tl;dr The martech landscape grew again since last year, up 9% to 15,384 solutions. While new AI natives continue to blossom, the previous generation is consolidating more. There’s also an exploding “hypertail” of custom software. We cover all of this and more in our new State of Martech 2025 report (free and ungated).

Over 15 years ago, I tossed a bunch of martech logos on a slide to present the Rise of the Marketing Technologist to a room of CMOs, making the case that marketing was becoming a very technology-integrated discipline. (For our younger readers: “marketing technologists” were what we called go-to-market engineers back in the day — you know, before electricity and indoor plumbing.)

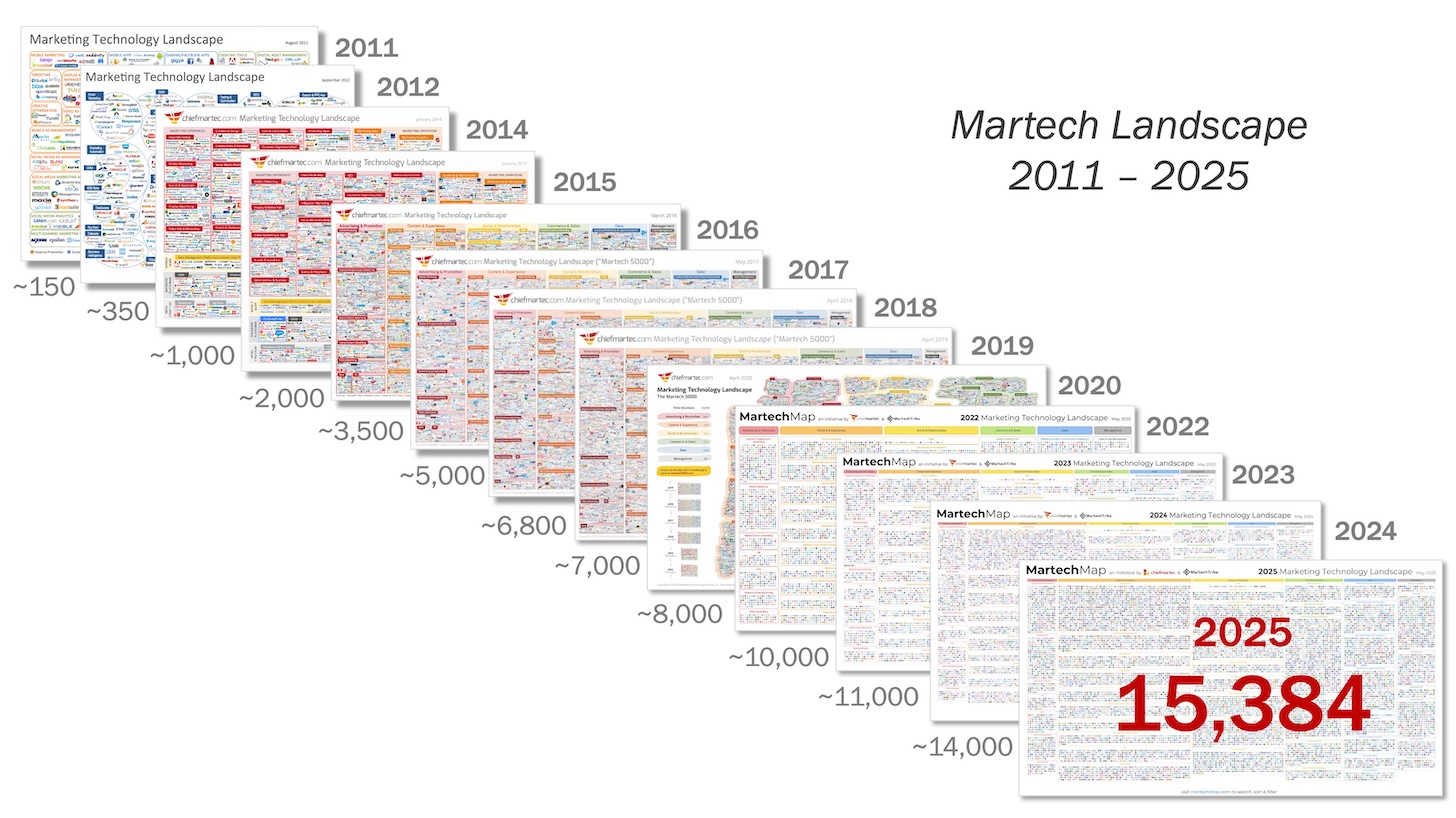

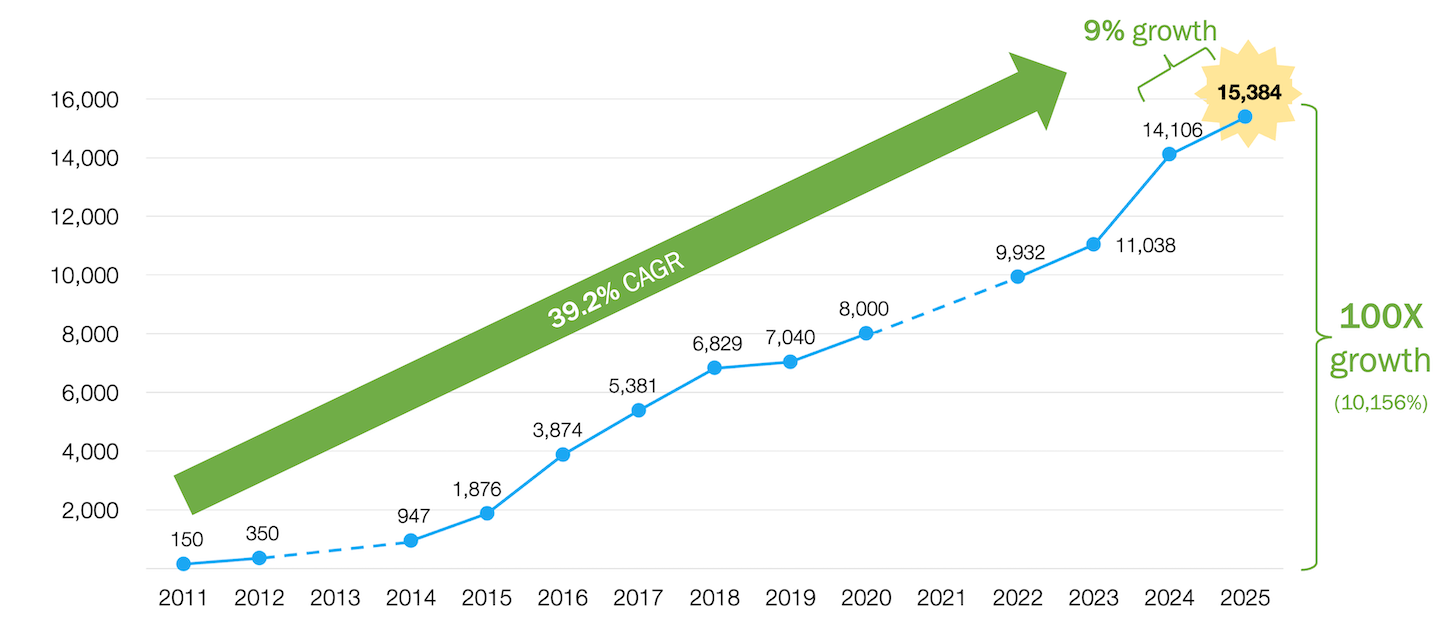

The next year, I formalized the slide into the first official marketing technology landscape, with a whopping 150 — gasp! — solutions categorized. From there, things got surreal. The market of martech grew exponentially to thousands and thousands of products. Every year, pundits predicted it would collapse within the subsequent year. And every subsequent year, empirical reality proved otherwise.

Which brings us to today’s release of the 2025 marketing technology landscape, now with 15,384 solutions organized in 49 categories. Yes, it grew. Again. Up 9% from last year’s 14,106. Massive credit goes to Frans Riemersma, who has been co-producing the landscape with me since 2022 with a small army of researchers and volunteers.

Of course, as a mere slide, it’s been completely unreadable for years. But to prove that it’s not just random dots on a page, you can:

- Download a hi-res, clickable PDF of the full martech landscape

- Visit MartechMap.com to zoom, search, and filter an interactive version

“If you keep squinting at all those little logos, you’ll go blind!” I’m sure my mother would have advised. So let’s step back and look at the growth quantitatively, year-over-year. The headline — literally — is that the martech landscape has grown 100X since 2011. Or 10,156%, which seems larger. (Yeah, I’m bad at math.)

