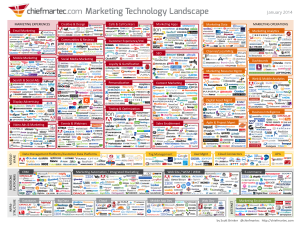

Overcrowded.

That was probably the most common remark to my latest marketing technology landscape. Well, aside from more colorful exclamations that decorum prevents me from repeating.

And the truth is that this graphic, even with nearly 1,000 companies represented, was far from complete.

There are hundreds of great companies that weren’t included: AppNexus, AdColony, Addroid, Adestra, Aginity, Ambassador, Amobee, Amplifinity, Avoka, and AWeber are just the ones beginning with the letter “A” that people noted in the comments so far! Mea culpa. I even missed entire categories that begin with “A” such as Affiliate Marketing and Agency Operations.

The marketing technology space is gargantuan. (So rarely have an opportunity to use that word.) There are so many vendors that it’s impossible to wrap your head around all of them. And new ones continue to launch at a prodigious rate.

Hence people feel, quite viscerally, that the space is overcrowded.

The logical conclusion — other things being equal — is that consolidation is inevitable. A few companies will grow to dominate the landscape. The rest will be acquired or killed. Across the history of business software, that narrative of consolidation has played out again and again. So it’s natural to linearly extrapolate the pattern and predict that the same will happen with marketing technology too.

But what if other things weren’t equal?

This is a bit of a long post to make the case for why they’re not, but here’s the outline:

- Marketing technology is the first major business market of the cloud computing era.

- Large marketing technology vendors must still wrestle with diseconomies of scale.

- There will still be some large marketing technology vendors — especially platforms and middleware that simplify integration — but they will also accelerate diversity.

- Marketing buyers may actually benefit more from a larger vendor space.

- Agencies/marketing service providers will blur the line between software and services.

- Context: the 50-year trajectory of exponential hardware and software growth.

While my conclusion — that marketing technology may have a large and diverse field of vendors for the foreseeable future — may contradict conventional wisdom, I think you’ll find that the individual steps along that journey aren’t particularly controversial. At the end, when you connect the dots, what do you conclude?

The first native business market of the cloud computing era

Let’s start with the supply-side. How can so many of these marketing technology ventures afford to build these products, launch them, find customers, and stay in business — even if they’re relatively small? I believe the answer is simple yet profound: marketing technology is the first major business market to be born in the age of cloud computing.

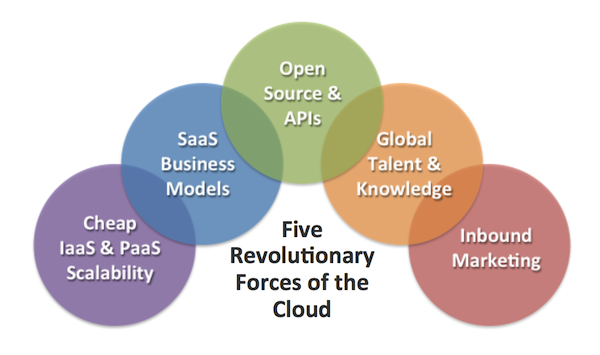

Consider the perfect storm of these five forces:

1. Infrastructure-as-a-Service (IaaS) and Platform-as-a-Service (PaaS). Thanks to Amazon Web Services (AWS) and competing offerings from IBM, Microsoft, Rackspace, etc., any entrepreneur in their garage now has state-of-the-art computing infrastructure at their fingertips. It’s cheap — and getting cheaper. It requires no capital commitments. You pay for only what you use, which means you only pay when you have actual customers. You can instantly scale up to support explosions in customer demand. You can replicate across regions around the globe. You can provide redundancy and continuity options that rival almost any private data center.

What would previously have taken millions of dollars, armies of operations experts, and months or years of intensive labor can now be orchestrated by someone on a laptop in a coffee shop before they finish their latte.

2. Software-as-a-Service (SaaS) is easier to buy and sell. There’s no quagmire of physical installations or long lead times to get started. New updates and bug fixes can be instantly deployed. Vendors have direct, real-time visibility into customer usage, which significantly facilitates technical support. Developers gain much deeper insight into how customers are really using their products, which helps them improve them. Scaling up or down is often as easy as turning a dial — without complicated capital budgeting issues — making free trials and low-risk pilot projects feasible.

That’s not to say that SaaS doesn’t have its own challenges. But compared to the overhead of on-premise installations, it’s relatively easier to adopt and operate for a wide range of marketing applications. These simplifications generally make life better for customers — but they also reduce the overhead for vendors, especially if they’re able to provide good self-service options. This disproportionately benefits smaller vendors.

3. Open source software, the API economy, and SaaS for developers. What IaaS did for the economics of hardware infrastructure, this trio had done for software infrastructure. World-class databases (PosgreSQL, MongoDB, MySQL, Cassandra), distributed computing platforms (Hadoop), back-end web application frameworks (Rails, Django), front-end web frameworks (jQuery, Bootstrap, Backbone.js), and more are all available for free. Any developer can use these technologies to inexpensively stand on the shoulders of giants.

