This is the first of several articles leading up to my predictions for marketing technology in 2016. Because martech is a relatively complex space, I thought it would be helpful — at least for my own thinking — to break out a couple of foundational ideas, which we can then build upon.

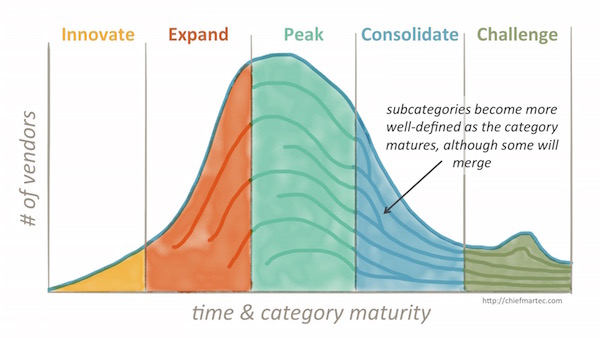

Let’s start with the illustration above, the 5 stages of maturity in marketing technology categories.

While this certainly echoes Everett Roger’s famous diffusion of innovations graph, it’s a little different. The y-axis here doesn’t represent the percentage of adopters at a given stage, but rather the absolute number of vendors in the market at that particular stage of the category’s maturity.

Here are the stages as I think of them:

- INNOVATE — The category is just emerging. Most people aren’t aware of it. The early vendors pioneering the category may be jockeying for different labels to call the category.

- EXPAND — The category has broken through and is now rapidly gaining traction. Many new vendors enter the space, both new start-ups being launched as well as more established companies adapting their products (and content marketing) to address the opportunity. Smart VC investments happen at this stage. The label for the category has generally converged, and now subcategories are starting to emerge. Examples today include account-based marketing and interactive content marketing.

- PEAK — The category is at maximum vendor noise. If we were to view the parallel adoption curve, products are now crossing the chasm into the “early majority.” Partly to counter the noise, subcategories are increasingly well-defined. Consolidation through acquisition begins to happen at notable valuations (which drives even more late entrants and investment into the category in the short-term). An example today is the content marketing category, which has well-defined subcategories for content curation, content distribution, and content lifecycle management. Interactive content marketing is essentially a subcategory that grew so large — and differs enough from the rest of the category — that it split off into a category of its own. (Reminder: I’m biased when it comes to that particular category.)

- CONSOLIDATE — The category is now becoming mature, and the leading vendors are pulling away from the pack. A significant number of vendors will exit the space in this stage, either by being acquired, running out of funds, “pivoting” to a different category, or gently fading into the night. A few new vendors enter the space at this point, but they’re either very deliberate or very delirious. Subcategories are well-defined, but several will likely collapse together. The subcategories more likely to persist align with market segmentation: for instance, SMB versus enterprise, and B2B versus B2C. An example today is the marketing automation category, which has very distinct subcategories for market segments, but within most of those segments there are usually 2-3 leaders and maybe another 3-5 runner-ups — and then the mindshare for the rests drops off precipitously.

- CHALLENGE — The category is now mature, consolidated down to a small number of well-established brands within each subcategory (which mostly correspond to market segments). In the adoption curve, the category is now selling into the “late majority.” There’s tremendous growth in adoption at this stage. There may be a couple of big mergers that are more about economics than technology. However, at this stage, the dominant players can become complacent — since they “won” the category — leaving the door open for new challengers. To succeed, those challengers must have a clear strategy to disrupt the status quo, and they may actually trigger the development of a new category (for instance, the way MAPs disrupted ESPs). An example today includes the CRM category — with a handful of established brands owning the majority of the market, but still the occasional disruptive new entrant (e.g., HubSpot’s CRM).

There are three important points here:

First, the marketing technology space is a collection of many different categories — each at different stages of maturity within the above model. This is why predicting the rate of growth or consolidation in the overall martech space is so difficult, because while some categories are consolidating, others are expanding — and still new ones are being innovated.

Second, there are always new entrants to market, at all stages of a category’s maturity. The real difference is the quantity — which I’d put at an order of magnitude or two greater in the EXPAND stage.

