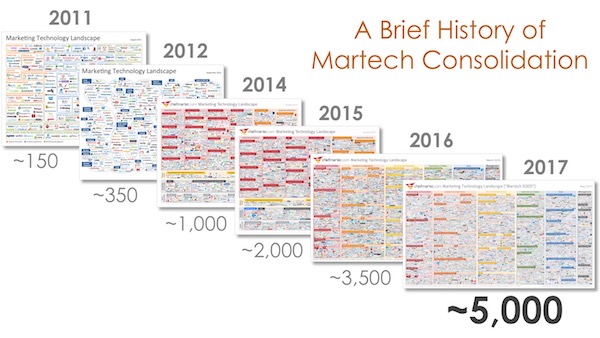

Officially, my first published marketing technology landscape graphic was in 2011. That was the one where I categorized around 150 marketing technology companies. My most recent one, produced in collaboration with Anand Thaker, was released in May 2017 with nearly 5,000 marketing technology companies on it.

By sheer quantity of logos, it got 32 times bigger in just 7 years.

Just based on the gross number of companies in the field, that would seem to debunk the notion that the marketing technology industry has “consolidated.” I find some wry amusement in showing this progression and labeling it as A Brief History of Marketing Technology Consolidation:

But a raw count doesn’t tell the full story of what’s actually happened.

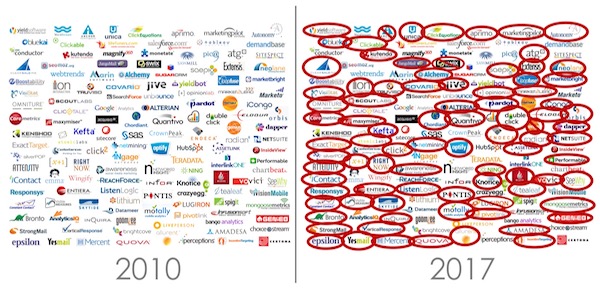

The 2011 marketing technology landscape was my first attempt at organizing vendors in the martech space. But a year before that, back in April 2010, I assembled a slide of 142 martech companies for a presentation on the Rise of the Marketing Technologist that I gave at a small search marketing conference:

The point I was making was: look how dependent marketing has become on technology. This is why you need technical talent — marketing technologists — as a native part of the marketing team. As our recent martech and the modern marketing org study revealed, that prediction of the rise of marketing technologists has indeed come true.

But what about those 142 companies from that slide in 2010? How have they fared?

61.3% of the 2010 martech landscape has been consolidated

I recently came across that old proto-landscape slide and found myself wondering how many of those companies had been acquired or went out of business — or, more euphemistically, were “consolidated?” So I tracked most of them down one afternoon to find out.

As you can see above, the vast majority of them have been consolidated. Most were acquired (red circles). A few just went out of business (circles with lines).

My own former company, ion interactive, is one that was recently acquired.

Of those that remain, some of them, such as Emma, Lithium, iPerceptions, Marketo, and (sort of) Sitecore, were actually acquired by private equity firms, but kept operating as stand-alone brands — so I didn’t circle them in red. But I suppose we could.

Some, such as Alterian and Aprimo, were acquired — and so I’ve circled them red — but since then, they’ve actually been spun out on their own again. Maybe they should now have a dotted circle?

Add them up and you find that 87 out of 152 were acquired or went out of business. 61.3% were consolidated. (If you add in the private equity deals, it’s 64-65%.)

The Martech Class of 2010 — where are they now?

A number got rolled up by the large enterprise companies seeking to build their suites/clouds. For instance, Oracle could be nicknamed “The Consolidator” — isn’t that a great name for an action/thriller movie? — having acquired Eloqua, Responsys, Market2Lead, ATG, RightNow, Maxymiser, BlueKai, NetSuite, and Endeca (plus many more not included on my 2010 proto-landscape).

Adobe, IBM, and Salesforce took pretty big bites out of this landscape too.

But many others were absorbed more diffusely among different technology companies and service providers. For instance, HubSpot, where I work now, acquired Performable relatively early on.

