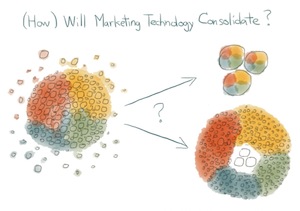

Will marketing technology consolidate into a handful of behemoth super-platforms? Or will it continue to diversify with more innovative new software?

My theory on marketing technology consolidation vs. diversification has been both.

I believe that a set of “backbone” platforms will serve as the foundation of marketing’s technology infrastructure, but they will promote open APIs and robust third-party developer communities. Marketers will have the best of both worlds: a coordinating platform for standardized data and back-end processes, strategically enhanced with select point solutions for differentiated marketing capabilities.

But that’s been just a theory up to now.

However, with a news release today — that marketing automation provider Act-On Software has expanded their partner ecosystem by opening their APIs to third-party developers — it struck me that the theory may now have empirical evidence to support it.

Act-On now joins the ranks of many other marketing automation platforms that have developed open APIs and featured “marketplaces” to promote third-party applications that plug into their backbone:

- Act-On’s Partner Exchange (APEX) is launching with over 20 apps

- Eloqua’s AppCloud has over 100 apps

- HubSpot’s App Marketplace has over 60 apps

- IBM’s Digital Marketing Network has over 110 apps from certified partners

- Infusionsoft’s Marketplace has over 75 apps

- Marketo’s LaunchPoint has over 100 apps

- Pardot’s App Center has over 30 apps

- Silverpop’s Technology Partners with over 60 partners

Update #1: a previous version of this post said Pardot didn’t have an app marketplace, but they do — I just missed it on their website. In addition to their App Center, it’s worth noting that Pardot’s mothership ExactTarget also has a robust HubExchange with over 75 apps, and their mother-mothership Salesforce.com set the bar for third-party developer SaaS ecosystems with their AppExchange with over 1,000 apps.

Update #2: a previous version of this post said that IBM didn’t have much mention of third-party app support on their website for their Enterprise Marketing Management platform. However, as Jay Henderson, their Strategy Director, pointed out in the comments below — I just missed the link. Indeed, they have a very impressive set of third-party application partners, over 110, in their Digital Marketing Network.

Admittedly, there are other marketing automation providers — Adobe and Neolane (which Adobe acquired), Responsys, and Teradata Applications (formerly Aprimo) — who don’t emphasize third-parties as much. They endorse a smaller number of partners on their websites, who are presented more as explicit partnerships rather than an open third-party developer community:

- Adobe’s Integrated Applications

- Neolane’s Complementary Technology Providers (now owned by Adobe)

- Responsys Partners and their Interact API

- Teradata Application’s Technology Partners

Further down the spectrum, for SAS’s Customer Intelligence platform (which includes a marketing automation module), I could find almost no third-party applications mentioned on their website. I am certain that they do integrate with some third-party products, but they don’t make that a prominent part of their web marketing.

At the risk of someone crying, “Objection, Your Honor, speculation!”, I can’t help but wonder if the difference across these companies is the degree to which they see an emphasis on third-party developers and open APIs as a strength or a weakness.

Can your solution be considered “complete” if you make a big deal about all the things you can plug into it? I would argue, yes. They don’t have to be mutually exclusive statements, as companies from Apple to Salesforce.com have demonstrated. It’s the difference between a suite strategy vs. a platform strategy. Do you believe marketing benefits from more of an open platform? If so, then a thriving third-party developer community is a great strength.

Framed another way, do you believe the API economy is indeed emerging and will grow to be a significant part of marketing in a digital world? (“Objection, leading the witness!”)

It will be interesting to see if Adobe, Responsys, SAS, and Teradata will evolve to a more engaged third-party developer strategy in the years ahead.

