get to wrest from the total relative to each other.

While the marketing technology landscape is a thriving example of horizontal competition — thousands of martech and adtech vendors competing with each other to be selected by marketers — there is also a powerful axis of vertical competition in digital marketing.

As illustrated above, the digital “channel” between marketers and consumers passes through several distinct stages:

- Service providers working on behalf of marketers.

- Martech and adtech software used by marketers or their agents.

- Internet services, such as social media, with which martech and adtech interface.

- Client interfaces including hardware (devices), software (browsers), and connectivity providers.

In general, a vertical competitor is “strong” if there are few or no alternatives for others in the chain above or below them. They’re “weak” if many alternatives exist — and weakest if they’re a commodity.

Facebook is an example of a very strong vertical competitor — if a marketer wants to reach Facebook’s audience, they have to pay Facebook’s price, regardless of the other martech or adtech software they’re using. Web browsers are generally weak vertical competitors, since they largely adhere to common standards. (This is why browsers such as Chrome emphasize proprietary extensions which make them less of a commodity.)

For a while, Internet Services have been the strongest players in the vertical digital marketing chain. However, the recent explosion of new client interfaces such as Amazon Echo, Google Home, Slack, Occulus, and a wave of Internet of Things (IoT) devices is creating new sources of vertical strength further down the pipe.

If people use Amazon Echo to answer common questions that they used to search for on Google, that is a powerful piece of the “channel” now controlled by Amazon. The same applies to Apple’s Siri. Or Facebook’s Messanger bot.

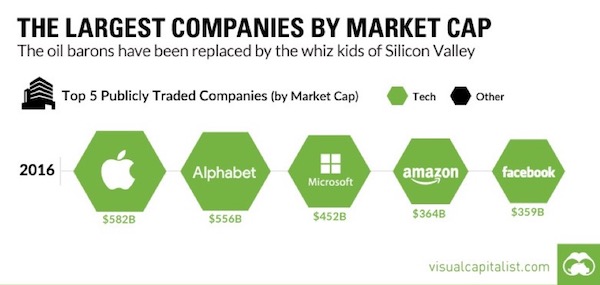

One of the more fascinating aspects of the above illustration is vertical ownership across the entire digital chain by Alphabet (Google’s parent company), Amazon, Facebook, and Microsoft. These companies have client interfaces, Internet services, and martech/adtech offerings — and perhaps by no coincidence, they happen to be 4 of the 5 most valuable companies in the world today.

You can see the potential of such vertical ownership most clearly with Amazon, which leverages devices such as Amazon Echo and Amazon Dash Buttons as exclusive client interfaces that feed back into Amazon.com.

This model also explains why Salesforce was rumored to be interested in acquiring Twitter. If you’re aiming to sell the world’s best “service cloud” to companies, wouldn’t it be great to have exclusively deep control over one of the world’s most popular social media sites for real-time customer commentary?

So how will vertical competition affect marketers?

FIRST: the increased jostling of more vertical competitors will require marketers to react to more and bigger changes in their digital environment — both as direct effects and side effects.

The traditional martech and adtech vendors that marketers have relied on for a “unified” interface to the digital channel will face increasing competition from Internet services and client interfaces, who will seek direct relationships with (and monetization from) marketers. Examples today: Google AdWords and Facebook Ads. Marketers will need an adaptable martech stack — see Part 2: Microservices & APIs — to access such “walled gardens” or vertically-integrated “walled pipelines” either directly or through more specialized vendors.

SECOND: vertical competition will motivate a wave of new client interfaces that will dramatically multiply and fragment the number of digital touchpoints marketers will need to address.

An additional factor to keep in mind here is that new client interfaces will increasingly give consumers more control over how they automate their interactions with businesses — foiling the martech/adtech software further up the chain. Ad blocking plug-ins for browsers are one example today of how this can vertically disrupt marketing. Marketers will need to adapt to these new factors in the digital chain.

And THIRD: marketers will need to factor more vertical thinking into their own strategies, to avoid being vertically squeezed themselves, by direct competitors, near-adjacent competitors, or “partners.”

For instance, keep in mind that building a presence on Internet services such as Facebook and Medium is “borrowed” media at best, not “owned” media. It may be valuable for you, and worth doing, but it also vertically strengthens those services — which can then exert leverage over others in the chain, ultimately effecting marketers.

As rule of thumb, the more stages from the vertical chain that marketers can bypass in their relationships with customers, for as many digital touchpoints as possible, the better.

But by far the most dangerous threat from vertical competition for marketers is a competitor building (or exclusively partnering with another provider of) a new client interface that could siphon off your customers elsewhere in the digital channel. Amazon Echo is clearly a threat of this kind to other online retailers. A proliferation of new devices and IoT objects ahead will explode the number of opportunities for such vertical disruption.

Will you be the vertical disruptor or the vertically disrupted?

The next article in this series is Part 4: Digital Everything.

If you found this article relevant, you should plan to attend the MarTech conference series, where leading practitioners and experts share their experiences and insights at the evolving intersection of marketing, technology, and management.