On top of that, consider all the APIs that are available free or cheap to developers: Twitter. Facebook. LinkedIn. Google Maps. Google Prediction. MailChimp. Stripe. Recurly. 80legs. Mixpanel. Hundreds more. Affordable SaaS products for running your business such as ZenDesk, GitHub, Google Docs, Trello, Xero, Zenefits, Atlassian, etc. Even small vendors can have amazing capabilities for very little cost.

4. Globally accessible and fluid talent pool. Freelance markets such as oDesk and Elance. Crowdsourcing services such as TopCoder, Innocentive, 99designs, and crowdSPRING. Free communities of knowledge from Stack Overflow to Quora — to anything you can find with a Google search. Regardless of where a new marketing technology vendor is located, they can tap into first-rate skills and knowledge from around the world, pretty much on-demand.

Even when hiring full-time employees, small companies can compete better than ever. SaaS tools, video conferencing, screen sharing, and ubiquitous connectivity enables people to effectively work remotely. Distributed and virtual companies are increasingly feasible. And since big company job security isn’t what it used to be, more people are now willing to work for small companies, where they can make a larger impact and have greater freedom.

5. Globally accessible customer pool in a merit-based, inbound world. As marketers, we already know this. You don’t need huge ad budgets or large sales teams. You need a great product, promoted with great content marketing and engaging digital touchpoints. You need a voice in social media that resonates and connects. Yes, you should advertise and, yes, you should have people doing sales. But you can target those efforts towards the right prospects with incredible precision now — reaching the right people at a fraction of the scale previously required. You’re virtually unconstrained by geography. You almost certainly have no distributors or dealers acting as gatekeepers. Imagination, talent, passion, daring, perseverance — these are the most valuable assets in modern marketing, and they’re not a function of size.

Each of these forces is revolutionary unto itself. But together, they’re extraordinary. Let’s not take this for granted. Step back and appreciate just how dramatically “the cloud” has changed the dynamics of the software industry. This is a very, very different world than the software markets of the last century.

The biggest difference: the scale required to be a “successful” software company has shrunk by two or three orders of magnitude. You don’t have to become a billion dollar company to win. For many kinds of products, you can be a $10 million company that is profitable and sustainable, with loyal, happy customers and a passionate team that loves their work.

Companies like 37signals — now known simply as Basecamp — are the prototype for this new kind of software venture. While their revenue is surely much greater than $10 million, they’re just 43 people at the time of this writing. Instead of a hindrance, that’s part of their secret sauce. Except, it’s not so secret: they’ve shared it in their immensely popular books: Getting Real (free!), Rework, and Remote.

Large vendors must still wrestle with diseconomies of scale

Now, let’s consider the other end of the vendor spectrum.

Large companies have both economies and diseconomies of scale. As long as the former outweigh the latter, size is an advantage. But the cloud has diminished some economies of scale in software ventures, while the diseconomies remain — and, arguably, have been accentuated by the accelerating pace of change and the explosion of direct feedback loops among customers in a cloud-connected world.

What diseconomies? Slower reaction to change. More management layers, as overhead and a drag on responsiveness. More complications in coordination. Front-line employees with less power to affect individual customer outcomes. New business ideas must cross a higher NPV threshold. More entrenched interests with the innovator’s dilemma. Legal departments that dampen or slow initiatives. These are clichés, but they’re clichés for a reason.

There are also two specific diseconomies that challenge large marketing technology vendors — particularly those pursuing “integrated consolidation” strategies:

Engineering Complexity: As a code base gets larger and more intertwined, it becomes more difficult to update and extend, especially with backwards-compatibility constraints. It’s hard to manage all the interaction effects, keep up with the rapid changes in the broader digital marketing ecosystem, and still deliver something usable by regular people. Hello, entropy.

Marketing Complexity: While the “we do everything” pitch should simplify marketing, it only does so to a point. When people are evaluating specific capabilities, questioning how you stack up to alternatives and substitutes, and — most importantly — learning how to use those capabilities to produce brilliant marketing, a massive footprint can be unwieldy. It can be harder for people to find what they want on your website. Your content marketing and social media marketing “voice” can get diluted. Your sales and support people can have a difficult time representing the many facets of your portfolio.

This doesn’t mean that big marketing technology companies are infeasible. But I do believe they’re harder to manage successfully than other large software businesses were in the past. It’s a different environment. Those who pull it off deserve tremendous admiration.

Of course, there are still advantages of size.

One is staying power. Although, with high churn among the Fortune 500 and the fact that individual products in their portfolios can still fall behind or be discontinued, size is not a long-term guarantee. Product sustainability depends on other variables too.