Death of a Martech Salesperson? For some, yes

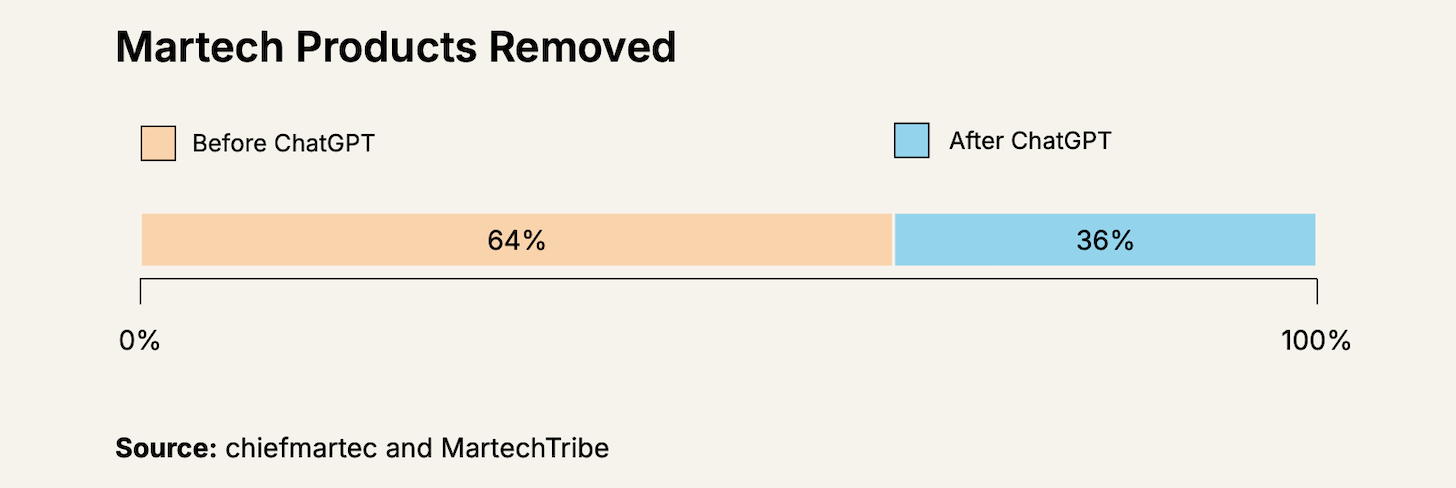

Now, before you accuse us of sandbagging this by including anything thrown our way with a URL and a favicon, I’ll note that we actually evaluated 11,133 new candidates this year, out of which only 2,489 qualified. At the same time, we removed 1,211 from last year’s landscape that vanished either through acquisition or simply shutting down. That’s a churn rate of 8.6%. (Again, being bad at math, the 1,211 number feels larger to me.)

You might expect that most of those that went away were flash-in-the-pan products from last year’s massive explosion of new AI-native products that surged after the release of ChatGPT. In fact though, 2/3 of the ones that went away were from the previous decade, 2010-2020.

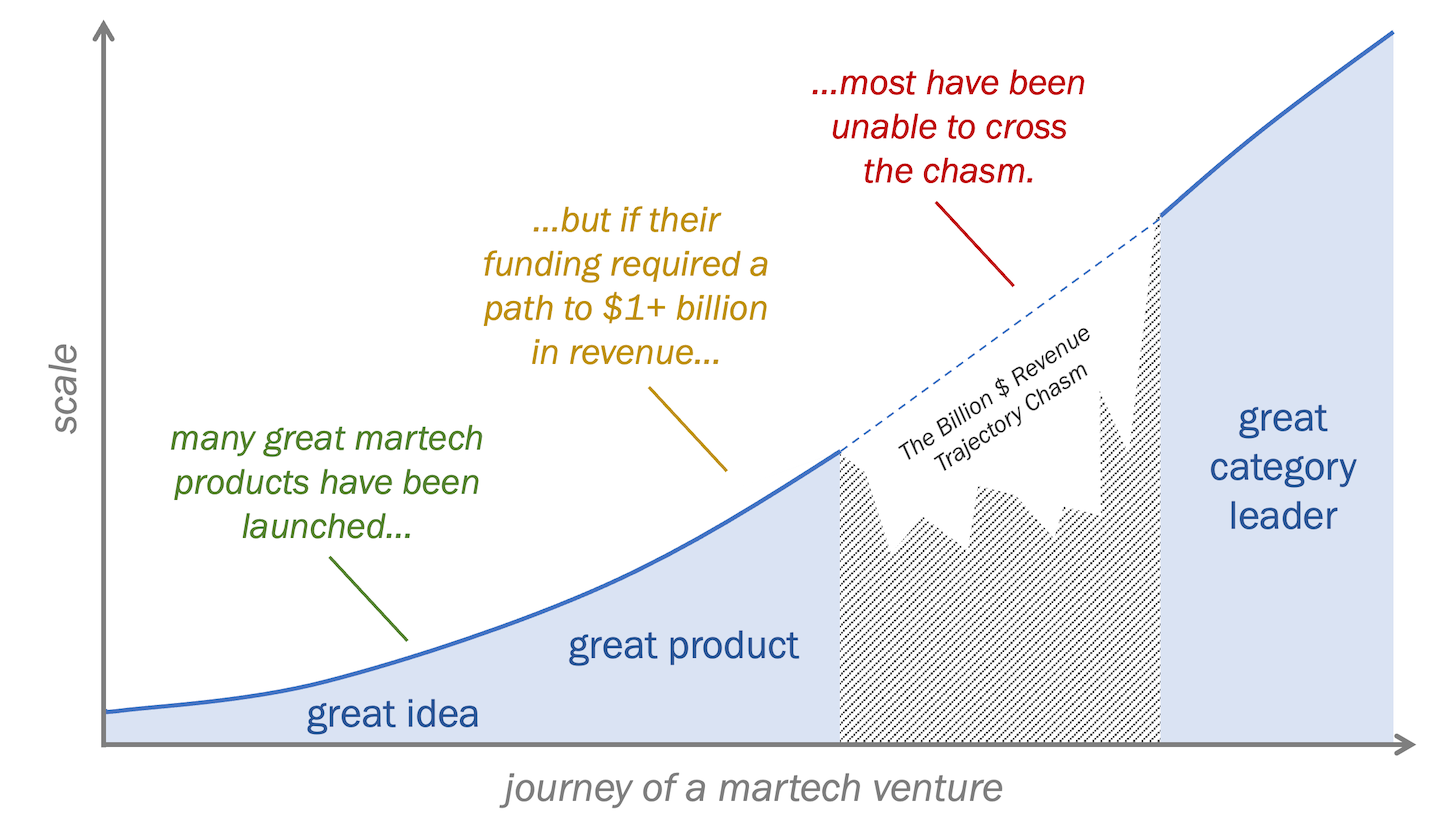

Yes, the consolidation of that first big wave of martech products is finally happening. The laws of gravity can be defied only so long. While many of the ones that disappeared were smaller, organically funded solutions in the “long tail,” the more newsworthy ones had raised significant venture capital as the darlings of their time.

