Just last month, I wrote that salestech is the new martech, and that it’s supercharging both professions. Here’s more data to support that case.

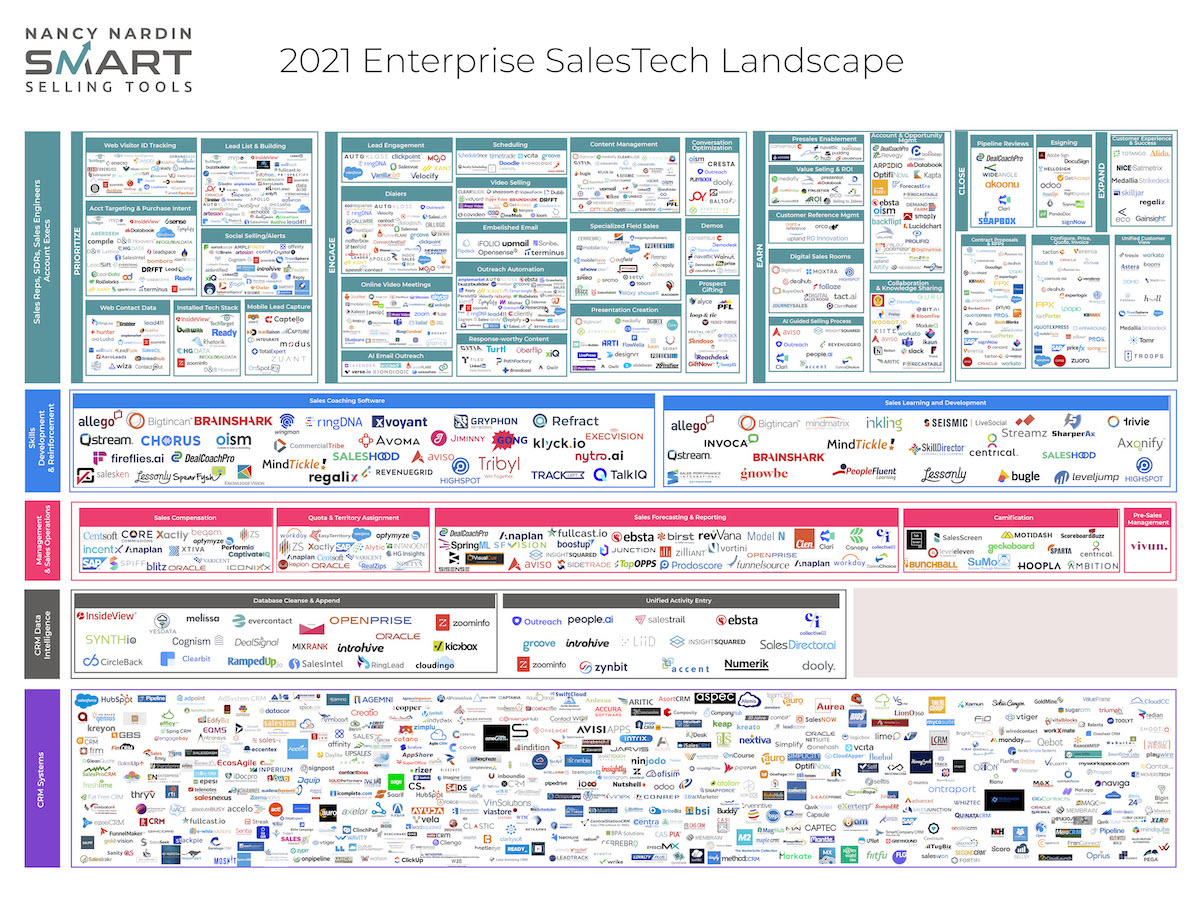

First, the 2021 Enterprise SalesTech Landscape above, produced by Nancy Nardin of Smart Selling Tools, was released last week. It now features 1,078 solutions across 45 unique categories.

