The following is a follow-up guest post by Jeremy Epstein, CEO of Never Stop Marketing, to his previous articles on blockchain marketing, blockchain brand promises, blockchain brand “logos,” and blockchains as brand equity. Jeremy currently works with several of the leading companies in the blockchain and decentralization space.

DON’T MISS A CHANCE TO HEAR JEREMY SPEAK. He will be presenting at the MarTech Conference in San Francisco, May 9-11, with a fascinating talk on Marketing in a Blockchain World. Register now for the “beta” rate discount on tickets to guarantee your seat.

If someone came to you in 1992 and said, “Hey, there’s this thing called the Internet. Let me explain how billions and billions of dollar are going to be created in value in entirely new business models.” How would you have reacted?

The state of the blockchain industry — really, the decentralization industry, is at a similarly nascent stage, and the opportunities are immense.

My friend, and leading blockchain industry analyst, William Mougayar (subscribe to his excellent blog), who wrote The Business Blockchain, makes this comparison frequently.

I’ve co-opted it, and after attending the DC Blockchain Summit recently, I’m even more convinced of this analogy. The point of this post is to explain it and think about it more deeply.

How the Industry is Initially Shaping Up

Aside from the evolution and implementations of the technology, it’s interesting to see how the market is shaping up in a similar way. There are plenty of people focused on leveraging shared ledgers (a.k.a. blockchains) for efficiency gains within the largest enterprises.

They should. In the short-term, there’s a ton of efficiency and waste that should be removed from the system. This is where Accenture, Deloitte, and Cognizant all live.

Cost-reduction is great, but it’s not the same as value creation. As usual, Fred Wilson says it succinctly and with authority in his post, The Golden Age of Open Protocols. I believe that business model innovation is more disruptive that technological innovation.

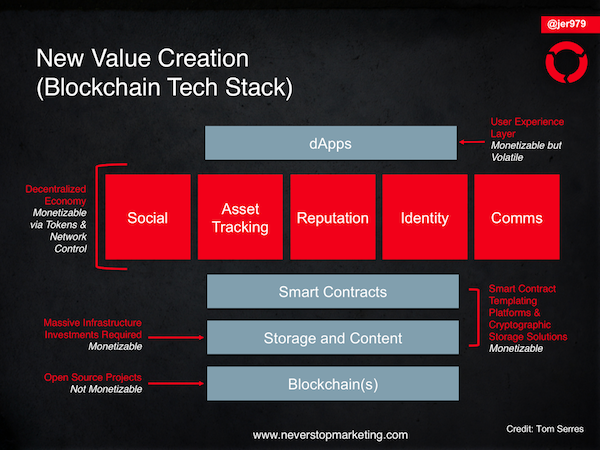

Which is why I think it’s worth exploring the “blockchain tech stack.” Understanding the stack, even in its earliest stage will help us all begin to explore where the huge value creation will occur.

Understanding the Blockchain Tech Stack

Full disclosure: I got the outline of the blockchain tech stack graphic at the top of this post from Tom Serres (and am using it with his permission). Tom is a co-founder of Animal Ventures with Bettina Warburg (who has a great TED talk you should watch). Together, they have a fantastic Udemy course on the Basics of Blockchain. I took it and highly recommend it.

Ok, so let’s dig in and explore this from the bottom up.

BLOCKCHAINS — as has been said by many people, “It’s just a database.” And that’s pretty much true. It’s a distributed database (instead of centralized) where each entry in the ledger is time-stamped and cryptographically secured and linked to the previous and following set of entries in “blocks” of transactions.

This linkage, if you will, forms a chain of transactions. Hence, “blockchain.” Instead of a central authority stating, “here is the state of the ledger,” the network’s contributors and participants maintain the consensus and reject anything that doesn’t fit.

For a good intro to blockchain, see Common Craft’s overview of blockchains. A bit more technical, but still consumable is this one from MIT.

STORAGE AND CONTENT — A giant spreadsheet of time-stamped transactions doesn’t really require that much storage space. You can keep that on your computer without much fanfare. But what happens when we have images, audio, video, and VR worlds running off of blockchains?

