Productiv, a SaaS management platform (SMP), published a report on The State of SaaS Sprawl in 2021. Since Productiv’s software manages the tech stacks — or “app portfolios”, as they like to call them — of hundreds of organizations, the data in their report is based on objective facts of app adoption, instead of merely surveyed opinions.

This kind of hard data is particularly helpful in scenarios where there tend to be wide gaps between perception and reality. Perception: when asked how many apps they have in their tech stack, people almost always significantly underestimate the count. “A handful.” “Maybe a dozen.”

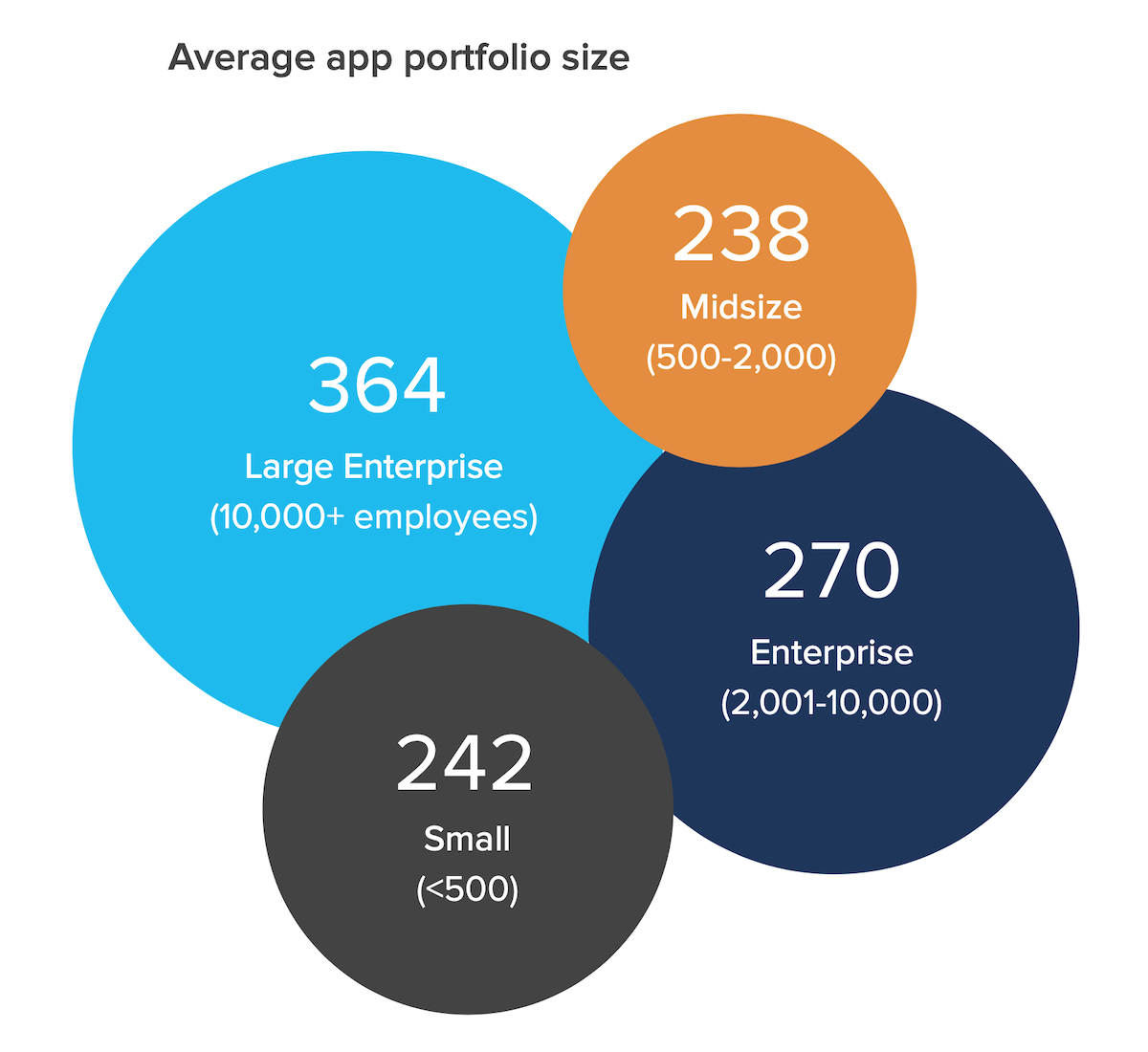

Reality: businesses often have a ton of SaaS apps these days, as revealed by the chart from Productiv at the top of this post.

(Of course, you might insightfully point out that any company deploying a SaaS management platform is probably skewed towards having a lot apps to manage. Point acknowledged.)

Interestingly, there’s not a huge difference between the app count for small and midsize businesses (with 2,000 or fewer employees) and large enterprises (over 10,000 employees) in this data set. 242 apps compared to 364 — the latter is only 50% larger with more than 5X the number of employees.

The suggests a diminishing value to the number of apps in an organization, regardless of size. Which makes sense intuitively, to achieve cohesion in how a business operates. The data from Productiv indicates that limit might be a few hundred — at least for commercially purchased apps.