It reminds me of when the 2014 Marketing Technology Landscape hit ~1,000 companies. It was a real inflection point in the martech industry — both for investors and startups, who started to pour into the space, and for marketers, who began to take martech seriously as a major pillar of their department.

(A month later, I wrote What if 1,000+ marketing technology vendors were the new normal? — which seemed outlandish to most people at the time. Of course, now that we are up to 8,000 martech solutions and climbing, that prediction seems rather quaint in hindsight.)

Is 1,000+ salestech solutions the new normal now too?

My bet: yes.

I wrote a lot last year about The Great App Explosion and how platform dynamics are driving simultaneous app expansion and platform consolidation in martech. I believe those same dynamics apply to salestech as well.

But that’s mostly a supply-side view. What about the demand side? Why are sales teams suddenly embracing so many new apps?

Arguably for the same reason marketers ended up embracing so many martech tools: their profession has changed to be weighted much more toward digital interactions. In a digital world, apps are the tools of your trade.

And 2020 gave us quite a crash-course in digital selling.

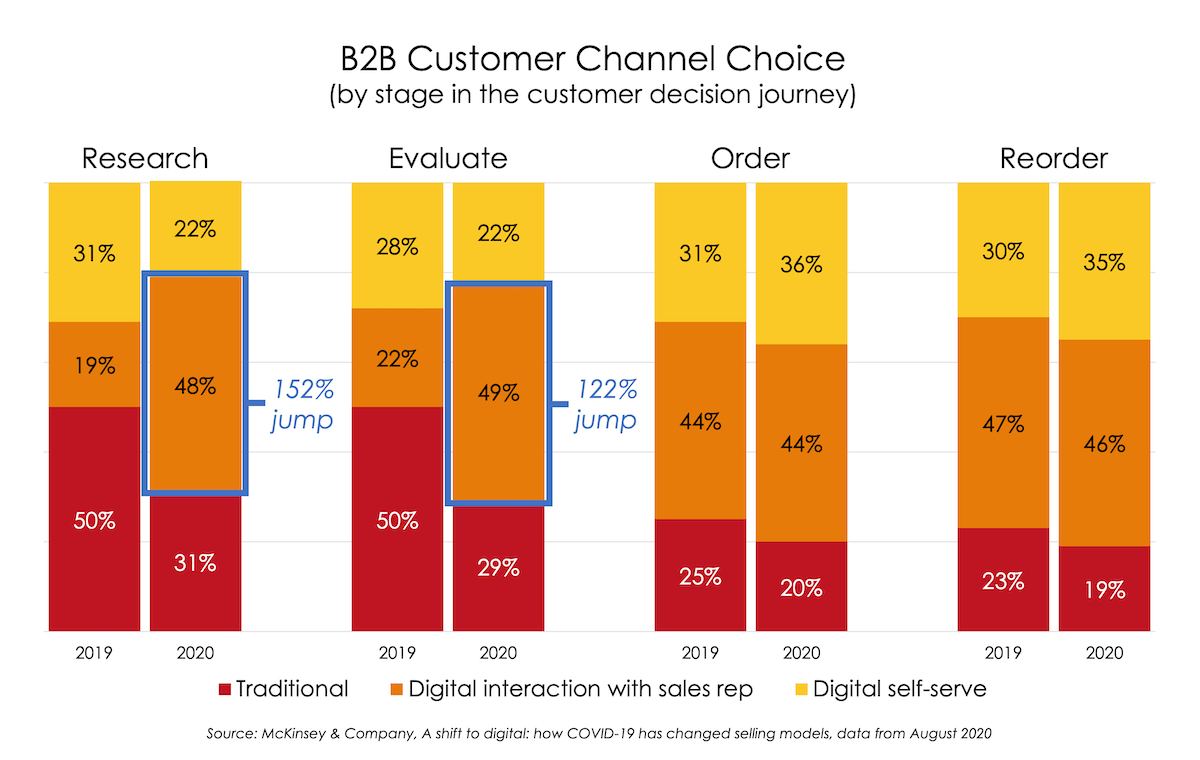

This past weekend, I read McKinsey & Company’s latest report, A shift to digital: how COVID-19 has changed selling models for B2B companies. I recreated the following chart based on their data that shows a remarkable shift in the channels that B2B buyers choose for researching, evaluating, ordering, and reordering:

From 2019 to 2020, traditional buyer/seller interactions were down across the board. Not surprising. What is remarkable, however, is how many interactions were redirected into “digital interactions with a sales rep” — even at the expense of “digital self-service” options.

