Last week, Y Combinator held their Demo Day(s) for their Summer 2021 cohort. This was a massive graduating class: 377 startups from 47 countries. You can read a quick overview of all 377 (!) on TechCrunch, split across part one and part two.

I read through all 377 and discovered 47 that I would put on the martech landscape. Here’s the list:

- Cococart — online store builder

- Writesonic — AI-powered copywriting tools

- AppX — app builder for social media creators

- Varos — competitive performance benchmarking

- Zensors — “Google Analytics for the physical world”

- Storylane — deliver personalized product demos for prospects

- Arengu — plug-and-play sign-up flow engine

- q&ai — analyzes sales calls to provide insights on messaging

- Goodkind — video messaging for B2C teams

- Whaly — no-code tool for modeling business data

- Mailmodo — no-code tool for building forms and widgets embedded in emails

- Genuity — SaaS management and procurement platform

- Myse — no-code tool for building immersive 3D websites

- Idemeum — access control management for your SaaS stack

- Hotswap — facilitate switching vendors (including martech platforms)

- Clarity — collaboration and project management workspace

- Abstra — no-code app built meant for designers

- Lago — no-code tool for segmenting and syncing customer data across channels

- Pipekit — scale data pipelines quickly

- Plai — ad tool for microbusinesses

- Inspector Cloud — computer vision analysis of products displayed at physical retailers

- Genei — automatic summarization of background content for content creators

- Shopscribe — subscriptions for local businesses (coffee shops, nail salons, etc.)

- Preki — website/e-commerce builder for LatAm businesses

- Aleph Solutions — marketplace for offline businesses to offer services online

- Datlo — sales and marketing data analysis service for LatAm businesses

- Pide Directo — LatAm online store and marketing platform, with delivery network

- Tablevibe — customer loyalty via QR-code-based surveys for restaurants

- OneSchema — make CSV imports a billion times better

- Ahazou — online local business platform for LatAm businesses

- PaletteHQ — sales commission management

- Breadcrumbs.io — no-code analytics tool to identify “hidden” revenue

- Hotglue — developer tool to create native SaaS integrations in minutes

- BrightReps — no-code tool for customer response workflows

- Watu — enable shopping directly within interactive emails

- Anakin — competitive price monitoring for e-commerce businesses

- Laudable — video testimonials engine for B2B marketing and sales

- Beau — no-code customer-centric workflows

- Noloco — no-code web portal builder for SMBs (agencies, realtors, etc.)

- Dots — automate online customer communities in Slack, Discord, etc.

- Hyperglue — track customer feedback/sentiment in Reddit, Discord, etc.

- Sleek — browser extension to enable “impulse buys”

- CartX — Shopify competitor for the Brazilian market

- Alchemy — no-code platform to create unique/differentiated e-commerce experiences

- Secoda — aggregating company data and metadata, especially for startups

- Whalesync — sync data between multiple no-code tools

- Tavus — personalized deep fake videos for marketing/sales outreach

Now, I’m sure some of you will be skeptical to cynical about how many of these will survive in the market — especially those competing with major leaders such as Shopify (albeit, always with a twist that might give them the edge in a specialized region or domain).

However, what I appreciated about this Demo Day “event” is that it got enough coverage to cause one to stop and realize just how many startups keep taking swings at new ways to innovate — even in markets, like martech, that already have significant competition.

Some of them will make it through to the big leagues. Case in point: two years ago, you might have thought the events platform space was saturated and mature — but then Hopin came along and became one of the fastest growing SaaS products in the history of the world.

My point is that while consolidation is happening, diversification is thriving too.

