CEOs have come to recognize, more than ever, that disruptive technology poses the single biggest existential threat to the future of their businesses. Or, on the optimistic side of that coin, it promises tremendous opportunity for them to capture new ground.

IBM recently released their latest global C-suite study — The Customer-activated Enterprise — and I highly recommend downloading it. Their research was conducted by interviewing over 4,183 C-level executives from across 70 countries and 20 industries. They collected views from CEOs, CMOs, CIOs, CFOs, CHROs, and CSCOs.

(Apparently C-3PO could not be reached for comment.)

The report reveals what these senior executives are thinking about, at a high-level, in regard to technology, strategy, and the market. What initiatives are they prioritizing? What is important to them today? What do they expect to be important in the next 3-5 years?

But I want to focus on just one: disruptive technology.

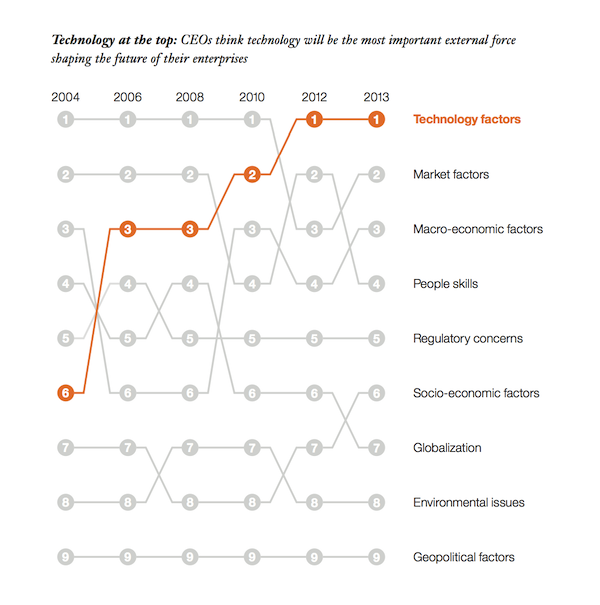

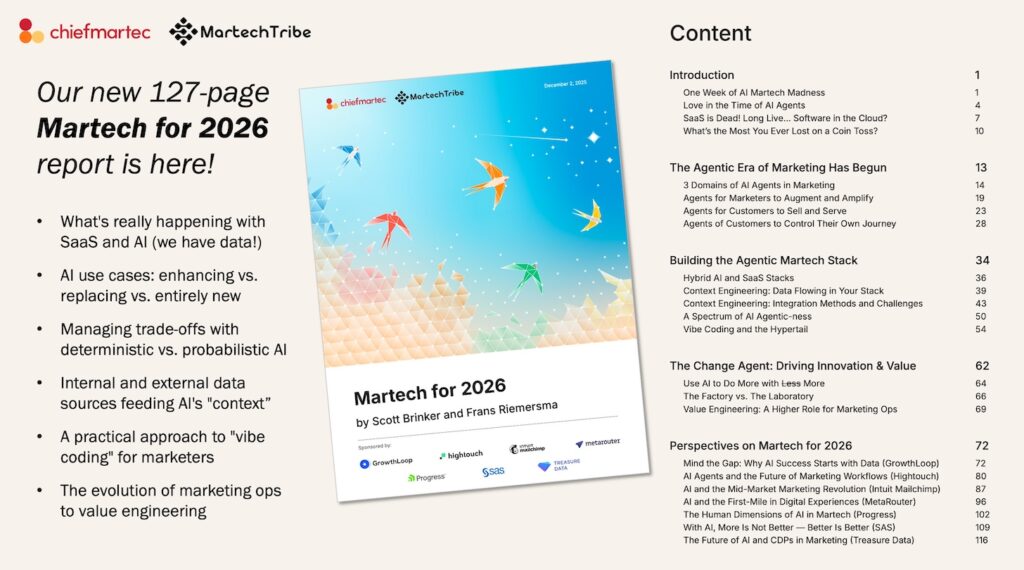

As the chart at the top of the post reveals, for now two years in a row, CEOs rank technology factors as the most important external force shaping the future of their enterprises. That’s ahead of market factors, macro-economic factors, people skills, regulatory concerns, and so on. And it’s up from being the 6th most significant concern to them back in 2004.

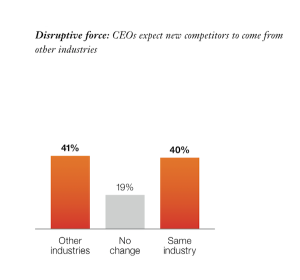

Closely related, CEOs now expect that new competition is as likely to come from other industries as it is their own.

Think of what happened to the GPS device manufacturers — destroyed categorically by the rise of GPS features in smartphones (illustrated in the recent HBR article Big-Bang Disruption).

Disruptive technology is usually the spark that ignites such conflagrations.

A great new book by Rita Gunther McGrath, The End of Competitive Advantage, makes the point that old-school barriers of long-term competitive advantage aren’t what they used to be. She argues that executives should think more about “arenas” than industries — broader playing fields — and be prepared to move at a much faster pace to reinvent transient competitive advantages.

