First, a quick ask: please take this 5-minute survey on martech composability. We’ll share the full results back with everyone. I bet it will be very interesting. Thank you! Okay, back to today’s post…

I prefer empircal data over gut-feel prognostications. For 12 years, I’ve been told that SaaS in general — and martech in particular — is going to dramatically consolidate. People can be quite vehement in such predictions. Yet year over year over year, the data consistently fails to show that outcome.

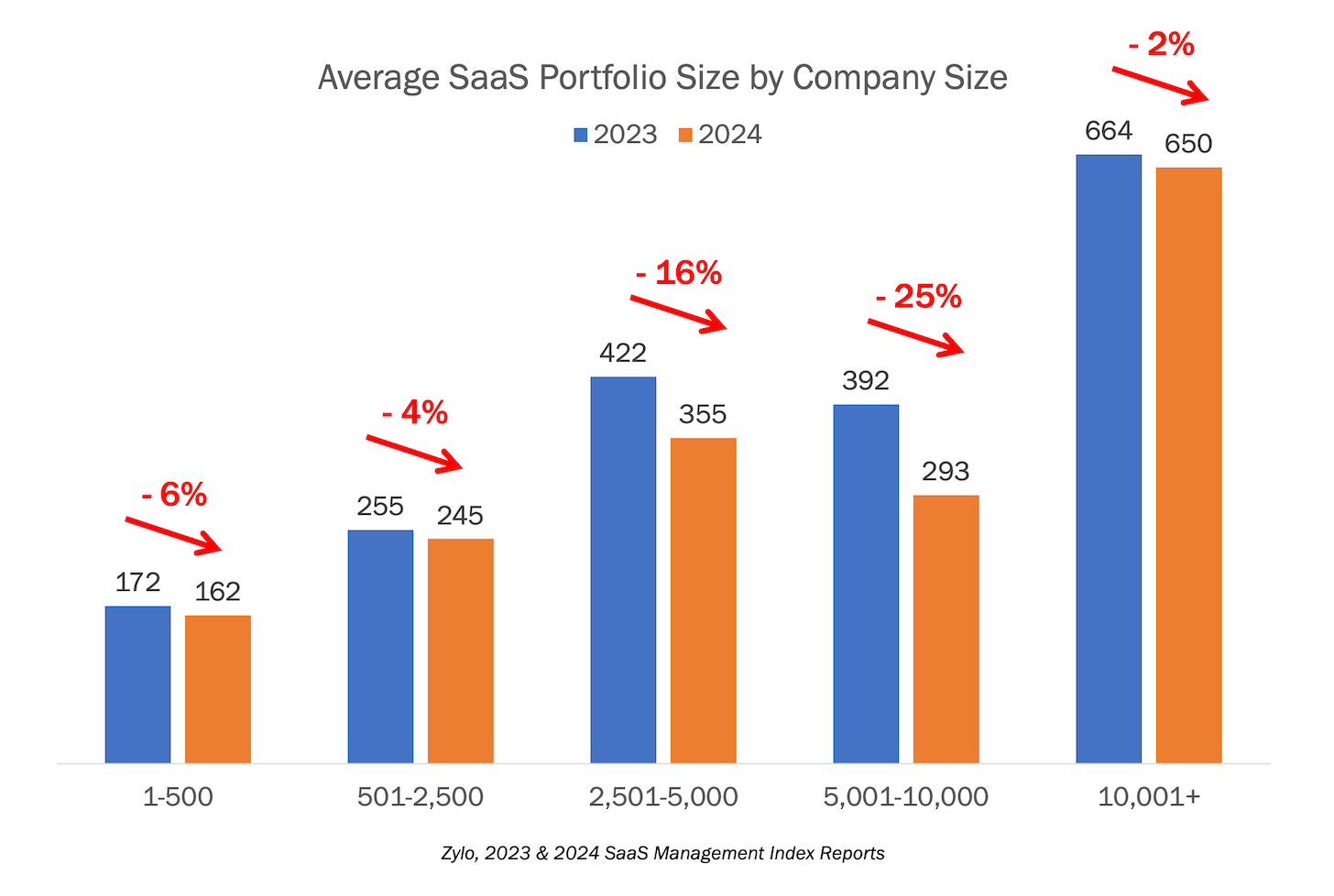

According to the 2024 SaaS Management Index Report just released by Zylo, a leading SaaS management platform that manages over 30 million SaaS licenses for companies of all sizes, the average SaaS portfolio shrank from 291 apps to 269, just a hair under 8%.

