I’ve said many times that change is at the heart of modern marketing operations. It is at the very center of the “4 forces” diagram of The New Rules of Marketing Technology & Operations because it’s the dominant variable of our profession.

And what’s the most common and concrete change in martech? Why changing martech applications, of course.

This well-known yet not well-quantified phenomenon was the motivation for Chris Elwell and Jennifer Cannon of MarTech Today to launch a research study, Martech Replacement Survey 2020: What Motivates Marketers to Change Applications & Vendors.

I picture every martech vendor sitting on the edge of their chair for this one.

Here are a few of the findings that stood out to me…

83% of marketers have swapped out at least one marketing software application in the past year. It may have been ditching one martech vendor in lieu of another (51% of the time). Or replacing a homegrown system with a commercial solution (the other 49%).

Frankly, I was surprised by how often homegrown systems were being replaced. That’s fodder for another study of its own about just how much homegrown martech — sometimes called “dark martech” because of how little industry-wide visibility we have into it – there is out there. The results of this replacement study suggest the answer is: a lot.

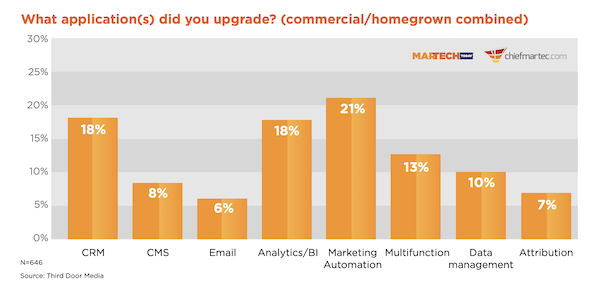

The top three most likely applications to get replaced, commercial or homegrown?

- Marketing automation (21%)

- CRM (18%)

- Analytics/BI (18%)

But why do marketers swap out software?

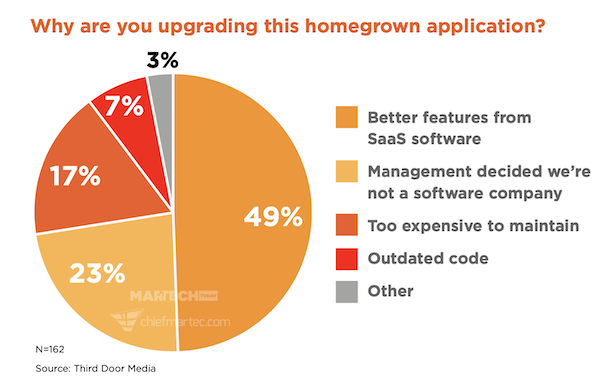

The answers differ for commercial vs. homegrown systems. For homegrown martech, the reasons are:

In nearly half the cases of homegrown martech being replaced, the motivation is to get better features from a commercial SaaS application.

This seems like basic comparative advantage at work.

If a company is going to invest in building their own software — and I believe that many will (“software is eating the world“) — it should be for capabilities and customer experiences that are truly unique to their business. They don’t need to reinvent the wheel for common martech apps such as CRM, CMS, email, etc. (Although Lyft made a pretty good case for creating their own marketing automation platform, given how tightly it was entangled in their core business operations.)

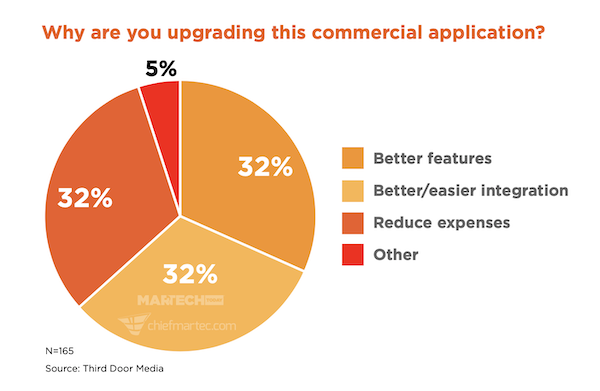

But with commercial, off-the-shelf packages from martech vendors, it’s a different story:

It was a remarkably even three-way split between better features, better/easier integration, and reducing expenses.

The one that leaped out at me: better/easier integration. That was as important – in some cases, clearly more important – than features and price. If an app doesn’t integrate gracefully into your existing martech stack, or you don’t have the freedom to augment it with new apps or even your own homegrown apps, then you’re going to switch.

This is the why platform ecosystems are the primary catalyst of the Second Golden Age of Martech. Marketers are demanding that vendors solve this problem for them. Vendors who do will take market share away from those who still pretend to “do all the things” and don’t play well with others.

What does this mean for martech vendors? Each of these categories provides martech vendors with a potential entry point to unseat an incumbent.

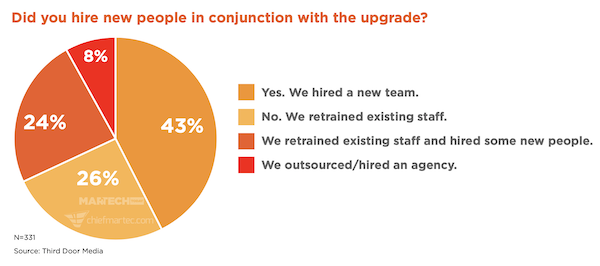

One more fascinating discovery from this survey was how companies handled hiring new staff versus retraining existing staff when switching martech apps:

In 67% of the cases, new people were hired as part of switching to a new martech solution. In fact, 43% of the time a whole new team was hired. Whoa.

Now, there are a couple of different possible causations behind this correlation:

- The old team wasn’t performing, so a new team came in, and the new team insisted on changing the martech stack as part of their turnaround.

- The company decided to pick a specific martech app or platform — an executive-level decision? — and felt they needed to hire people who had proven experience with it to implement it properly.

Which came first: the team or the martech app?

Either way, it’s a little scary the amount of turnover implied by this. If 83% of marketers are ripping-and-replacing a martech app every year, and 43% of the time that results in a new team for that app, that’s a new martech team — at least for that particular app — 36% of the time.

Granted, 50% of the time, existing staff are retrained — but only 24% of the time is replaced martech handled entirely by retrained staff.

Frankly, I’m surprised there isn’t greater investment in retraining. One can learn a new app. The institutional marketing knowledge that serves as the context in which those apps operate is much harder to pass along to new staff.

Brings us back to the Gartner report I shared last month that identified “investing in training and upskilling existing martech talent” as the #1 impediment to marketers achieving their business goals.

Definitely worth downloading the full report for more insights.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.