As with crime and politics, if you want to reveal the real plot in marketing’s evolution, follow where the money is going. Hmm. That’s probably not the most flattering of metaphors. Okay, scratch that image.

But it is why I always look forward to Gartner’s annual CMO Spend Survey report. Allocation of budget is a CMO’s way of “voting with their wallet” for what they think is most important. Grab a copy of The State of Marketing Budgets 2021 and the accompanying deep-dive into The Role of Marketing in Digital Transformation & Innovation to puruse for yourself.

I’ll skip over the most common headline from this year’s report — that as a percentage of their firm’s revenue, marketing budgets dropped precipitously from 11% to 6.4%. Yowzers. You can pretty much sum it up with a Tom Fishburne cartoon:

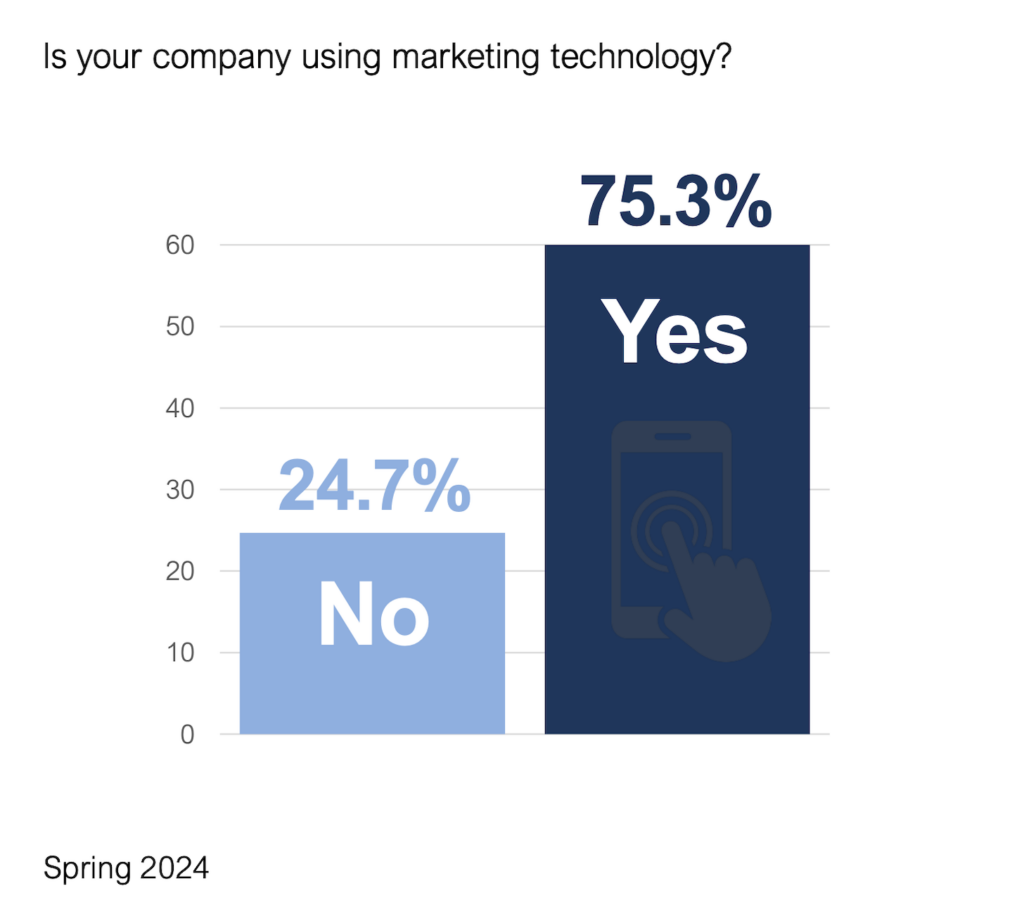

It’s worth noting that as a percentage of that budget, “martech” (in the broadest sense of the word) remains the largest category at 26.6%, followed closely by paid media (25.1%) and labor (25%). Nonetheless, given the amount by which overall marketing budgets shrunk, money for martech was certainly squeezed this year too. Probably good to tighten up discipline there.

(I find myself humming, “Money for martech and clicks for free” to an old Dire Straits tune.)

