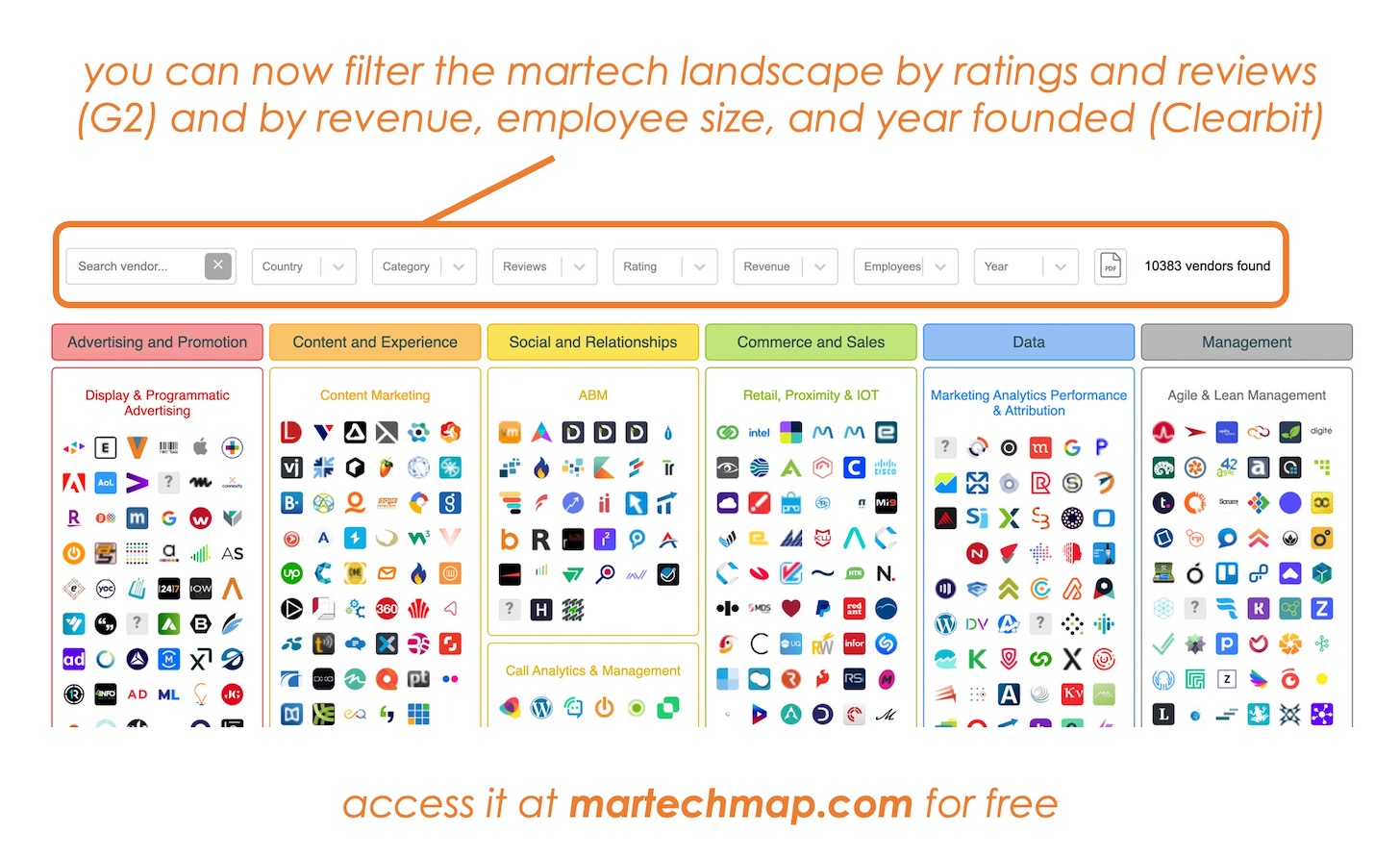

In today’s virtual event Martech for 2023: The (Really) Big Picture — full video will be shared tomorrow — Frans Riemersma and I released a major update to the interactive martech landscape on martechmap.com.