A toast to them from Four Weddings and a Funeral, “May we all in our dotage be proud to say, ‘I was adored once too.'”

Yet the great circle of life martech continues…

But that hasn’t dissuaded others from diving in. With AI further lowering the barrier to entry for building software — while simultaneously widening the vista of new opportunities for innovation — martech startups continue to be born at an unrelenting rate.

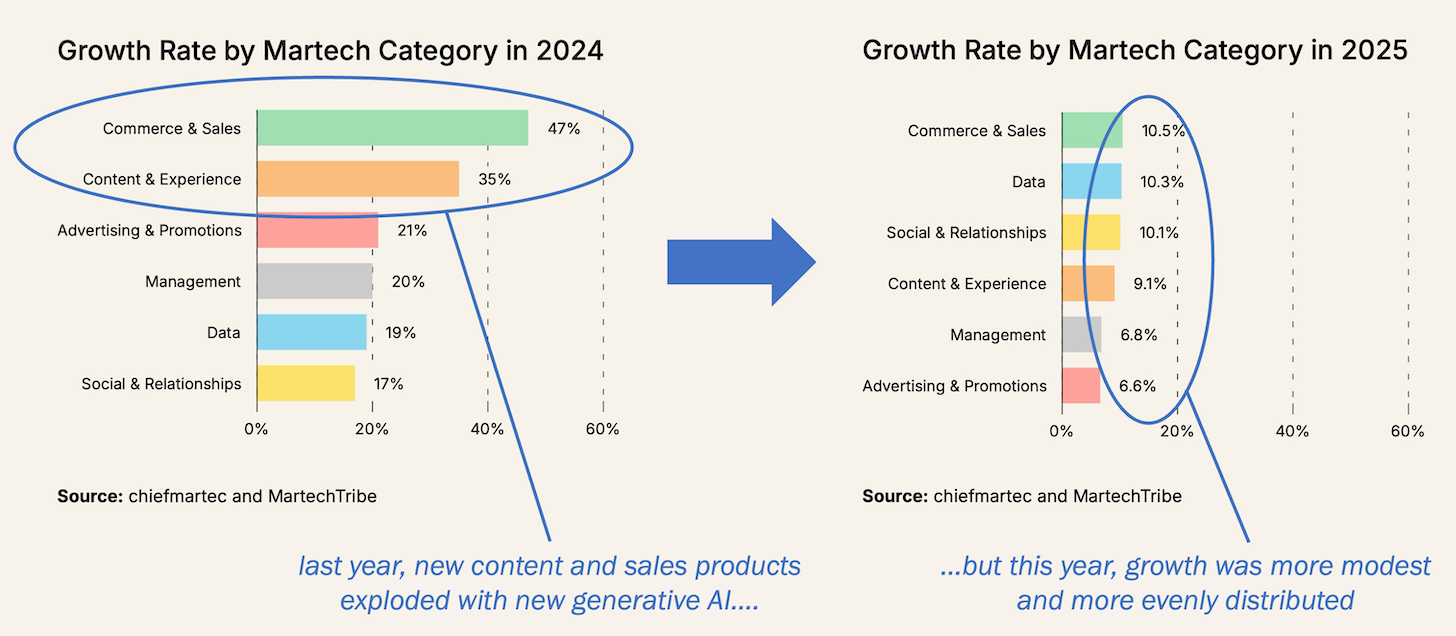

Last year, there was an incredible explosion of new startups in content and sales, at 35% and 47% growth rate respectively. These were two domains that immediately benefited from the conversational magic of generative AI.

This past year, growth has been somewhat more subdued — and more evenly distributed — with ~7-10% growth in each of our 6 major martech landscape domains.

Digging down into subcategories, it was interesting to see SEO had the highest percentage growth of all — an eyebrow-raising 24% — albeit more modest in absolute numbers, expanding from 212 to 262 products. It’s ironic, given all the “SEO is dead” talk of the past year. But in martech as in life, when one door closes, another one opens: there are new product to help you optimize your content for AI services, AI Optimization (AIO), which we’ve lumped into this subcategory.

