The following is a guest post by Tony Byrne, founder of Real Story Group, a research and advisory firm that evaluates digital workplace and marketing technology vendors.

The past several years have seen growing attention to martech “stacks,” the ever-expanding set of tools involved in enterprise customer engagement and marketing. As just one indicator, the latest MarTech Conference saw a record number of submissions to its famous Stackies contest.

Stack diagrams are useful at showing systems hierarchy, task or data flows, and potentially even customer digital journeys. However, they’re not always great at indicating the relative importance or centrality of the different toolsets. In terms of your martech services, what’s truly core? Versus what’s supporting, experimental, or a niche service?

A common theme among the Stackie submissions is that most enterprises do indeed deploy a subset of highly critical martech platforms. These usually consist of three or four key systems — surrounded by a variety of smaller collaboration, marketing, and engagement services.

Your Martech Mall

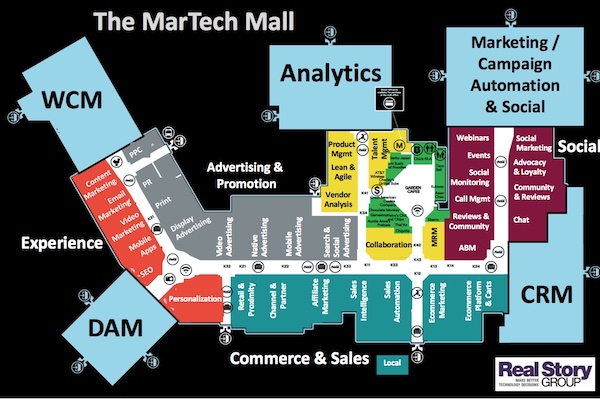

This got me thinking that a useful metaphor for visualizing these stacks was the prototypical North American shopping mall. But in lieu of shoppers, it’s content, data, and enterprise marketers coursing through your martech mall.

Arising in the 1950s, shopping malls would come to vary in shape and size, but they almost always had a particular configuration: anchor tenants connected by boutique or niche stores.

Similarly, in your martech stacks, you have “anchor” platforms surrounded by a growing array of smaller players. To be sure, your anchors might prove to be different types of platforms than you see in this diagram. For a retailer, perhaps ecommerce takes the place of WCM. For a media company, perhaps social media monitoring and engagement replaces CRM.

Shopping malls succeeded in part because of this combination and variety. Anchor stores attracted people who then often lingered, browsed, socialized, and shopped in the food court. Smaller tenants offered intriguing choices, even if they were higher risk for closure. The boutiques made the overall ecosystem more interesting and useful — and for its time, quite adaptive.

You need both anchors and boutiques in your martech portfolio as well. But firstly, you need to get the anchor players right. At Real Story Group we sometimes see enterprises struggling with core web content & experience management (WCM) or digital asset management (DAM) services, with the negative effects reverberating across their martech landscape.

Limits to the Metaphor

Malls became popular because shoppers could park conveniently and traverse them easily. Alas the data moving across our MarTech systems does not move so readily. It’s like the open atrium has doors and locks and other obstructions. In an ideal MarTech mall, our marketers, data, and content would easily flow among systems. Few of us can claim that now.

Traditional North American shopping malls are experiencing a long-term decline, largely because of the demise of many anchor tenants, often mid-sized department stores getting disrupted by the likes of Walmart and Amazon. However, I don’t see a single über-player dominating (or replacing) your increasingly diverse martech portfolio. If anything your MarTech “mall” is likely to get bigger before it gets fundamentally disrupted.

The mall metaphor is still useful because it turns stacks on their side and offers a supplement to traditional layer cake diagrams. To be sure, you still want to chart the hierarchy of technologies stretching from your internal networks to the customer. But you should also identify anchor platforms and ensure that you’re performing well in those areas — giving you the freedom to experiment on all the intriguing sets of boutique services that could differentiate your customer engagement going forward.

Tony will present on best practices for selecting marketing technology at the MarTech Conference in Boston, October 2-4. Don’t miss the opportunity to register now for the lowest “alpha” early-bird rates.