So what types of third-party applications are being offered? Here’s a small sample:

- Content marketing workflow management and optimization from Kapost

- Call tracking for leads originating on the web from Ifbyphone

- Webinar registration and delivery from Citrix GoToWebinar

- B2B data profiles and personalization from Demandbase

- Predictive sales and marketing analytics from Lattice Engines

- Rich media advertising and content modules from Kwanzoo

- Interactive content, such as contests and polls, from SnapApp

- Content curation discovery, organization, and deployment from Curata

- Advanced landing pages, microsites, and mobile web apps from ion interactive (disclaimer: my company)

And many more. Third-party applications range from customer-facing applications that deliver better or more specialized experiences to more advanced back-end data analysis and management capabilities, and everything in between.

In browsing through the more mature marketplaces — such as Eloqua’s and Marketo’s — the breadth and depth of the different applications available makes a strong case that it would be impractical for a single vendor to have all of these capabilities built into their core product. Within a particular category, such as B2B data profiles, having more than one alternative to choose from keeps those providers competitive and continually innovating new, differentiated features.

And it’s great to see many of these third-party developers represented across multiple platform marketplaces. This demonstrates that third-parties can achieve a wide reach across many different backbone providers — enough to achieve significant scale in their own speciality.

In a way, it’s standardization in the other direction. Everything that plugs into your marketing automation platform adheres to the data exchange rules of that API. But at the same time, a product like Kapost offers you consistent content marketing workflow whether you use it with Eloqua, HubSpot, or Marketo.

I also found it highly encouraging that Eloqua, which started their third-party marketplace back in 2010, claims that over 90% of their customers have tried out apps from the Eloqua AppCloud. It’s evidence that, given the opportunity to plug-and-play more specialized marketing apps into their marketing automation backbone, marketers will happily do so.

Finally, I would also argue that by embracing third-party developers, marketing automation providers are in a position to significantly broaden the applicability of their platforms. In a quick Q&A I had with Atri Chatterjee, the CMO of Act-On, about today’s announcement, he agreed that this “broadens the approach” of marketing automation.

“Marketing automation technology provides a lot of rich profile data that can be used to augment our customers’ other applications, as well as improve Act-On campaigns through real-time external data sharing. Marketing is increasingly interfacing with other functions, and those function in turn need information from the marketing platform.” (Emphasis added is mine.)

It sure seems like the third-party era of marketing automation is emerging.

Good post Scott! You´re pointing out some really important trends. I do agree with you that third-party era is coming on strong and I do believe in that strategy myself. Do you see any down-side of it? One could be that it ends up with to many choices for the customer? They are looking for a solution and ends up with a puzzle?

Hi, Stefan.

It’s a great question. I think another way of phrasing it is: what should be “in the box” in a marketing automation platform, and what can — or should — be available as plug-in extensions?

Since most marketing automation platforms seem to be converging towards a common set of core features (albeit implemented in different ways), and since the examples of third-party applications that I gave in this post have little contention with those core features (at least today), I think you can have the best of both worlds.

To compare with a different category, with what Salesforce.com did with CRM and SFA, they seemed to strike a good balance of providing a CRM/SFA solution and enabling many plug-in choices of third-party apps.

I agree you have to have a good core. But I also think that a robust/easy interface for third-parties helps make the adoption of those add-on apps more part of the solution than a puzzle. If you don’t have a good third-party interface, then any third parties that you do want to work with seem much more puzzle-like.

Your spot on it. It´s about balancing these two “worlds” in a successful way. We (Leadsius Marketing Automation) have plenty of work ahead of us figuring out what is core in our solution, what is built in as add-on (works integrated with the platform) and what is nice to offer as supplement to our solution. Right now I am looking into how we can include re-targeting ads in our offer and when talking to customers of ours and agencies it seems like the combination has a huge potential. I am reading interesting posts in Programmatic Site retargeting and my gut feeling tells my that those two “technologies” could be a mega hit. Have you any thoughts about that?

Stefan, Please drop me a note and we can chat. Kwanzoo has been innovating around integrating display & retargeting into marketing automation / CRM. We integrate with Eloqua, Marketo, Silverpop, Salesforce, Oracle Fusion CRM (and now Act-On). Be glad to explore if we could be helpful to you. – Regards, Mani

Stefan, take a look at Bizo’s offering as an example of integrating retargeting with marketing automation. Demandbase has also done some interesting things here, focusing more on the company level.

