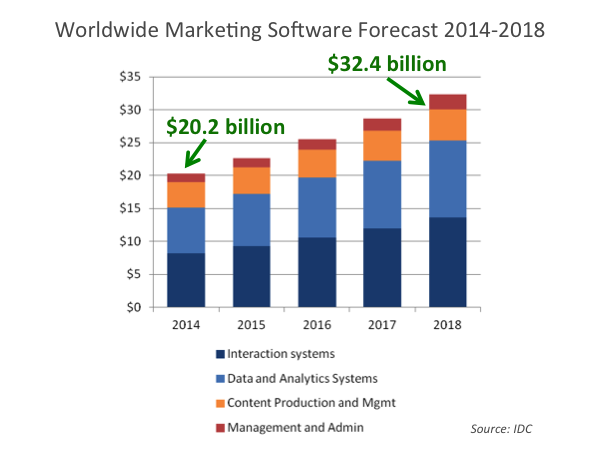

How big is the market for marketing software today?

Gerry Murray at IDC has an answer to that question, which he announced in a blog post last week: $20.2 billion here in 2014. He expects that the market will have a compound annual growth rate (CAGR) of 12.4% for the next five years, resulting in a $32.4 billion market by 2018.

IDC breaks that market down into four broad categories:

- Interaction Systems — the majority of customer-facing marketing software advertising, digital commerce, marketing automation, web experience management, mobile apps, social media tools, etc.

- Content Production and Management — internal authoring and publishing tools, CMS platforms, DAM platforms, etc.

- Data and Analytics — storing data and producing insights from it, such as business intelligence, predictive analytics, financial analysis, and broader marketing analytics.

- Management and Administration — internal communications tools, workflows, budgeting, expense tracking, MRM, project management, collaboration tools, etc.

That’s just the software itself — although IDC predicts the rise of “marketing-as-a-service” (MaaS) offerings, through which agencies and other marketing service providers run the software on behalf of their clients, as part of a larger bundle of services. (I confess, I harbor some skepticism around the dynamics of agencies as the landlords of a brand’s marketing technology infrastructure — but that’s a topic for a whole different post. Either way, it won’t reduce the demand for the underlying software.)

The last time I saw a hard figure on this market was two years ago, with Dan Salmon’s estimate of $12.1 billion, which at the time represented 1% of global marketing spend.

If you take these numbers at face value, the marketing software market has grown by 67% in just two years — which when you’re starting with $12 billion as your baseline, that’s rather impressive.

But again, it’s still just a drop in the bucket in overall marketing spend. To put this in context, the most recent estimate of global advertising spend (just media purchases) from ZenithOptimedia is $523 billion in 2014. The spend on marketing software will be just 3.8% of what we spend on media this year.

However, the trend lines are certainly in software’s favor. Meanwhile, the advertising world is eyeball-to-eyball with a tremendous number of cataclysmic disruptions, such as:

- Print faded and TV advertising isn’t what it used to be (TiVo, HBO, Netflix, Amazon).

- Display advertising is a poor substitute (ad blockers, banner blindness, fraud, hate).

- Programmatic media buying is squeezing the margins of traditional agency cash cows.

- Data has forced greater transparency and performance-measured accountability.

- Search engines and social media thwart PR spin and inauthentic brand advertising.

Sorry, I keep drifting into wanting to write that post about the future of agencies. Soon enough. But my point in this article is simply that each one of those losses of territory in “advertising” stands to be replaced by other kinds of market engagements that are driven by software.

Put another way, I do think that $21.8 billion of venture investment in marketing technology is a pretty good bet.

IDC’s complete research report is available for purchase on their site.

Hi Scott,

Thanks for writing about our market forecast. I haven’t seen Dan’s work but I just want to caution people comparing our numbers to other forecasts that most likely define the market differently. This forecast was designed to capture any and all software we expect to be provisioned for marketing which includes a lot of categories outside of the typical marketing automation or digital marketing/ad tech envelop.