For context, 2023 was a brutal year for SaaS companies, as customers sought as many opportunities as possible to reduce spend by cancelling unnecessary app subscriptions. And indeed, average SaaS spend shrank closer to 11% over this past year.

Yet the average stack size for SMBs with 500 or fewer employees is still 162 apps. For mid-market companies with 501-2,500 employees, it’s 245 apps. Yes, these are down by 6% and 4% respectively, year-over-year. But that’s not exactly the scorched earth scenario that the prophets of consolidation were promising we’d see at this point.

I’m sure they’ll say, “Just wait until the end of this year!” Maybe they’ll be right eventually.

Don’t get me wrong. I’m all for companies being cost-conscious and proactively managing their stacks to maximize ROI. I’ve also got no problem with market forces that tend to drive a small number of competitors in a category to pull away from the crowd.

But the reality is that we’re in a time of continuous technological innovation. If anything, the pace of change in tech has been accelerating — and is accelerating even faster now in the current wave of all things AI. In an environment like this, new opportunities for startups abound. And the pressure for companies to adopt new technologies to keep pace with their competition are real.

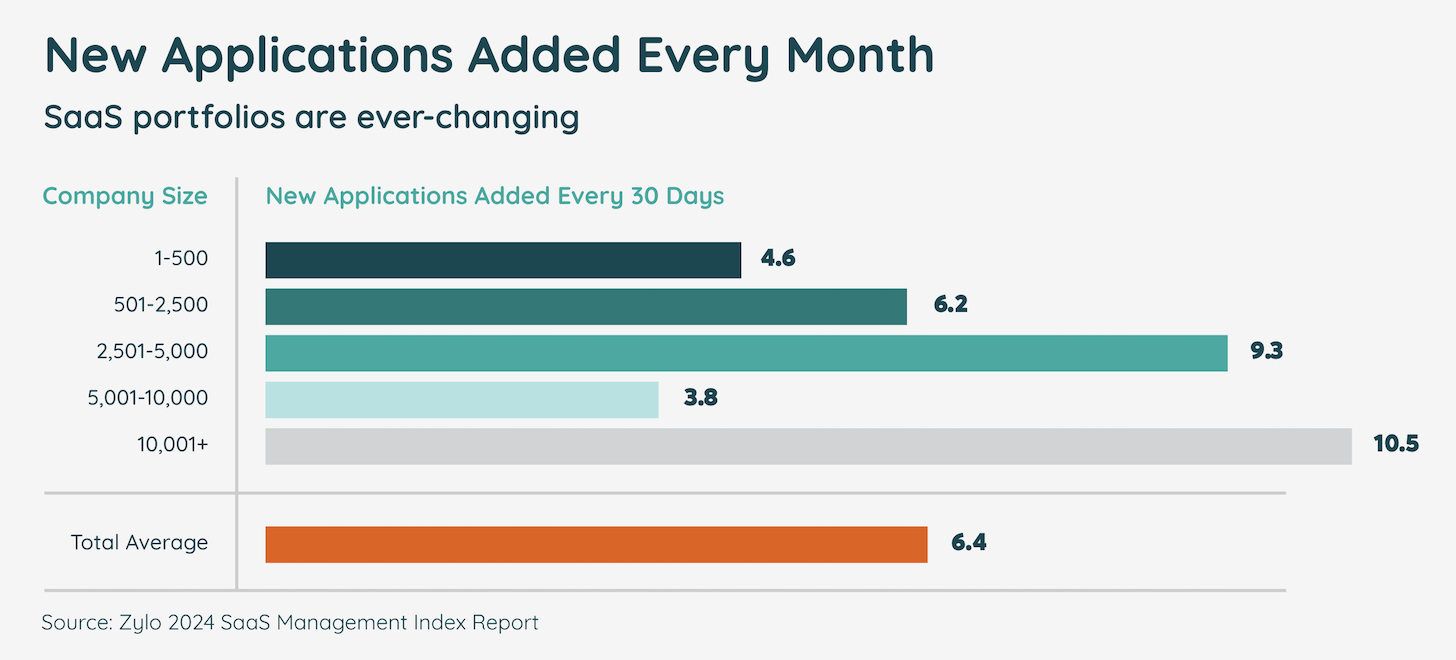

You can see evidence of this by the number of new SaaS apps that keep getting introduced into a company’s SaaS portfolio every month:

This continuous evolution is a significant counterweight to the forces of consolidation.

