The deal was announced yesterday afternoon: Adobe is acquiring Marketo for $4.75 billion.

(As fate would have it, it was just a few hours before I was speaking at a MOCCA marketing operations event in New York on the topic of martech industry trends — to be followed by a Q&A with Sarah Kennedy Ellis, Marketo’s CMO, and Jill Rowley, Marketo’s growth maestro and legendary martech industry force of nature. It was a fun evening of discussion!)

As TechCrunch noted in their coverage of the news, “[This acquisition] was a pretty nice return for Vista Equity partners, which purchased Marketo in May 2016 for $1.8 billion in cash. They held onto it for two years and hauled in a hefty $2.95 billion in profit.”

Here are my initial thoughts on the deal:

1. It’s a major vote of confidence in martech.

We don’t know exactly what Marketo’s current revenue is, but back-of-envelope estimates — extrapolating ~30% year-over-year growth from Marketo’s last published quarterly revenue as a public company back in 2016 — likely puts them below $475 million.

That would put the Adobe acqusition at above a 10X multiple of Marketo’s revenue.

That is a major vote of confidence in the future growth potential of martech.

2. Consolidation in martech revenue — but that’s only one dimension.

“Ah ha, see! Consolidation in martech! Take that, Brinker, you logo lunatic!”

That’s not a verbatim comment I’ve received about this deal, but it might as well be.

Make no mistake. This deal represents a huge consolidation in martech. But, at least in the short term, it’s mostly revenue consolidation. Adobe adds half a billion dollars to their Experience Cloud revenue that would have otherwise been attributed to Marketo as an independent company.

But it’s not necessarily product consolidation.

As David Raab observed from Adobe’s official comments on the deal, it seems like they will keep Marketo separate from their existing Adobe Campaign solution (which originated from their acquisition of Neolane in 2013). Marketo would be their B2B solution; Adobe Campaign would remain their B2C solution.

This would be comparable to the division between Eloqua (B2B) and Responsys (B2C) in Oracle’s portfolio and Pardot (B2B) and Exact Target/Marketing Cloud (B2C) in Salesforce’s portfolio.

It’s a topic for another day about whether these divisions between B2B and B2C still make sense, or if this is just an artifact of M&A, Conway’s Law applied to software-built-by-acquisition.

But setting that debate aside for now, for a B2B enterprise, you still have the same number of choices for tentpole solutions for marketing automation that you had before this acquisition. It’s just that your Marketo choice will now have an Adobe logo.

Now, that being said, I do believe this revenue consolidation will put pressure on smaller competitors or new competitors who want to go after the enterprise marketing automation space. The continued rise of CDP (customer data platform) solutions may be contenders there, but it will be a battle. (And some will almost certainly be acquired by the giants.)

And I do think that Adobe will move to integrate Marketo more tightly with the rest of their portfolio, which will make their combined “suite” more attractive — and further deepen their moat as a tentpole enterprise martech platform.

But by number of companies, how much will the broader martech landscape consolidate?

3. One martech company acquired. How many new ones spawned?

This is the question of the ages. Well, okay, maybe not up there with, “Why are we here?” or “What exactly is Cheez Whiz?”. But for us martech nerds, it’s in the top ten.

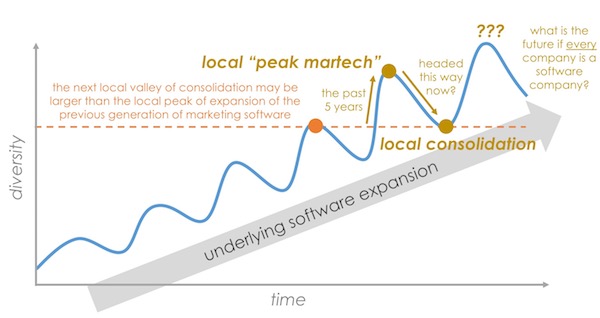

My best guess at the moment is there will be a significant bloodletting shake-out of the current marketing technology landscape over the next 12-18 months as vendors that were funded by VCs in the past 5-7 years who have failed to achieve either a breakout growth trajectory or profitability run out of money and are either sold or shut down.

As an over/under, I’ll predict — even though I hate predicting anything in a world of constant change — that 25% of the existing landscape will euphemistically “consolidate” within this next 12-18 month period.

But…

There are reasons why the fallen may be replaced by a new generation of many more martech ventures. I’ve recently written about these dynamics as the paradox of simultaneous martech consolidation and expansion, but I’ll make a few points in the context of the Adobe/Marketo deal:

