The world’s three largest Internet companies are American: Google (Alphabet), Amazon, and Facebook. The fourth largest — actually the 9th most valuable company in the world by market capitalization — is the Chinese giant Tencent.

The sheer scale of Tencent is almost impossible to comprehend — at least it was to me as a marketing technologist from the Western world. From a simple instant messaging service founded in 1998 (think AOL messenger, for those of you over the age of 30), Tencent has grown into an absolutely massive platform/portfolio that dominates digital life in China — a country with more than a billion people.

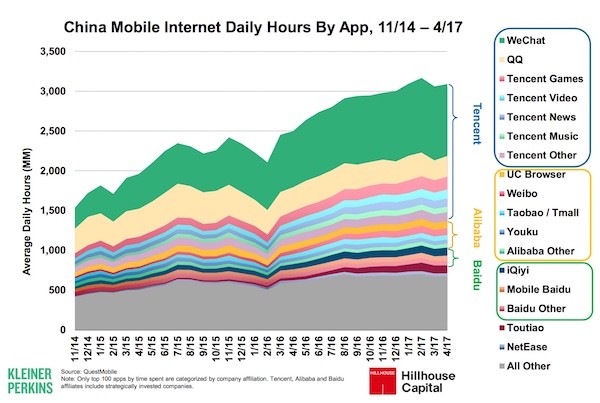

From Mary Meeker’s yearly state of the Internet report, you can see

Combine Google, Facebook, Amazon, Twitter, eBay, Paypal, Spotify, YouTube, etc., mash them together into a kind of super-Internet-app, and divide them into three overlapping and highly-competitive entities — multiplied against a user base that is measured in the hundreds of millions — and you get an a kind of approximation of the Chinese Internet landscape with Tencent, Alibaba, and Baidu.

Whatever you’re picturing in your head, multiply it by a factor of 10X.

I’d read about this phenomenon, but I’d not experienced it first-hand. So when Tencent invited me to keynote the 10th anniversary of their MIND marketing conference in Shanghai, I couldn’t resist the opportunity to participate — and to learn.

To give credit where it is due, I owe a tremendous debt of gratitude to David Shi, who beautifully translated an article I wrote years ago — Art and science in marketing: meaning, truth, and money — into Chinese.

Apparently his translation went viral on Weibo (kind of like a Chinese Twitter), with millions of views. Senior executives from companies all over China, including Tencent, read and endorsed it.

Again, David deserves much of the credit for stirring their enthusiasm with his translation. I delivered clay; David crafted it into sculpture.

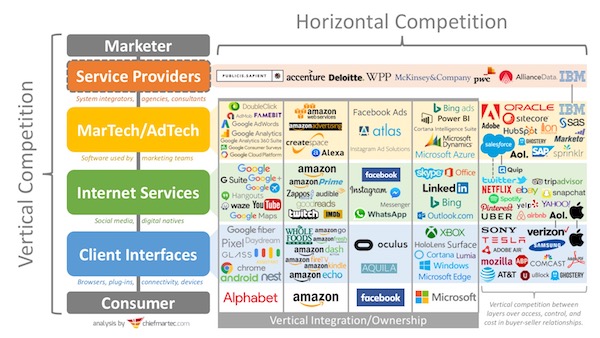

A Vertically Integrated Martech Duopoly/Triopoly

I’ve been writing about vertical competition in marketing technology for a while. I believe the biggest battles won’t necessarily be between “marketing clouds” as we know them today — horizontal competitors — but rather those enterprise software vendors and the Internet giants who increasingly control proprietary interfaces to consumers (i.e., “walled gardens”).

This is happening today in the US with Amazon, Facebook, and Google. But because of the openness of websites and email, which are still the primary digital touchpoints between companies and customers here, the effects of vertical competition have been limited.

So far.

But looking down the road at the growth in proprietary messaging systems, like Facebook Messenger, and voice systems such as Amazon Alexa and Google Assistant, you can see the threat of vertical competition significantly restructuring the dynamics of the martech industry.

For a glimpse of what that might be like, look at China today.

