This past weekend, I caught up on Mary Meeker’s latest Internet Trends report for 2017. As always, it was jam-packed with incredible data and insights, and this year it ballooned to 353 pages worth of them.

There’s a ton of topics in the report that are important to marketing — voice-based platforms, convergence of advertising and commerce, gaming-inspired innovation, the reinvention of media, and the spectacular Internet explosions in China and India — but I want to highlight some data from her analysis of “the cloud” and its accelerating change across enterprises.

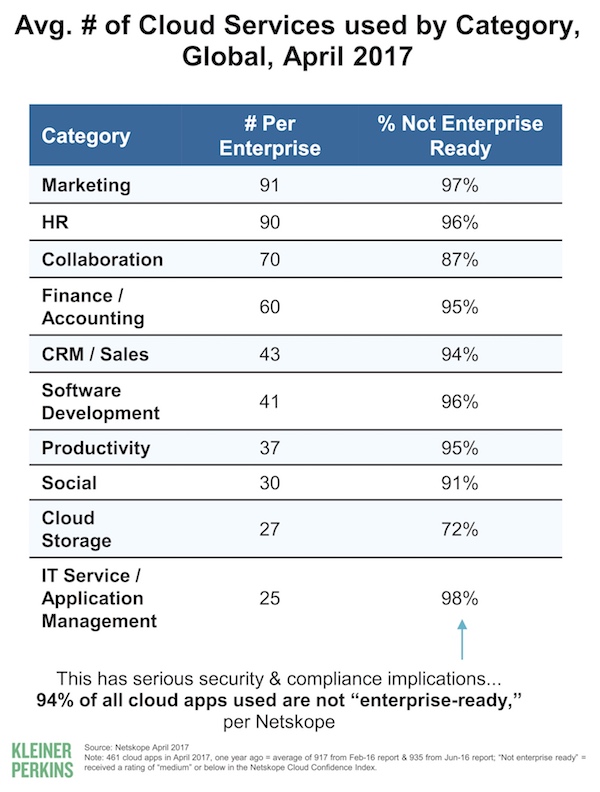

The chart at the top of this post reveals one of the more striking findings that she shared (from page 190 in her report, with credit to cloud security provider Netskope), showing the average number of cloud services an enterprise uses across different categories.

The big revelation: the average enterprise uses 91 marketing cloud services.

Now, in fairness, the definition of a “cloud service,” according to Netskope, is pretty broad. It includes Facebook, LinkedIn, and Twitter (although those are in the social category, separate from marketing). It also includes Skype, Slack, and WebEx in collaboration, Box, Dropbox, and Google Drive in cloud storage, and so on. Here are the top 20 cloud services in Netskope’s study:

Not in the top 20, however — yet clearly prolific — are all the marketing cloud services out there — see the marketing technology landscape for the thousands of SaaS offerings in this space. Of course, not all of them are large-scale, foundational systems — many are more narrow products used by individuals or small teams. But in aggregate, marketers use a ton of them.

A few points worth making:

1. Real enterprise marketing stacks are larger than you think.

When I published Cisco’s marketing tech stack earlier this year, which illustrated 39 different technologies they use in marketing, some people claimed that was way too many. I pushed back on that, because when analyzing the different components in their stack, I didn’t see much overlap. In fact, I thought it was a highly rationalized and well-organized stack.

Now that we know that the average enterprise uses 91 marketing cloud services — plus many more for collaboration, CRM, cloud storage, and social media — 39 actually seems like a rather conservative number. (In truth, Cisco probably uses many more marketing-related cloud services that just didn’t make it into their stack diagram.)

In retrospect, my post from three years ago hypothesizing that marketers regularly use over 100 software programs — even if they don’t consciously identify them all — seems like it has now been confirmed with empirical data. Because it’s not just “marketing” apps they’re using…

2. The app explosion isn’t unique to marketing — or marketers.

Sure, the average enterprise uses 91 marketing cloud services. But that is essentially neck-and-neck with the HR category, with an average of 90 cloud services per enterprise. Another 70 for collaboration. Another 43 for CRM and sales. 37 for productivity. 30 for social. 27 for cloud storage.

So claims that exponential growth in the number of cloud services that marketers adopt are somehow because marketers are obsessed with shiny objects — or similar “they don’t know any better” claptrap — are clearly false stereotypes.

The data here shows that finance and HR, with an average 60 and 90 cloud services each, aren’t that different. But before you naysayers start picking on them for being “look, squirrel!” retrievers, just keep in mind who approves your budget and manages your vacation days.

3. Total cloud services used by an enterprise are 10X greater.

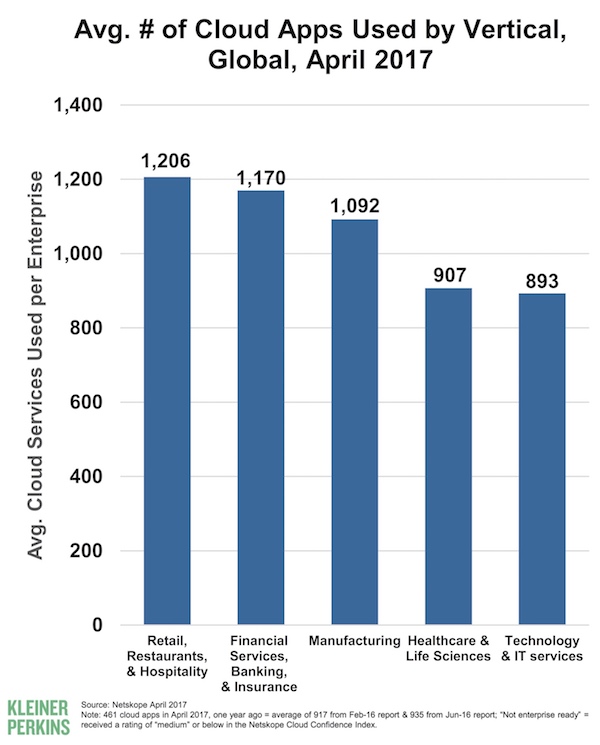

Meeker also shared data on the average number of total cloud services — across all categories — used by enterprises, and it’s 10X larger than just marketing:

The counts vary a bit by industry vertical, but it’s around 1,000 cloud services per enterprise overall. In the big picture, marketing applications only make up about 10% of the total.

