I’m used to getting a lot ribbing pushback on the scale of the marketing technology landscape. “7,000 martech vendors is way too much!” My gut-level, defensive reaction is to reply, “Hey, it’s not my fault. I’m just counting them.”

Of course, one could argue with the work I do with HubSpot’s platform ecosystem, we are enabling and encouraging more martech ecosystem entrepreneurs. Which is true (see the 4 layers of app integrations with SaaS platforms). So maybe it’s a little bit my fault.

Ultimately though, the number of martech apps in the world is less a function of supply-side enablement and more one of demand-side adoption. Sellers cannot exist without buyers. Marketers are adopting a ton of apps because, well, they can. But it’s not just marketers. HR, finance, operations, sales, etc., are all doing the same.

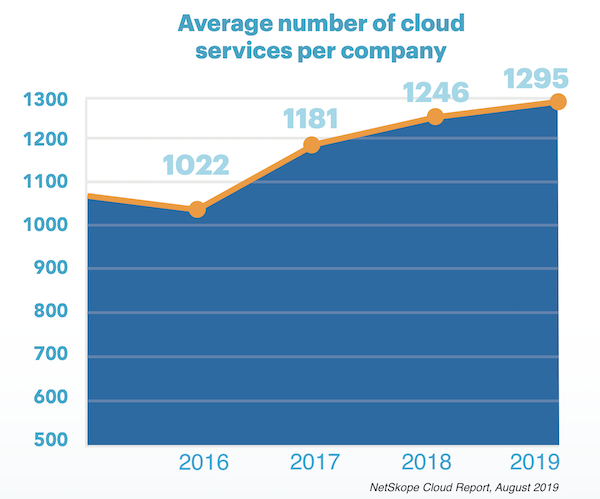

As you can see in the chart at the top of this post, the latest data available from Netskope’s 2019 Cloud Report shows that the average enterprise is using 1,295 cloud services — a number that keeps rising, year over year. (Netskope monitors and secures cloud interactions for many enterprises, so they’re in the privileged position of being able to report on actual cloud service usage, not merely reported usage, which is almost always dramatically underestimated.)

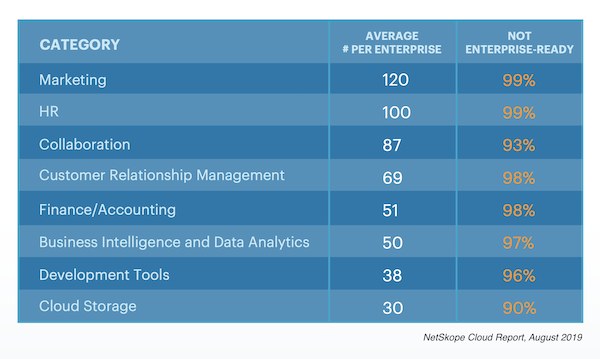

As part of their report, Netskope also categorizes cloud services by their function:

It’s hard not to look at this as a kind of leaderboard and acknowledge marketing is #1 with 120 cloud services on average in a typical enterprise. (Are you cheering? Or crying? Both?)

But HR isn’t far behind with 100 cloud services. In contrast, finance and accounting seem downright conservative with only 51. Ironically, development tools — which enable more cloud services to be created — are near the bottom of the list with a paltry 38.

The point is: this isn’t a phenomenon of marketing. This is a phenomenon of the cloud.

What about the “Not Enterprise-Ready” column on the right of that chart? That sounds a little scary, with the vast majority of these cloud services not passing that bar. It also seems slightly paradoxical that 90%+ of cloud services being used by enterprises are not enterprise-ready.

Sounds like the premise of a 21st-century Joseph Heller novel set in the IT department.

Well, speaking of marketing, keep in mind that Netskope is in the business of providing security and monitoring for cloud services — from data loss prevention (DLP) to web threat detection. There’s an inherent tension between moving all your data to the cloud and, um, preventing data from being moved into the cloud. Getting really strong, granular, activity-level controls across all the cloud services that companies use is going to be a long, evolutionary journey.

Netskope isn’t wrong about the risks it’s identified. But acceptable risk/reward cloud practices in most enterprises aren’t held to that bar — yet. I fully expect this will become one of the most interesting axes of development across cloud-based apps in the years ahead, as security and data control requirements and capabilities continue to advance.

We can argue about the reasons for all the buy-side adoption of cloud services, and whether it’s good or bad. But the count is simply a fact.

P.S. Want to dig deeper into the dynamics of managing all these marketing apps in your stack? Come join us at the MarTech Conference in San Jose, April 15-17.

Is the MarTech Conference still going ahead at this stage?