In the research stage, digital interactions with sales reps jumped 152% year-over-year. In the evaluation stage, they jumped 122%.

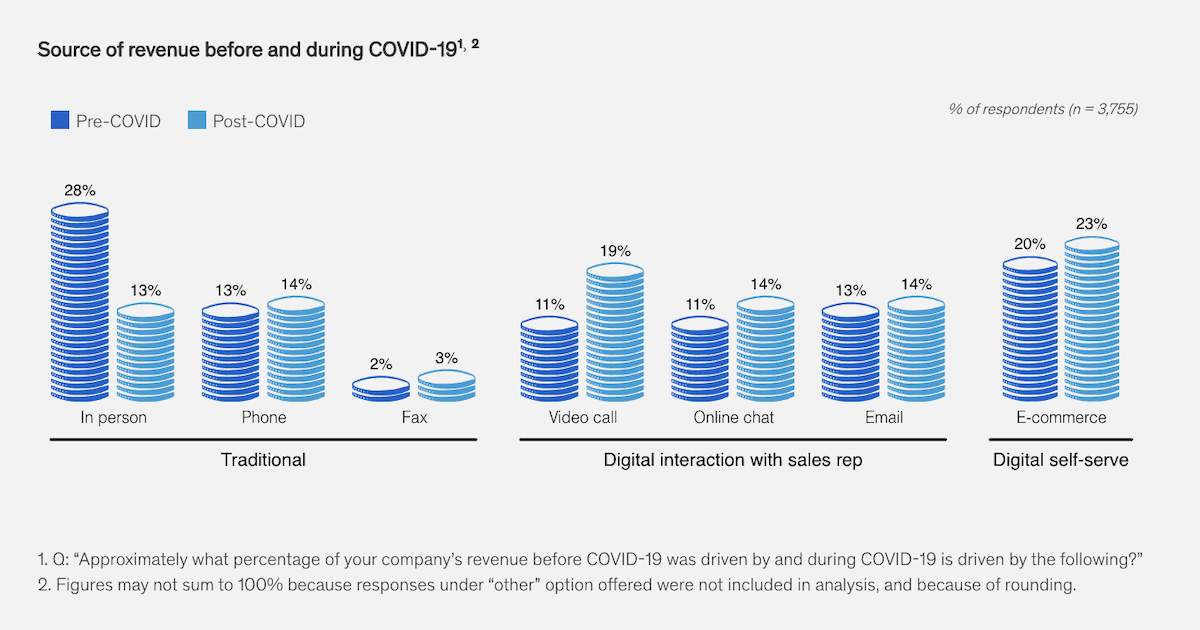

These digital interactions with sales reps could happen over email, online chat, or a video call (graphics below from the McKinsey article):

The key characteristics:

- It’s a real human salesperson engaging with the buyer.

- The engagement is happening through a digital channel — which makes it malleable and measurable through software.

From those two seeds, a whole field of salestech capabilities blossoms: optimizing those engagements through data and AI-assisted scheduling, state-of-the-art demos and sales presentations, AI-powered sales coaching, sales rep learning and development, sales compensation and gamification, deeper forecasting and pipeline reviews, CPQ and RFP tools, a plethora of CRMs, and more.

These products feed on the data trail of digital interactions while augmenting salespeople with bionic powers to impress and delight customers. New sales motions and playbooks are being forged, fertile ground for innovative products and processes.