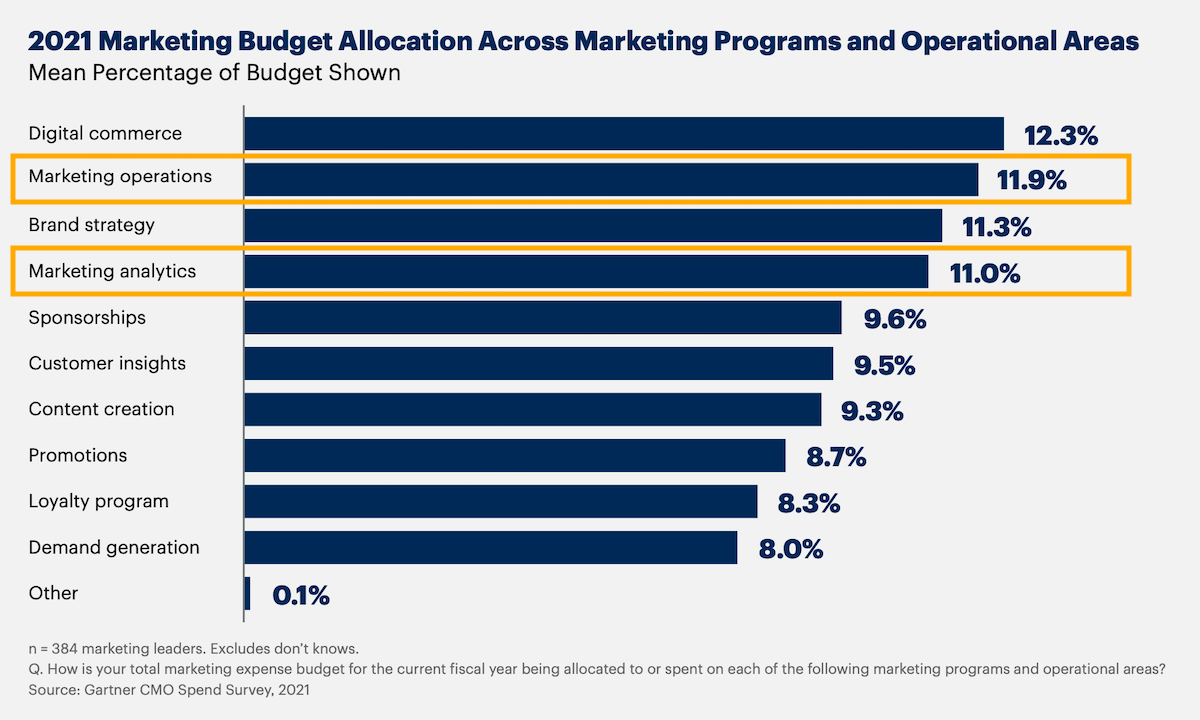

But the most interesting findings to me were the chart at the top of this post and the one below. The first shows marketing operations as the #2 largest program/operational area where 2021 marketing budgets have been allocated — on average 11.9% of the budget. Closely related, marketing analytics was ranked #4 with 11% mean budget allocation.

That’s good affirmation that marketing operations is a major pillar of marketing now.