A more questionable advantage is unification. The proposition that if you buy everything from one vendor, and it’s all interconnected out of the box (more or less), is a benefit. But it can also lead to vendor lock-in. The more tightly coupled everything is, the harder it can be to substitute or extend individual components. Switching costs can become daunting. This may be a Faustian bargain worth making, but we should acknowledge that there are non-trivial trade-offs involved.

However, the best advantage is being able to leverage size for true network effects.

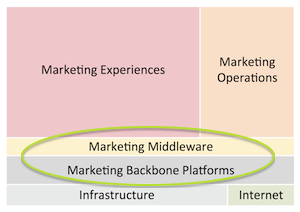

Platforms and middleware: the sweet spot for large vendors

I believe there are four classes of products on the marketing technology landscape that will benefit most from size and will undergo significant consolidation in the years ahead:

- Marketing backbone platforms

- Marketing middleware

- Infrastructure

- Internet (the digital environment)

The one that’s different from the others is infrastructure, which still benefits from physical economies of scale. Prices continue to be driven down here: the biggest provider becomes the lowest-cost provider, a reinforcing feedback loop. See Amazon Web Services.

The dynamics of the broader Internet — services like Google, Facebook, LinkedIn, etc. — are really beyond the scope of this article. But it’s worth noting that some of the most successful companies there have harnessed network effects. Why are you on LinkedIn? Well, because everyone else is on LinkedIn too.

Network effects are also the key to creating giant platform and middleware companies in the marketing space. But they must be genuine platforms in the sense that they’re open environments that promote third-party developers to build on their foundations.

This offers them two huge advantages:

First, it’s a judo move on the challenge of accelerating change. Platform providers don’t have to keep up with every new feature, tactic, and technology out in the broader marketing world — which is evolving at a blinding pace. They can let their ecosystems of third-party developers address the far majority of these innovations, competing with each other in a true evolutionary fashion. They are inherently adaptive systems.

Second, the dynamics of being a “dominant exchange” are a reinforcing feedback loop. The more third-party applications you support, the more attractive you are to customers, which in turn attracts more third-party developers, and so on. Once that engine is in motion, it’s immensely powerful — and becomes highly defensible against new platform contenders. Think of the lock Windows had on the desktop for two decades. Or the lock iOS and Android have in the mobile space today.

Platforms almost have to become big companies, because once critical mass is established in third-party ecosystems, there can only be so many platforms that harness this dynamic. Unless there is an open industry standard for integration — which we don’t have here, yet — third-parties can only afford to maintain so many platform-specific integrations. It may not be a pure winner-take-all market, but there will be a limited number of winners.

The companies who are best poised to be these dominant platforms generally have one of two pillars as their foundation (and most are working to have both):

- Customer data — a central repository of unified customer profiles

- Content data — a central repository of “content” (broadly defined)

What makes them platforms, however, is that they allow other marketing applications to tap into their data repositories — both contributing to and reading from them — through open APIs. They enable a whole range of customer-facing marketing experiences and back-office marketing analytics to easily plug into their backbone.

But here’s the punchline: platform consolidation will actually accelerate marketing software diversification. There will be more net new companies (albeit fewer platforms).

Today, the marketing technology industry is primarily held back by the technical challenges of integrating different components and dealing with disparate data silos — most painfully, fragmented customer data silos. But once there are a manageable number of platforms, providing data centralization, with well-defined interfaces for third-party applications, the biggest barriers to deploying new marketing applications will be torn down.

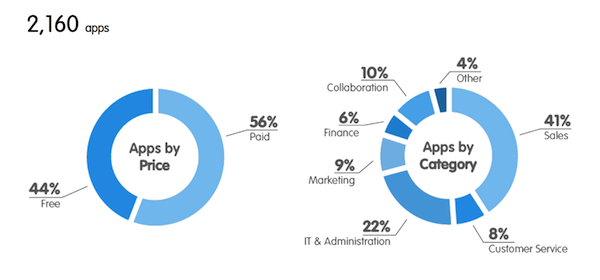

A small number of platforms — each competing to provide a better, richer environment for third-party applications — will catalyze an explosion of new marketing software on top of them. The AppExchange (2,160 apps) for Salesforce.com and the Plugin Directory (29,282 plugins) for WordPress are forerunners of this future.

Marketing buyers can benefit from a large vendor landscape

We’ve discussed the supply-side rationale for a large marketing technology landscape, but what about the demand-side?

Let’s start with what really matters to marketers. Simply put: they want to reach the largest number of customers, deliver amazing experiences to them, differentiate their brand, and do that as cost-effectively as possible. Marketing technology has become important to them — but only because it’s a means to that end.

The biggest downside marketers claim of a large vendor landscape is “confusion.” How do you sort out all of these different technologies and pick the right ones for your company? But what if there isn’t just one perfectly right set, but rather many, many different products that would satisfice? As long as the marketer chooses a set that enables them to achieve their objectives, does it matter if many other technologies were never even considered?

I’ll dare to claim that it doesn’t.