Although I’m hesitant to call it a mega hit, because for many marketers it is, by definition, a small scale element, it is a very interesting opportunity.

I believe some providers will move beyond retargeting and start to integrate this information into a DMP environment so it can touch ALL digital advertising, not just one small slice. That is, in my opinion, when it moves from a interesting tactical addition to a pervasive change in the way online advertising can be executed.

— @wittlake

Eric, Completely agree with your take on where things are headed re: display advertising + retargeting integrated with marketing automation. Here at Kwanzoo, we are enabling serving multiple rich media ad formats, that can read AND write lead information and digital body language (DBL) into multiple MAP/CRM platforms, while the rich media ads can be served through a broad range of real-time-bidding platforms / DMP environments. Our current list is here: http://www.kwanzoo.com/solutions/display-retargeting/supported-networks-exchanges/

We are then trying to add value in terms of all the analytics and insights we are able to gather with each rich media ad execution (viewable impressions, ad engagement, lead captures, partial form fills, poll / survey response data) all where possible tied back into individual prospect or profile records in the MAP / CRM. Net-net, that significantly accelerates the nurture process.

We are seeing the most success is at the top-of-funnel (for both net new prospecting and retargeting unknown site visitors). Most enterprise marketers are still figuring out how they want to extend their current nurture programs beyond their own website into display, or across email and display.

Among the MAP/CRM/ESP providers, Responsys has some capability here as well across their email sends + display ads with their Interact module.

Eloqua is only just coming out of beta with their AdFocus module, where they are packaging some of the rules to be used for display ad serving when display campaigns are coordinated with email sends. (Email retargeting.). What we like is Eloqua’s open approach, where are enabling multiple partners to plug into AdFocus. Eloqua provides the rule definition capability through their interface. Marketers still need a display ad execution engine that leverage the Eloqua rules, and allow for media buying tied into DMP environments, as you suggest, to make it all happen.

It is interesting times ahead for all of us!

Regards,

Mani

Very interesting stuff here. I’m a long time and gung-ho Marketo gal myself but I think competition drives innovation. Bring it on!

Hi Kimi, Marketo is a great system that has it all (almost…) and for those who can (money and time) to get it up and running it is for sure one of the most powerful solutions there is. But for most SMB Marketers it is just undo able and even if they did go for it, I know that many would end up using only half or less of its capability – but paying for all.

That´s no good. Therefore I see a huge potential in a solution who does it the other way around, giving away the essential stuff you need to get Marketers to chance to see what MA can do for them, and over time, as their efforts are paying off easily can add on more features to do what they have learned (by doing) more advanced and efficient.

What is your experience over time using Marketo?

Hi Scott. I wholly agree that the big vendors want to be platforms, since that’s the only way they can retain control of their clients. But if you’re already a Salesforce.com customer and they are your platform, do you also want to be an Eloqua, Marketo, Act-On, etc. and be on their platform as well? I guess it would be technically possible to have layers of platforms but it sounds pretty inefficient, especially if the functional definition of “platform” is “whoever manages the database”.

Regarding open APIs — the way that platform vendors (think Mac hardware or Windows operating system) make money is by having lots of people plug into their system, but not allowing anyone else to set up a compatible competing platform that can replace them. So it you can probably expect the platform vendors to make it hard for people like Kapost to work with several different platforms; otherwise, the platforms themselves become commodities.

If you put those two issues together, it means that there will be heavy competition among MA vendors to become the primary platform at their clients, and one dimension of that competition will be to attract third party developers who will support that platform alone. The third party developers won’t want to limit themselves, but the cost of supporting multiple platforms is high, so they’ll limit themselves to the platforms with the biggest market share. In other words, the platform strategy will result in a small number of large platform vendors and ultimately accelerate industry consolidation.

