The following is a follow-up guest post by Jeremy Epstein, CEO of Never Stop Marketing, to his previous articles on blockchain marketing and blockchain brand promises. Jeremy currently works with several of the leading companies in the blockchain and decentralization space including OpenBazaar. Previously, he was VP of marketing at Sprinklr.

In a previous article, I introduced Bitcoin and blockchain, the technology that sits beneath it and provides a censorship-proof, distributed, immutable ledger based on a set of software rules that govern the operation of the Bitcoin network.

But that’s just the tip of the proverbial iceberg. Below the surface of any blockchain lies the “digital token,” a native crypto-instrument where the value is intrinsically and securely linked to the overall value of the network.

To put it in context, a Bitcoin is simply a digital token that gives you a right to participate in the Bitcoin network. It can’t be duplicated, forged, or created out of thin air by central authority because it’s running on a blockchain and its rules are backed by immutable code.

The digital token which fuels the protocols of the blockchain era has immense potential for investors, engineers, and marketers. As Cade Metz wrote in Bitcoin Will Never Be A Currency — It’s Something Way Weirder, “It’s not something that will improve what the world has, such as money or stock. It’s something that will give the world stuff it has never had. Maybe.”

Fair enough. Let’s investigate together.

A brief primer on tokens and “fat protocols”

We’re all comfortable using the Internet. Our phones are packed with applications. Those applications deliver services to us and can interact with each other because of the underlying protocols (i.e., rules) that govern how things works, such as TCP/IP, SMTP, HTTP, and so on.

For most of us, it’s not important how they work. It’s just important that they work.

The same is true of blockchain technology. It’s not particularly important how it works. It’s important that it does work. And it’s critically important to understand what that means for business, society, governments, and institutions.

Blockchains provide greater security, improved network resiliency, and reduced transactional costs because of their distributed peer-to-peer nature. But what’s really powerful about them is how they reduce the need for intermediaries and flip the paradigm of app development of the web on its head.

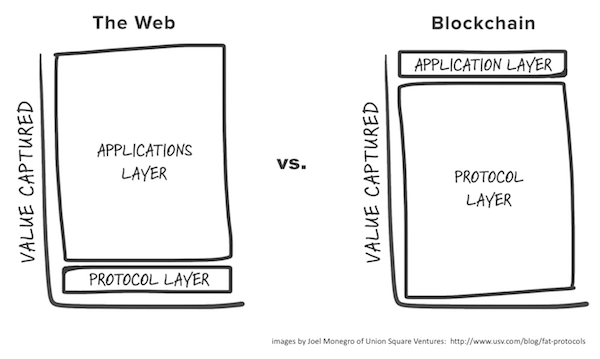

Joel Monegro of Union Square Ventures explains it as well as anyone in his post Fat Protocols, and it comes to life in these two images (which are his):

In the Web model, the rules are intentionally simple, giving application developers a chance to add a lot of value (e.g., Facebook, Airbnb, Spotify) on top of it.

In the blockchain (a.k.a. “decentralized)” model, the rules can be much more robust, and the data is immutable and shared. So, for example, a protocol developer can write the same matching algorithms that Facebook, Airbnb, or Spotify uses and make it native to the protocol. You get the same benefits, you just don’t need the centralized party to do the matching, the software does it for you.

So, where’s the value? Where’s the profit motive, you ask?

Good question.

One potential answer is that it’s in the tokens that the protocol can issue (if it chooses). These tokens, which give the holder a right to participate in the network, can be bought, sold, traded, or simply held.

So, one scenario that could play out in a world of tokens (or appcoins as Naval Ravikant has termed it) is if you want to participate in a peer-to-peer Uber, you would need a token for that network; a peer-to-peer Facebook, you’d need a token for that network; and so on.

Then, supply and demand takes over. Simply put, if you build a great network that more and more people value, then the value of the token for that network will increase. Token holders (instead of the 3rd party intermediary) reap the benefits.

And they aren’t alone. The protocol developers who retain a portion of the tokens for themselves see the value of their holdings increase. Boom — value creation and profit.

Albert Wenger of Union Square Ventures puts it succinctly in Crypto Tokens and the Coming Age of Protocol Innovation, “A for profit company can now create a new protocol and create value for itself (and its investors) by retaining some of the tokens. If the protocol becomes widely used, the value of the tokens will increase.”

Storj is a good example.

Storj has built a protocol to facilitate the renting and leasing out of hard disk space all over the world. If you rent out your extra 2GB of hard drive, you get paid in Storj tokens (disclosure: I own some). If you are an app developer, you can store your files in an encrypted, distributed, accessible environment that is significantly cheaper than Amazon Web Services and you pay in Storj tokens. The more people who use Storj, the greater the value of the tokens. The more value the tokens, the more supply of hard drive space comes online, and so on.

This whole business model sounds crazy, I know. There are days when I question my own sanity and am skeptical about whether this will play out at all. However, as Reid Hoffman wrote in Why the Blockchain Matters, “the most transformative ideas are not the ones that achieve broad consensus early on. Instead, they’re the ones that are so uniquely out there, so contrarian, that even informed observers have wildly differing opinions regarding their potential value.”