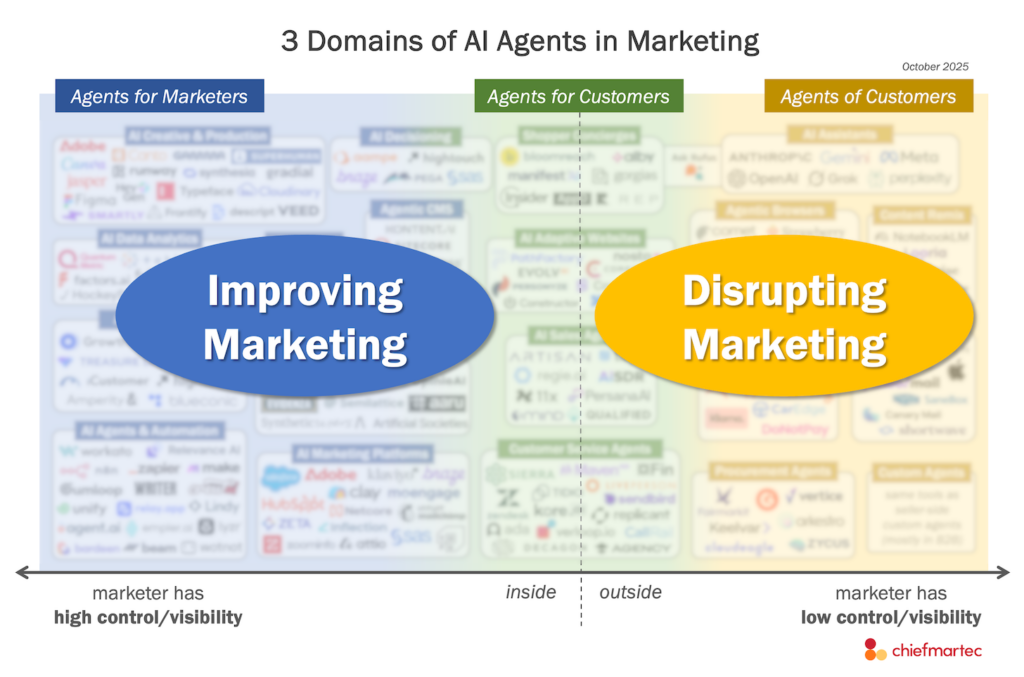

- Entrepreneurs will be inspired by this big exit. They will continuously look at the weak spots of the major tentpole solutions for ways they can disrupt with something better. And if there’s one thing the digital world has taught us, it’s that anyone can be disrupted.

- Capital has to go somewhere. All the money that Vista and their investors made on this deal is going to look for the next place it can be put to work. Not necessarily martech, that’s true. But given the potential growth in the future of digital business and customer experience, writ large, some portion is likely to be reinvested in some kind of martech opportunity. (And the boundary of what is or isn’t “martech” will continue to evolve accordingly.)

- There are still effectively zero barriers to entry in launching a new software start-up. For a tiny fraction of the capital once required, entrepreneurs can leverage open source software and cheap infrastrucutre-as-a-service in the cloud to bring an idea to life. Very few will be breakout billion-dollar giants, true, but those aren’t the only kinds of martech companies…

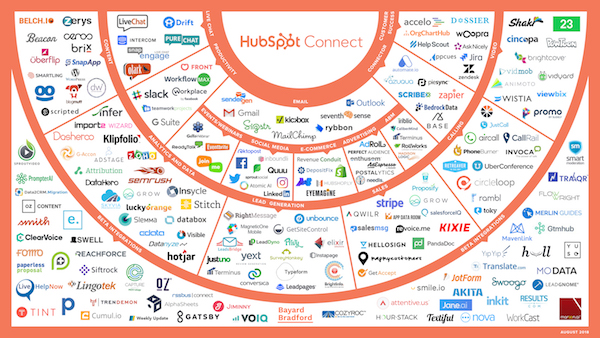

- The “platformization” of martech — a small number of tentpole solutions that establish a stable backbone for a huge number of marketing stacks — can actually make it significantly easier for smaller companies to develop specialized martech apps that plug in to these larger platforms. It requires these major martech providers to become true platforms, with open APIs and broad extensibility, but essentially all of them — including Adobe and Marketo — are committed to that path. These smaller ventures built on top of platforms can deliver awesome vertical market solutions, deeper capabilities in specialized areas of functionality, and emerging technologies that the major platform may be years away from tackling. They may not generate billions in revenue, but they can generate millions in revenue — and do so without big Series A funding from classic VCs. Many will be sufficiently funded by customers, angels, founders, etc., and grow organically.

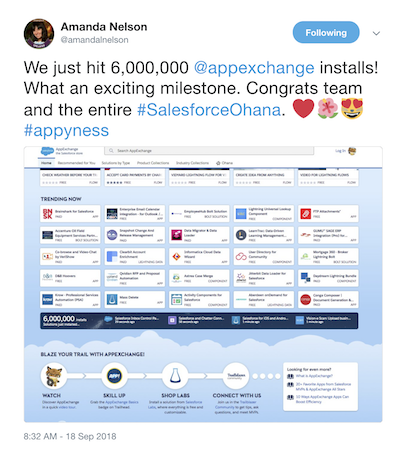

It’s worth noting that a day before the Adobe/Marketo deal was unveiled, Salesforce crossed more than 6,000,000 installs from their App Exchange business app store.

There are approximately 3,500 apps in the App Exchange, and many of them are exactly these kinds of more specialized niche players.

But Salesforce’s App Exchange is only the beginning. Clement Vouillon of Point Nine Capital recently wrote an analysis of the burgeoning SaaS app store era.

Of the 20 biggesting public SaaS companies, 70% of them have an “app store” of some kind offering third-party solutions on top of their platforms.

I’ll note that HubSpot is one of the companies that Clement identifies with this model, and indeed, the reason I joined them as VP platform ecosystem last year is because I believe this “platformization” of the martech space can be a transformative movement in our industry — for marketers, for the major platforms, and for a universe of more specialized martech ventures that can build and deliver solutions faster and better on top of these foundational systems.

As a point on the curve, in the past year, HubSpot’s own platform ecosystem has more than doubled:

Just as the iPhone and Android inspired millions of apps (or micro-apps), the consolidation of major platforms within the martech space could enable an incredible wave of app and micro-app innovation in marketing and customer experience.

The martech landscape is going to go through some big changes in the next couple of years. (Which is why there’s so much opportunity for marketing leaders to design for change and harness the 4 forces of marketing operations & technology in their strategy and management.)

But on the other side, the martech landscape could be both larger and better organized.

Never a dull moment in marketing technology.

P.S. Want to see some amazing martech innovation in person and, more importantly, learn how to harness its full potential? It’s not too late to join us at the MarTech conference in Boston, October 1-3.