So, forgive me for underlining this point, but the kaleidoscopic explosion of cloud software is not just a phenomenon in marketing. It’s the new normal in business (and life).

4. The fundamental structure of software is changing.

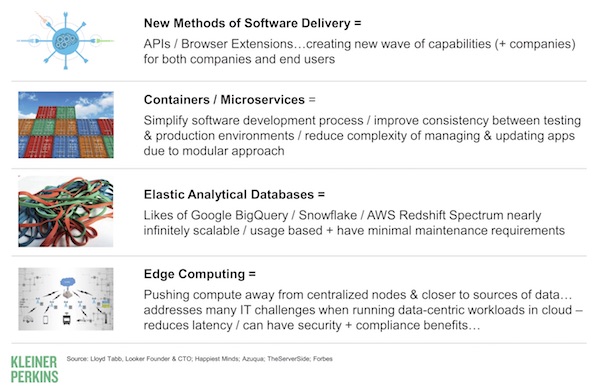

If you’re thinking that an enterprise using 1,000 different cloud services is ridiculous, then it might help to understand that software in the age of the cloud is structurally quite different than the giant on-premise suites of classic enterprise software.

Meeker cites four major innovations in the nature of software in the cloud (p. 184):

Instead of a small number of massive monolithic applications, you have a loosely-coupled network of hundreds of smaller services. This is exactly what I was writing about last year in 5 Disruptions to Marketing, Part 2: Microservices & APIs.

This is a feature, not a bug. It gives organizations tremendous digital agility.

5. Resistance to vendor lock-in is now a top 3 criteria.

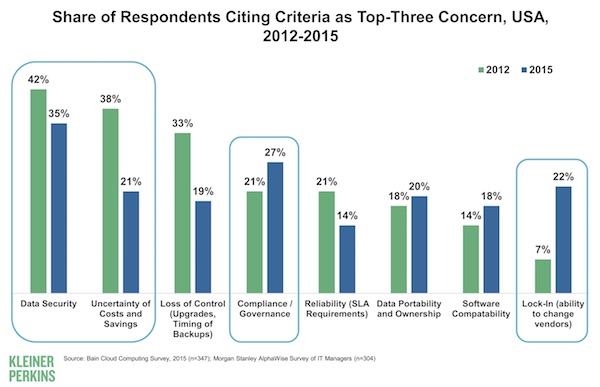

This is reflected in how the concerns businesses have around cloud software software have shifted over the past five years (from p. 183 in Meeker’s report):

Lock-in — the ability to change vendors — was the least of buyers’ concerns back in 2012. But by 2015, it jumped to be the third most common concern, now ahead of uncertainty of costs and savings, loss of control, reliability (SLA requirements), and software compatibility.

It’s remarkable both how those other concerns have been steadily mitigated in the span of three years — but also how great the resistance to vendor lock-in has become.

Going back to the previous point above, agility and flexibility are some of the top benefits that businesses get through their expansive menagerie of cloud services, and they’re increasingly reluctant to be held captive by the technical and contractual chains that were de rigueur with classic enterprise software.

6. Serious security and compliance implications abound.

But the cloud isn’t without its problems. From 2012 to 2015, the #1 concern with the cloud has been data security. By 2015, compliance and governance had become the #2 concern. And for good reason.

If you glance back at the chart at the top of this post, you’ll see that the vast majority (94%) of cloud services analyzed by Netskope are not considered to be “enterprise ready” — generally meaning that they don’t implement enough controls to enforce enterprise-level security and compliance requirements. This includes things such as who can upload or download data, deleting or changing records, and how such activities are audited and monitored.

As a category, marketing cloud services are the second worst in this regard, with 97% of them failing to meet that standard. (Ironically, the worst offender was actually IT Service/Application Management services, where 98% fail. Yet another blow to the stereotyping of just marketers as being oblivious to security.)

Although the culture around enterprise governance is likely to have to change too as part of the evolution of the cloud — command-and-control hierarchies are having a rough time keeping pace in a high-speed networked world — there are significant risks in today’s cloud service environment that need to be addressed.

I suspect that security and compliance solutions for this new reality will look different than their predecessors from the pre-cloud era. There’s a lot of opportunity for innovation here. But it is a significant issue that will almost certainly grow in urgency.

Which allows me to close with a plug for MarTech Conference in Boston, October 2-4, where one of our featured speakers will be Holly Rollo, the CMO of RSA Security, presenting Digital Marketing and Cybercrime: What Every Marketer Should Know. Get your ticket now while the “alpha” early bird rate is still available.

Holy shit Batman! no wonder we are confused.

Wow. Amazing, timely analysis lives in The Brinker/Meeker Zone.

Bravo!

And “Look, squirrel!” is my new catchphrase for martech meetings.

I only have two words to respond to all this: Data Governance.