On Marketing as a Service. It certainly won’t work if agencies set it up as a lock-in model. That’s a non-starter. But fast forward a couple of years of maturity in platforms and agency competency and these offerings will be viable options for CMOs. The groundwork is already underway with Publicis deploying Adobe and Omnicom standardizing on Salesforce. It’s not an all or nothing proposition and it won’t be for everyone, but we expect it to be attractive for many CMOs particularly those that:

1) Lack the tech budget and organizational skill sets to own and operate a cutting edge marketing infrastructure.

2) Have made a hash of their marketing infrastructure and can’t afford another rip and replace.

3) Need to supplement their internal digital marketing capabilities.

As a bundled creative/infrastructure offering MaaS enables CMOs to acquire infrastructure as part of the agency relationship which they fund via ad dollars. As you point out the ad spend is half a trillion (going to 2/3.) If MaaS carves even a small percentage of the combined ad+tech market it is an enormous oppty.

Best,

Gerry

Hi Gerry,

I noticed that “Marketing Automation” does not appear, per se, in the note or graphic. You do include “Email Marketing” under “Direct Marketing”…have you included firms such as Oracle / Eloqua, Marketo, Salesforce / Pardot, IBM / Silverpop, Salesfusion and the various other MAP providers in this category?

Thanks,

Brad

Thank you for sharing this information, Gerry — greatly appreciated!

And good note on other estimates potentially being apples and oranges.

I do see the benefits of MaaS. I absolutely agree that agencies will need to work very closely with the marketing technology infrastructure that a brand has in place — far more than ever before. I think they will be the drivers of some of the most innovative ways to harness marketing software in the pursuit of delivering creative and compelling customer experiences. I believe their technical capabilities will grow accordingly, and in many ways, I expect that agencies will become ISVs on top of the major marketing platforms.

Where I’m a little less certain is whether or not they will be the “owner” of those platforms. The benefits you describe make sense. But the relationship that brands have had with technology has been relatively more permanent than their relationships with agencies. Yes, there are plenty of “rip-and-replace” stories out there. But those rip-and-replace projects have also been known to take years. It’s much harder to replace technology platforms than it is to replace your creative services provider.

By tying those two things together, if you end up being unhappy with either the creative or the technology — which still feel like two very different kinds of offerings — you either have to fire both or live with being unhappy with one half of that equation.

I do have other concerns around (a) the data, (b) brand ownership of customer experience, and (c) what “assets” a company should control in support of those things, which seem to become more complicated in a MaaS arrangement.

But, that being said, the benefits of MaaS that you present are valuable, and there are clearly companies that are doing this today. It’s a very different kind of agency relationship, but I am the first to acknowledge that clearly agencies NEED to change the nature of those relationships for this brave new world.

It’s an intriguing model. I will continue to ponder…

Scott – thanks for the post. I am pleased to see that Gerry and IDC put some real meat behind the marketing technology growth by category. I am not sure if this was on purpose but Gerry was keen enough to stay away from who will actually be the purveyor of the tech (CMO vs. CIO or CMO+ CIO). Of course, with Black Ink being a financial predictor and customer intelligence analytic tool, especially pleased he put in the data analytic category. it just makes more sense than just a cost/budget admin tool in the MRM space.

As for the whole ad agency deal, the annual spend for media is around $1Trillion globally (source AAAA). This does not account for any other media channels. And yes Scott, I agree that the cost of channels being attributed long term will cannibalize the current baseline.

I have first hand experience with providing outsourced marketing as a service using plenty of technologies to support any client’s needs. We have been doing it for 4 years so glad bigger guys are catching up. This is an important offering to provide when the internal marketing department becomes so restrictive that it can t operate at the speed of its customer. However, like many marketplace shifts, it will be a commodity offering in about 5 years.

Thanks, Jeff.

