REMINDER: don’t miss the upcoming INAUGURAL EPISODE of chiefmartecTV live with David Raab this Friday, June 10 at 2pm EDT.

Last week was a big week for marketing technology M&A news.

Two billion-dollar M&A deals: Marketo was acquired by private equity firm Vista Equity Partners for $1.79 billion and Demandware was acquired by Salesforce for $2.8 billion. (Granted, these deals aren’t closed yet, but for now, let’s take them at face value.)

What does this mean for marketers and the industry?

After reflecting on it for several days — I hate to make rushed, from-the-hip statements just for the sake of hitting a news cycle — I’m inclined to conclude: not a tremendous amount.

Sorry, you were expecting something more dramatic?

That’s not to say that either of these is a bad deal — for the acquirer, the acquired, or their respective customers. On the contrary, I think they’re both quite good for all parties involved. But neither one significantly alters the structure or dynamics of the industry.

Marketo’s deal isn’t industry consolidation — at least not yet

Let’s start with Marketo.

Marketo’s acquisition by Vista is not “consolidation.” It doesn’t result in fewer marketing technology vendors in the marketing technology landscape. Marketo remains Marketo, an independent company, albeit under new, private ownership.

Consolidation would have been if an existing marketing software giant — Adobe, Oracle, or Salesforce — had acquired them, particularly if they sought to phase out the Marketo platform as an independent offering and absorb it into a competing product. Someday the industry may see such large-scale consolidations, but we’re not there yet.

On the contrary, Vista’s acqusition significantly reduces the likelihood that Marketo will be absorbed in a pure consolidation play anytime soon. In the short-term, Marketo obtains:

- Deep-pocketed financial support for growth in sales, marketing, and R&D.

- A multi-billion dollar vote of “staying power” to assure customers of stability.

- A reduced risk of destructive consolidation at the hands of a competitor.

- Freedom from the often short-sighted quarterly demands of Wall Street.

- Potential benefits of a private vs. public company in stealth and agility.

These attributes are particularly valuable as Marketo executes its ambitious Project Orion, a bottom-up rearchitecturing of their platform around ultra-high-scale data engines. (The luxury of such a grand rewrite is not something that enterprise platforms easily carve out — but in a space such as ours, where so much has changed in the past decade since Marketo was first designed and engineered, it’s a powerful opportunity.)

Of course, Vista is in the business of making investments, and they’ll certainly want to exit with a nice return at some point. I’m going to estimate that’s at least two years out though — long enough to build up sufficient return.

It’s possible that they may sell to a direct competitor — true consolidation — at that time. But if Marketo is successful, it will likely be more valuable to buyers who would want to nurture that growth even further, either (1) a larger enterprise not fully in this space yet (e.g., Microsoft is a great example, which is why they were rumored to be a likely suitor in this most recent round), or (2) the public markets again, who may greater appreciate Marketo at a different scale under different circumstances.

So this is not consolidation today, and may not be even a couple of years from now.

That being said, there are possible consolidations that could result from this deal:

- Vista could provide Marketo with capital to make more acqusitions.

- Marketo’s continued growth in marketing automation (and related categories) could further reduce opportunities for small players in that space, driving the industry towards more of an oligopoly.

- Vista could combine Marketo with other marketing tech ventures in its portfolio — for instance, Cvent — to attempt to create a larger enterprise marketing software company with a bigger footprint (although it would be highly unusual for a PE firm to orchestrate something like that).

I think the first two are likely. The third not so much, but an interesting thought exercise.

However, as an ironic counternarrative to consolidation, it’s possible that the Vista deal may also promote greater diversity in the marketing tech landscape, intentionally or unintentionally:

- Strengthening Marketo’s ISV ecosystem (intentionally). Marketo has championed a platform strategy more vocally than many of their peers with their LaunchPoint program. I think it’s an underappreciated strategic asset, but one that still has incredible potential. As Marketo grows, the dynamics of such a platform should naturally feed a virtuous cycle: a larger customer base attracts more ISVs, which in turn attracts more customers, and so on. But if Marketo and Vista put more weight behind this — for instance, a richer set of APIs for Project Orion combined with a greater marketing effort on an open marketing platform position — they could accelerate those dynamics significantly.

- Enabling key Marketo employees to start new ventures (unintentionally). Marketo alumni have already started two marketing technology companies — Captora and Engagio. With the all-cash deal from Vista, a number of other employee stockholders may decide it’s time to set off on their own. And what domain do they have the most expertise in? Applying software to marketing. Surely they’ve observed many other challenges that marketers still face that they may seek to tackle entrepreneurially. After all, the Vista deal reminds everyone that successful founders can reap huge financial rewards.

Salesforce acquiring Demandware is a challenge to IBM, Oracle, SAP

The acqusition of Demandware by Salesforce is slightly closer to industry consolidation — where there were two logos on the marketing tech landscape before, albeit in completely different categories, there will now only be one.

But that strikes me as mostly corporate, not product, consolidation: Salesforce did not compete with Demandware, nor vice versa. On the immediate horizon, it’s unlikely to significantly change the dynamics of who buys Demandware as an e-commerce platform and what they do with it. Perhaps it marginally helps the Demandware platform’s perception of longevity in the market — but they were already perceived as a strong, indpendent public company.