At least it doesn’t matter functionally. Psychological pressure rises with the paradox of choice — but we face that in many contexts beyond marketing technology these days.

Sure, there are concerns in picking vendors that go beyond their functional capabilities today. Will a vendor continue to exist and evolve over the years ahead? If they don’t, or if a marketer’s needs diverge with the vendor’s capabilities, what will the switching costs be? However, while that uncertainty may be reduced in a smaller landscape, it can never be eliminated — even in a highly consolidated oligopoly (“too big to fail” organizations aren’t). There are better ways to mitigate those risks, which we’ll discuss momentarily.

But the upside for marketers of this large vendor landscape is tremendous. Competition among all these companies drives new innovation, better pricing, and more specialized solutions that are better tailored to a marketer’s needs. Making choices may be hard, but having choices is a powerful advantage.

After “confusion,” the next two biggest concerns that marketers express about dealing with many different marketing technology vendors are:

- Integration challenges — how do we make this work with everything else we have?

- Vendor risk — what happens if this vendor goes away or we diverge in the future?

Both of these concerns can be significantly reduced if you choose open platforms for key systems that are actively growing their third-party ecosystems.

Integration challenges are dramatically reduced if platform vendors and third-party applications have already established out-of-the-box interfaces for connecting to each other. As for vendor risk, if you evaluate your backbone platforms on their core capabilities and the strength of their third-party programs, you reduce risk in three ways:

First, you don’t have to make sure that your platforms do everything in the ever-evolving marketing landscape and will keep pace with all the changes in the broader marketing world — through their third-party ecosystem, you’ll always have lots of options.

Second, due to the positive reinforcement of a “dominant exchange,” a platform provider with a healthy third-party ecosystem is probably more likely to be sustainable for the long run.

Third, the third-party applications that you adopt may still have some volatility, but your risk there is now limited. Your important data is stored in your underlying platform(s). If a third-party vendor doesn’t work out, you can swap them out with something else. (This also makes it easier to bet on new, experimental vendors as part of an innovation program.)

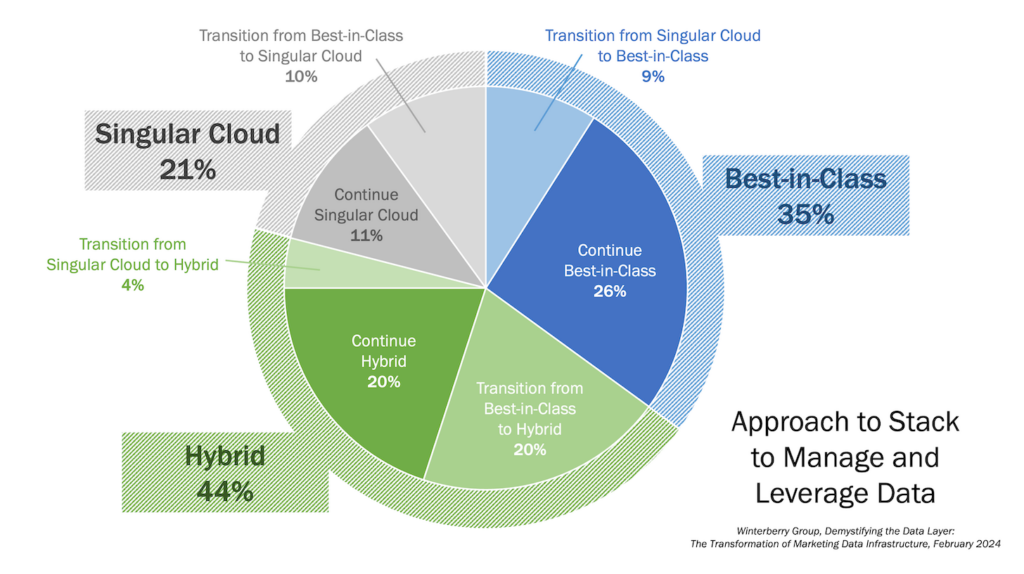

In finance, such a strategy would be called maximizing optionality. In engineering, it would be called a loosely-coupled architecture. It’s an approach to designing your organization’s marketing technology stack that is highly robust to change — and lets you achieve best of breed capabilities that are tailored to your business.

While open platform ecosystems in marketing are still relatively young today, they’re gaining momentum. (The advantage of a reinforcing feedback loop.) Growing marketing middleware products, such as customer data platforms, tag management, and rapidly expanding “cloud connector” solutions are further accelerating the viability of these kinds of architectures.

The impact of this: for a marketing technology buyer, an open platform “structure” makes a large and diverse vendor landscape a benefit more than a drawback.

Agencies and MSPs will blur the line between software and services

While the future of agencies and marketing service providers is definitely beyond the scope of this article, there is one aspect of their evolution that is highly relevant to this discussion: agencies and marketing service providers will increasingly build software for their clients.