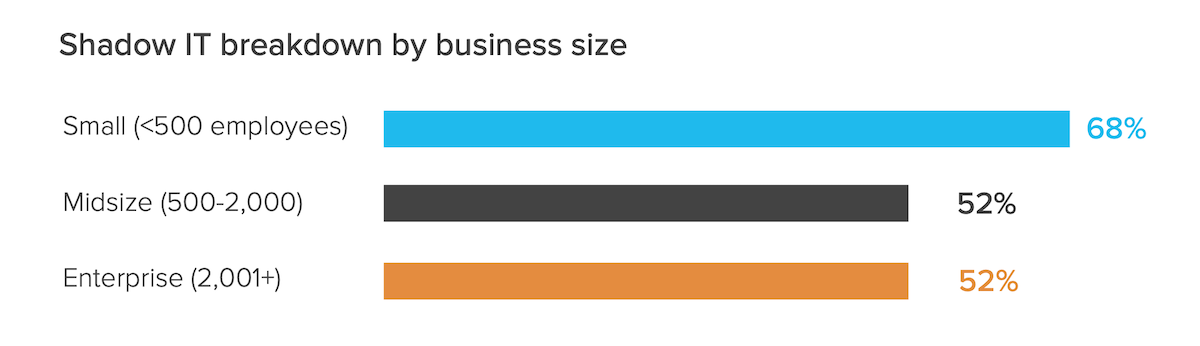

The label “shadow IT” popped up again, defined as “tools not managed or owned by the IT department.” I don’t hear that phrase as often as I once did, and the data from Productiv helps explain why: the majority of SaaS apps today are not managed or owned by IT.

After that tipping point, who is the body and who is the shadow?

Philosophical ruminations aside, more than ever this divide strikes me as a false dichotomy. Instead of an all-or-nothing stand-off, there’s a very happy middle ground where many apps are owned (i.e., paid for) and run by business teams who use them as an integral part of their mission — hello, marketing automation — but under a structure of good governance from IT.

This is how finance and HR work, letting other teams take responsibility for their budgets and staff, but under a common governance framework.

SaaS apps owned and managed by business teams should still be required to adhere to compliance and security requirements set by IT. Indeed, this is one of the ways that SaaS management platforms such as Productiv can be helpful, providing visibility into usage and compliance across the company-wide tech stack app portfolio.

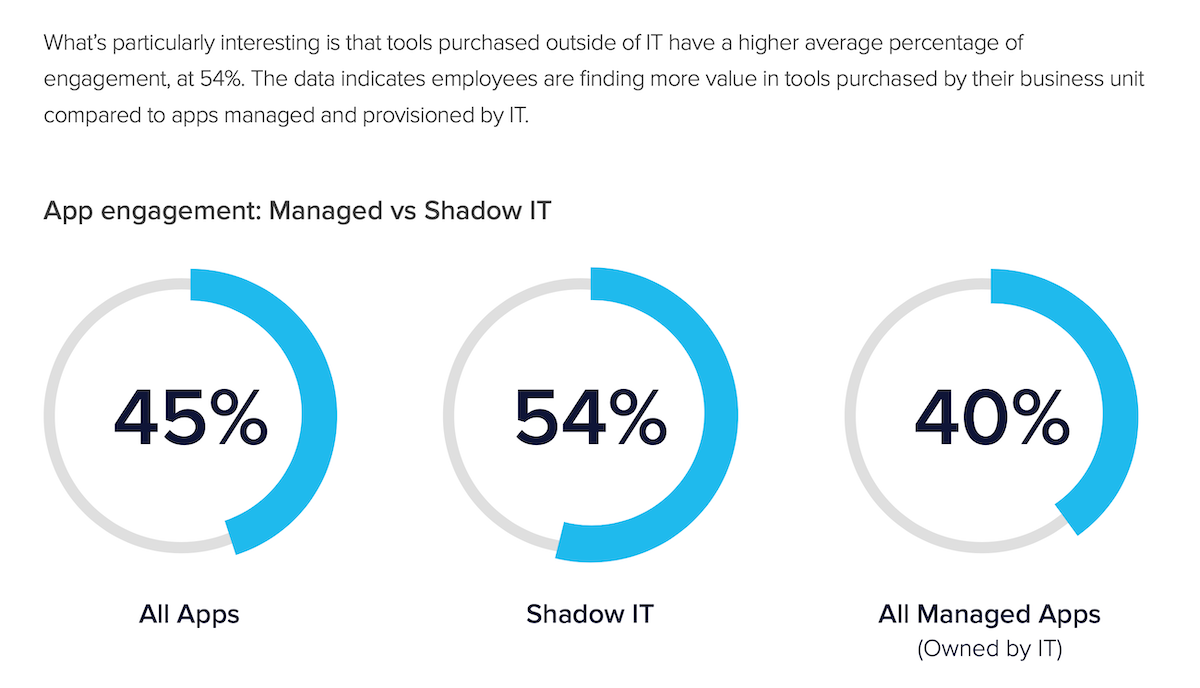

But this was the most interesting finding in this report to me: so-called shadow IT apps have significantly higher app engagement (54%) than apps managed/owned by IT (40%). (Productiv defined “app engagement” as feature-level usage within tools on a monthly basis, across all tools, for every employee with a license.)

To quote Productiv, “The data indicates employees are finding more value in tools purchased by their business unit compared to apps managed and provisioned by IT.”

The closer you are to the need, the more you appreciate the best way to fulfill it.