One final thought — what will determine which vendors emerge as the winning platforms? Financial resources and initial market share are certainly factors, and perhaps even the deciding factors. But it may also be that some vendors have more flexible internal architectures that allow them to more easily expand their database structures — something that has been a notable weakness of SaaS in general and B2B MA vendors in particular.

Hi, David. Thanks for the great comment! I’m a big admirer of yours — I consider you to be the leading independent authority on marketing automation platforms — so I really appreciate your perspective on this.

You raise a number of excellent points.

First, as you’ve mentioned in your own writing, there’s growing platform competition between marketing automation vendors (and their related multi-channel marketing system brethren) and the web content management systems that are evolving into customer experience platforms. More overlap on the horizon — the combination of CQ5 and Neolane under Adobe’s umbrella is intriguing — but is it conceivable that companies will have both for sometime still?

I bring that up because, like with Salesforce.com (or any other back-end CRM), it does seem that marketers are going to have multiple platforms for a while. If that’s the case, does having open APIs on all of them make it easier for them to work together (and for third-party products to work across them)? May not be the most theoretically optimal architecture, but can it be pragmatically effective?

Second, yes, although the dynamics of marketing automation platforms are not exactly like competition among operating systems, there are a lot of similarities. That could lead to moves such as trying to lock up exclusive third-party relationships. However, I think there are two reasons that we’re a ways away from that:

1) There’s a lot more functionality “in the box” in most marketing automation systems than you typically have with an operating system. This gives them tremendous opportunity to compete on those differentiated baseline features. They’re more than just middleware. (Although I would imagine that those who get better at the middleware part, to facilitate third-party plug-ins and API economy extensions, will be able to use that as a point of differentiation too.)

2) It’s still a many-horse race — no one or two marketing automation platforms have dominant market share yet. It would be hard for a third-party, at least one that seeks any real scale, to commit to just a single platform. That being said, I’m sure third-parties will be strategic in choosing which platforms they integrate with first — and how deep those integrations are — and the marketing automation providers will try to incentivize those choices to their own strategic advantage.

But I believe you’re right that, per reason #2, this will be a force towards further consolidation in the marketing automation space.

As for which vendors will end up on top of that consolidation, I’d trust your analysis more than my own armchair opinion. But I think you’re right that the internal architecture — which will go a long way towards supporting a great open middleware architecture for third-parties — will play a larger role in the years ahead.

After all, the whole marketing technology space is continuing to evolve at such a rapid pace; the challenge for marketing automation providers moving forward is how adept they’ll be at continuing to adapt and innovate their platforms for the future.

Hi Scott. I greatly admire your work as well, and not only because we so often agree ;). In this case, I agree that marketers will always have multiple systems, if only because there’s always something new (Pinterest? Video? Gamification?) that their primary vendor won’t have yet been able to incorporate. But I’m not sure they’ll have multiple platforms, at least voluntarily. Synching between CRM and MA is already pretty annoying, and synching multiple platforms within marketing would be almost unbearable. So, as a practical matter, I expect marketers to pick one primary platform and either use APIs to integrate third party products, or just use the third party products without integration when necessary. In the long run, as you know, I’ve long predicted that CRM and MA will merge (a tune that Pardot has started singing since their acquisition, to my bemusement), and that Web management will eventually become part of the same platform as well.

The problem with this vision is that it leads to a huge integrated suite that would inevitably be expensive and unwieldy. So my real prediction is that marketers will end up buying “customer data platforms” that are essentially marketer-built data warehouses with built-in recommendation engines; these in turn integrate with multiple execution systems (email, Web, CRM, social, etc.) to deliver their recommendations and manage all other aspects of execution in individual channels. That gives what I consider a more realistic separation of functions between the core customer database and treatment selection (two things which must be shared, and hence the real “platform”) and the channel-specific execution details, which are still best left to specialists. A few “customer data platforms” like this already exist; none are close to dominant. But I think they have huge potential. (I’ve written more about this on my Customer Experience Matrix blog, if anyone wants to dig deeper.)