This already happens today. Agencies build sophisticated web sites that include custom software extensions programmed in Javascript, PHP, Ruby on Rails. They build mobile apps and Facebook apps. They have developers and “creative technologists” on staff. Many have written their own software applications for specialized campaign management, workflow coordination, marketing analytics, social games and contests, and more that are used across multiple clients.

For a growing number of service providers, software capabilities are now an integral part of their value proposition.

Given that the world becomes more digital by the day, that marketing is increasingly about delivering impactful customer experiences across digital touchpoints, and that everything digital is powered by software, software is only going to become more central to these businesses.

Agencies that aren’t fluent with software are going to be a dying breed.

At the same time, many “pure” marketing software vendors are increasingly expanding their service offerings — helping their customers leverage their technologies to execute amazing marketing. This blurs the line between software companies and service providers.

There are three important points to take from this:

First, the number of companies who offer software to marketers will grow dramatically. Many of them will do so under the banner of being a service provider, but when you look at what’s actually happening at the technical level, they’re providing software.

Second, while integration challenges are hurdles to this today, the consolidation of open platforms and middleware will make this easier. Agencies and marketing service providers will become, by far, the largest cluster of third-party developers in these ecosystems.

Three, the blending of software into creative will demonstrate why marketing software will never consolidate down to a handful of big companies. The most exciting kinds of marketing software ahead will be invented to deliver unique and spectacular customer experiences. That will always be an evergreen opportunity.

Note that today, you don’t hear marketers rant “there are too many agencies in the world!” — at least nowhere near to the degree that the large marketing technology landscape disturbs them. The blending of these two worlds will, I believe, help marketers become more comfortable, relatively quickly, with the explosion of software choices.

We must simply recognize that our image of “a software company” from 10 years ago is a relatively narrow definition that doesn’t reflect the future.

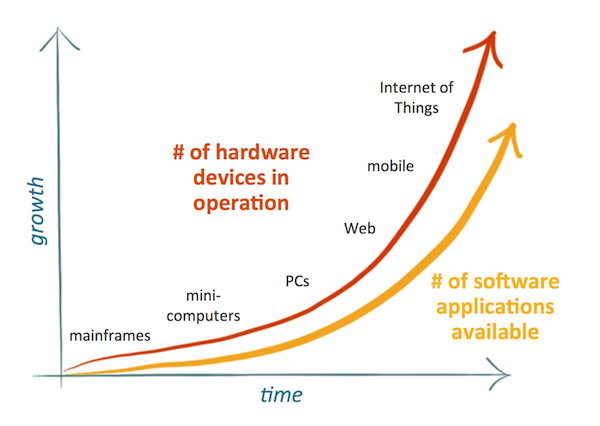

The 50-year growth trajectory of hardware and software

To conclude, let’s step back and look at the broader context. As the number of hardware devices operating in the world has grown exponentially over the past 50 years, the number of software applications available has grown at a similar pace too:

In the days of mainframes and minicomputers, there were only a handful of software vendors (usually the same ones selling the hardware). With the PC revolution, there was an explosion of stand-alone software companies — including, with Microsoft, the first great example of a “dominant exchange” with a core platform that gave birth to a massive third-party developer ecosystem.

The Web brought another exponential jump in the amount of “software” applications out — if we acknowledge that every web service out there is actually software. Mobile devices triggered another wave of software expansion: both the Apple and Google app stores now offer millions of apps. And it’s easy to see that the Internet of Things will inspire yet another surge of software growth too.

This is what Marc Andreessen meant when he said that software is eating the world.

Software is going to continue to power more and more things in our lives. And not only will marketing use software as tools in its own work — marketing will increasingly be “baked in” to other software applications. We already see this with freemium web and mobile products today. The growth hacker movement was launched this way.

Like it or not, marketing is going to have to deal with a lot more software ahead. (This is why the career prospects for chief marketing technologist roles are very bright.)

Hey, I understand the resistance to this. It’s a huge change, and change is hard.

