My post from last week — is marketing technology consolidating or diversifying — resonated with the folks at HubSpot, and they invited me to contribute a few thoughts on that subject to their blog.

The result: Will Marketing Technology Look Like iOS Someday?

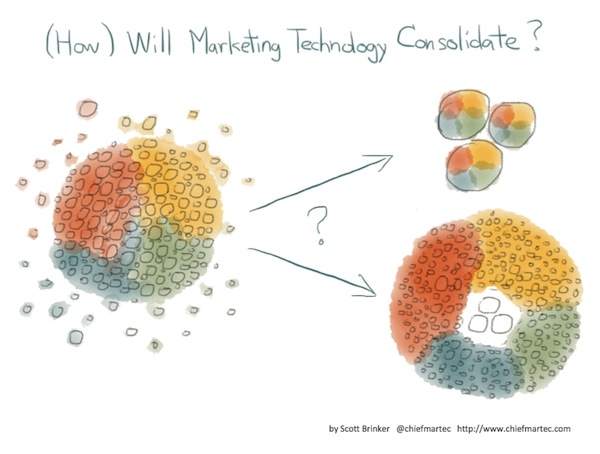

As illustrated in the graphic above, we consider three possible futures for marketing technology:

- Diversified with no real center of gravity (kind of what we have today), on the left.

- Consolidated into a handful of all-in-one marketing suites, in the upper right.

- A few consolidated platforms with highly diversified ecosystems of specialized apps, in the lower right.

I call the second one the “ERP vision” of marketing technology consolidation, while the third is the “iOS vision” as an alternative. Here’s an excerpt from my the post on the HubSpot blog:

Can we have the best of both worlds, consolidation and diversification?

Indeed, that may be the answer. Consider an alternative “iOS vision” of marketing consolidation, where a small number of platforms emerge as the “backbones” of marketing operations. The analogy is inspired by Apple’s iOS and Google’s Android platforms — two contenders that have unquestionably consolidated mobile operating systems, while simultaneously fueling an explosion of diversified apps built on their foundations. Apple just recently announced the availability of over 700,000 such apps. It doesn’t get more diversified than that.

Of course, most marketing technologies are far more complex than consumer smartphone apps. Don’t take this metaphor literally. But conceptually, the same architecture could exist. Imagine a handful of marketing platforms that standardize certain events, workflows, and data structures at the core of marketing operations. By exposing a rich and expressive API, other marketing software products could easily interface to that backbone, using it to seamlessly feed in and out of a company’s overall marketing technology ecosystem.

Companies could have the benefits of a consolidated infrastructure, sparing themselves expensive custom integration work at every turn, while simultaneously leveraging a plethora of specialized marketing applications that combine to give them a unique set of superpowers tailored to their distinct brand vision of the ultimate customer experience.

Sound far-fetched? Well, take a look at Salesforce.com’s AppExchange. Or the business software synchronization service Zapier. Or, more relevant to readers of this blog, HubSpot’s App Marketplace. The parallels to Apple’s app store don’t seem so far off in comparison.

Click to read the full post.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.