I’ve called the past decade of the 2010’s The First Golden Age of Martech. It was an explosion of both a new industry (martech) and a new profession (marketing technologists).

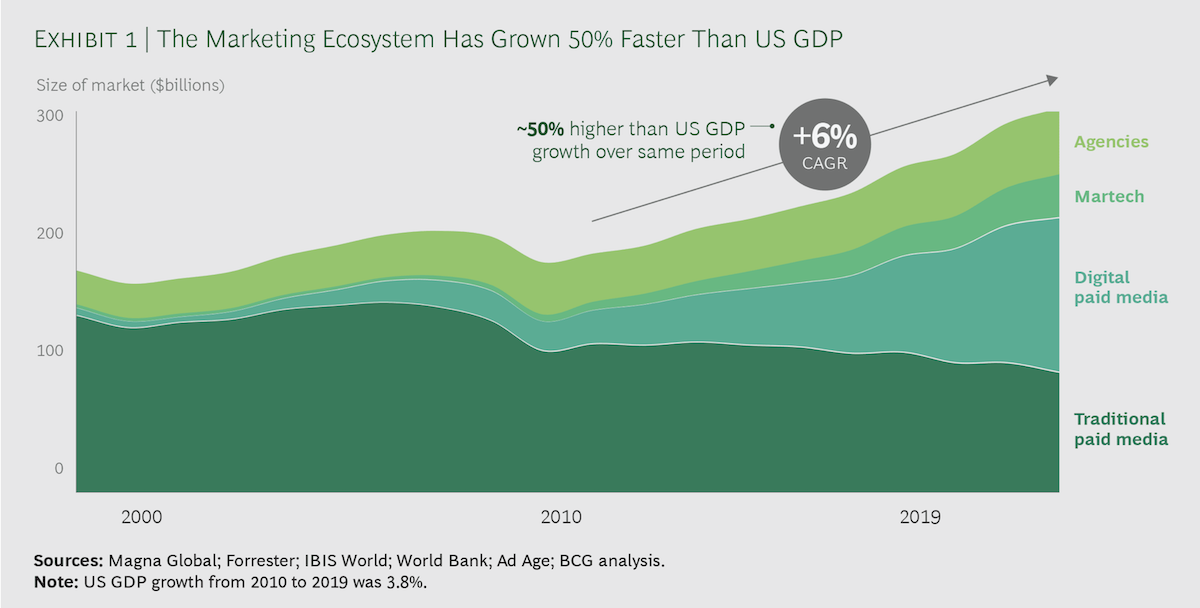

I’ve spilled a gigabyte of digital ink on why this next decade will be The Second Golden Age of Martech (including a recent update on how platform dynamics are driving this next wave). But today, I want to share with you the nice quantified measure of The First Golden Age of Martech shown in the chart above.

While working on my previous article — Why does the massive landscape of marketing services firms not bother people the way martech does? — based on research from BCG, I came across another article they published last month, Making the US Marketing Ecosystem Work for You.

Sounds a little like a public service announcement.

The article would be worth it just for the stacked area chart above, which elegantly illustrates several major changes in the marketing industry over the past 20 years:

- The marketing ecosystem — agencies, traditional media, digital media, and martech — expanded by around $120 billion over the past 10 years to a $300 billion total.

- Paid media continued to constitute the lion’s share of industry spend — in fact it grew to over $200 billion last year — but digital media overtook steadily declining traditional media.

- Spend on agencies stayed approximately the same throughout, ~$50 billion/year, but therefore declined as a percentage of spend.

- Martech grew from around $2 billion in 2010 to about $35 billion in 2019 — on the order of 1,650% growth in ten years. It accounted for nearly 30% of the economic growth in the total marketing industry in this past decade.

- As BCG points out, the whole marketing ecosystem grew about 50% faster than GDP in the US, at a 6% compound annual growth rate (CAGR) compared to the 3.8% growth for GDP.

Overall, BCG estimated there are around 60,000 companies who make up that marketing ecosystem, taking a bite of that shiny $300 billion apple.

They didn’t provide the split, but if it’s at all like the European market I wrote about last time, the vast majority of those firms are small agencies. From my research, only about 10% are martech companies. So, yes, Virginia, there are a lot of martech companies. But they’re only 1/10th of the industry.

Anyway, I recommend reading BCG’s full article for more interesting nuggets. I’ll leave you with one anonymous quote they included which makes me smile, as I’ve been shouting this in the wilderness for a while:

An agency executive said, “Consolidation of platforms is actually creating whitespace for point solutions.”

For further elaboration on that concept, see Platform dynamics driving martech app expansion and consolidation explained in one (relatively) simple model.