We know: the martech landscape is overwhelming. In our latest update to the database, even after removing a number of solutions that were either acquired or shut down over the past six months, we ended up with more than 10,000 products represented. When you step back and look at them from a bird’s-eye view, it’s a fascinating picture. But it’s a haystack of needles. Not easy to find things in it.

But today, it’s just gotten a little easier…

Thanks to two new data partnerships with G2 and Clearbit — thank you, both! — we were able to enrich our database of martech solutions with more information. Clearbit provided data about estimated revenue, employee size, and founding date for many of these companies. G2 provided data about the ratings for many of these products.

Frans and I have added these filters to martechmap.com, so you can now search and filter by any of the following fields and combinations:

- Keywords in website meta-description and Twitter profile bio

- Country in which the company is headquartered

- Category in which is the solution is classified

- Number of reviews received on G2

- Average rating on G2

- Estimated revenue

- Estimated number of employees

- Year founded

Disclaimer: we don’t have full coverage between our dataset, Clearbit’s, and G2’s, so the results from using these filters is incomplete. We’ll be working on filling these gaps, as well as tweaking the functionality and ironing out any bugs. But hopefully it’s good enough to be interesting and considerably more useful.

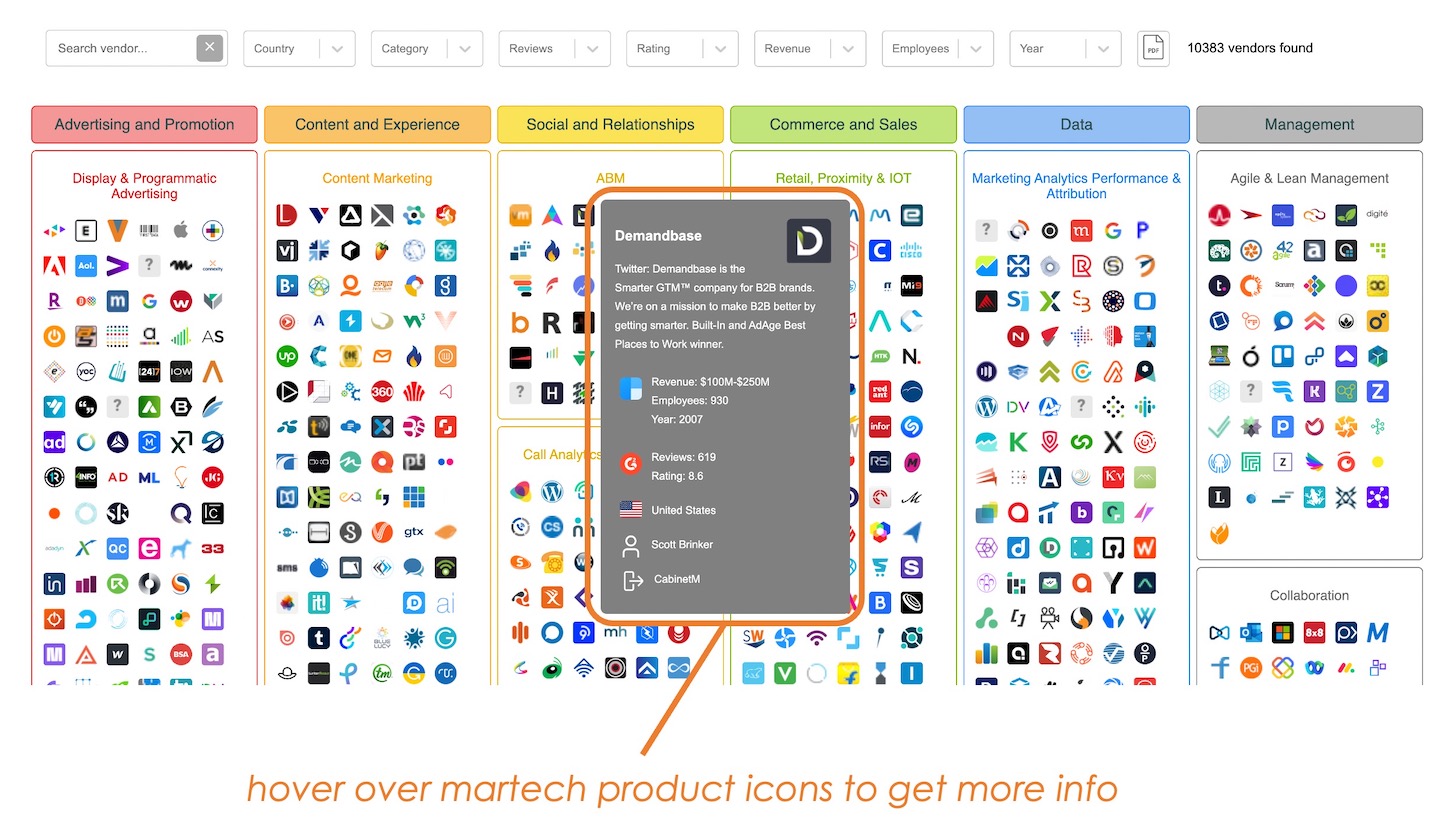

When you hover over any of the icon logos — we harvested the favicons of these martech vendors’ sites — a card will appear with more details, including the Clearbit and G2 fields where we have them.

Is there a martech product you know that is missing or needs its category updated? Contribute your suggestions here.

Martech Product Ratings: Patterns & Hypotheses

Frans and I ran a few analyses on this data in aggregate and found several interesting patterns.