The main effect of this deal is to position Salesforce — the company — as a growing competitor to IBM, Oracle, and SAP. Each of those competitors have had a strong e-commerce offering (IBM Commerce, Oracle ATG, SAP Hybris). With the growth of digital commerce as an increasing priority for businesses, this was an increasingly significant gap in Salesforce’s portfolio. (The same is true for Adobe, which I heard was interested in Demandware as well, so Salesforce may have been extra happy to snatch it up.)

Again, I think this is generally good for Salesforce, Demandware, and their customers.

But I’m skeptical of how deeply Salesforce will integrate Demandware with the rest of their products. Sure, there will be some cross-product enhancements that will be helpful. But it’s not clear that those cross-product wirings will be significantly better than what is achievable through their respective APIs and ISV support capabilities — certainly Salesforce has been an ISV superstar with its AppExchange and Demandware has a very impressive ISV community in its LINK Marketplace.

Salesforce will certainly get leverage from having Demandware in its portfolio — particularly with its enteprise relationships and growing partnerships with major systems integrators and marketing service providers.

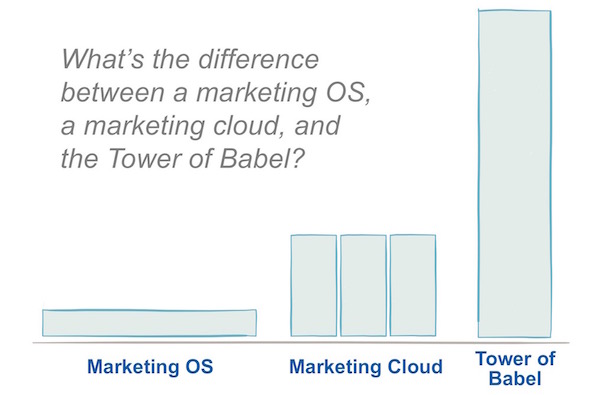

But there’s a reason that, for instance, Oracle’s ATG e-commerce platform is not tightly integrated with their Eloqua (B2B marketing), Responsys (B2C marketing), or BlueKai (DMP) products. These are each massive products in scale and scope on their own. Maintaining and innovating each of them independently is a Herculean undertaking. Attempting to combine each of these incredibly complex products into some fully entwined “superstack” strikes me as the marketing software equivalent of the Tower of Babel.

There are architectural advantages to keeping the major components of a “marketing cloud” relatively independent of each other. In software development terms, Salesforce’s acquisition of Demandware is more like “horizontal scaling” than “vertical scaling.” But I think that’s what makes this a good, solid move.

What do you think?

Scott,

An insightful analysis, and I bow to your great domain knowledge.

However, I am reminded every time I look at your graphic of Bruce Hendersons ‘Rule of three and four’ http://tinyurl.com/jrf4bf8 which I have found over a very long time to hold a lot of water.

Assuming this is the case, the landscape is ripe for a massive rationalisation, at some point.

I am also pretty sure that the level of innovation opportunities around will keep the environment pretty fluid for a while yet.

What a great time to be an ‘active observer’!

“Assuming this is the case, the landscape is ripe for a massive rationalization, at some point.”

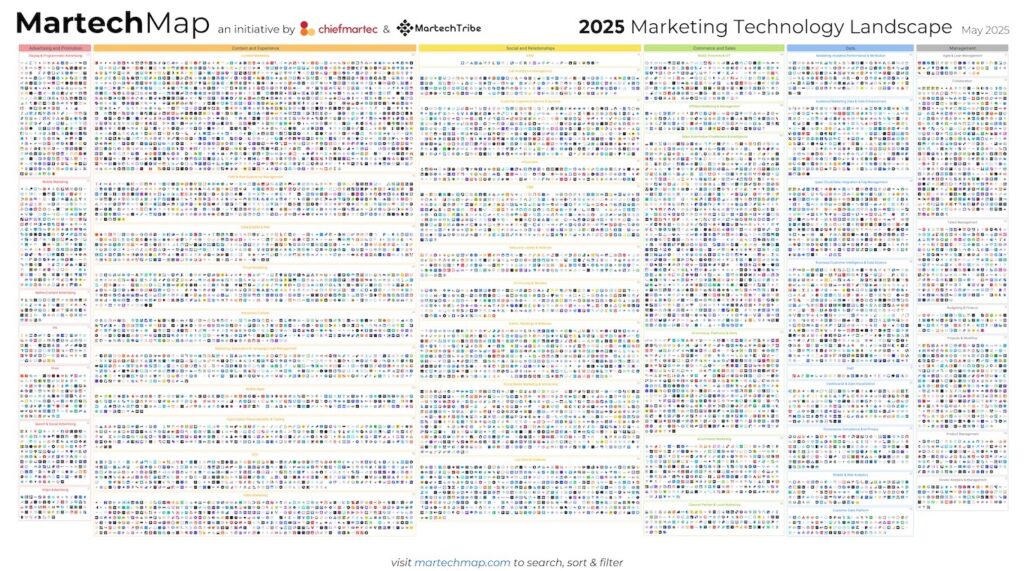

Fully agree that rationalization is what will precede consolidation. I believe the reason we’re not seeing massive consolidation is due to the wide disparity of offerings. There are thousands of martech products that are difficult to classify due to the endless changing features within each. It makes it nearly impossible to create apples to apples comparisons, as many products would require a category just for themselves.