We’ll need those to protect media rights of creators and ensure redundancy in our systems (to avoid things like the recent Amazon S3 crash).

Think about it this way. Most of us have unused assets that could be turned into value in the form of hard disk space. You may have a 500 GB drive on your computer, but you are only using 200 GB of it.

So, what do you do?

You can rent it out to someone like Storj (disclosure, I own some StorjCoin), Sia (own some of that as well), or FileCoin. Their network protocol then pays you for hosting some of the files that people put on the network. These files are encrypted and sharded (cut up), so you only have a fraction of someone’s file and you have NO idea what’s in it. And, these files are copied to many places, so you don’t even have the only copy of it.

A developer who wants to use one of these protocols as the back-end system for storing the data required in their application then pays the network via one of these coins. So, you may get 1 StorjCoin or SiaCoin for hosting a file. The developer may get 1.1 StorjCoin or SiaCoin from an end consumer for the service the app provides to the end user. That .1 is the profit to the developer. These numbers are totally made up and just for example.

The network doesn’t take a commission at all, which is why these networks will be able to provide the same storage as Amazon or Google for a fraction of the cost, say 90% cheaper. Of course, for it to work, they need hundreds of thousands of people to rent our portions of their computers. In a classic chicken-and-egg problem, those people will only come if there are developers who are building on these platforms — which they will do only if there is enough storage. You get the picture.

Eventually, however, it will be worked out, and the creators of these protocols (at least the winning ones) will see the value of their limited tokens increase because of the increased demand for it. That’s how they will make money.

Investing in the coins of the winning storage protocols now is how you can make money. For a primer on how I invest, you can see this post.

SMART CONTACTS — if you think about a legal contract or a business agreement, it’s essentially a series of “if, then” statements. If Party A agrees to do X, then Party B will do Y. And so on.

Now, if you think about that, you realize that it’s basically the same thing as software code. Put it all together. We call it a “Code of Law,” don’t we? The “legal code.”

Except now, instead of having it in big volumes or stuck in contracts that are just sitting on DocuSign’s servers (eventually replaced by someone like BlockSign), the digitization of all of these assets can be programmed to have the legal and business rules associated with them directly connected to them, not sitting in a “legal silo.”

I’ll give you a simple example of one I used at a site called, appropriately enough, SmartContract.

Let’s say I want to be #1 in SEO for the search term “blockchain marketing” (ed: I’ll give that link juice for example purposes), “marketing in a blockchain world”, or “blockchain + marketing” and a few derivations of that. I might find a world-class SEO person who says, “Yep, I can do that for you in the next 2 months, and it will cost you 2 Bitcoin (or whatever).”

In a traditional model, that person sends me a contract, I sign it, she does the work and then after 2 months, let’s say she gets the job done. She might send me a screenshot saying, “Hey, I did it, now pay me.” I would say, “Okay, send me the invoice.” I’d get the invoice, send it to accounts payable, they would do a check run or whatever and eventually, maybe 30 days later, my vendor gets paid. There’s time, effort, and friction in that process.

In a smart contract, we set up the rule that says, “If the result for search term ‘blockchain marketing,’ goes to Never Stop Marketing on May 21, then pay Sandy 2 Bitcoin. If not, only pay .5 BTC.” We might agree that we will use the .json feed from Google (called an “oracle”) to serve as the arbiter, and then we would both sign it with our unique cryptographic signatures. I would put the 2 BTC into an escrow account for payment. Then, we let it run.

On the prescribed date, the contract queries Google, sees the result and the appropriate amount is released immediately (or not, if it fails). Either way, the contract is recorded in a blockchain and open to verification (here’s one I ran).

Done. Basically no friction or time delay. The provider of the service, in this case, SmartContract gets a transaction fee of .0001 BTC. Do that 10,000,000 times and you have 1,000 BTC — which is $1 million dollars.