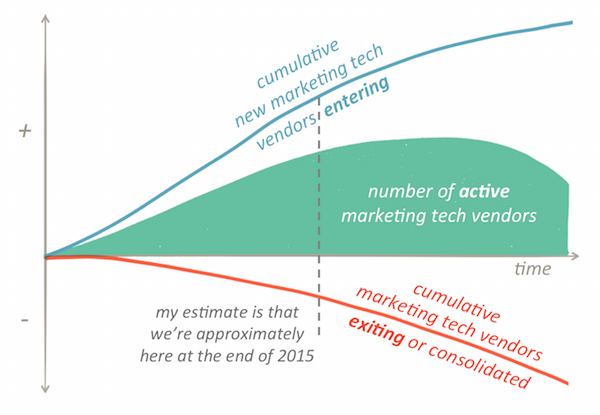

If you sum these first two points together, my best guess is that the overall growth of the marketing technology landscape looks a bit like this:

We’re approaching a lot of consolidation for some big categories, but new categories (and new disruptive entrants in existing categories) will continue for some time. As some vendors leave, new ones will continue to arrive. The total number active may be nearing a plateau, but I don’t think we’ll see massive consolidation of the overall space — at least not as far as I can see within the horizon of the next several years.

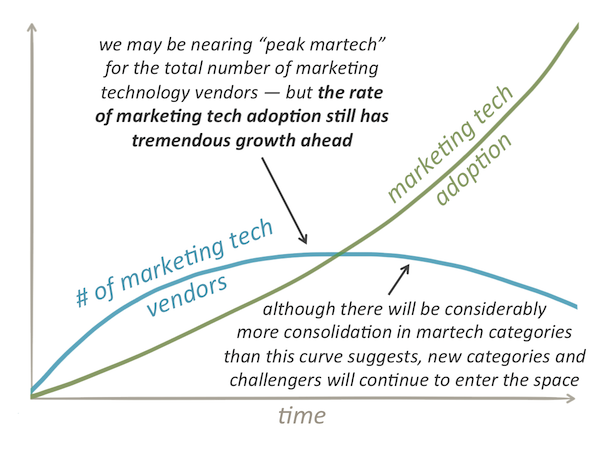

Third, the number of active marketing technology vendors may be nearing its peak, but the adoption of marketing technology has tremendous growth ahead. I was just reminded of this by Sheryl Shultz at CabinetM last week — a fascinating service for marketers to track and manage marketing technology vendors — who sketched out the following curve on a piece of paper:

In other words, while it will be a tough market for many marketing technology vendors — and their investors — to struggle for who will dominate each of the categories within the space, the winners have incredible growth opportunities ahead of them.

And the opportunities for applying marketing technology effectively inside organizations are still in the early stages of blossoming. It’s a great time to be a marketing technologist.

Really good articulation of the evolution of a market, Scott. I would highlight that “hype” in a category is highest BEFORE the market peaks. That’s when there are many unknowns and buyers and influencers are trying to figure out what is true, what works, what the real costs are, etc. If the answers to these questions are negative, the category either adjusts or fails. If the answers are positive, category participants get the benefits of the most lucrative time in the life-cycle. I might also add that acquisitions are most likely right before the market climb. Big players are set up for scale.

Hi, Kathleen. Thanks for adding your perspective here (and sorry for the delay in replying to your comment). The points you raise make sense, although some of the largest acquisitions happen after a company has hit maturity — i.e., Salesforce’s acquisition of ExactTarget (for email marketing) and Microsoft’s attempt to acquire Salesforce (albeit unsuccessfully).

Best wishes for 2016!

While a little late to this post. I am not sure we are that far along in the lifecycle of marketing technology. My sense unfortunately is there is little differentiation between solutions as segments of technology move toward a Peak. In normal marketing life-cycles you clearly start to see a firming up of the differentiation of products. I am also amazed at the speed of adoption. But many teams seem to not gaining efficiency but actually loosing some as the new marketing technology requires more resources not less. Also many of the competing solutions are still in the copy cat approach product to products. Additionally, I do not see much shoring up of the complexity that many in marketing teams now face in reporting across so many cross sections of data and insight from the various tools. The complexity and ability to demonstrating clarity and ROI for many is still a hurdle that is exacerbate by the number of tools one must work with just to exercise simple marketing efforts. Clearly marketing technology still has a long way to go.

I suppose what is interesting is to think where are the biggest gaps still? Talking to digital marketers are they just complaining too much, and never happy – or are there genuine issues that aren’t quite solved by the bigger players?