I guess I see marketing-as-a-service (MaaS) along a continuum — from everything owned and operated by the agency to everything owned and operated by the brand. I imagine most companies will be somewhere in the middle along that curve. It’s interesting to consider what kind of framework a brand should use to govern that decision.

Scott, except for agencies serving SMB customers, I don’t see MaaS – from a technology perspective – working in enterprise accounts.

I see marketing agencies / system integrators MANAGING the data and marketing technology stack of a brand, but not OWNING it. Just like today, when we provide an ongoing marketing service to clients, we don’t own the content, or the campaigns or the strategy, but we do manage it.

The one exception is if we were to offer a unique set of technical capabilities in conjunction with a component in the marketing technology stack — then I can see MaaS working for a large brand.

As you know, we are watching this space very closely and watching for opportunities to serve clients in unique ways to give them a competitive advantage.

Thanks for sharing!

Hi All,

Great comments. Controversy over MaaS is welcome. Its an emergent idea and may take many forms in different market segments. It is definitely a continuum not an all or nothing proposition. In the next two to three years, marketing platforms will mature to the point that the technology becomes democratized – at least in terms of the fundamental building blocks. There will be a lot of specialty capabilities needed to fill in a wide array of business cases but those are equally available to third parties to build into their offerings. Here are three facts that I find compelling about the future of MaaS:

1) Tech spend is fractional relative to ad spend

2) Markets follow the money

3) MaaS enables CMOs to get infrastructure in the context of their agency relationships which they pay for with the big ad bucks.

In that respect I think MaaS is a logical extension of the market.

I take the point that large brands that have extensive investments in place will maintain their “owned and operated” models. But there is a wide world of companies out there particularly outside the US where the marketing function is not going to be able to own or operate a complex infrastructure. They won’t have the funds or the skills. They may have marketing automation and a CRM but will not be able to compete with companies with substantially more firepower without assistance. Agencies are not the only channel, there are a lot of MSPs and BPOs out there serving marketing, call center, and other customer facing functions that could utilize MaaS to expand their service offerings.

One thing we can probably all agree on, it will continue to be a highly diverse market with many different solution models.

(Brad – marketing automation is included on our map in Direct Marketing under Integrated Marketing Management/Marketing Automation)

Gerry and Scott, I’d like to weight in as we (Transform) might be considered a MaaS provider – though I’m still somewhat unclear on what exactly that means. So here is a thought experiment based on our experience.

Our technology integrates internal performance databases (spend and results – foot traffic, PoS, revenue, media buying, etc), breaks down spend into MESSAGE/MEDIA/AUDIENCE components (the meaningful toggles of CMO decision-making) and produces what could be called “Marketing Mix Optimization 3.0.” (Long store on the 3.0 designation)

We originally tried selling both to brands and agencies, thinking to ourselves that agencies would want to prove the value of their work, get the brand to pay for it, and thus we’d have a deal. Alas, we were naive.

Agencies (A) didn’t want to quantify their work but instead wanted to keep it creative (I was told by one large agency CMO “We believe marketing is creative-driven and data-inspired” which we of course disagree with), or (B) wanted to black-box and package up the whole thing, thereby hiding our value from the brand, or (C) tried (and failed miserably) to recreate our approach. And it wasn’t like we were talking to the wrong people – we had a sitdown with the team responsible for promoting valuable tech/platforms in the data-driven marketing space to a very large network of agencies.

Brands, however, need the level of control, visibility, predictability and measurable improvement we offer. We make VPs/CMOs champions in board rooms, because they can numerically demonstrate the value of their approach. Conversations directly with them are much more successful than conversations with agencies.

And within our flexible approach to optimization models, we can accommodate what you might call “vendor mix optimization” – as in, statistically modeling the value of various software and agency vendors based on spend over a couple years. Naturally, this is seen as a threat to legacy vendors with outdated approaches.

Anyways, didn’t mean to self-promote but instead thought our experience might be interesting to this conversation about MaaS.