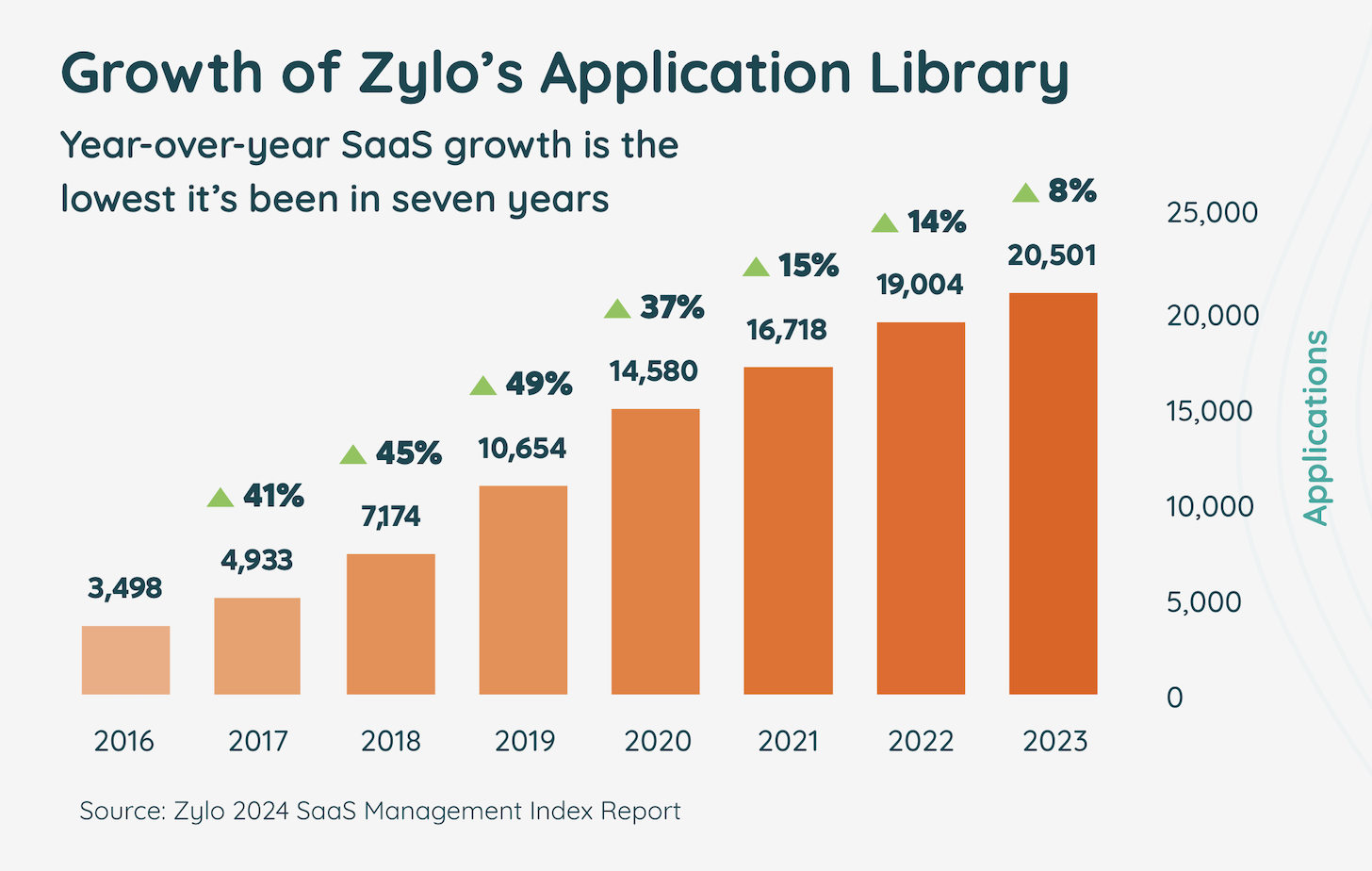

It’s worth noting that, while average stack sizes have been shrinking these past few years — albeit by relatively modest amounts — the number of distinct SaaS apps in the market has continued to grow. Of course, you’ve witnessed the upward trajectory of the martech landscape for the past decade. And a couple of years ago, the review site G2 shared they had over 100,000 SaaS products in their database.

But as another source to triangulate app diversity, the above graph from Zylo shows the number of different apps that they keep track of. It’s only been growing, now up to more than 20,000 apps. Yes, growth has slowed. But it’s still been growing, even as average stack sizes have started to shrink.

There may be (slightly) fewer apps in stacks these days. But if you do the math, it’s an increasingly diverse collection of apps across those stacks.

Shadow IT, a shadow of what it once was?

Once upon a time, “shadow IT” was the pejorative phrase given to any software app that wasn’t owned by the IT department.

