You might already be leaping to a conclusion. “It seems like every other week, I read about a major acquisition. Surely the 2020 martech landscape with its 8,000 solutions was Peak Martech! The only question is by how much has the 2022 landscape shrunk.”

Perhaps.

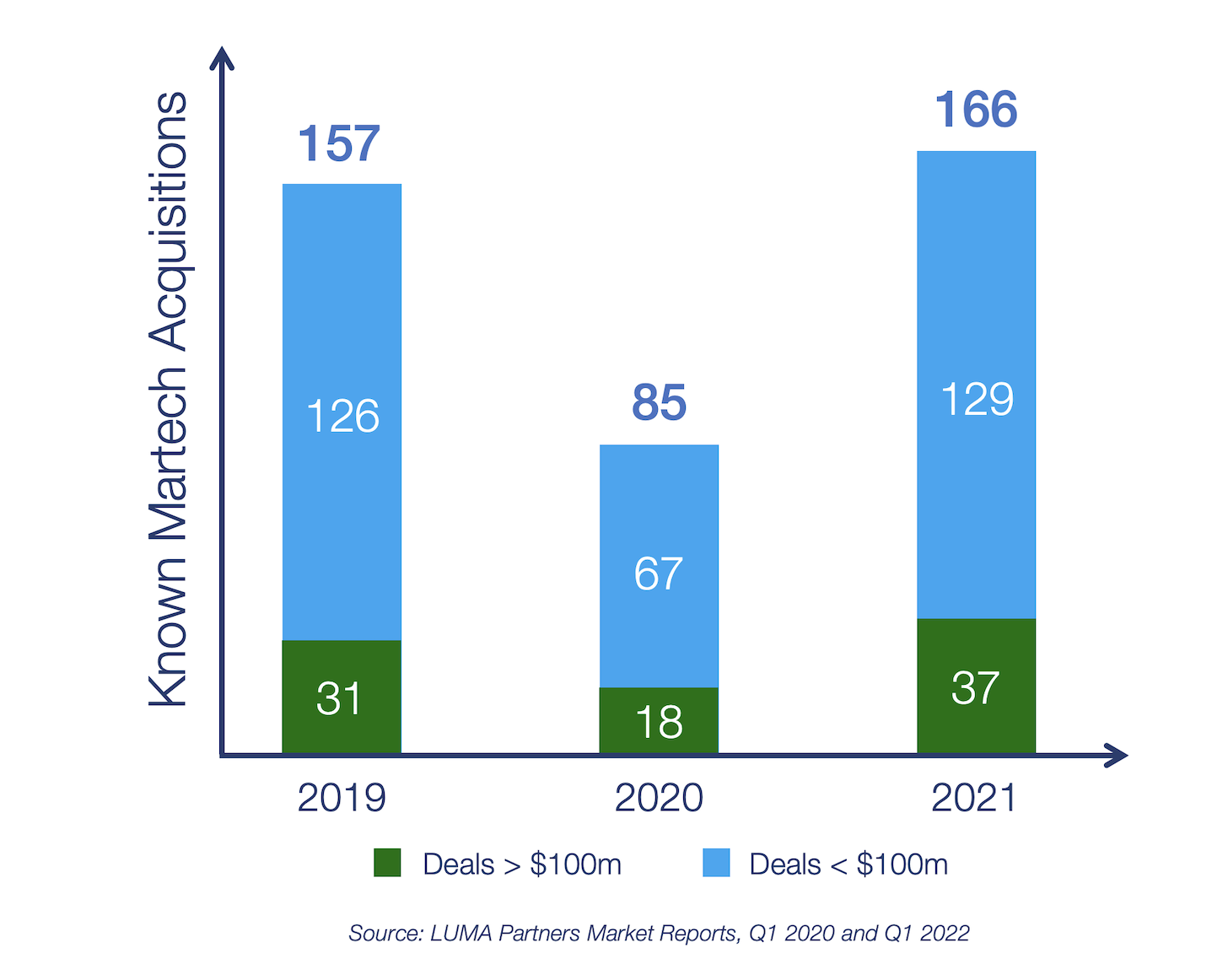

Indeed, the martech industry sees a tremendous amount of M&A activity. LUMA Partners, one of the leading investment banks in martech — and the creators of the original adtech landscape that inspired us over a decade ago — publishes quarterly reports of known deals. There were 157 in 2019, 85 in 2020, and 166 in 2021.

About one out of every five of those was a deal valued at $100 million or more. Such large acquisitions almost always make the news. Last year, there were 37. On average, that’s 3 per month that likely garnered headlines in industry publications.

It’s a testament to just how large the martech industry is that so many significant acquisitions are constantly occurring. All those headlines naturally give the impression of massive consolidation.

Yet while that consolidation is real, as a percentage of the total number of martech solutions, these known acquisitions are 2% or so of the total landscape. Meanwhile, new martech startups and other more established companies continue to enter the space. Ironically, consolidation is often a catalyst for more software to be created.

Consolidated platforms make it easier for software developers to build apps on top of them. If you’re standing on the shoulders of giants, the bigger the giant the better. And the fewer giants you have to choose among, the better too, as it’s more likely it is that the one(s) you choose will have scale and staying power.

These positive feedback loop dynamics — often framed as “winner takes all,” even if in reality there are usually several big winners — is why AWS, Microsoft Azure, and Google Cloud are so dominant as cloud platforms. And they’re still growing at a remarkable pace. But in the process, they’re birthing millions of apps built on top of their foundations.

The rise of ecosystems and marketplaces in SaaS businesses further enables the Cambrian explosion of commercial specialist apps as well as tons of custom apps tailored to individual businesses. They help solve the challenges of discovery and integration.