Hi David–

Just to respond to your thought about platform vendors making it tough for third parties like Kapost to integrate: I can tell you that hasn’t been the case for us at Kapost at all. If anything I see accelerating efforts from all MAPs to open their platforms, with no corresponding restrictions being place (at least for now).

Hi Toby. Demanding exclusivity (or making integration difficult to consume vendor resources and thereby limit how many other platforms they can support) only works if you’re a dominant platform, so that wouldn’t have happened yet in the MA space, except maybe if you’re Salesforce.com. But it’s surely part of the long-term strategy; otherwise, the MA vendors are just commodities and can’t compete on the scope of their app partnerships. The real question is whether that sort of exclusivity can work, or it can be easy for third parties like Kapost to keep integrating with everyone, either directly or via integration apps like Kevy, which has posted elsewhere in this discussion. If so, everybody’s a platform and the competition shifts to something else — presumably price and service, since even a system with poor “core” features could compete if those same features were available through apps.

Pardot does have app listings (http://www.pardot.com/apps/) but with them becoming a native Salesforce platform I would expect them to integrate with the majority of Salesforce Appexchange partners (1,000+).

Wow, I can’t believe I missed that. Thanks for letting me know. I’ve updated the article above to reflect that.

Too many plugin applications can be problematic. API integration isn’t always seamless. I think that foundational ‘out-of-the-box’ features (like CMS, CRM, Email, Landing Pages, Analytics, Content Marketing) is a much more streamlined approach, with ‘extra’ functionality availabity through plugin or API integration.

Hi, Ruth.

I agree — you shouldn’t have to assemble your entire marketing automation suite from individual third-party components. The baseline features in those packages should be robust and “complete” (within some reasonable definition).

The advantage of third-party apps is for marketers should be to selectively pick and choose a few of them to support their particular strategy. They can add capabilities that are more relevant to their market and mission and that provide them with operational or experiential points of differentiation.

That’s the gist of my (much longer) post on “in defense of marketing technology point solutions”:

https://chiefmartec.com/2013/07/marketing-technology-point-solutions-can-be-pure-gold/

You don’t want a whole mess of point solutions. But a few select ones can be highly advantageous.

As marketing automation platforms make such third-party integrations easier and more seamless, that will help change the balance of what and when to plug-in such specialized capabilities.

Ruth – I understand what you are saying in the sense that integration is often time-consuming and costly. But, going back to Scott’s original question “Will marketing technology consolidate into a handful of behemoth super-platforms? Or will it continue to diversify with more innovative new software?” I believe we will see more of the latter. I think that the time, cost and labor associated with developing a robust, out-of-the-box suite is difficult an unnecessary to maintain.

With the API Economy growing and the continuous release of new, innovative products and companies – I think that it is only to the benefit of the larger platforms to enable a plug-and-play offering as the ones mentioned above. The sheer number of man-hours associated with in-house integration is staggering and steals attention away from their core business. Why not enable a third party company like Kevy (my company) to fully facilitate, manage and build integrations?

As a company centered fully around integration, Kevy, and other third party integration companies, are able to offset the time spent on one-off integrations and open up a door to more robust platforms. The needs of each company are different – just as Stefan mentioned – so enabling an open API for third party apps gives greater customization to the unique needs of the customer.

In fact, allowing this ‘smart-pipe’ of information will significantly broaden the scope of marketing automation companies. When customers are able sync their CRM, social profiling, eCommerce and other cloud apps directly into their marketing automation system, they get a better view of their data and are able to take full advantage of their existing cloud apps in order to be more effective in their core business.

Thanks for the comment, Brooke. I think solutions like Kevy can go a LONG way towards tipping the scales in favor of a rich ecosystem of third-party marketing apps. Really excited to see how you move things forward.

Scott–

What a fascinating post. Thank you so much for publishing this.

I think all of the Marketing Automation vendors have been really smart in building out their Platforms / APIs. Given the scale and customer base they’ve achieved the best way for them to innovate is to open up. The beneficiaries are their customers and their party vendors like us at Kapost.