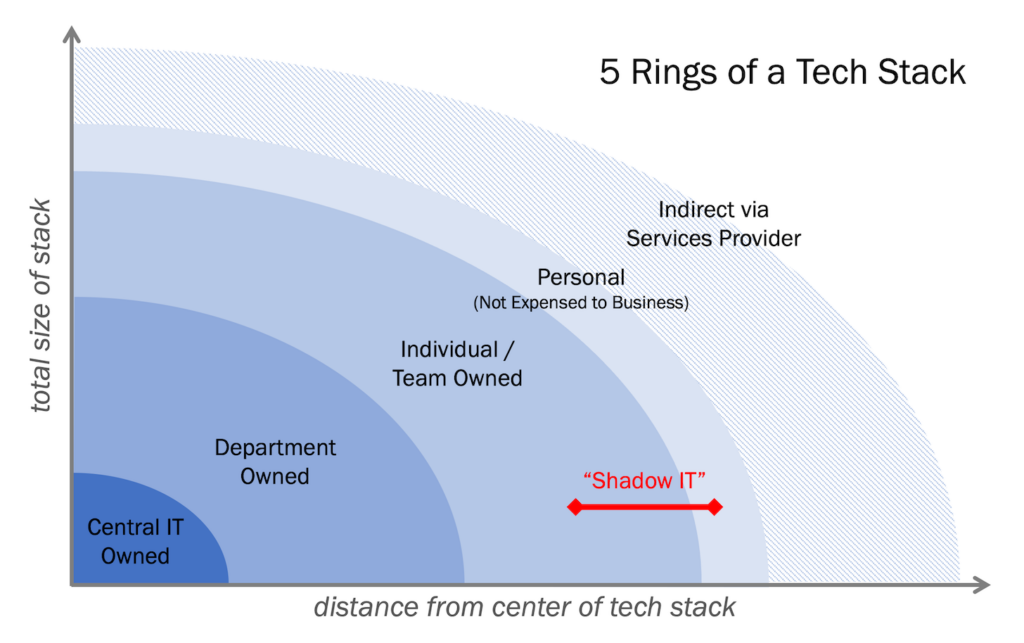

I also appreciate the motivation of IT departments to limit the number of hardware and software variables in their environment. But the track record of IT successfully resisting the natural expansion of technology — you don’t need a PC, you don’t need Web access, you don’t need cloud apps, you don’t need your own smartphone, you don’t need a tablet, etc. — is sobering. Every single one of those ramparts has been breached.

That’s why I believe that “other things aren’t equal” — and that the number of marketing technology vendors in the world will never again drop below 1,000 in my lifetime.

Yes, there will be structural changes to the landscape. There will be major consolidations at the platform and middleware layer. The definition of what is “software” will be blurred. And many individual companies will come and go. But the genie of marketing software is out of the bottle, and it’s not going back in.

Agree? Disagree? Share your comments and let’s discuss.

Love the post – thanks for the thoughtful followup to the info-graphic.

But why is this happening in Marketing specifically? The technology landscape is the same in other business functions (sales, support, etc).

I agree that software is eating the world, but why is starting with marketing? Is it because marketing people are more likely to be early adopters? If so, why?

This is a fantastic post, it articulates what has been happening around us, that we were aware of, had used, but had not considerred in such an organised way.

Thanks.

Thank you. I wasn’t sure if 4,000 words was tremendous overkill or failed to do enough justice to these tremendous forces that are colliding — glad you found it helpful!

Thanks, Grant. “Why marketing?” is a great question, probably deserving of its own 4,000 word post.

But I think the short version is a combination of (a) the Internet thoroughly disrupted traditional marketing, opening up a lot of white space for new ventures; (b) the digital world created an explosion of channels and touchpoints for marketers, each with their own characteristics, opening many opportunities for different kinds of software; and (c) marketers are driven more by differentiation than standardization, motivating more interest in new innovations.

Of course, I also mostly pay attention to marketing, so this post was written through my biased lens on the world. I’d love to hear from people with more domain expertise than me in other functions and professions.

Grant,

This article does an excellent job explaining the proliferation of marketing technologies from an IT perspective—particularly the benefits of SaaS platforms for both creators/entrepreneurs and buyers of software. But you ask a very important question; Why Marketing?– which Scott answers briefly…and I would like to expand on just a bit.

Advertising, and more generally Marketing, has been in the throes of transformation for decades, or what the Economist Joseph Schumpeter called ‘creative destruction’. To understand it, think of marketing way back…before Social Media, before Google, even before email and the Internet. Content was created by a few large ad agencies (think Don Draper) and pushed to consumers. Of course we still have ad agencies doing big TV campaigns but that’s far from the full story today. Google (and others, of course) have transformed marketing from what was largely a top down, indiscriminate, push of content from a few companies…to a much more efficient, bottom up, pull from 100s of millions of consumers via Internet search. That’s how Google has gone from Start-up in 1998 to a $400 billion (last I checked) company 16 years later. But it’s more than just Google and the search engine.

Today, that vast bulk of content is created, bottom-up, through websites, blogs, and social platforms. Today (again, last I checked) there were over 640 million websites, 40 million WordPress blogs (just 1 of many blogging platforms), 150 billion emails sent per day, 500 million daily Tweets, and 4.5 BILLION Facebook Likes—the ‘Like’ is the ultimate in abbreviated content.

Add to the proliferation of content, the exponential growth in digital interactions, and now marketing has become more data intensive than Wall Street—hence the acquisition of marketing tech firms by tech giants like IBM, Oracle, Microsoft and Adobe.

The transformation of marketing is represented both by meteoric rise in content and the ability of marketers to interact with that content. The primary challenge of marketing today—and the focus of many of today’s marketing technology firms—is managing the proliferation of content and interactions, and harnessing this data to put relevant content in the hands of customers and prospects so that products can sell themselves, or, in the case of B2B, at least do the bulk of the selling work before a hand-off to sales people is made.

Hope this give some additional insight into the ‘why marketing’ question.

