I’m going to start the year with a controversial prediction: we are at the beginning of a massive wave of growth in martech. The next 7 years of expansion in our industry and profession will dwarf the past 7 years.

I assume that’s a controversial claim because most people think this is going to be a rough year for the martech industry. Partly due to macroeconomic factors — small recession? big recession? And partly due to the glut of martech companies that have flooded the market over the past decade that are now playing lightning rounds of musical chairs, Squid Game-style, as ops and finance teams rationalize and optimize their Falstaffian tech stacks.

Those skeptics are not wrong. 2023 is going to be a rough year for many martech firms.

The martech companies that will struggle the most are those that have taken a ton of VC money to put breakthrough growth over profitability — but they have not achieved such high-velocity and sustainable growth yet. To survive, they must reorient to profitability. But they must do so while offering clear value to their customers, at a competitive price point, with at least some axis of meaningful differentiation.

Oh, one more thing: they’ll need to adapt to a tech landscape that is about to undergo multiple seismic shifts. We’ll cover those in a moment.

It won’t be easy. But those who achieve that will actually do quite well, as there are much bigger tailwinds for the future of tech-powered marketing than the temporary headwinds of a downward business cycle. Many will. Unfortunately, many won’t.

The Plateauing of 3 Major Technology S-Curves

First, the bad news. (“Wait, what you said above isn’t the bad news?”)

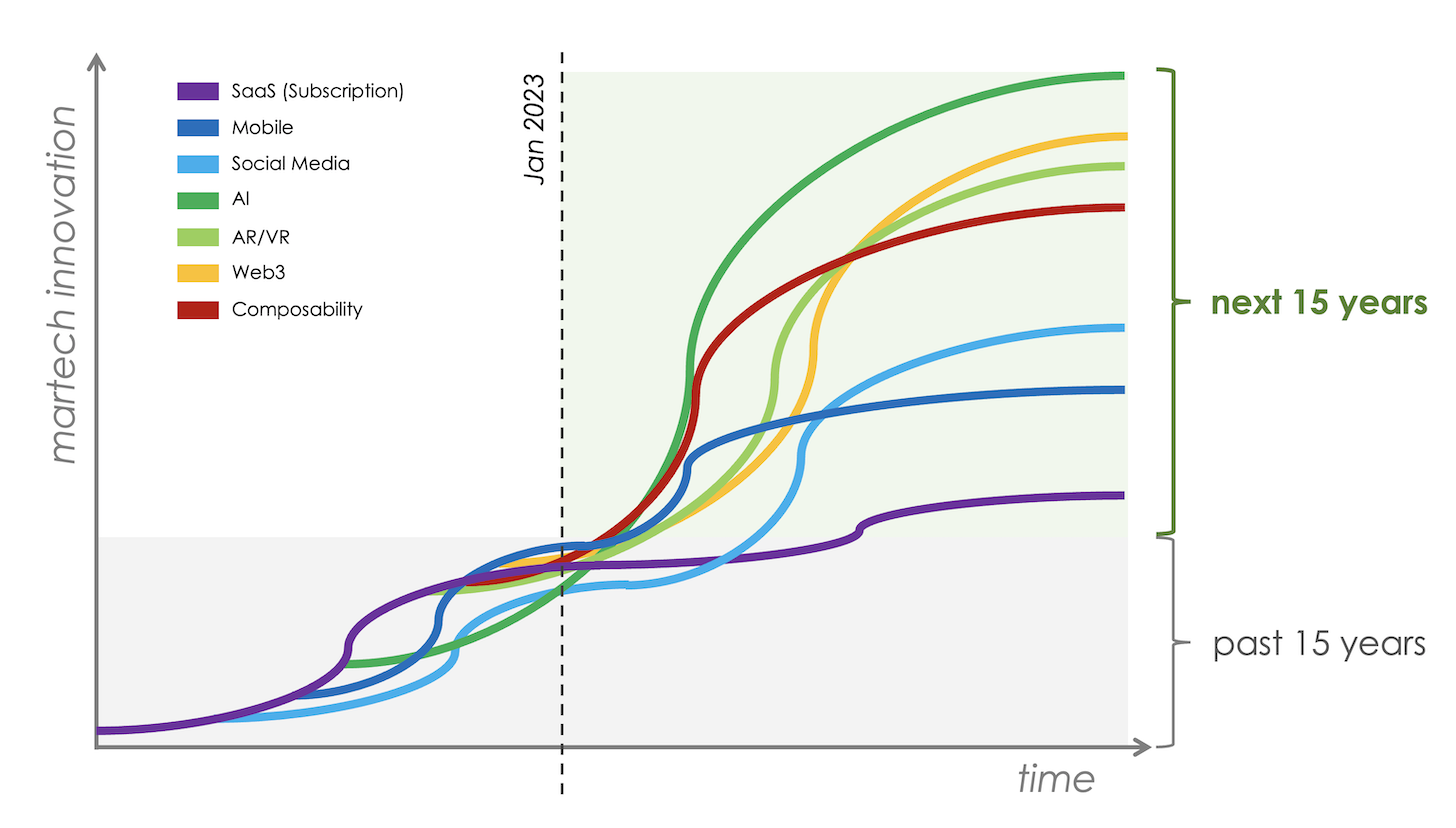

Technology tends to follow a recurring pattern of adoption, where it starts with a small footprint, then ramps upward in exponential growth over many years, but finally tapers off. If you draw it on a chart, it looks a little like an “S” — hence why people talk about S-curves in tech strategy and investment.