Some sort of consolidation / coordination among the various technology tools is inevitable. There is great value in all of the “point solutions” (as you call them), but marketing teams can be bewildered by having too many tools to contend with.

By providing APIs, Marketing Automation vendors benefit customers by allowing them to enjoy the innovation of many tools by consolidating them together in a more usable package.

However I’m not certain that Marketing Automation vendors are the end game for such integration of the various apps. On a data / lead-scoring basis I would say that yes, they are. Much of the success of MAP App Stores have been 3rd party vendors inserting their data into MAP systems for inclusion in lead scoring (e.g. a webinar vendor inserting webinar attendee data in).

But MAP vendors are primarily still email systems at their core. The need is strong in marketing departments to coordinate the department planning and activities across all of the various apps and channels into a single workflow. And workflow is not at all a native component of the MAP systems.

By contrast, workflow is core to SFDC and its platform has thrived as the workflow foundation upon which many other apps run.

So this is still a gaping hole for marketing departments that MAP vendors are unlikely to fill. Exciting times to see how things will play out in our industry!

Thanks again for posting.

Disclosure: I’m the CEO of Kapost.

Thanks for the great comment, Toby. I’m glad to hear that this resonates with your view of the market and its evolution as well.

Your point that MAPs may not be the be-all-and-end-all of marketing technology infrastructure is well noted. Indeed, there are other companies and categories that are vying for that position — and more will likely appear in the years ahead. The middleware layer of marketing does seem like it has a lot of opportunity for innovation still.

It will be interesting to see how the major MAP players evolve. For instance, the way in which the Salesforce, ExactTarget, and Pardot combination will take shape (as Richard Davis also mentioned in his comment above).

As you say, however this plays out, it’s going to be exciting!

Scott,

HubSpot is actually unwinding it’s marketplace– any global thoughts on that or do you bucket that as a “one off” decision?

Hi, Julie. I hadn’t heard that.

I’d be interested in knowing more details. Are they going to shutdown or deprecate their underlying technical APIs? Or will they still support (promote?) third-parties but in a different context?

We’re not unwinding the HubSpot marketplace at all. What we are doing is raising the bar on quality and making sure that every app we recommend is amazingly good.

The short term result will be fewer recommended apps in the marketplace, but they will all deliver an amazing experience and delight our customers. For instance, the integration we have with the video hosting / player Wistia is the best on the market – far better than any video player integration with any other CRM or Marketing Automation system. You get a full heat map of a single contact’s view of your video right in the HubSpot contact timeline, just awesome.

The feedback from our customers was clear – they don’t want the whole App Store, they want editors picks of the best apps and our technical and customer support to stand behind them.

Our APIs remain open and anyone can build on them and we’re not going to limit the ability of 3rd parties to integrate with or extend HubSpot.

Straight from the source. 🙂 Thanks for chiming in, Mike.

It sounds like your emphasis on quality over quantity in recommended third-party apps will have the effect of making them easier and more seamless in the way they plug into your platform.

The challenges of third-party app integration in the past don’t have to be the constraints of the future. Godspeed!

Hi and sorry, Mike and Scott– I didn’t mean to create any confusion. The email we had received indicated that effective mid-October the app marketplace would be “shutting it’s doors,” but that current integrations and public facing APIS would absolutely still be available.

Mike, it sounds like more of a “curated” (to use the current buzzword) marketplace will emerge at HubSpot. Do you envision this be more like the second group of backbone-partner relationships that Scott highlights, e.g. Adobe, Neolane, Responsys, or something else?

Regardless, I believe there are multiple models that can “work;” as with most things, it comes down to execution. As an active member of several of the marketplaces Scott highlights, we will look forward to seeing how each of these evolve over time. Exciting stuff.

Scott – Great post. At IBM, we believe pretty strongly that a rich and easy-to-leverage partnership ecosystem is table stakes for marketing software platform vendors. We’ve developed an open IBM Digital Marketing Network (https://ibm.biz/BdDJFn) within our Enterprise Marketing Management portfolio.