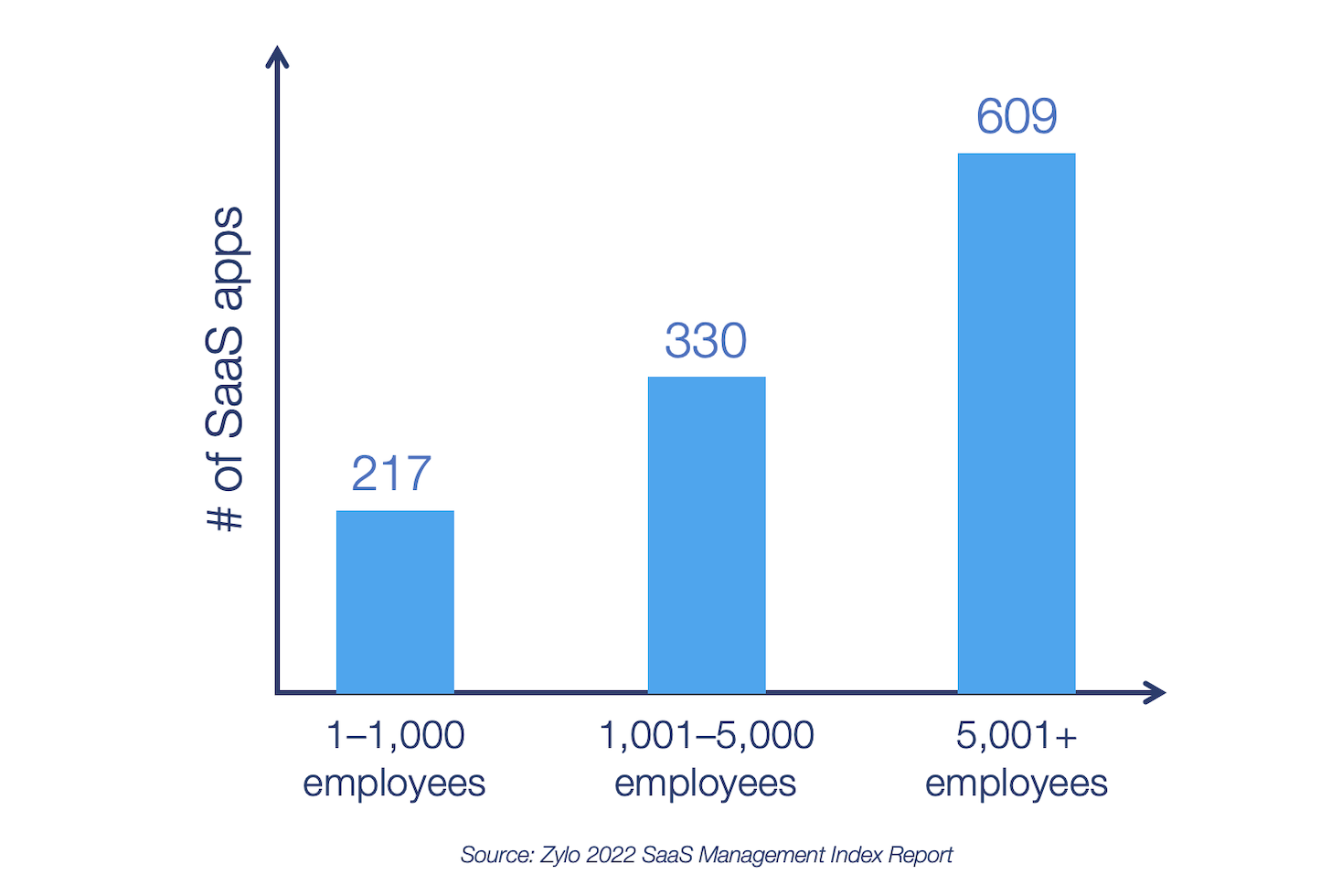

Meanwhile, demand for specialized software continues to grow too, as reported by the number of SaaS apps that companies have in their stacks:

We’re entering a post-digital-transformation era, where companies are no longer planning to become “digital.” They are digital. And as they now compete ferociously for competitive advantages in their digital operations and digital customer experiences, they’re increasingly comfortable buying and building more specialized software.

Marketing remains one of the most intense domains in which that competition takes place — giving martech entrepreneurs ample opportunities to create value.

Investors still believe in these opportunities too. They continue to fund new and growing martech ventures. If you pick up a copy of LUMA’s Q1 2022 Market Report, you’ll see the hundreds of millions of dollars in capital put into martech firms just in the first three months of this year.

That said, there are rational limits for how many martech firms can exist at one time and how many martech apps any one company can usefully adopt. While new martech products are continually born, old ones fade away into mergers, pivots, and discontinued oblivion.

The questions the martech landscape has answered each year are: (1) what’s the balance between martech expansion and consolidation and (2) what’s the composition of solutions within the overall martech industry? Those answers reveal a lot about the ongoing evolution of marketing.

What will the 2022 martech landscape reveal? Tune in next Tuesday to find out.

We’re going to release something really special this year that I guarantee you’ll want to be one of the first to have access to.

P.S. Researching the martech landscape has become a project of epic proportion over the years. And with the special surprise we will be unveiling this year, the effort to produce it has grown even more. We wouldn’t have been able to do this without the financial support of several generous sponsors:

- Learning Experience Alliance (formerly MarTech Alliance)

- OfferFit

- Workato

- SAS Customer Intelligence

- Amplitude

- Goldcast

If you haven’t taken a look recently at the innovative martech solutions these companies are producing, check them out. It’s impressive.