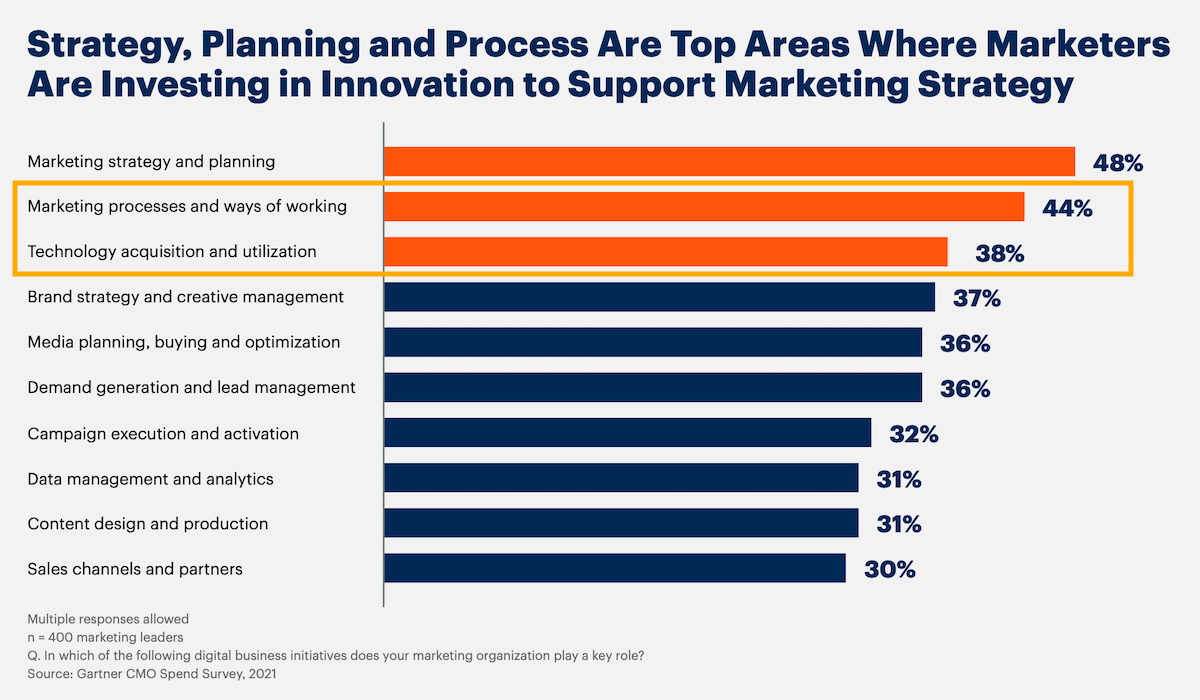

But even more interesting, the Digital Transformation & Innovation deep-dive reported that 72% of marketers were increasing investment in “marketing innovation” this year. Makes a ton of sense in the current environment that has required rapid adaptation — as well as preparing for “the next normal” we’re barreling headlong into.

But where specifically is marketing innovation investment being directed?

First and foremost, innovative marketing strategy (48%).

But #2 and #3? Marketing processes and ways of working (44%) and technology acquisition and utilization (38%). In other words, marketing operations and martech.

Innovating “marketing processes and ways of working” is particularly exciting to me. Because in general, I’ve seen the bottleneck to getting the most value out of martech investments isn’t the technology itself — it’s the organizational capital that needs to get built around these new capabilities.

Just a little more evidence that, indeed, ops is sexy these days.

I am utterly astonished that ‘Demand generation’ ranks at 8% of marketing budget allocation.

have we lost our collective minds? or am I misreading the data.

if marketing is not about generating demand, I have just wasted the last 45 years of my life, as well as being deluded along the way.

My guess — and without having Gartner’s raw data, it’s only a guess — is that this is a quirk of the survey. The percentage of each of these programs/areas is the mean for all participants. Since “demand generation” — as an official program name — is more common in B2B, while the enterprises Gartner serve include a ton of giant B2C firms, there may have been wide variance in this answer. A few B2B’s ranking demand generation high could have been weighted down by many more B2C firms ranking it low.

The second thought is that a lot of the individual elements that go into demand generation — content creation and marketing operations — were broken out separately.

Isn’t Digital commerce the post pandemic way of demand generation?

Excellent point.

I would imagine that martech as an umbrella captures a lot of the demand gen $. IE CMOs are buying technology-enabled demand gen solutions. EG if you spend $30k on a ZoomInfo SaaS subscription, that might be categorized as martech spend rather than what it actually is which is buying lists = Demand Gen.

Agree on 8% Demand Generation surprise. That’s the fuel for CRM & MA. Critical, especially if you like to track and measure performance.

Survey design aims to reflect how marketers speak about their dollars, so you may want to look at demand generation as including ‘loyalty’ and ‘digital commerce’. In my opinion, demand generation as a survey response choice suffers from a perceived narrowing of its scope/impact. Digital Commerce and Loyalty are both ways to focus demandgen efforts on an outcome. Even in B2B we see a focus on direct to customer and customer retention through digital means vs classic demandgen which can suffer from lead quality issues in that GTM model.

Looking toward the future, I think the focus on creating new operating models and analytics will persist for a couple of years because marketing organizations need to scale the impact of the tech they’ve already bought. Longer term, if those efforts have an impact, then I think you will see content design and production start to dominate if ROI at scale starts to be delivered.

I can’t get past the absurd-on-its-face finding that marketing budgets fell by almost half. No other survey suggests anything like that; mostly, we hear about budgets rising — and a huge year on year increase in media spend in particular. The martech industry would be suffering hugely if budgets had fallen anything like that much, we’d be seeing mass layoffs from staff budget cuts, etc. If the topline data is so questionable, how can you take any of the components seriously?.

Paging Gartner media relations.

Lol at 8% of Demand Gen. Get a clue.