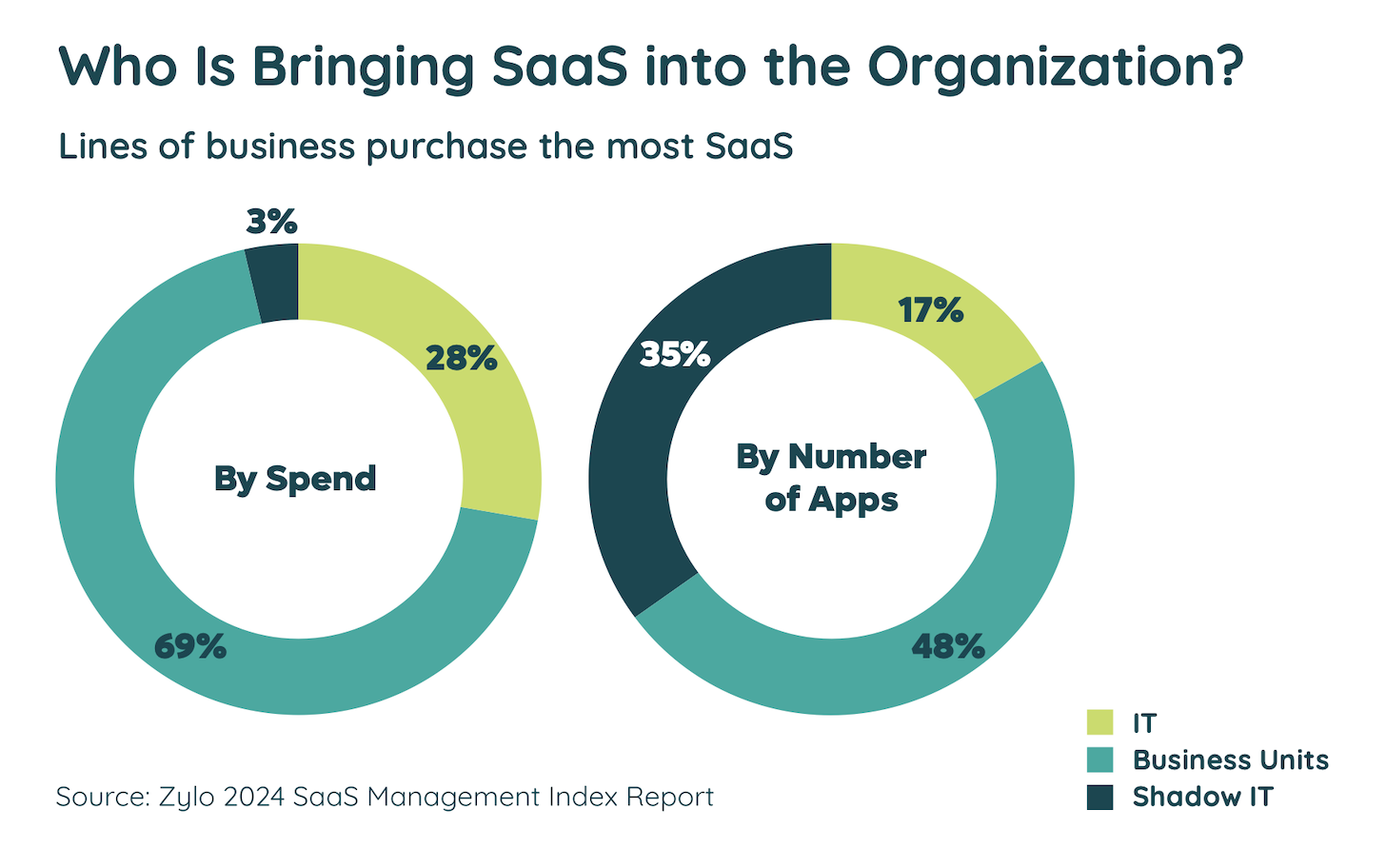

We’ve come a long way. Now, the majority of software — both by total number (48%) and spend (69%) — is owned by business teams. Marketing is running most of its own martech apps (although the amount of IT-owned, company-wide data and aggregation infrastructure used by marketing is growing).

These business-owned SaaS apps are no longer considered shadow IT because, although business teams are footing the bill and running these apps, the IT department still has full visibility and can insist that they comply with their governance and security requirements. In many ways, this is the best-of-both-worlds scenario we long sought in martech. It balances central control and distributed empowerment.

But shadow IT still exists. Its definition has narrowed though, and it now mostly refers to SaaS apps that individual employees or teams expense on their credit cards, outside the watchful eye of IT governance.

As you might expect, most of these shadow IT apps are small enough — or at least inexpensive enough — to fly under the radar as a credit card expense. According to Zylo, only 3% of the total spend on SaaS falls into this category. What’s fascinating, however, is how many of these small apps there are. While they’re only 3% of the spend, they’re 35% of the number of apps in people’s stacks.

Yikes! More than 1/3 of a company’s SaaS apps are ungoverned shadow IT! This sounds like a four-alarm crisis.