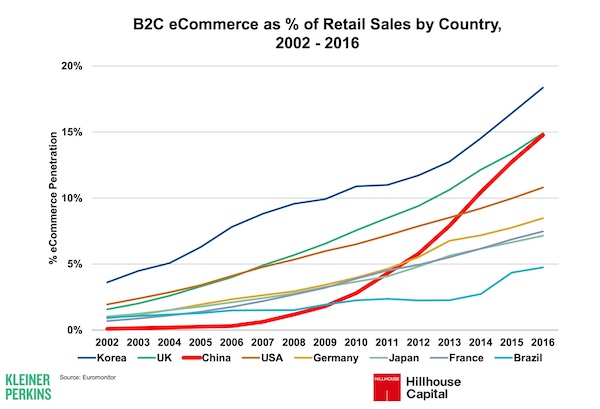

The vast majority of Internet activity in China happens through proprietary applications run by Tencent and Alibaba. The explosion of ecommerce in China is almost entirely based on these platforms. (While we’re contemplating social commerce here in the West, they’ve made it a way of life in China.)

Email is not really used by Chinese consumers, who leapt into messaging services like WeChat, QQ, and Aliwangwang instead. And independent ecommerce sites are rare in comparison to Alibaba, Taobao, and JD.com.

As result, Tencent and Alibaba — and their umbrella of affiliates — are more than walled gardens. They’re more like walled forests. They own the interface to the consumer across multiple touchpoints. And they own the data that comes as a result of that.

So their proposition to marketers is simple: deal with us directly if you want to reach your audience. The only real martech you need, you’ll get through our services.

Let that sink in for a moment.

This isn’t hypothetical. You can read a bit about Alibaba’s “Uni Marketing” suite of marketing services and the new “One Tencent” integrated marketing solution. Actually, go skim through those right now — I’ll open them up in separate windows so you can easily come back.

Granted, they still engage in partnerships with other marketing services companies. Alibaba announced a big partnership with Publicis for Uni Marketing. At the Tencent conference I spoke at, there were large exhibits from GroupM, Dentsu Aegis, and Nielsen.

But the power in those relationships strikes me as dramatically weighted against the agencies. And I heard multiple examples of brands skipping the agency “middleman” entirely. (Man, it’s been a rough decade for the agency world.)

The same goes with independent martech software vendors. There are API programs available with a number of these services — for instance, here’s English documentation for the WeChat Open Platform.

But make no mistake: these APIs are accessible only by the grace of the provider, and the rules are subject to change at any time. It reminds me of the early days of Twitter apps and what happened when Twitter decided to lay claim to third-party functionality as its own — and shut out the ISVs, whose businesses were dependent on those APIs, that they suddenly deemed to be “competitive.”

Interestingly, one of the dynamics of this environment is that Tencent and Alibaba actually invest in hundreds of start-ups building things on top of their platforms. But the intent behind that seems to be more of a crowd-sourced R&D engine: seed a thousand possibilities and then harvest the few that blossom.

If Amazon, Facebook, and Google dominated marketing through vertical ownership here in the US, this is probably a pretty good approximation of what that parallel universe might look like.

But the one constant about the Internet is constant change.

While I was in Shanghai, I also had the chance to present at another independent martech conference organized by ConvertLab, a digital marketing hub native to China. Hundreds of marketers turned up at that event, deeply interested in embracing “martech” as a new mantra.

In talks with people there, it’s clear that there’s a groundswell of innovation that may yet develop into a martech ecosystem that grows beyond the control of the vertically integrated giants.

The entrepreneurial energy in China is electrifying, and “China Internet speed” is an even faster rate of change than the already blinding pace of “Internet speed.” There’s much we can learn from each other, and I’m excited to see how their martech universe will evolve from here.

Photos credits: David Shi and Alvin Foo.

Hello Scott.

Thanks for the article and the approach on how things are done elsewhere by showing there are alternatives and “speeds” (yup, we are not alone).

Any chance you could advice on how to get to know more about this (quoting you) “much we can learn from each other” (magazines, blogs, articles, people to follow…)?

Meaning… what is going on in China -in, at least, English-? 🙂

Sincerely. Thanks!

Guille

Hi, Scott

I believe the dinner in Shanghai is good too. It was great to meet you there.

David YIN