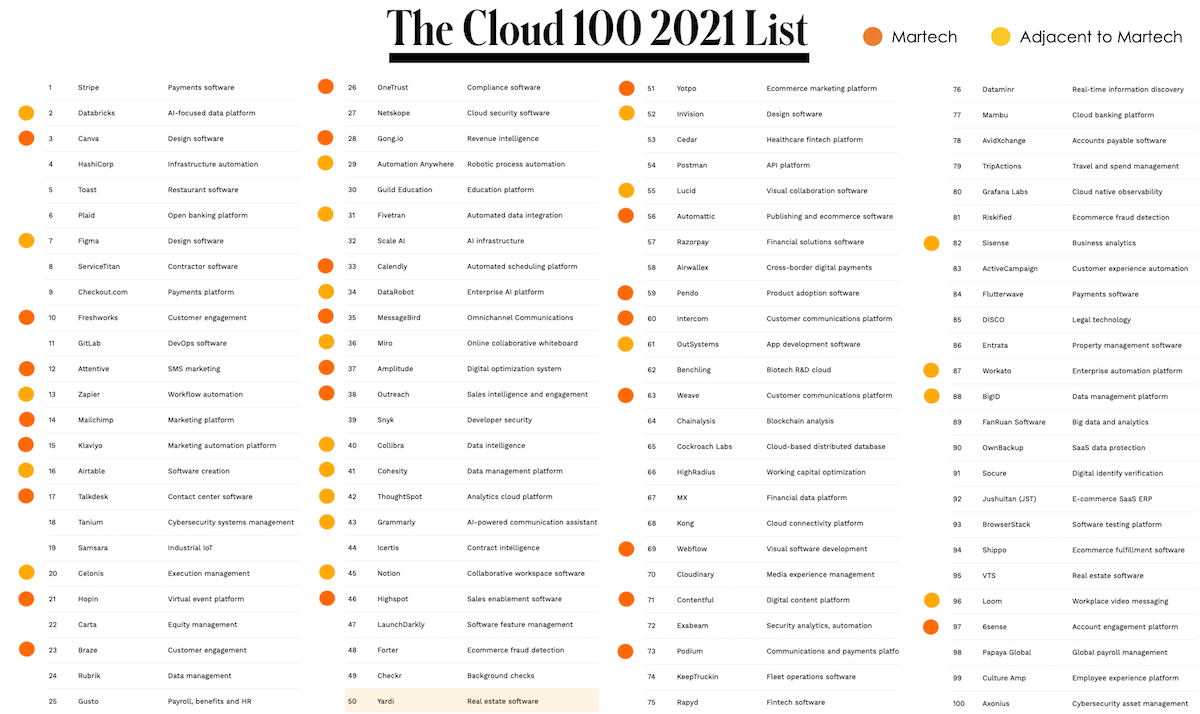

Last week, Forbes published the 2021 edition of The Cloud 100 — their “definitive ranking of the best, brightest, most valuable private companies in the cloud.”

The selection process involved an unpublished editorial formula that considered growth, sales, valuation, culture, and a “reputation score derived in consultation with 34 CEO judges and executives from their public-cloud-company peers.” Or, in other words, don’t read too closely into the exact ranking of any one company — there’s some artful hand-waving here, in constrast to, say, the Fortune 500 list that is solely based on a public, quantitative measure (total revenue for a fiscal year).

Nonetheless, even with that caveat, it’s an impressive list. Based on the valuations available to the editors — remember, these are private companies — they represent a total market value of $514 billion.

What popped out to me, of course: 35 of these 100 companies are in or around martech.

Well, technically 19 of them are very specifically martech/salestech companies, while an additional 16 are “adjacent to martech.” The adjacent companies offer products for data management, design, workflow automation, collaboration, etc., that aren’t solely for marketing and sales functions. But they are important and popular pieces of the modern martech stack.

The martech/salestech-centered ones include: Canva, Freshworks, Attentive, Mailchimp, Klaviyo, Talkdesk, Hopin, Braze, OneTrust, Gong.io, Calendly, MessageBird, Amplitude, Outreach, Highspot, Yotpo, Automattic, Pendo, Intercom, Weave, Webflow, Contentful, Podium, and 6sense. (Congratulations!)

Consider: how many of these companies would you have recognized two years ago?

If you were hanging out with a CMO at a bar — as one did, two years ago — and ran through this list to ask them what each of these companies did, how many would they get right?

My bet would be about 1/4 on average. (They almost certainly wouldn’t have known Hopin, as the company had only been around a couple months at that point.) And for the ones they did recognize, they would regard most of them as startups on the periphery of their world at best.

Yet two years later, they’re among the top private software-in-the-cloud companies.

17 of the companies from last year’s Cloud 100 list went public in the past 12 months, so there’s some historical evidence that this Forbes list does correlate with reality. Many of these martech companies may soon join the public company circle of Adobe, HubSpot, Salesforce, etc.

My point is that if you were claiming a few years ago that martech had run its course and everything was going to consolidate down to small number of players, you almost certainly wouldn’t have included this year’s Cloud 100 martech companies in your list.

Now, that doesn’t mean martech might not yet consolidate further. (See platform dynamics driving martech app expansion and consolidation for the best explanation I can offer.) But who are the consolidators and who are the consolidated isn’t necessarily what one might have thought of two years ago.

Consider then that the martech startups today that you may not even yet heard of, two years from now might be significant forces to reckon with too.

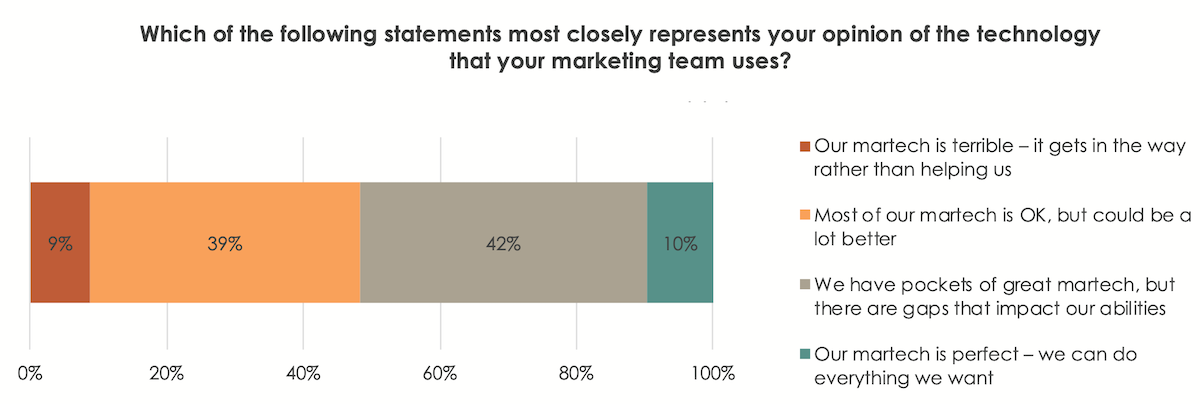

As I wrote last week in covering The State of Marketing Operations report from BrandMaker, there is clearly still implicit, if not explicit, demand from CMOs for better martech solutions:

The market will address that opportunity.