Wow, this certainly tops off a spectacular year in the marketing technology space: yesterday, Eloqua announced that it was being acquired by Oracle for $871 million. Reflecting on this last night, five thoughts came to mind:

Thought #1: Congratulations

First, big congratulations to Joe Payne, Steven Woods, and the rest of the Eloqua team! I’ve been a big fan of Steven’s thinking around digital body language for many years. They’ve done an amazing job of executing on that vision.

Thought #2: Customer Experience

Second, the language around this announcement is very telling because it emphasizes customer experience so heavily. The headline for the press release expressly frames this acquisition as a part of a comprehensive mission “to help companies deliver exceptional customer experiences.”

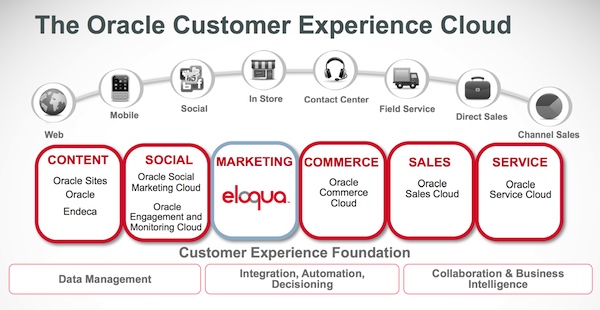

The graphic at the top of this post was included in the presentation deck released along with the announcement, and it positions Eloqua as the “marketing” component of The Oracle Customer Experience Cloud. Most of the rest of the deck focuses on this unified customer experience mission, as the following slide declares that “great customer experience is the sum of all interactions.”

The rise of customer experience as the overarching umbrella for modern marketing has been one of the great themes of 2012, and this deal will certainly place that thesis at the center of many CMO-level discussions in 2013. “Every customer experience is a brand moment of truth.” This is why everything is now marketing.

Thought #3: Post-Digital Marketing

According to Oracle EVP Thomas Kurian, Eloqua “will become the centerpiece of the Oracle Marketing Cloud.” What’s particularly striking about that statement to me is that Oracle is one of the giants of the traditional, pre-digital marketing world. Eloqua, in contrast, is one of the stars of the native digital marketing world. This merger — if executed in the way in which it’s presented — will be a true mash-up of those two worlds at the enterprise level.

Customer experience may be the rallying flag for this, but there’s something noteworthy purely about Oracle championing the vanishing boundaries between traditional and digital channels and methods. The Oracle-Eloqua deal is not the first move in that direction — IBM has clearly been pursuing this as well — but it is a major step forward in that transition.

This is what David Cooperstein of Forrester recently called post-digital marketing.

“Like the shift from modern to post-modernist art and architecture,” David wrote, “where we encountered architects like Michael Graves and Richard Meier who blended modern purity with classical touches, we are entering a world where digital innovation is merging with traditional marketing fundamentals to create new approaches, new brand leaders, and new models for success.”

Thought #4: Race to the Top

This is generally good news for Eloqua’s larger competitors, especially Marketo and Hubspot, as they advance towards their own IPOs, as this acquisition further validates the scale of this market — and heats up some very attractive valuation ratios.

For the biggest strategic buyers though, this speeds up the tempo of the music. IBM and Oracle have now staked their claims with the Unica and Eloqua acquisitions respectively. Adobe and Salesforce.com — the two other largest contenders in the enterprise digital marketing space — are both missing this “marketing automation” backbone piece in their portfolios.

Now that Eloqua is off the table, I imagine they’re taking a closer look at Marketo, Hubspot, Act-ON, Neolane, Infusionsoft, etc., as well as the publicly-traded ExactTarget (which now owns Pardot). Aprimo, which is owned by Teradata, is probably out of reach given the parent company’s market cap. But maybe not for the likes of SAP or Microsoft? Good times in the corporate development office, I’m sure.

Remember those rumors of Microsoft acquiring Adobe a while back?

Thought #5: More Investment & Innovation Ahead

Given the major marketing software acquisitions that have happened this year, there’s no doubt that we’re in a wave of consolidation in this space.

But unlike other consolidation phases of other industries, I don’t think this is the end game of the marketing technology landscape. On the contrary, I believe these deals will create a chimney effect that causes the start-up fires of new marketing technology ventures to burn even brighter.

We’re experiencing simultaneous waves of consolidation and diversification in marketing technology. And I predict more investment in this space in 2013 than any year before.

Why? Because this new era of marketing — the post-digital marketing era of customer experience — is just at the beginning of a 10 to 20-year revolution. The world in which this new approach is emerging is still tremendously in flux, with new innovations appearing at an accelerating rate. There’s no lack of opportunity for new ventures in this remaking of the world.

That being said, I do think this deal moves us closer to a market structure that has a consolidated marketing backbone supporting a diversified marketing body. This is the third possibility I discussed in my post on 3 different futures for marketing technology: a few consolidated platforms with highly diversified ecosystems of specialized apps.

According to the FAQs released by Eloqua and Oracle, “Eloqua will continue to be an open platform for marketing automation and integrate with third-party systems including sales force automation solutions and social platforms.” It remains to see how open Oracle really is with their customer experience cloud. But given the open platform strategies that Salesforce.com, Marketo, Hubspot, and others are pursuing, they have incentive to accelerate towards a dominant position as an ecosystem player — or risk that being a weak spot in which competitors will surely attack.

It’s going to be an exciting 2013.

Nice writeup Scott.

The idea of provoking other software houses to acquire other Marketing Automation vendors is an interesting one. I think consolidation would be good for technology partners but bad for competitors.

Even some unseen giant like Microsoft or Google might take an interest. Particularly in Hubspot with their slightly different focus.