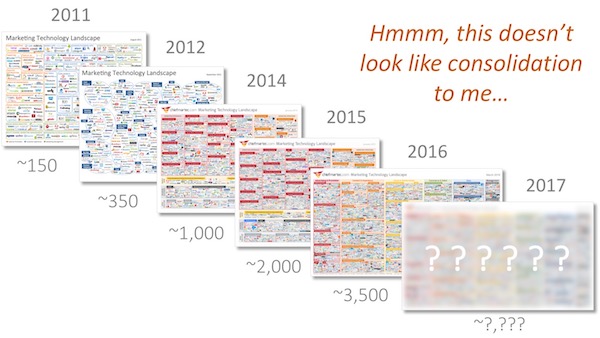

You’ve surely seen those eye charts with hundreds of marketing technology vendor logos. There are the iconic LUMAscapes by Terence Kawaja. And there’s my own chiefmartec.com marketing technology landscape, which last year organized 3,874 martech solutions on a single slide. (Spoiler alert: the upcoming 2017 edition will have more.)

These charts provoke a visceral reaction of shock (“how can there be so many?”) followed by fear, uncertainty, and doubt (“how do I pick the right ones?”). One marketing executive referred to my landscape as a kind of graphic horror novel for CMOs.

Instinctively, perhaps as a coping mechanism, most people conclude that a martech marketplace of such scale is unsustainable. It’s bound to consolidate, and soon. And then, thank goodness, we will have a manageable number of marketing software choices.

But what if that didn’t happen?

Before you start sputtering or twitching, hear me out. Because not only is that scenario plausible, it actually could be a good thing.

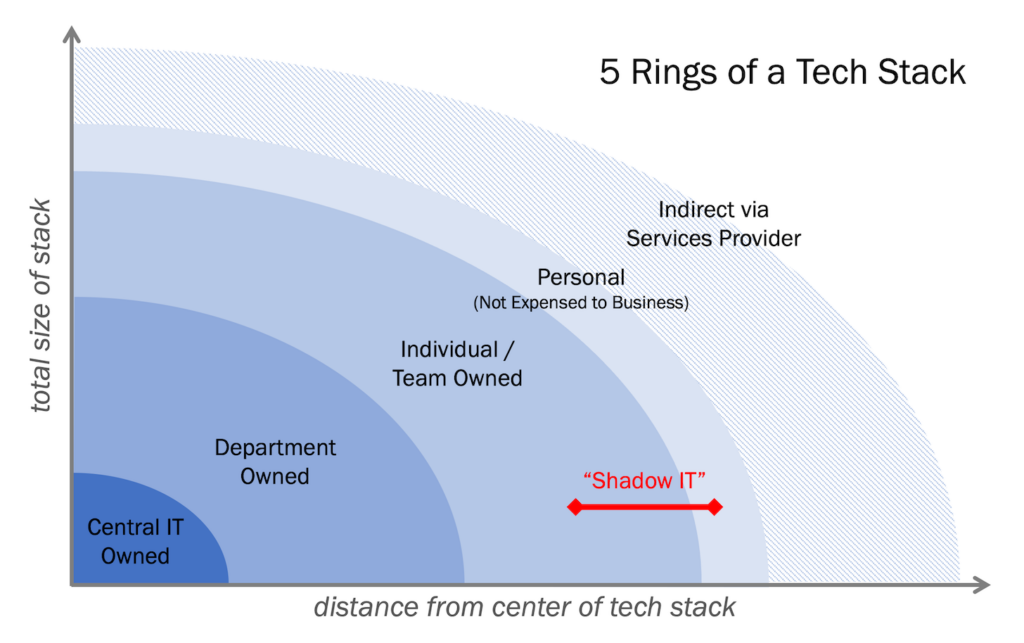

First, let’s clarify what we mean by consolidation. People often frame consolidation as a reduction in the number of vendors in the space — i.e., the number of tiny logos on that marketing tech slide. So going from 5,000 martech companies to 50 would constitute major consolidation.