It’s interesting to see who remained “single” in this field. Firms that were or are now public: Google, HubSpot, Liveperson, Marin Software, Salesforce, Tableau, and Teradata. Big private companies that have that scale, like Infor and SAS (and Lithium, Marketo, and Sitecore, if you count private equity ownership, which I think we should).

But it’s also interesting to see the smaller ones, such as ClickTale, Demandbase, Kissmetrics, Monetate, Moz, ReachForce, SiteSpect, SugarCRM, Wingify, and WordStream that have carved out and sustained well-known brands for over 8 years — no small feat.

Was this Martechaggedon?

That sea of red circles illustrates a fact: the martech landscape of 2010 did consolidate.

I could creatively theorize why that happened — and why, as a countertrend, the overall landscape continued to grow geometrically (25 growth!) over the past 8 years. But we don’t need hand-wavy explanations. We’ve got data.

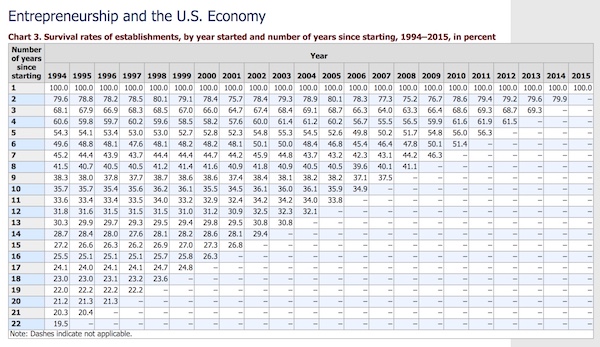

Here’s the survival rate for businesses started in the US over the past 20+ years:

The currently published Bureau of Labor Statistics data only goes up through 2015. But if we say that all of the martech companies on that 2010 proto-landscape started at least 8 years ago (2009) — and many started earlier — and then slide back on this chart two more years (2007-2015), we see that the survival rate of any business for that long was 37.5%.

In other words, 62.5% of all US businesses started were, um, consolidated within 9 years.

The marketing technology landscape consolidated 61.3% during that same time frame.

Admittedly, my proto-landscape was far from comprehensive — there were undoubtedly many martech companies that were operating in 2010 that I didn’t capture and may have gone out of business at a higher rate. And certainly not all of them were based in the US.

But with a little hand waving on my part, I’ll suggest that, more or less, martech companies “consolidated” at about the same percentage as any other business.

It wasn’t Martechageddon. It was simply The Law of 65/10. Over 10 years, approximately 65% of businesses end (although I wouldn’t call a good exit-by-acquisition an unhappy ending). Okay, I just made up naming that a “law” — but the statistics are clear.

So how did the martech landscape grow exponentially?

One simple explanation: way more marketing technology companies were born than died in the period of 2010-2017. An order of magnitude more.

If you’re a demand generation marketer, you know this math: it’s pouring more prospects into the top of your funnel. Even with a constant conversion rate, you generate more net leads.

Perhaps that’s an overly simplistic view. But let’s play out its logic. If we turned a blind eye to anything special about martech firms that would somehow cause them to defy the odds of entrepreneurial ventures in general, then consolidation of the marketing technology field will when happen when annual “deaths” of existing firms outpace “births” of new firms.

There was definitely a swelling of new martech firms starting around 2013. The Bureau of Labor Statistics charts would suggest that half of them will be out of business next year.

We can get this data — I’m glancing towards my #FeelTheData landscape collaborator Anand Thaker. This would make a fascinating presentation for MarTech West in San Jose in April, my friend. (Hint, hint.)

Assuming that model holds true — and I suspect that within a few percentage points it will — then the relative size of the martech landscape in the future simply comes down to one big question: will entrepreneurs still keep launching new martech ventures at or near the same pace they have been?

I have an opinion, but I’ll leave that question for you as the reader for now. Will new marketing technology ventures keep being launched at today’s pace in the next year or two ahead?

Maybe it depends on how you define “marketing” and “technology.”

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.