IBM customers now have integrated access to more than 110 solutions from certified partners in digital marketing areas. For example:

• Ad Networks for making easier to buy targeted ad inventory from numerous sources. IBM Digital Marketing Network partners include: Google, Advertising.com

• Data Management Platforms for enabling the collection of audience intelligence towards better ad relevancy. IBM Digital Marketing Network partners include: BlueKai, x+1

• Demand Side Platforms for buying digital advertising by managing multiple ad exchanges. IBM Digital Marketing Network partners include: The Trade Desk, Turn

• Gamification, for engaging customers with game style sets of rewards. IBM Digital Marketing Network partners include: Badgeville

• Privacy Management for helping companies and consumers manage data privacy preferences. IBM Digital Marketing Network partners include: Evidon

• Search Marketing for marketing promotion via paid and organic search channels. IBM Digital Marketing Network partners include: Doubleclick Search, Marin Software

• Social Engagement/Loyalty for managing customer engagement via social media or crowd sourced means. IBM Digital Marketing Network partners include: Bazaarvoice, CrowdTwist

• Social Media Marketing for executing marketing via social media channels. IBM Digital Marketing Network partners include: Shoutlet

• Voice of Customer for insight into customer experiences, wants and needs. IBM Digital Marketing Network partners include: OpinionLab

You can find a complete list of partners, here -> https://ibm.biz/BdDJFG

Jay — I apologize, I somehow completely missed that sidebar link to your Digital Marketing Network. Indeed, it’s very impressive, and I’ve updated the post above accordingly.

I’ll be making an appointment with my eye doctor tomorrow.

Thank you for bringing this to my attention!

Hi Scott and Jay,

This is a perfect case of where things can get really confusing for customers, as we talk about integrations between marketing technology platform / suite providers and their application partners.

There are so many different marketing technology components in each platform providers suite. APIs in/out of one module or component does not translate to APIs in/out being available for all areas of interest to an enterprise marketer.

So the availability and maturity of APIs varies a lot from one platform to the next (and even from one module to the next within a single platform provider’s entire suite of marketing technology products). An interesting challenge for both 3rd party app providers and for our mutual customers.

Jay,

Here at Kwanzoo we have developed integration into several MAP & CRM platforms from our rich media ads (Eloqua, Marketo, Silverpop, Salesforce, Oracle Fusion CRM, and now Act-On). One key point of value we deliver to marketers is direct lead capture inside the ads to boost top-of-funnel leads and increase media efficiencies.

The IBM Digital Marketing Network integrations you have listed all seem to be to your analytics and related offerings. We did have several conversations with your partnering team around integrating with IBM Unica.

However, the last time we checked, a few months ago, there were no APIs available for lead capture in/out of Unica from 3rd party apps (such as Kwanzoo). Another issue was the “behind-the-firewall” or “on premise” implementation of Unica. As you know, many other MAP and CRM platform providers are cloud or SaaS-based, which in our experience makes cross app integration a whole lot easier to develop, maintain and deploy.

Perhaps you have an update for us on IBM’s plans in this area – viz: moving to a cloud-based implementation, as well as providing REST-based APIs from/to IBM Unica, IBM Marketing Center and your other lead management products?

Regards,

Mani

It’s a good point, Mani. Just counting “number of apps or partners” and visibility of links in a website is, admittedly, a highly superficial way of gauging the relative strength of a vendor’s third-party ecosystem.

A deeper analysis is definitely called for.

Great post Scott! Appreciate the mention of Curata’s content curation solution.

As good as your post is, the resulting comments and related discussion are even better. 🙂 Especially the “dialogue” between you and David Raab.