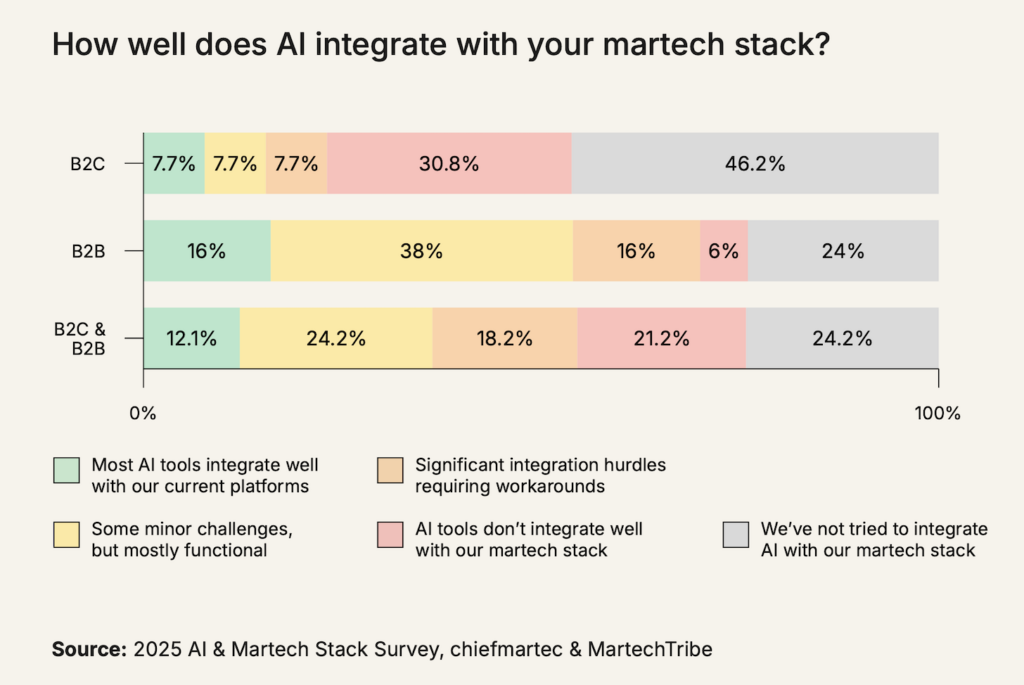

With the continued proliferation of new products, especially AI-native ones, the average tech stack grew a little last year, by 2.2%. For more mature marketing teams though, the fluidity of their toolset has been balanced by aligning and integrating these new AI products with an established platform at the center of their stack.