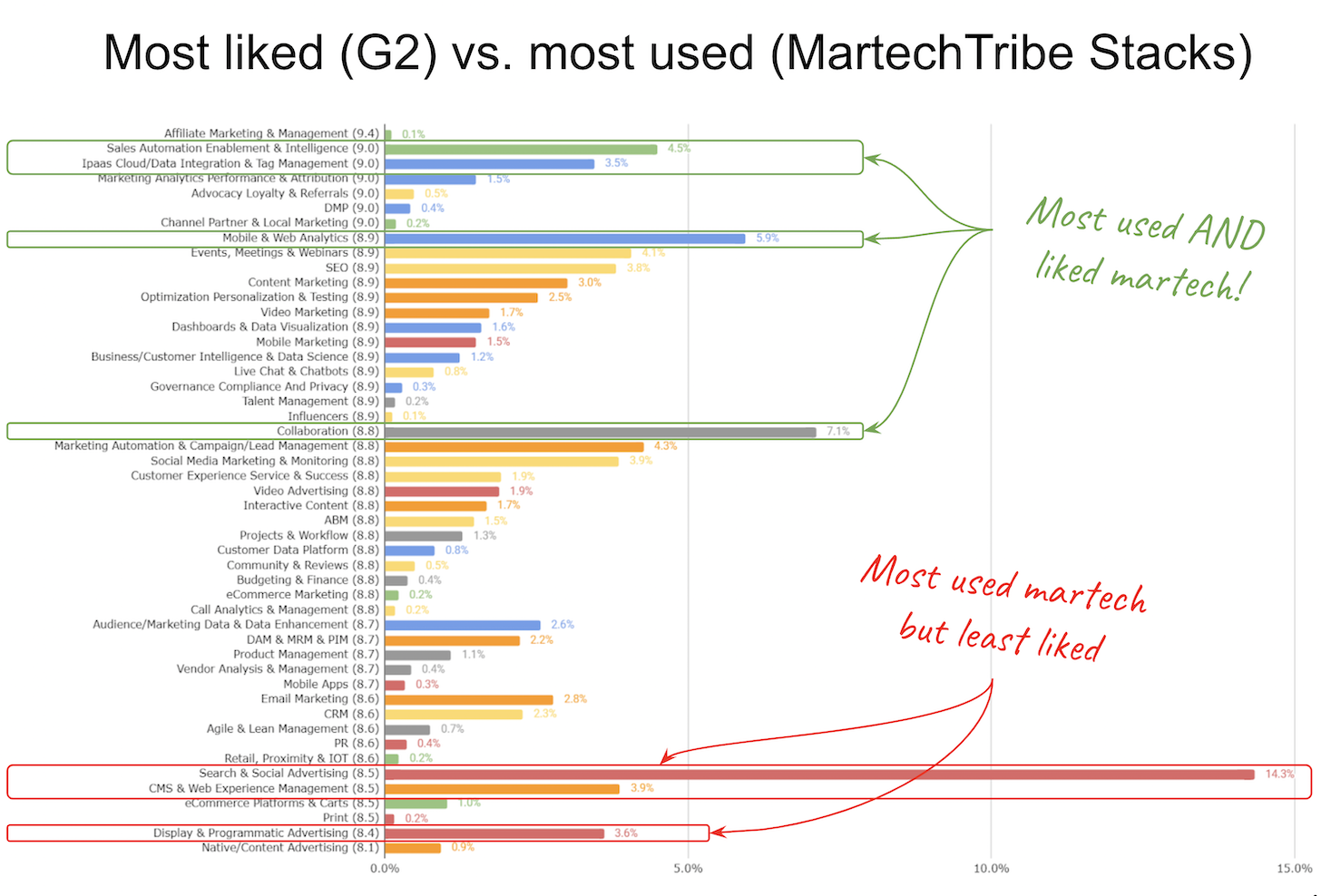

First, we created a bar chart of all the martech categories and the frequency by which products in those categories appear in the database of martech stacks that Frans has collected over the past several years. We then ordered the bar chart by the average G2 ratings of products in those categories from highest to lowest, top to bottom.

The result above shows that salestech, iPaaS, mobile & web analytics, and collaboration tools were both highly rated and frequently included in stacks. Approximately speaking, they’re the most used and most liked martech.

In contrast, search & social advertising, CMS & web experience management, and display & programmatic advertising were frequently included in stacks — but not particularly well-liked, at least on average.

Of course, CMS and adtech are also two of the oldest categories in martech. Which led us to take a look at this distribution:

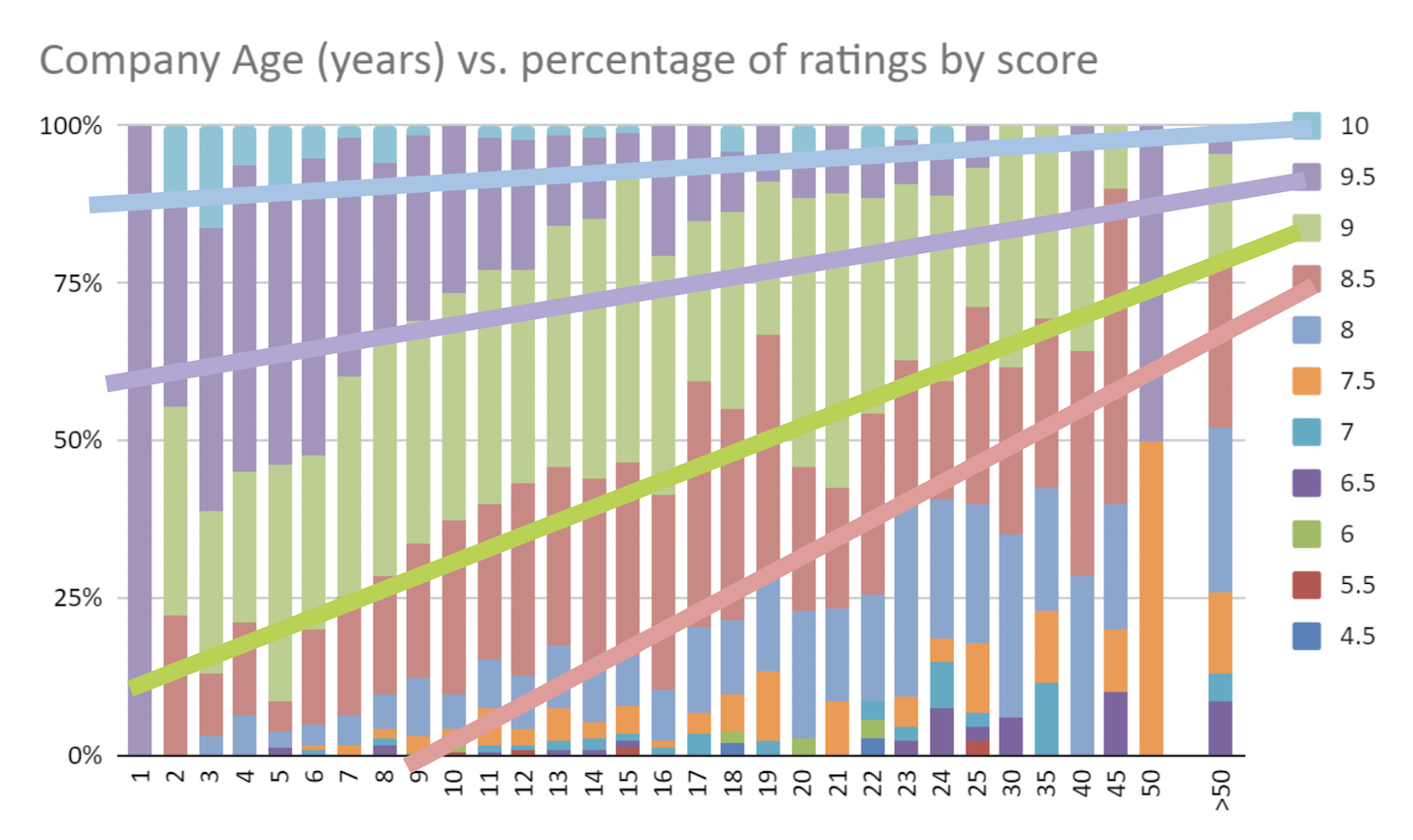

This shows the percentage of different G2 ratings, high to low, on the y-axis, compared against the age in years of the vendors on the x-axis. Newer vendors on the left to older vendors on the right. (Yes, there are some martech companies that have been around 50+ years.)

There’s a very clear pattern here: newer martech companies tend to have higher G2 ratings than older ones.

A hypothesis that seems reasonable to us: this is evidence of new disruptors challenging the “old guard” in existing categories. Martech products that have been around a long time might have trouble keeping up with the latest trends and customer expectations in their category. Their ratings, on average, slide downward over time.

New martech startups see this as an opportunity and launch challenger products in those categories — and generally do well enough to earn better ratings.

It’s an explanation for why the martech landscape as a whole has defied consolidation. Sure, products do get “consolidated” into larger companies over time. But then those larger, older, consolidated companies get challenged by new startups that better serve marketers on one or more dimensions — features, price, user experience, etc.

Further analysis in the chart above, comparing G2 ratings by average size of company in number of employees — which is generally correlated with a company’s age — further validates this hypothesis. The smaller the martech vendor, the higher their ratings (on average).

It’s interesting to note that in this chart products in the Native/Content Advertising category have the worst average ratings. An opportunity for disruption?

Meanwhile, products in the Affiliate Marketing & Management category have the best average ratings.