To take one of the boxes out of your landscape, “Web Site / WCM / WEM”: that one alone had 2000+ products ten years ago. And for the past fifteen years, everyone’s been predicting “consolidation”. And even though many have been acquired or merged, we probably have 3000+ by now.

And that’s just one square.

And each square, when you look at the logos in it, probably would fit in or overlap with multiple other squares. Many of the products would fit in multiple squares. nPario is built on Hadoop. SilverPop is maybe best known for email marketing. Limelight would argue they do Digital Asset Management (though they don’t do WCM anymore, since they’ve sold Clickability last month). Jive used to OEM Docverse before it was acquired by Google. Those are just the first things that came to mind. I could go on for ages. Out of this overview, there’s at least two dozen or so I currently work with.

Each square is a universe of its own.

The “consolidation” part is the wishful thinking that creeps up while being overwhelmed by this huge landscape. The reality, of course, is that it will keep getting more complex and more diffuse as we go along. That’s what makes this exciting. There’s no definite status quo to analyse and neatly categorise in an encyclopaedia of marketing tools. It’ll be different tomorrow.

But let’s not forget the main reason your overview is impossible to get completed. It’s because you take a pretty broad view of what “marketing technology” is. The infographic shows suites, tools, infrastructural components, service providers, multinational software companies…

Maybe the consolidation needs to be more in narrowing down the map… because the market is only going to get more complex. Even if you do narrow the scope each month, the chart could remain the same size 😉

Then again, every time I think I should really narrow down my own interests to a subsection of what’s going on, I branch out again. Collections like these are useful to discover options and make new connections.

Consolidation is the wrong thing to wish for. The lines between services and software are blurring: software is just a ready-made set of rules for you to use. The further we master the technology, the easier it gets to create more of it. And the more diverse it gets.

And the more interesting it gets to keep track of what are the best options available, and in which combinations 🙂

Thanks, Adriaan — it sounds like we’re picturing the same thing.

The WCM/WEM category is a great example, for many of the reasons you listed above. However, I’d also point out that it demonstrates that this future is not incompatible with having big marketing technology companies. There are some very big companies with WCM/WEM offerings. There are also a boatload of smaller and mid-size companies there too.

I suspect the network effects of platforming — which haven’t really affected the WCM/WEM category yet, but I believe will over the next few years — may promote more consolidation. I think we’ll see a “fat tail” of the dominant platforms and maybe a “long tail” of many other specialists.

Of course, as described above, I also believe that such open platform consolidation will trigger even more third-party software development that will be better able to plug in to those backbone environments. Category lines there will be, I imagine, even harder to define than they are today.

Either way though, it’s going to be a fascinating future for marketing technology!

Charles H. Duell, Commissioner of US patent office in 1899 said “everything that can be invented has been invented.”

Scott’s right: don’t be another Commissioner Duell. Even in B2B we haven’t even scratched the surface.

Awesome quote, Joe. Thank you!

You sir, are a genius! Marketing is going to get ridiculous. It’s the one field where people are always looking for ways to differentiate themselves, and different technological combinations seems to what people are after.

Thanks, Steve — glad to hear this resonates with you.

That being said, I do think it’s important for us to keep in mind that all these amazing technological combinations are still just a means to an end. As an industry, we’ll have to constantly work to maintain the balance between taking advantage of the technology but not letting it take advantage of us.

I agree, it’s almost like being a kid in a candy store sometimes…and there’s different flavours to try all the time.

Great, challenging thinking in this article. Our research shows well over 1000 vendors in the CRM, email, social media management, A/B Testing, and Web Analytics spaces ALONE. I spent over 10 years buying software from $250k ecommerce platforms to tiny free trial SaaS platforms. Each time I did, I knew I was on the losing side of a pretty bad asymmetrical information problem. Each time, I would be irritated that I knew more about the burrito joint I was going to try for lunch than I did about the software that I was staking my company or my job on.

That’s why I founded Vendorsi. We’re tackling this problem head on with the goal to level the playing field for buyers, especially those in small companies and startups who don’t have a $10,000 budget to spend on huge research firm. Time spent on a 30 day trial for a piece of software that doesn’t work isn’t free. And making sense of those massive sound alike features lists isn’t free either. It’s not uncommon for startup founders to spend 8-12 hours or more just researching a “30 day free trial.”

We steadfastly do not agree that “satisficing” is appropriate for most businesses when it comes to choosing software. But we do agree that Satisificing is about all anyone with a small budget can do right right now given the current state of affairs. We’re changing that, and we’d love to talk more with anyone who’s interested.

Sincere regards,

Melinda Byerley

CEO and Co Founder

Vendorsi.com

Thanks, Melinda.

I’m glad to hear that this aligns with your perspective — indeed, your business is built around the opportunity to make such a large landscape more navigable for marketers. I wish you the best of success!