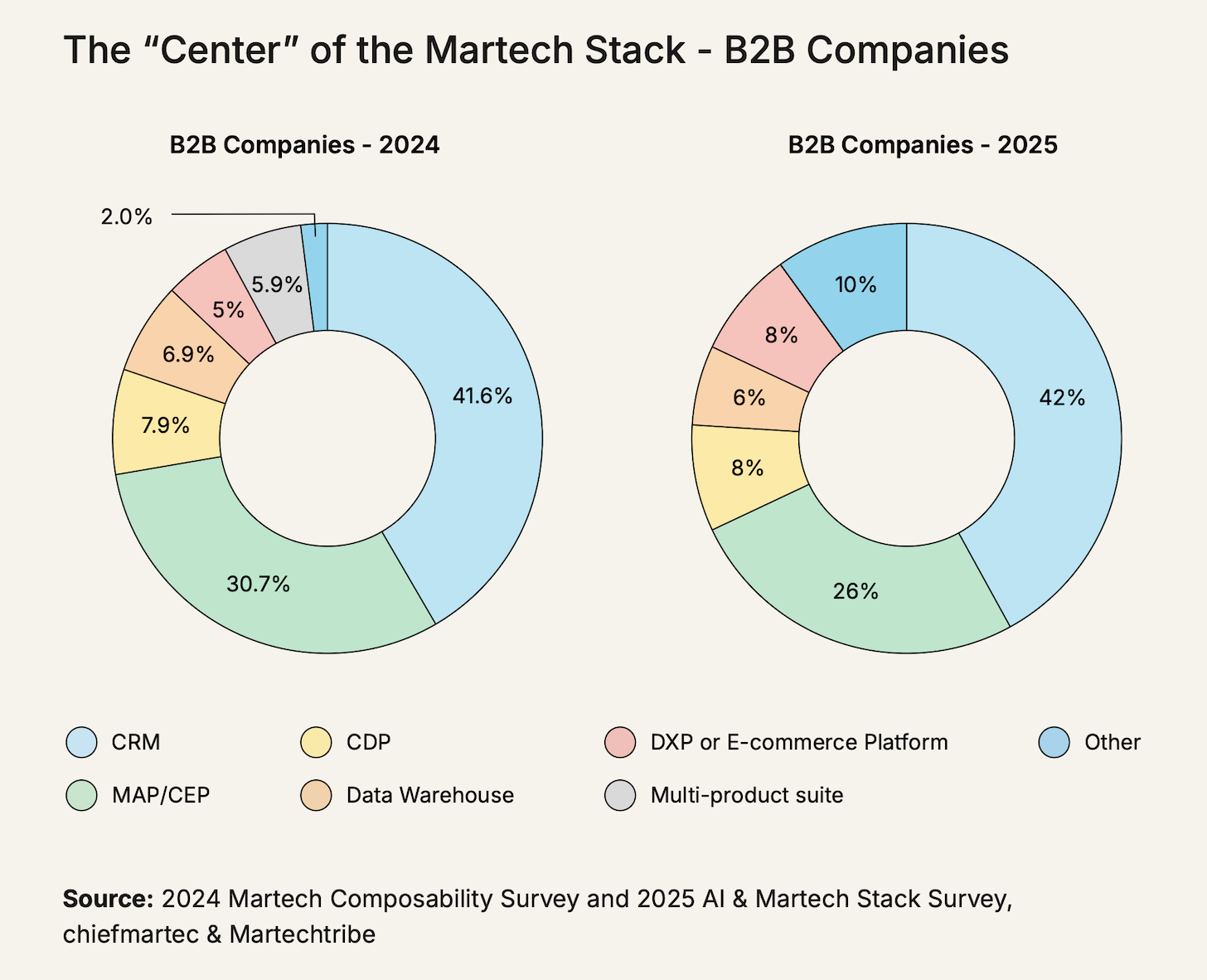

We re-asked the question of which platform martech and marketing operations leaders considered to be the center to see any shifts from 2024 to 2025. In B2B companies, there was very little change: most consider either their CRM or their marketing automation platform (MAP) to be the center.

One notable change in the B2B segment was the 5X rise of “Other” as an answer, from 2% to 10%, which includes custom-built martech platforms. While that’s still a small slice of the pie, it’s an interesting reversal of a decade-long shift from custom to commercial martech.

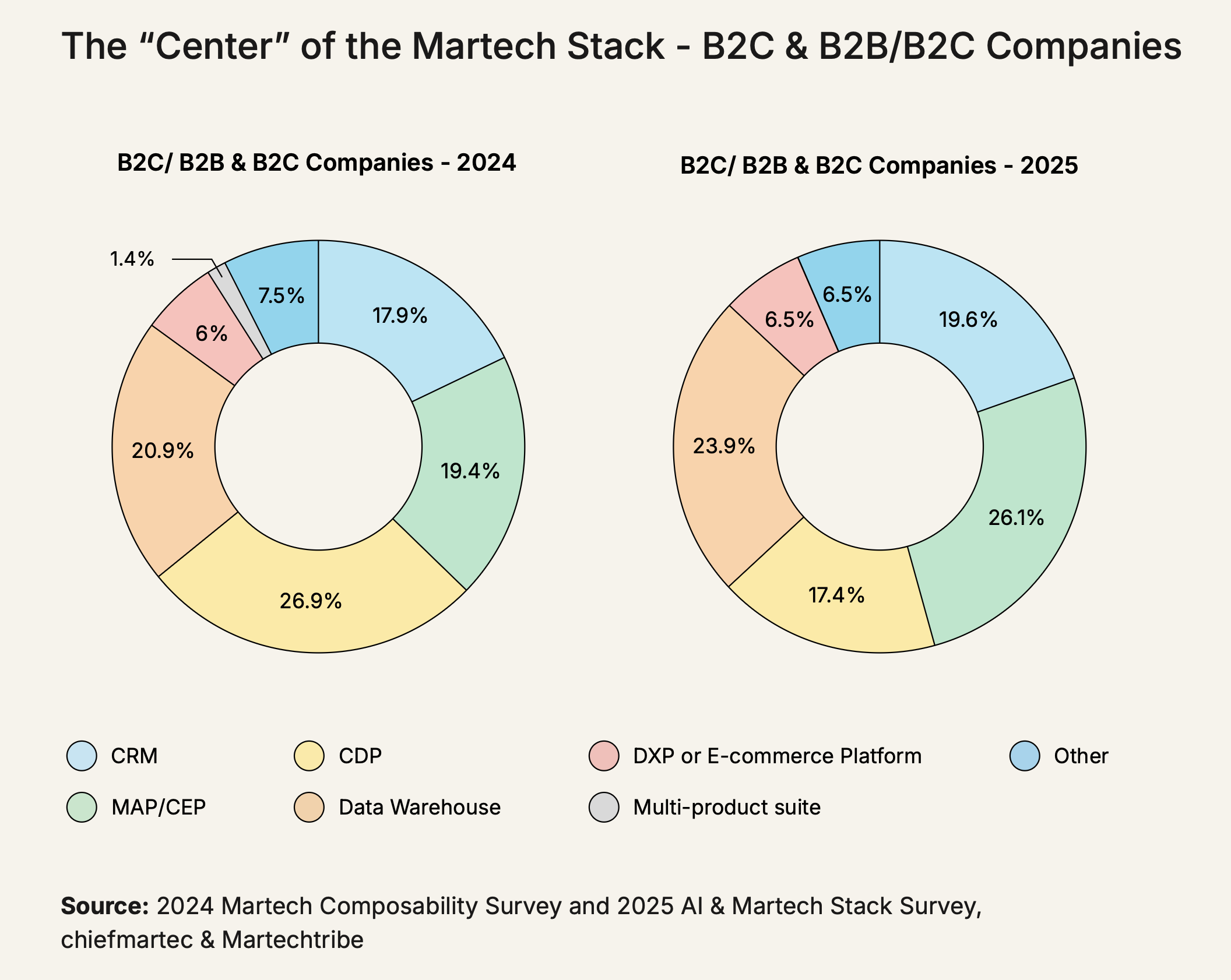

With B2C and hybrid B2B/B2C companies, the most notable change was with CDPs, which dropped from 26.9% to 17.4% of those surveyed citing them as the center of their martech stack.