What I most agree with across all of this discussion is that marketing automation is still a very immature space. That is, even with the popularity of Eloqua, Marketo and Hubspot, there are still many good marketing automation solutions out there. The continued acquisition of these companies (e.g. Pardot/ExactTarget by SF.com and Eloqua by Oracle) may reduce the openness of these platforms to third party vendors; however, it will be some time before this happens. And as you indicate Scott, although having multiple marketing platforms is “not the theoretically most optimal architecture”, it will be a reality for some time to come. Not to mention that it’s still questionable as to whether marketing automation platforms will even be the centerpiece of a marketer’s technology roadmap in the future. (e.g. content marketing may be the third platform integrated with marketing automation and CRM)

Michael, now you’ve scared me. We have to add content marketing as another possible alternative / additional platform to CRM, marketing automation, and Web content management! Just the sort of thing I’d expect to read on Halloween. Maybe I should change my costume to be a “franken-architecture”.

Incidentally, I adamantly deny any speculation that Scott Brinker and I are actually the same person writing under different names, and thus talking to himself. It’s true that we’ve never been seen together at the same time, but that is NOT proof.

This is a welcome trend. Businesses like ours (www.Catalog-on-Demand.com) thrive on opportunities presented by integrations and after-markets. We already add value to many e-commerce platforms; it is a logical next step to offer integration with marketing automation. The more these platform providers do to cultivate relationships with 3rd party vendors, the stronger their competitive position. In our case, print is at its most powerful when the content and messaging are personalized. We look forward to finding ways to use the profile data from marketing automation to create highly targeted and compelling publications.

What you don’t mention is that the ecosystem gets even more interesting when 3rd parties work with 3rd parties to more fully leverage the MA platform. Using our solution as an example, why not use ad and content modules to generate components for inclusion in custom print catalogs, along with profile-specific product content? Or sophisticated landing pages that trigger generation of a custom print catalog that arrives on the customer’s doorstep the next day (probably 4 or 5 vendors in that one)?

It is an interesting point that David makes regarding the difficulty for 3rd party vendors to work with multiple platforms. I concur with Toby’s response. That issue is not an showstopper. If the 3rd party solution is rich in its own right, with a wealth of independent functionality, then the integration details are just plumbing. We 3rd party types are not exactly strangers to technical problems. Relatively speaking, the challenge of interconnectivity via a well-documented API is not so not bad. Yes, the 3rd party vendors have to be smart about how they integrate, but that becomes one of their competitive advantages. The clever vendors will even come up with integration ideas that don’t involve the API at all.

I’m late to the discussion, but it’s an interesting one so I’m going to dare to add one more comment.

Seems like the discussion here blurs the distinction between three things: (a) APIs & openness of marketing automation systems; (b) partner networks; (c) actual exchanges where partner applications can be considered, bought, activated, etc. online. As you move from (a) to (c) you get a more packaged, more “frictionless” (to use an old dot-com term) approach.

Parts (a) and (b) are mostly table stakes at this point for marketing technology vendors. Exchanges are the most new and seemingly exciting part of the mix. But have they really delivered on their promise? To echo an earlier comment, merely counting the number of partners in an exchange seems like a hollow way of assessing success.

I’m confident many of them have delivered real value. The more interesting question is for what type of buyer, exactly. My sense is it’s probably smaller companies and in particular B2B companies. The reason is these types of companies tend to have simpler requirements when it comes to customer data. If your customer data is simple, and somewhat predictable, it makes sense that the cookie-cutter approach of choosing a partner from an exchange would be practical and indeed valuable. “Square peg in a square hole” might be another applicable metaphor.

As soon as your data gets a bit more complicated, however, and starts to change or get added to a lot, I’d imagine it gets harder for the exchanges to work. So, B2C companies and larger B2B companies probably don’t really get a lot out of partnerships consummated through exchanges.

I say this in part based on our experience over here at RedPoint, where we are finding more and more situations where we are brought in to provide companies with a reliable marketing software system, after they’ve basically broken the connection between two partners in an exchange as their data got more complex. I will deliberately not name the exchange(s) in question.

All that said, I’d welcome the chance to hear success stories of real value delivered through an exchange when the company involved has customer data with real-world complexity.