We may not agree on “satisficing.” I know the word doesn’t sound appealing — it sounds like you’re settling for something. But as a technical term, I do believe that it accurately describes the state of the world. Not just in marketing technology either. There is such an explosion of choice out there in every facet of our lives that a quest for the “perfect” anything seems inherently Quixotic.

That being said, I do believe that there’s a wide, wide range of possible outcomes along a satisficing curve — some will objectively be much better than others — so I think your value proposition at Vendorsi is in no way diminished by that the fact that, even if perfect optimization is unattainable, asymptotically approaching that is something to strive for!

Hi Scott, thanks for the reply. Yes–definitely agree that asymptotically approaching perfection is what we strive for. In the end there is no such thing as perfection. We can help buyers use technology to sift through the rapidly growing set of data out there, and focus their time on evaluating that short list and what the real trade offs are vs trying to figure out what each vendor really means with their marketing speak. I say that kindly as a former CMO myself. 🙂

As an aside, vendors will see less churn when buyers are more closely matched the first time. It’s sort of like getting married to someone you only went on one date with–when things get hard, you’re more likely to wonder what your other options might be.

Wow Scott. I think that this was just a fabulous post.

The critical piece is that the convention notions around economies of scale no longer apply. And I think you are so right.

I’d expand a bit more about your “Unification” point. The critical premise used to be that software all needed to work well with its related components and that couldn’t happen unless one vendor bought all of those up and stitched them together. In a cloud, API world, however, that no longer applies.

As much as this interests me as a member of the industry you analyze, I’m also fascinated by how this might apply more broadly. I think that many of the trends you mention around SaaS foretell dynamics that will go into most industries. Much of what we believe around the advantages of scale may soon no longer apply.

Thank you, Toby — I’m really happy to hear that this jives with your intuition too.

Great point the relationship between the growing API economy and “unification.” I think it’s interesting to note that some of the larger acquisitions in the marketing technology space over the past couple of years haven’t tried to tightly integrate different components. Keeping the products in their portfolios loosely-coupled and, to some degree, even operating as stand-alone brands, definitely seems like it has advantages.

I’d love to learn more about the changes these forces are triggering in industries beyond marketing. It does feel like these are seismic shifts in the future of business.

There’s another dimension here that exit paths for software businesses may evaporate (if there’s no longer a rationale for the big vendors to buy up new technologies).

But it’s a Monday and I don’t know if I’m up to thinking about that . . .

😉

Maybe. I’ve got a few thoughts on that, which I should write up in a follow-on post. But four possibilities come to mind:

1. Software that merges into the platform layer will be immensely valuable to the big platform companies.

2. Big companies can still benefit by having strong portfolios of loosely-coupled marketing applications.

3. In particularly hot categories within marketing experiences and marketing operations, there will still be opportunity for relatively big leaders (even if they face an ongoing long tail of competition).

4. As long as there is real value being delivered across this new environment — I believe there will be tremendous value — I suspect that other mechanisms for liquidity may arise.

I don’t want consolidation. I want interoperability. I want choice. I want “one-click” install, so I can easily try and buy new marketing technologies.

I really like what Segment.io is doing to bring order to some of this via a middleware tool that makes it easy to add new services. I would like to see the AppStore equivalent for marketing tools. This may need to come from one of the major vendors, such as Salesforce, which has done just that for CRM via their AppExchange.

Yes! Yes! And yes!

The biggest technical pain at this point is interoperability. The good news is that there’s tremendous development resources going into addressing that pain. As a set of dominant platforms and middleware products emerge from the primordial soup, this pain will be significantly reduced and the power of choice will be a lot more enjoyable.

Segment.io is a great example of marketing middleware.

Scott Brinker This is by far the best delivered article on what is now a very fragmented industry and will be for many years to come. I have read too many white papers that each only hit the nail on the head in one area. You have corralled the dynamics of this industries past, present and future. Excellent, excellent job.

Thanks, JP — glad to hear that this was helpful for you!

Hi Scott,

Thought provoking post as always!

Taking it from a different angle: Whether the number is 1,000, 10,000, or 100,000 marketing sw vendors isn’t it just as important to hone into those vendors that are working towards the critical mass where we can confidently say their business is sustainable for the foreseeable future? Would be interesting to see which of the marketing vendors have revenues of $10M, $50M, $100M, $500M, $1B (very few I imagine directly from their marketing tech businesses.) Certainly _one_ data point that would help understand where the momentum is within the industry.

Great piece – it really outlines the struggles marketers are going through- and will continue to go through. Has anyone viewed Gartner’s Digital Marketing Transit Map? This is a free version (there’s an interactive version for subscribers to the service), but it’s a very compelling map outlining the vendors in the space: http://www.gartner.com/technology/research/digital-marketing/transit-map.jsp

Max Bennett does a good job of explaining that the application layer will most likely be where the innovations will be coming from. http://www.emailvendorselection.com/application-layer-email-marketing-innovation-ecommerce/

Another missing latter A company, Ad-Juster – online advertising discrepancy management