However, while that’s an easy metric to count, it ignores the relative scale of those vendors. A more realistic view would show the distribution of revenue among them. Adobe, with $1.63 billion of revenue for its Marketing Cloud in 2016, is 1,000 times bigger than a martech startup that just made its first $1 million.

Through that lens, the market is already consolidating. It looks like a pyramid: a few billion-dollar giants on top, dozens of firms earning $100 million or more at the next level down, and thousands of comapnies with less revenue below that.

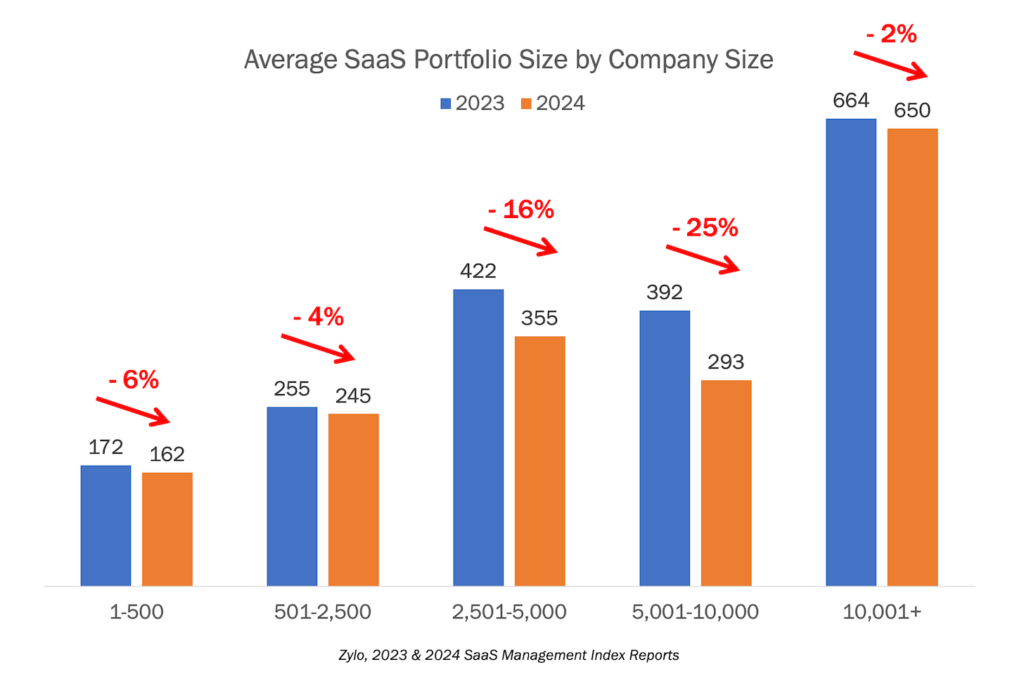

But interestingly, at the same time that the ones on top are growing larger, the number of companies on the bottom is still increasing. So by revenue distribution, the industry is consolidating. But by number of firms, it’s expanding.

Is that a paradox?

No, it’s actually a fairly common market structure in the age of digital platforms known as a “long tail.” A small number of blockbusters and a seemingly infinite trail of ever-more-niche offerings. We see this with Netflix (movies), Amazon (books), and Spotify (music). The same pattern also happens with software products built on top of software platforms.

In fact, great software platforms encourage this. They draw their strength from the vibrant, long tail ecosystems that blossom on their foundations.

For instance, Apple (iOS) and Google (Android) have “consolidated” the mobile market while simultaneously enabling a long tail of millions of mobile apps. Indeed, their large communities of app builders have been pivotal to their success.

Martech is a little different, since most of the large vendors — with the notable exception of Salesforce and their core CRM — initially downplayed the platform opportunity and positioned themselves as “all in the box” solutions instead. (In their defense, Steve Jobs was initially reluctant to open up the iPhone to third-party developers too.)