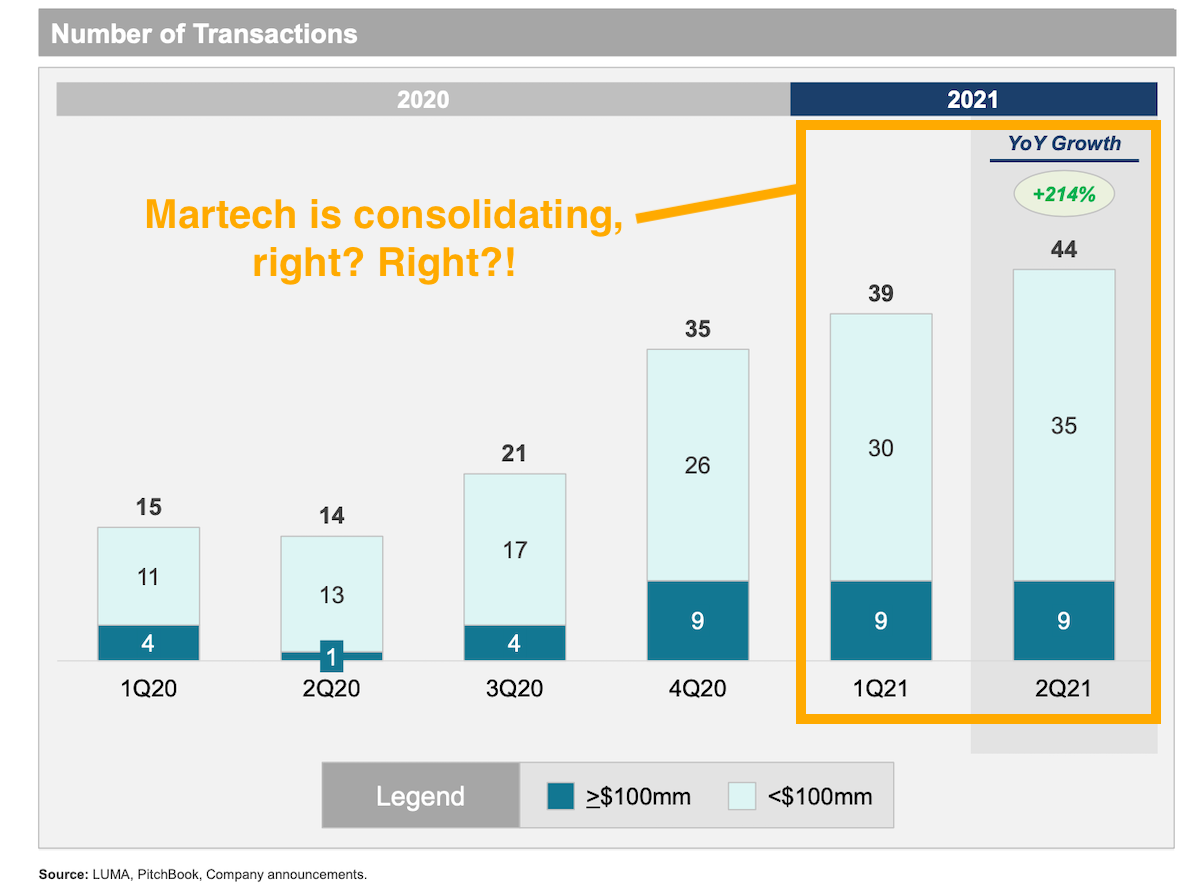

Yes, there’s been a ton of martech M&A activity this year. The LUMA Q2 2021 Market Report reported 83 martech deals in the first half of this year. (For those counting against last year’s martech landscape of 8,000 solutions, that’s about 1%.)

The biggest of these deals inevitably end up in headlines that you see from widely covered press releases. When you’ve seen a few of them in a row in a short period of time, it’s easy to draw the conclusion, “Ah, ha! Martech is consolidating.” Because that is what we see.

And, hey, there is truth in that belief. Acquisitions are consolidations of individual companies. In the long tail of all the martech in the world, this consolidation drives growth in the “head” of the tail.

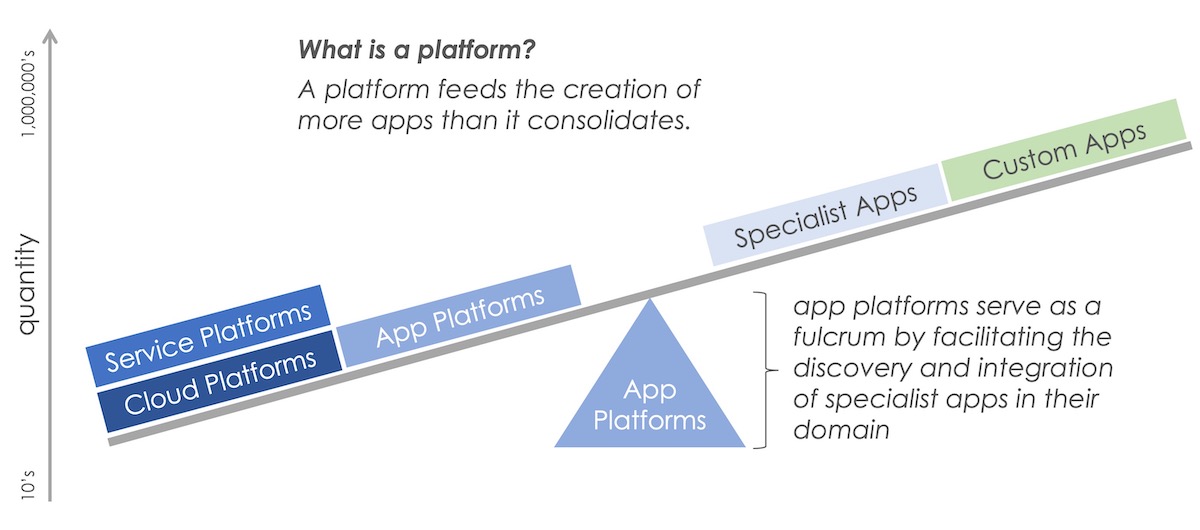

But as this Y Combinator event reminds us, it’s not the whole truth. Because at the same time that martech is consolidating, it is also expanding. This is not as paradoxical as it sounds, when you recognize that consolidated platforms enable greater diversification and specialized of apps on top of them. And platforms supporting such developers are hot!

While searching for the above graphic, I stumbled across an article I wrote 9 years ago on this exact subject: Is marketing technology consolidating or diversifying? Given that was the year when my martech landscape had only ~350 companies, and we’re now over 10,000, I’d say we’ve answered that pretty definitively.

It’s a decade later, and the primordial martech startup soup is still teeming with new life.