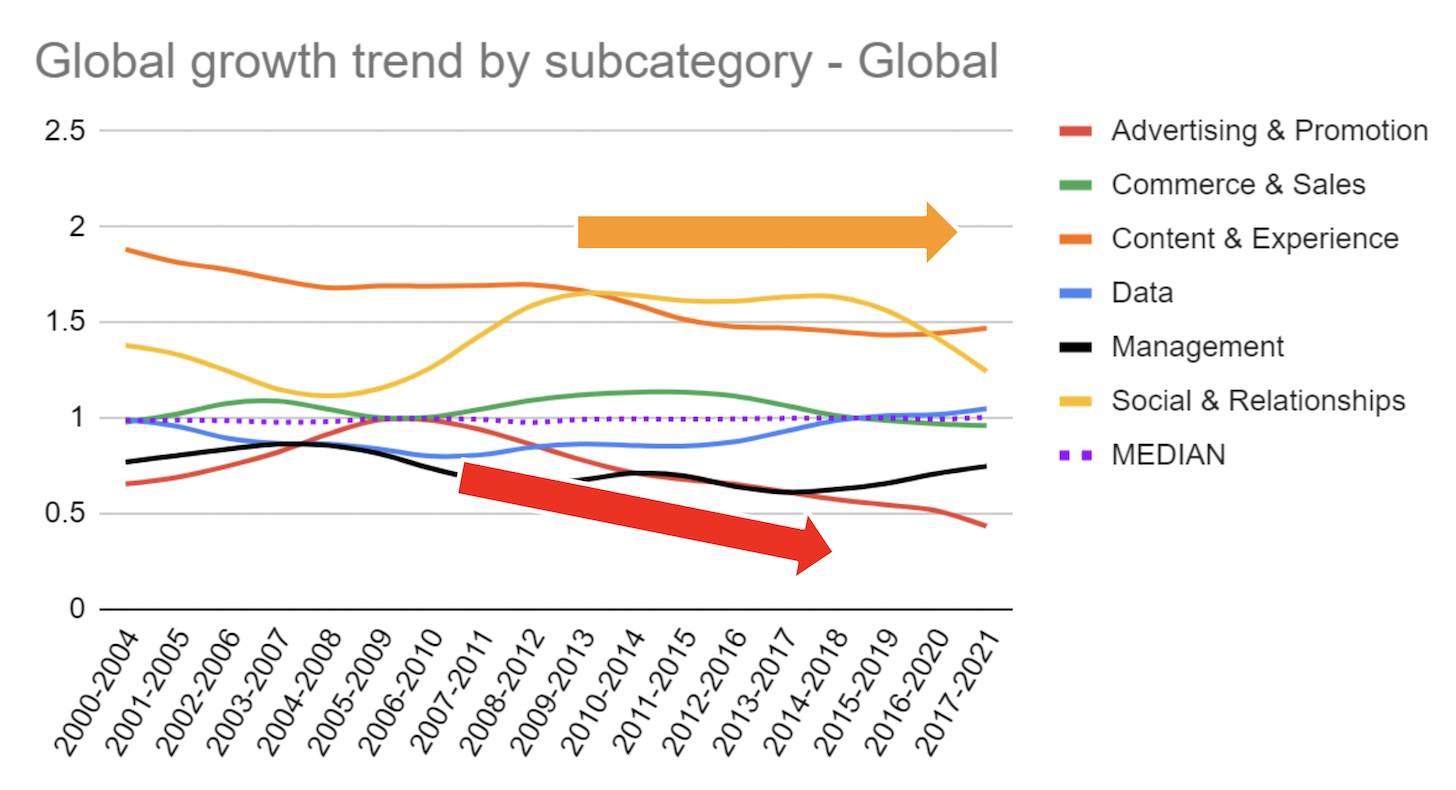

One last analysis to share with you: growth in the number of new martech vendors founded in different categories over time:

We normalized them relative to the overall median number of martech startups each year, to highlight which categories tend to have more or fewer new entrants.

The groups of Content & Experience and Social & Relationships categories have consistently had the most new startups. It makes sense. Those are the categories where the marketing environment and customer expectations have had the most changes over the past decade. There tends to be a lot of opportunity for differentiation there.

On the other hand, Advertising & Promotion categories have had fewer and fewer new startups since 2010. Relative growth of new entrants in adtech has been steadily declining for a decade.

But given the relatively low ratings that have accumulated in adtech categories, perhaps this is a space that’s ripe for new disruption?

In addition to Clearbit and G2, whom we are grateful for being “data sponsors” in this project, I want to thank SAS, Uptempo, and Calendly, who sponsored today’s virtual event, giving us financial resources to support our research such as this. I also want to thank Goldcast for being our virtual event platform sponsor. As these companies support us, I hope you’ll consider supporting them in return.

Stay tuned for the recording of our presentation to be posted tomorrow.