DECENTRALIZED ECONOMY — A good primer on this one is Joel Monegro‘s excellent post on Fat Protocols. It’s also where we’re seeing a ton of innovative efforts and initiatives such as OpenBazaar, Fermat’s Internet of People, Steem, Synereo, uPort, Metamask, and Blockstack, among many, many others.

In this layer of the stack, you will have these protocols, which are basically open-source, portable, and reusable software codified rules, that replace the proprietary systems which dominate our current landscape.

One of the most obvious ways that this layer will be monetized is via so-called “crypto-tokens” or, the more benign, “digital assets.” There’s an explosion of conversation going on around about this now, and I will readily admit that I am still trying to get my head around it.

For some good primers, check out Nick Tomaino’s post, Albert Wenger’s post, and both Jake Brukhman’s and Naval Ravikant’s excellent contributions to the ebook, Blockchains in the Mainstream: When Will Everyone Else Know?. I’ve also blogged on crypto-token possibilities more than once.

The key point here, I think, was summarized well by Nick in the aforementioned post, where he explains the difference between “network effects” (which we all know from phone, fax, email, Skype, etc.) and “network ownership effects,” which is what tokens unleash.

You not only get utility from more people joining the network, but since participation in the network requires ownership and use of network-specific tokens, you actually gain an increase in the value of the tokens you hold.

Let’s take La’Zooz as a very early example. It’s an effort to become a decentralized Uber.

In the Uber model, you join the network, and as more users and drivers join, the utility of the network goes up. As the utility of the network increases, the value of Uber increases, because they are effectively the “protocol” (rule maker), connecting buyers and sellers. The value appreciation goes to the owners of the protocol, in this case, Uber. (Facebook, eBay, Etsy, Craigslist, Twitter and most others in the so-called “sharing economy” fall into this category.)

In the decentralized token economy world, La’Zooz creates a token (which they have, it’s called a “Zooz”) and offers it for ownership to members of the network. Leaving the marketing question aside (though it’s my favorite topic and admittedly, critical), here’s what happens:

Riders need Zoozs in order to pay for rides. Drivers accept Zoozs in return for rides. As there are a finite number of Zoozs — or a predictable inflation to it based on the protocol rules — (though they are digital, so they can be cost-effectively sliced into multiple decimals), the value of each Zooz increases as the demand for them increases.

Let’s think of it this way and keep it very simple.

- There are 100 Zoozs out there.

- Each one is worth $1.

- There are 100 network participants. 50 drivers and 50 riders.

- Each ride costs 1 Zooz.

- As word gets around that La’Zooz is cheaper than Uber, more people want Zoozs. So they trade their dollars or Bitcoins for Zoozs, which increases the price of a Zooz to $2. So now, everyone who has a Zooz has $2 worth of value instead of $1.

- The purchasing power has doubled, so you can afford 2 rides for 1 Zooz instead of 1. So you sell half a Zooz to someone who needs one, keeps the Zooz you want for buying rides and get the profit from the other one.

- The drivers who were charging 1 Zooz now see the value of the ride they gave in the past go from $1 to $2 (retroactively) and are more inclined to accept Zoozs because they expect more people to join the network. In effect, by taking these tokens, you are getting value today and getting value in the future.

- Instead of Uber capturing the value that accrues, the owners of the network (the token holders) capture the value. Whoa!

This is what will happen in all kinds of networks. Identity networks, reputation networks, social networks (why should Facebook get all the value that you create by posting? You should), and many more will eventually take hold.

This is precisely what has happened with Bitcoin over the past 9 years. It’s why Olaf was so damn smart to get paid in Bitcoin only when the price was mega, mega low. He understood this very early on. And it’s why he has started a fund to find the next of these.

You can also research and invest in these (though it’s definitely caveat emptor time). Again, for a primer on how I invest, you can see this post.

Some networks will issue tokens and see the value creation there. And, if you question what’s the incentive for the protocol creators, the answer is that the protocol creators will hold a portion of the tokens for themselves and get to profit from the future value creation.