The space is still relatively immature. There’s been little time for maturity to set in as the tech continues to innovate and digress in various directions rapidly. The “window dressing” of features by providers further complicates the landscape. Buyers/users of these products still don’t really know what value they get for the cost (beyond licensing – resulting expenditures like personnel changes, consulting needs, organizational disruption, downstream IT impacts, risk exposure, etc.), which means there’s still a boatload of offerings that could go extinct as soon as someone can quantify their ROI (or lack thereof).

At that point we should see players dying off, winners emerging, and the rationalization of offerings into cleaner categories. That is when I’d expect to see the consolidation phase kick in to high gear. Not seeing many signs of it yet, so for the time being we seem stuck with a confusing marketplace full of products with questionable value propositions.

Prior to the consolidation, there must come understanding.

Mike you are right that the frills obscure the realities of the products and their claimed benefits, but it is also up to marketers to understand the numbers to be able to make apples to apples comparisons.

Sadly, marketers as a ‘breed’ are sadly lacking in the numbers department, so seem unable, perhaps unwilling to do the hard yards to identify the reality from the bullshit.

My view is that marketers need to get back to the basics of strategy, understand the means by which strategy can be implemented and measured, and resist the temptation to chase the latest shiny tool…. sorry, Toy.

Bob Hoffman on his Ad Contrarian blog has been ranting about this for some time, and Australian professor Mark Ritson adds to the fray regularly, most recently at the AANA conference last week with a monumental (well worth watching) rant https://www.youtube.com/watch?v=IJF7C1jvjXM based on numbers. These numbers expose much of the bullshit surrounding the marketing of digital products.

My business is advising small and medium businesses on strategy and marketing. Those running these businesses are as attracted to the shiny thing as any marketer as they are time poor, seeking any antidote, but they are often being sold a pup by marketers and digital product purveyors who start every conversation with the answer in mind.

Hey, Scott

agree across the board on the two acquisitions

this is more about the end of the piece and the 3 examples (Marketing OS, Cloud and Babel):

what continues to be missing is the middleware layer that conveys data and intelligence to the right outward facing channels at the right time with the right context. Marketo is moving in this direction with its new release this August of the new RTP (Real Time Personalization) release.

but the actual knitting of AdTech, MarTech and Sales Enablement still needs work

I am consistently amazed at how the big dogs talk about this and can never provide proof of life

so I guess the Marketing OS is yet to be hatched and companies like ours and others are on it and will check in with you

thx for all

Charlie

Hey Scott, great post. On Demandware, there are a couple of other key points to consider.

1st: The data side –

Oracle, SAP & IBM don’t have those e-commerce engines in the cloud, but Demandware does. I know Demandware was already considering all sorts of initiatives associated with the incredible amount of behavioral data they have on shoppers across all varieties of retailers. And remember, its not always about the individual level data (albeit as 1-1 marketers, we get the importance of that on true customer behavior predictions), but also aggregated to spot trends in demand/shopping patterns.

2nd: The e-2-e connected customer experience. I believe SF recognized that they had a huge gap in their ability to tell a full story on this, and now they are in a better position. Simple things like getting a promotion and automatically having it applied at checkout. Product catalog better integrated with marketing promotions. Price optimization, etc…So although I agree they will still sell a stack of stuff, they will also be in a good position to weld some key areas together better and sell a vision for a more seamless experience.

Hi Scott et al,

Great discussion. A few thoughts:

Marketo was an earnings-negative public tech company that just spend 25%+ of its eng on its new backend (Orion.) Both Orion and the PE move were brilliant. The old backend was not competitive for large enterprises and the future on the public markets was not great. Risk of lower stock price leading to hostile action. Microsoft missed out, let’s see if Google is in the future. Eloqua did the same math.

Re: SF/DW: ecomm was a missing tooth in SF’s customer facing IT (CFIT) smile. They had to buy the largest, independent, cloud-based solution. Good move.

Consolidation: It has already happened. It is a weighted function based on revenue. 80%+ of market is now owned by a handful of companies. The rest will battle against innovation and attrition – trying to find a niche and outgrow their funding horizons. Consolidation in a market with 3,000+ companies will not happen on a headcount basis, not enough M&A $ or time for that.

Best to all,

Gerry

Great points on all counts, Gerry.

It is an interesting question to ask what is meant by consolidation:

1. Revenue distribution.

2. Number of companies.

3. Feature consolidation.

4. Number of installations.

5. ???

They’re all different. My landscape shows #2. As you suggest, the largest companies in the space have the bulk of #1. But then you get open source and inexpensive products — e.g., WordPress — that have wider adoption than all the enterprise software giants combined for #4. And #3 seems quite diverse.

Food for thought. Thanks!