CDPs appear to have been squeezed between two layers of the stack. At the data layer, we saw cloud data warehouses rise as the identified center platform, from 20.9% to 23.9%. At the engagement layer, we saw marketing automation platforms (MAP) and customer engagement platforms (CEP) grow from 19.4% to 26.1%. CRMs also grew from 17.9% to 19.6%. CDP capabilities seem to be moving to either the warehouse layer (“composable CDPs”) or the engagement layer, where they are increasingly embedded into customer-facing platforms.

1,000,000X more martech that’s out of sight

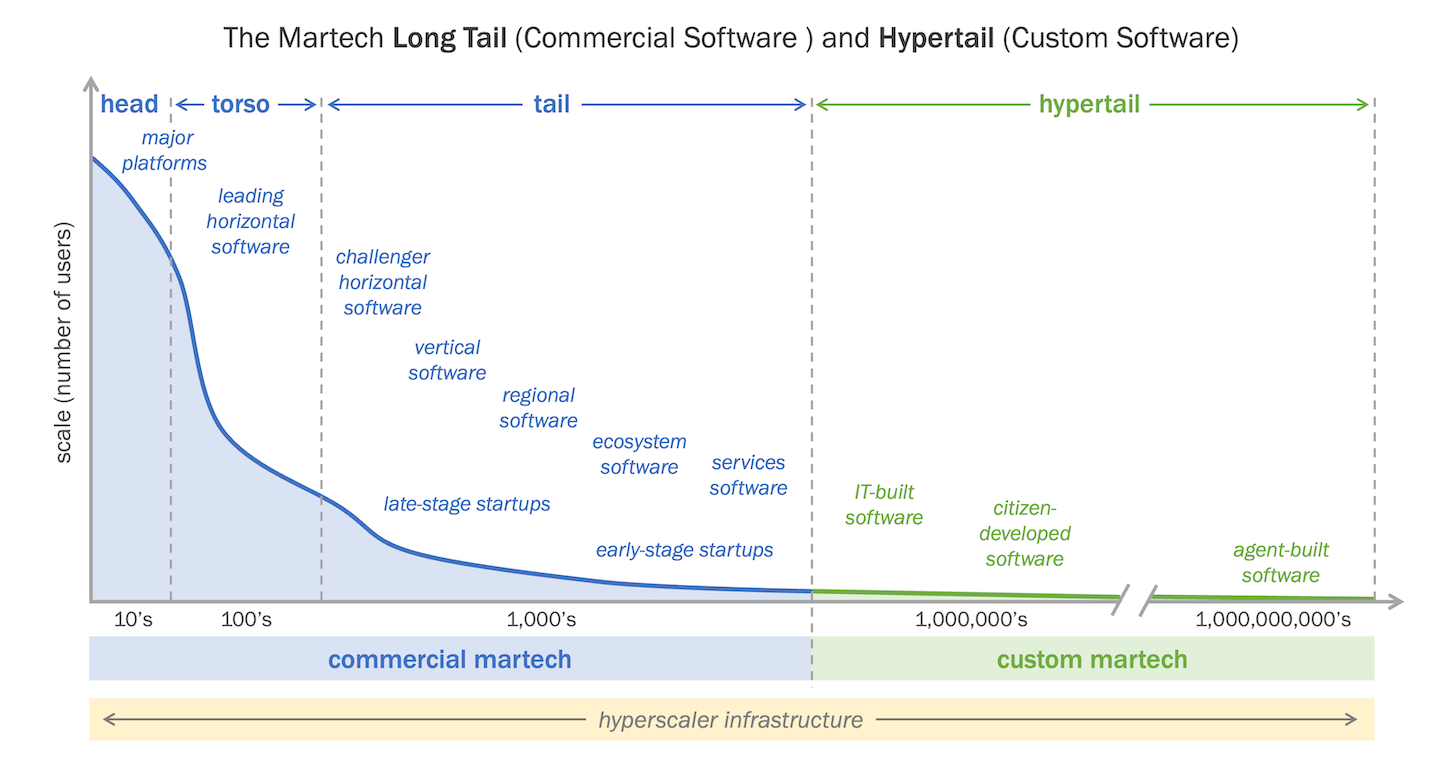

But arguably the most fascinating development in martech isn’t the long tail landscape of commercial products. It’s the rapid proliferation of custom-built apps and agents, what we call the hypertail.

There’s always been the option for businesses to build their own custom software solutions. For most companies, that represented a small amount of their tech stack — if any at all — because custom software was expensive to develop and maintain, requiring engineering skills that weren’t readily at the disposal of most marketing teams.