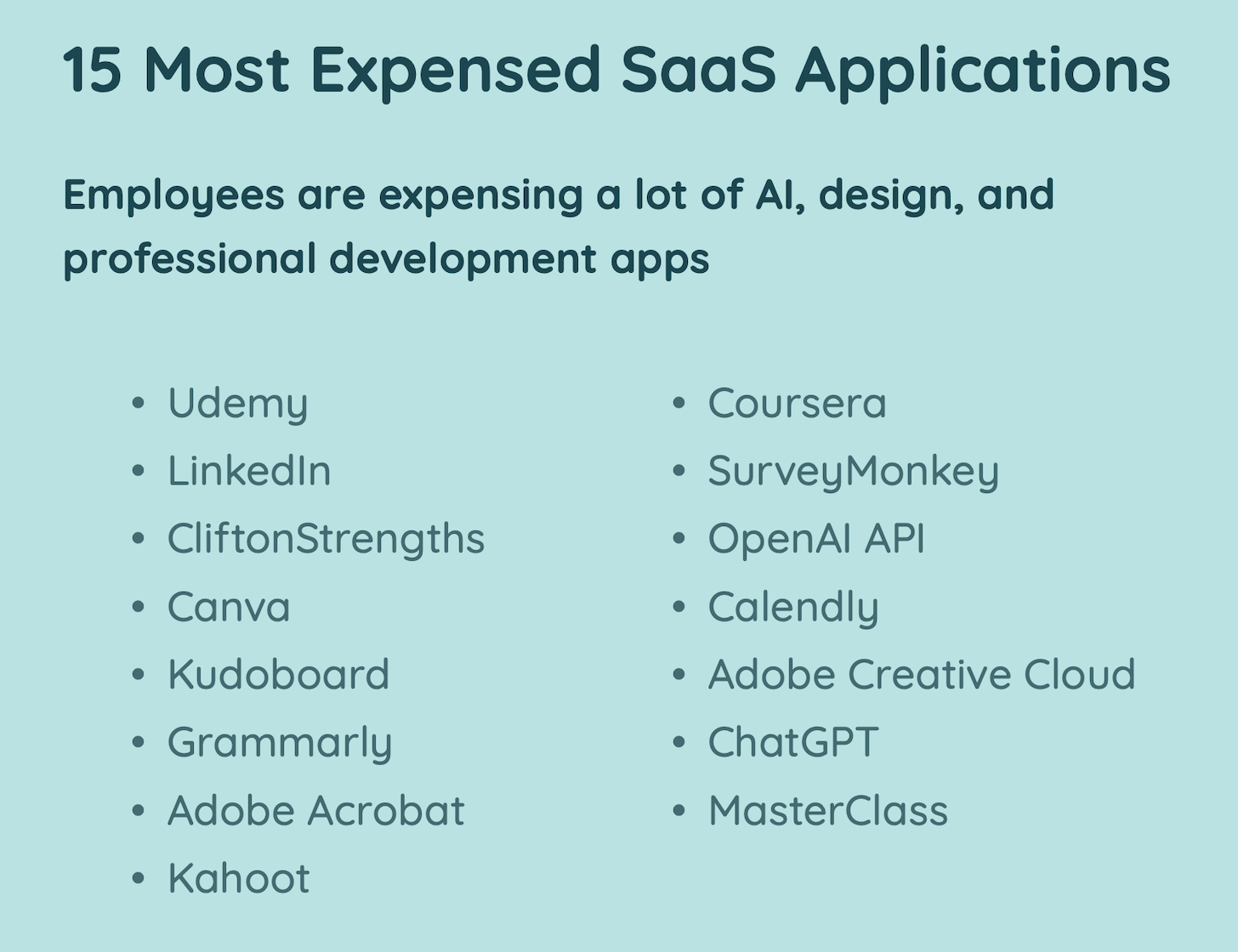

Maybe it is. But when you look at the most popular shadow IT apps, most of them seem relatively harmless. Udemy, LinkedIn, CliftonStrengths — as an aside, I’m a huge fan of StrengthsFinder, and highly recommend it — Kudoboard, Coursera, MasterClass, etc.

Yes, there would be benefits to having all of these subscriptions be official “daylight IT” instead of shadow IT. Mostly to keep expenses down by getting rid of unused licenses or negotiating corporate-wide discounts. (Although I’ll note those two levers are often trade-offs of each other.)

But we’re only talking 3% of total SaaS spend. So even if you cut those costs in half, it would be a mere 1.5% savings. Hey, 1.5% here, 1.5% there, next thing you know, we’re talking real money. But it’s no white whale.

A couple of these are more problematic. Using SurveyMonkey to collect customer data? That should be governed. Using Grammarly with confidential documents and emails? That should be governed. Using ChatGPT and the OpenAI API? Hell, yeah, that should be governed!

But this seems like a gap that can be closed by putting in streamlined mechanisms to officially purchase approved “personal productivity and development” apps (which is how I’ll broadly generalize most of that list).

In fact, the gap is closing. In 2022, Zylo reported that 20% of employees were expensing SaaS in this shadowy way. By 2023 the number had dropped to 15%. And here in 2024 it’s down to 7%.

In summary:

- Tech stacks are still large, although healthily trimmed.

- The universe of diverse apps in tech stacks is still expanding.

- Business teams definitively own most of their apps, albeit governed by IT.

- Shadow IT is fading into the shadows, mostly because we redefined it.

Lots more great stats in the Zylo report. Highly recommend picking up a copy.

One more reminder: please, please take our martech composability survey. When you see the questions, I think you’ll be as curious as I am to see what the results will reveal. But we need you to participate in order to have statistical significance. It’s my humble ask in exchange for the free content I publish. Thank you!