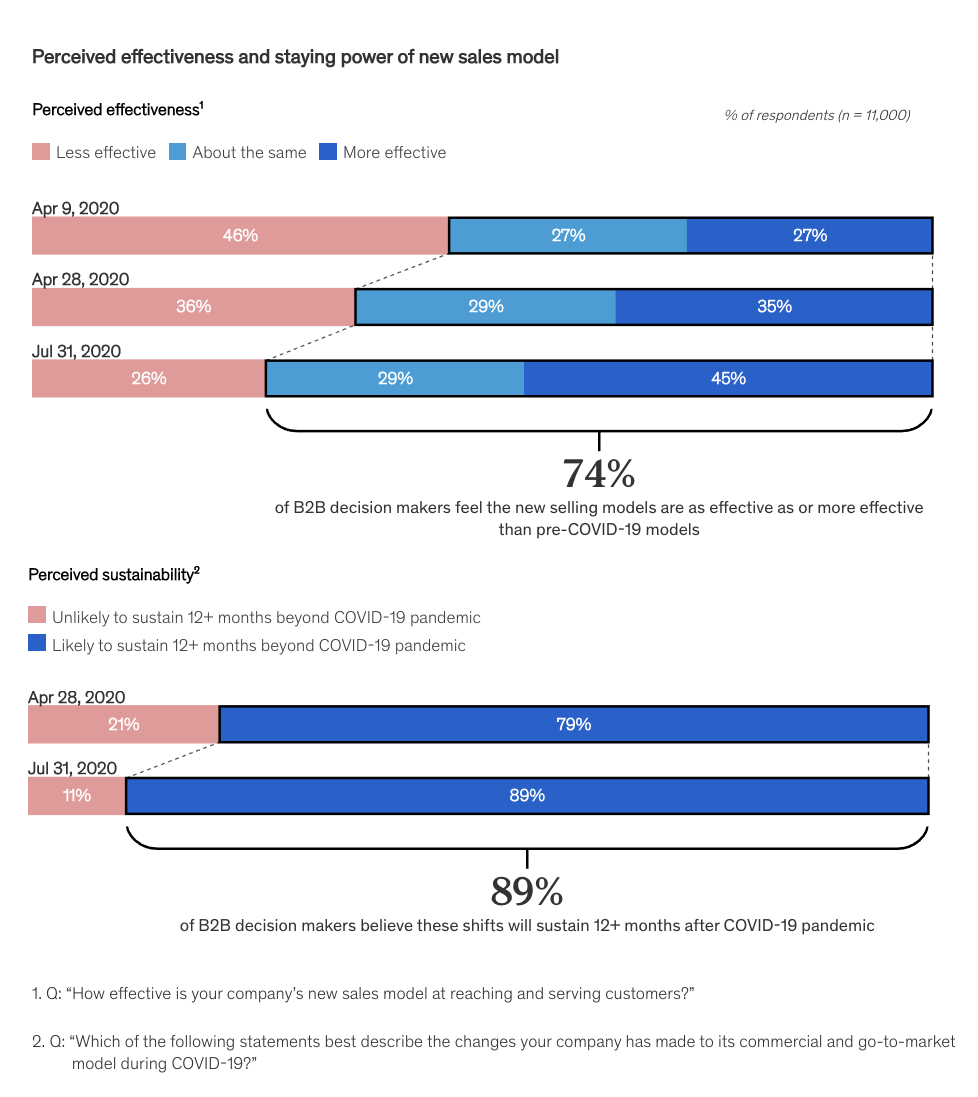

There’s no going back from this inflection point. In McKinsey’s study, 74% of B2B decision makers say these new selling models are as effective as or more effective than pre-COVID-19 models. (Notice the growth from 27% to 45% reporting these new models as more effective from just April to July.)

And 89% believe these shifts will sustain 12+ months after the CVOID-19 pandemic.

Welcome to the Golden Age of Salestech.