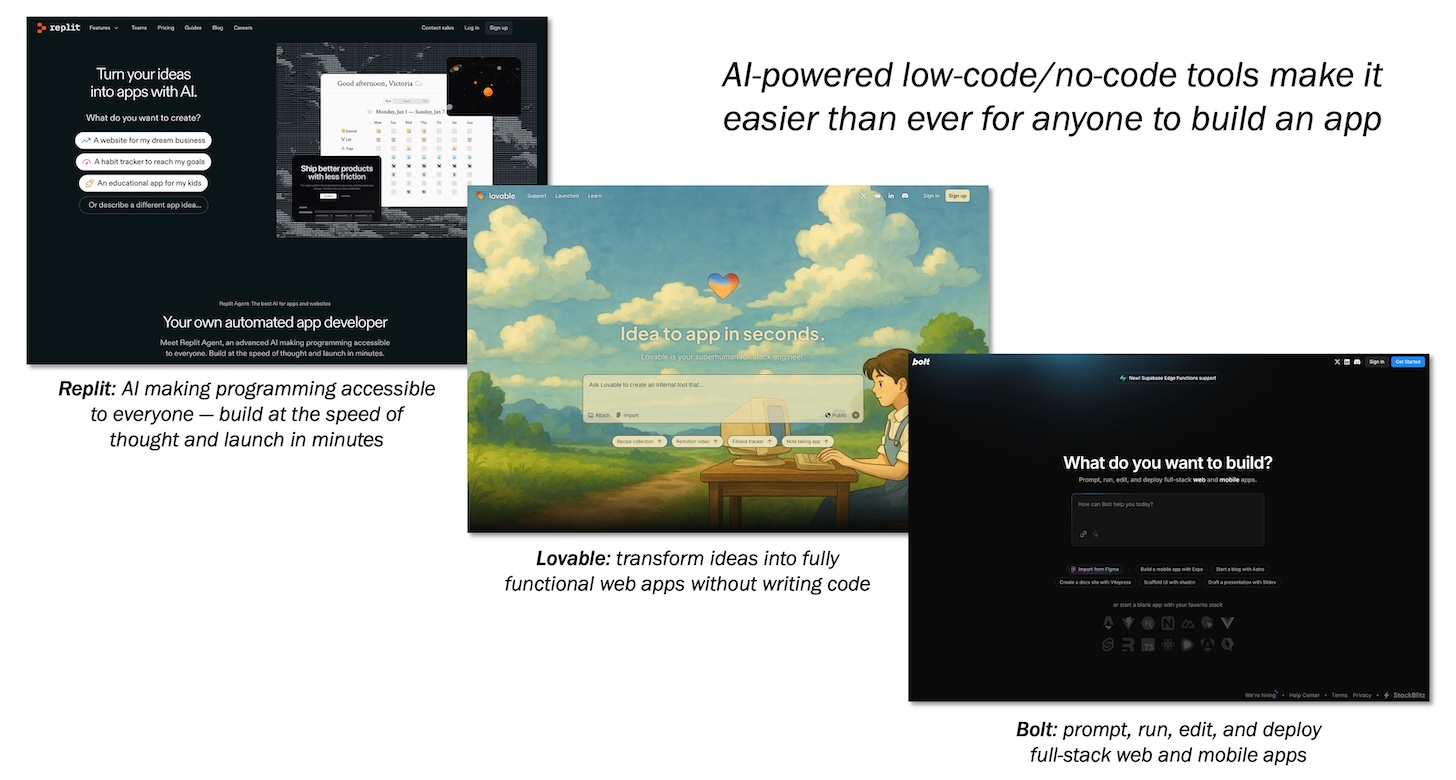

But the rise of low-code/no-code platforms over the past 5-10 years has steadily changed that equation, making it easier, faster, and cheaper to build, giving rise to “citizen developers” who could increasingly scratch their own itch by creating lightweight apps and automations.

As with nearly everything else it touches, AI is having a massive multiplier effect on this. It’s accelerating software creation at a blindingly fast rate. Professional developers now rave about “vibe coding” — whipping up new programs in a matter of hours that used to take days or weeks to construct.

For citizen developers it’s an even bigger boon. If they can describe something in a natural language prompt, the AI can build it for them. True, today that works best for simple apps and automations. But this is Clay Christensen’s classic pattern of disruptive innovation: serving the underserved with simple use cases, and then steadily climbing up the hill to more advanced ones. In our last report, we called this “instant software” — just add ideas.

And it gets wilder. Popular AI assistants such as ChatGPT, Claude, and Gemini — that have millions of non-technical subscribers — are often creating software programs behind the scenes to do the bidding of their users without those users even knowing that software was built and run on their behalf.

The result? Not millions but billions of custom software programs proliferating companies’ digital operations. Probably trillions, many blinking in and out of existence on demand.

That is the hypertail.

Download The State of Martech 2025 for free

I’ve just touched on a few of the many findings and insights from the full State of Martech 2025 report, which is available to download, free and ungated.

We want to thank GrowthLoop, Hightouch, MetaRouter, MoEngage, Progress, and SAS for sponsoring our research. We also want to thank Goldcast for providing the events platform for our #MartechDay sessions, which you can still watch on-demand for the month of May by registering at martechday.com. And we also thank G2 for sharing ratings data with us for our analysis of the martech landscape.