The number of tokens that the protocol creators receive will be transparently available for inspection by anyone via a blockchain. That way, you or anyone can decide if it’s too much — they are being greedy — or if it’s not enough — they won’t stick around, which seems kind of stupid.

Others will develop the protocol and not issue tokens. They (and others) will attempt to monetize the efforts of the creators of the decentralized economy protocols via the app layer instead.

DISTRIBAUTED APPS (dAPPS) — When you have a shared data layer and a shared protocol, the management of information becomes liberated. It is freed from silos and you have much more flexibility.

Let’s take a simple example, photos.

Right now, you take a picture on your iPhone or Android device and you save it to the cloud. Except the “cloud,” in this case is proprietary. Your iPhone picture sits in iCloud, and if you want to use the photos in any type of application, you need to use iPhoto. But what if you really love the way that Google does the “auto-animation” or if you want Adobe Photohop to interface with the same photo?

Well, you have to download the picture and then upload it to a different proprietary cloud. Now, you have two copies of the picture in two different clouds, both of which are technically owned by you (but now actually owned by Apple and Google) and management, tracking, and rights management (in some cases) becomes even more complicated.

Built on a photo asset tracking protocol, the world of distributed apps works differently.

The data layer is shared among any app that uses the protocol, so any photo editing app can interface with the same original photo. Obviously, you’ll be able to create a copy or version of it based on how you tweak it, but you don’t have to move it around from one proprietary cloud to another.

In this model, you might pay a video editing dApp creator a small token for use of their software (connected back to the protocol we just discussed above) and then a slideshow dApp creator another token for use of their software. All of this will be run in your browser, and the coins will be managed behind the scenes on your behalf. (Brave is starting this trend with micro-payments to publishers in Bitcoin in return for no ads, but there will be more to come.)

As an end consumer, you’ll get faster, cheaper, and definitely more secure application experiences, as well as the knowledge that only you have access to your data. The dApp creator will get value from the payments in creating the most valuable application for interfacing with the protocols below it. So, if the dApp QuickTime version is the best, everyone can use it — regardless of the OS.

The challenge here, and why Tom labeled it as “volatile,” is because switching costs are basically zero. If I don’t like an app, I can pretty easily move to another one, use the same tokens that I already have, and just start paying the new dApp creator instead. For example, the other day, I moved one of my Bitcoin addresses (the interface to the Bitcoin blockchain) from one wallet provider to another (just to see if I could do it), and I did it in 40 seconds.

Imagine moving your bank account from Citi to CapitalOne in 40 seconds. That’s what we’re talking about and why the UX of these dApps will be the killer differentiator.

So, there’s revenue opportunity and value creation at this layer as well. The person(s) who built the great user experiences will be freed from platforms to focus on utility for the end user and they will be created for it.

The Decentralized Economy Future on the Blockchain Tech Stack

The marketing challenges for this new paradigm are immense. As you can see though, it’s much more than simply a marketing challenge. It’s a huge opportunity to re-think entire industries and functions and how value will be created and distributed.

Hopefully, this helps all of us think about it a bit more deeply and broadly. I look forward to your comments, feedback, and criticism.

Thanks, Jeremy!

Reminder: Jeremy will be speaking at the MarTech Conference in San Francisco, May 9-11, with a fantastic presentation on Marketing in a Blockchain World. Register now for the “beta” rate discount on tickets to guarantee your seat.

Very well written and explains the opportunity with a clarity I haven’t seen written anywhere else. Thank you.

Chris–you made my day. Thank you very much for the kind words and taking the time.

As a marketer and startup guy (advisor/EIR role nowadays) I have been reading up on blockchain for ~1 year now. Every story I read talks about HOW it works (mining for bitcoins, server farms in China/etc, blah blah) but I have yet to read a story that showed real business cases (e.g. “The SEO guy with a SmartContract” as well as “the Developer who sells disk storage for 0.1 BTC profit”). This is incredible thank you so much for writing this up!

If you’re interested, I’d love to do a video or text interview for our digital agency’s blog. Hit me up on twitter! @mikekrass

Mike- you are way too kind. Thanks for the positive feedback!