As a result, today’s martech ecosystem evolved in the absence of a stable platform oligarchy, and that lack of underlying structure was why martech integrations have been challenging.

However, that’s changing. Adobe, HubSpot, IBM, Marketo, Oracle, and others now each support and promote integrations with dozens or hundreds of other marketing technology products. And new technologies such as customer data platforms (CDPs) and integration-platform-as-a-service (iPaaS) providers are emerging as platform-like alternatives.

There’s growing competitive pressure among the leading vendors for who will amass the biggest and best ecosystem. They’re motivated by the virtuous cycle that successful platforms can achieve: a large ecosystem attracts more customers, and more customers attract a larger ecosystem.

Stable platforms reduce the cost and risk of adopting third-party products. This encourages more of them to be adopted and, in turn, more to be developed. (How many apps have you installed on your smartphone? Martech won’t be that simple, but the principle is the same.)

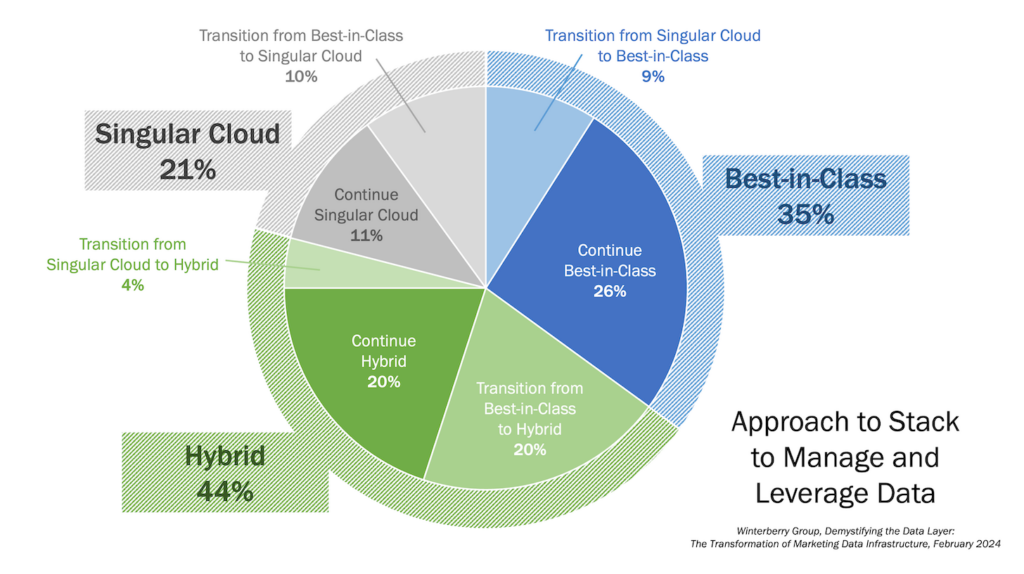

The result could be a market that is effectively consolidated at the platform level, yet splendidly diverse in the number of specialized products available to plug into those platforms. Some third-party developers will be big, with category-leading, horizontally-applicable applications. Others will be small and narrowly-focused on more vertical solutions. It will be a lengthy long tail market.

For marketers, this could be the best of both worlds.

You would have the benefits of stability and plug-in compatibility that good platforms offer, including a common backbone for unifying customer data. But you’d also have the benefits of augmenting those platforms with creative third-party products that best fit your particular business needs, harness the latest innovations, and give you the freedom to differeniate in a digital world.

That would be really good for everyone.

A version of this article was previously published in AdAge on April 17, 2017.

Want to understand how to be successful in today’s — and tomorrow’s — marketing technology environment? Join us at the MarTech conference in San Francisco, May 9-11, to hear from over 100+ brands and thought leaders who can show you how to harness this explosive innovation to your advantage.