Personally, I’m “wildly differing” on a daily basis! All I know is that decentralization is coming and it’s worth exploring. But let’s take it one level deeper.

Tokens, brand affinity, and the new meaning of logo

From 1974 to 1987, American Express marketing was known by the phrase “Membership has its privileges.” In essence, this is what crypto-tokens offer.

To have the privileges of the network, you must be a member. The only way to be a member of certain networks will be to own one of the network’s tokens.

There are already hundreds of tokens that have been floated. As Fred Ehrsam, co-founder of Coinbase wrote in Value of the Token Model, “Some token models don’t make sense. For every 1 huge hit there will be 3 minor successes and 100 failures, so we shouldn’t be surprised when some fail. However, the fundamentals of the token model are valuable and powerful. They allow communities to govern themselves, their economics, and rally a community in powerful ways that will allow open systems to flourish in a way that was previously impossible.”

It’s the last point, the “rally a community”, where marketers have an opportunity.

In the years to come, there will be tens, if not hundreds of protocols that will be written for a given transactional model, just like Uber, Lyft, Sidecar, and others attacked a given market. Some will win, some will lose. That’s natural.

What’s different is that customers won’t just participate by downloading an app, they will participate by buying tokens in their network. Some they will hold as speculative instruments and some they will use to purchase or consume services.

Demand for the tokens will increase not based simply on the actual service delivered, but on whether the values of the underlying protocol are consistent with the beliefs of the consumer.

Let’s make it real for a moment.

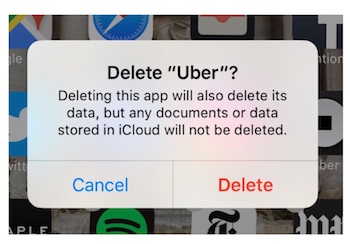

The other weekend, when thousands went to US airports to protest President Trump’s executive Oorder, the taxicabs at JFK airport went on strike for an hour. Uber, however, decided to eliminate surge pricing for that time. Essentially, their “protocol” called for “gaining market share.”

Many customers were upset by this and the #DeleteUber hashtag began trending on Twitter as people took screenshots of themselves removing the app.

Uber, to be sure, didn’t love the negative publicity (and whether the economics made sense or not is another story). But what if all of those Uber customers had started selling their Uber tokens and the overall market cap of a decentralized Uber protocol fell instead?

That would hit the “protocol developers” where it hurts and send a clear message about the market.

On the flip side, in a blockchain-empowered crypto-token world, consumers will be able to put their money where their mouth is by supporting the protocols that align with their values. They will buy the tokens affirming their beliefs.

Balaji Srinivasan wrote in Software is Reorganizing the World that there’s an “increasing divergence between our social and geographic neighbors, between the cloud formations of our heads and the physical communities surrounding our bodies. An infinity of subcultures outside the mainstream now blossoms on the Internet — vegans, body modifiers, CrossFitters, Wiccans, DIYers, Pinners, and support groups of all forms. Millions of people are finding their true peers in the cloud.”

Taking Balaji’s observation one step farther, it’s possible to imagine a protocol that only allows for the buying and selling of 100% vegan items, or products made by Wiccans, or certified DIYers.

A purchase of a token on any one of those networks is a chance to live in greater harmony with your values and connect and support economically those that do as well.

Instead of wearing a logo that says, “I’m rich enough to have this brand” or “I want to be like Mike,” we will offer a signal with the digital tokens we own and spend. Our online transactions (with privacy levels as we see fit) will communicate that “I support this cause, this community, in a way that empowers them economically.”

I’m the first to admit that the eventual use cases for blockchain-based technologies are simultaneous numerous and unclear. Just like no one predicted Instagram, Seamless, or WhatsApp 20 years ago, we don’t know how it will play out. But there’s enough evidence to suggest that blockchain and decentralized systems are inevitable.

Businesses and marketers who understand tokens and potentially use them to deeply connect with communities of like-minded people should have a leg up.

Thanks, Jeremy!

Readers: Jeremy will be speaking at the MarTech Conference in San Francisco, May 9-11, with a fantastic presentation on Marketing in a Blockchain World. Register now for the lowest “alpha” rate on tickets to guarantee your seat.

Jeremy: you write: “But what if all of those Uber customers had started selling their Uber tokens and the overall market cap of a decentralized Uber protocol fell instead?”

If people owned part of a decentralized Uber, it would be against their own self-interest to sell their tokens at a lower price. It would just be punishing one’s self for being part of the “wrong”/”against a world view” network. The person owning the token would lose just as the network would lose.

I would think the better analogy would be if we all “owned tokens” (stock) in a company, and a mechanism allowed our voices to indicate (perhaps in real time) a desire to shift policy. This would work better than a model to punish ourselves for being part of a network that made a decision with which we disagreed.

Thoughts?

So, the voting based on ownership/shares/tokens is a definite and that will happen. However, there may be times where we take principled stands that are against our own economic self-interests. So, I think either option could be available.

But for something very egregious, a customer/token owner might say, “screw it, I don’t care about the money, b/c the issue is too important.”