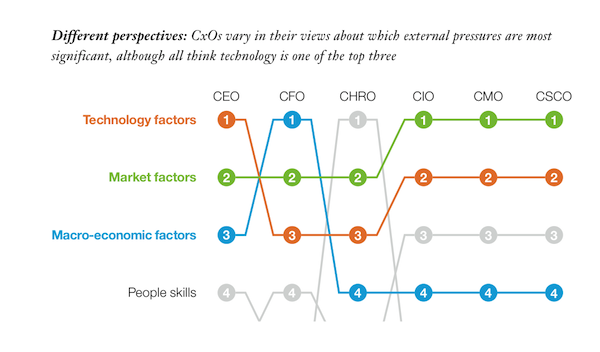

What’s interesting in IBM’s report is that CEOs rank such threats and opportunities from technology higher than CIOs and CMOs:

To be sure, CIOs and CMOs rank technology factors as their second most significant external pressure — and all C-level executives rank technology in their top three.

But it’s ironic that the CIO and the CMO, who have been jockeying for whose technology budget is bigger, would rank market factors as a bigger concern than technology factors. Why is that? Is it because they’re confident that they can tame and assimilate new technology, while they have less control over other external pressures? If so, is that confidence or over-confidence?

Or could it be — with apologies for the armchair psycho-analysis — because pointing at amorphous market factors provides a blame-free scapegoat? “Our problems aren’t a result of our lack of technological prowess, it’s the result of market factors.”

I’m not saying that’s an intentional excuse. But it seems dangerously easy to confound technology factors and market factors — we can blame consumer behavior on market factors without digging into the technological root causes for those changes in behavior.

A rebuttal may be: “We should care about customers more than technology.” And that’s absolutely true. I’m not saying that technology is a end unto itself. But it is changing the landscape of competition and customer expectations at a breathtaking rate. This was acknowledged this in a recent Forrester report where 96% of marketers agreed that the pace of change in technology and marketing will continue to accelerate.

“Accelerate” is an important word — faster than today, which is already blazingly fast.

Much of the rest of IBM’s report examines specific technological changes and challenges, mostly revolving around the themes of better customer experiences served through digital and hybrid digital-physical channels. As IBM’s own CEO, Virginia Rometty, says in the introduction, “Today, digitally enfranchised and empowered customers lead the agenda for every CxO profession.”

For CMOs, I believe this presents a clear opportunity to step-up investment in customer experience technology. It isn’t just about how technology can implement more efficient or effective marketing. It’s looking at how technology — and the tech-savvy talent necessary to leverage it — can change the playing field more significantly. Companies should pursue innovative, technology-powered capabilities to continually achieve and renew McGrath’s transient competitive advantages.

The big takeaway from IBM’s report for me is that the CEO is more attune than ever to such opportunities. The CMO should rise to the occasion to champion that charge forward.

Hi Emmanuel and thanks for the fun read,

Likes:

Example of stand-alone GPS Disrupted by app-based GPS

CEO expectation that new competition is as likely to come from other industries as it is their own

Implied understanding that a shift in market expectation

Concerns:

Interpretation that “technology factors” survey question actually represents “Disruptive Technology” to CEOs

Use of “Big Bang Disruption” article as credible reference

It is unclear to me whether Mr Brinker has yet internalized that the Disruption phenomena it would appear that he so very much wishes to confront is originated in a shift in market preference rather than in technology.

It is true and demonstrated through Christensen’s work that this shift can come about by an existing market being overwhelmed by technology development that takes place in some other currently-unrecognized and underserved market.

I suppose if it’s one’s peers that provide the grist at the newly emerging trough to which an incumbent’s customers migrate to feed we call it conventional competition and if the usurpers come from elsewhere we call it Disruption, but anytime one disregards one’s own market preferences one places oneself in the position to be replaced by one which is more attentive to that market.

If you like the stand-alone GPS disrupted by app-based GPS example, I’m not sure why the use of the “Big Bang Disruption” article is a concern — since the only purpose of my mentioning it was to cite it as the source for the GPS example.

It’s true, I am confounding “technology factors” with “disruptive technology.” But why would CEOs be most concerned with technology factors if those factors didn’t represent a potential disruption to their business?

In that same vein, it seems to me that many shifts in market preferences today are the result of a technology-related disruption. Why did the market shift to prefer smartphones over the previous generation of flip phones? It doesn’t seem like that preference shift was independent of the technical innovation in smartphones delivered by Apple and the Android ecosystem.

I guess the interplay between technology-driven innovation and changing market preferences is an open question to me — so indeed I have not internalized the difference yet.

Great write up of this important research Scott.

New research that links back to Porter’s classic five competitive forces model. Technology factors have increased the threat of substitutes and new entrants in a market by reducing barriers to entry. This creates additional competition for incumbent firms from all directions. Digital technology has also improved buyer power allowing us to easily find the best product and price.

Personally I think there is a gap missing in the people element of external factors. My reason for saying this is that a technology in its own right is rarely disruptive until applied by someone. Technology has latent disruptive ability which requires the right people to kickstart it.

Finding people who are equally entrepreneurial, technological and commercial is going to be a challenge for most blue-chips. Getting the best from these people is going to be your second challenge (hence Christensen’s recommendation to build a Disruptive Growth Engine).

Best regards

David

The item that caught my attention is the lack of importance the C suite appears to have placed on people skills. I would have thought that the ability to collaborate and work effectively in concert toward a shared goal (requiring people skills) would have been viewed as more important. Is not your operational responsiveness as important as the disruptive technology?

While its clear that technology can transform industries, technology must have substantive impact on the business case, customer’s perceived value exchange and experience to be a threat.