You might think, “Oh, martech is an S-curve, and we’re now at the top of it.” But I disagree. Martech is not really a technology, but rather a category of technology in service of a major business function: marketing. Specific technologies within martech certainly follow S-curve patterns. But the category as a whole is evergreen, continually adapting new technologies to marketing.

An analogy would be transportation. Transportation technology overall has continued to evolve for hundreds of years. Now, individual generations of transportation technologies — steam engines, airplanes, petro-fueled automobiles, electric cars, etc. — have all followed S-curves. But to mangle Walt Whitman, the powerful play goes on, while each S-curve contributes a verse.

However, the current generation of martech products have largely been borne on the back of three major technology S-curves:

- SaaS. The move from on-premise software to services offered in the cloud.

- Social Media. Sharing and consuming content from networks of friends and colleagues: Facebook, YouTube, Twitter, LinkedIn, Instagram, TikTok.

- Mobile. Designer computers carried in our pockets, connected everywhere we go, with ecosystems of millions of apps.

These three S-curves have delivered massive changes to the world, the tech industry, and the marketing profession. They made “martech” a thing. And in the process, hundreds of martech companies have made billions of dollars riding the exponential upward growth of these S’s.

But all three of these S-curves are plateauing. Think about it: there haven’t been any real earth-shattering changes to SaaS, social media, or mobile over the past five years. Plenty of incremental changes, sure. Faster, cheaper, easier to use, more features, etc. But not stop-the-presses, this-is-a-totally-different-kettle-of-fish, truly disruptive changes.

That’s not to say there isn’t still a huge amount of value in SaaS, social media, and mobile. These are universal technologies embedded in our lives now. Companies will continue to make fortunes with them. But the gold rush that existed in riding those S-curves upward for the past 15 years, disrupting the status quo, is over.

SaaS, social, and mobile now are the status quo.

Sure sign that an S-curve is plateauing? Private equity (PE) companies come swooping in to industrialize the space.

The Start of 4 New Major Technology S-Curves

Now the good news.

Four new technology S-curves are just at their early beginnings. Each of them is at least as big as the three we’ve just experienced. Personally, I think they’ll be bigger:

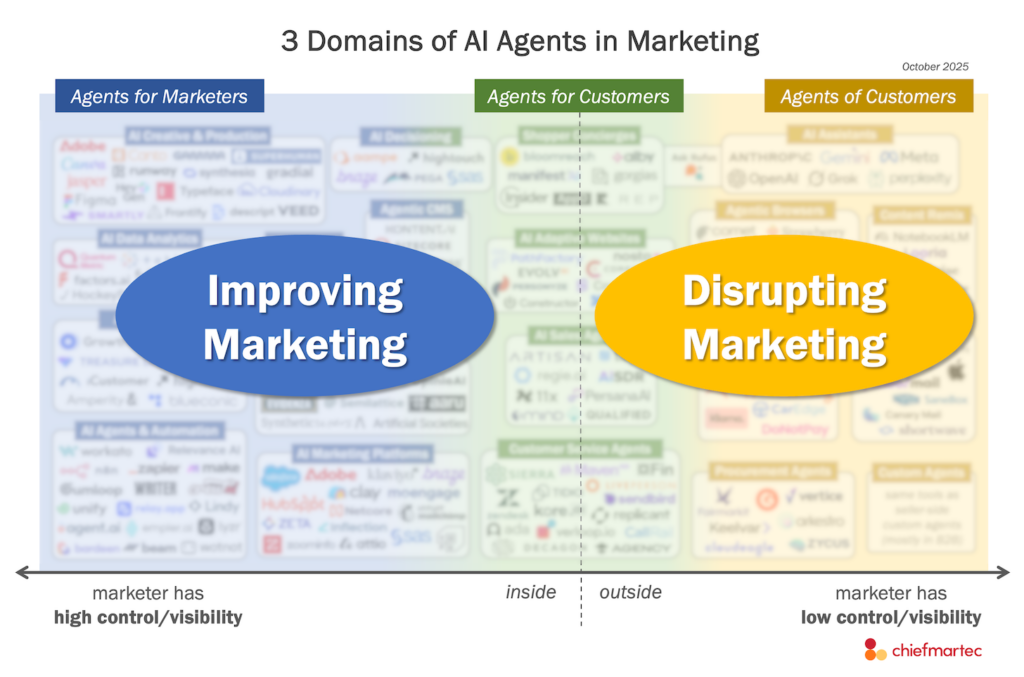

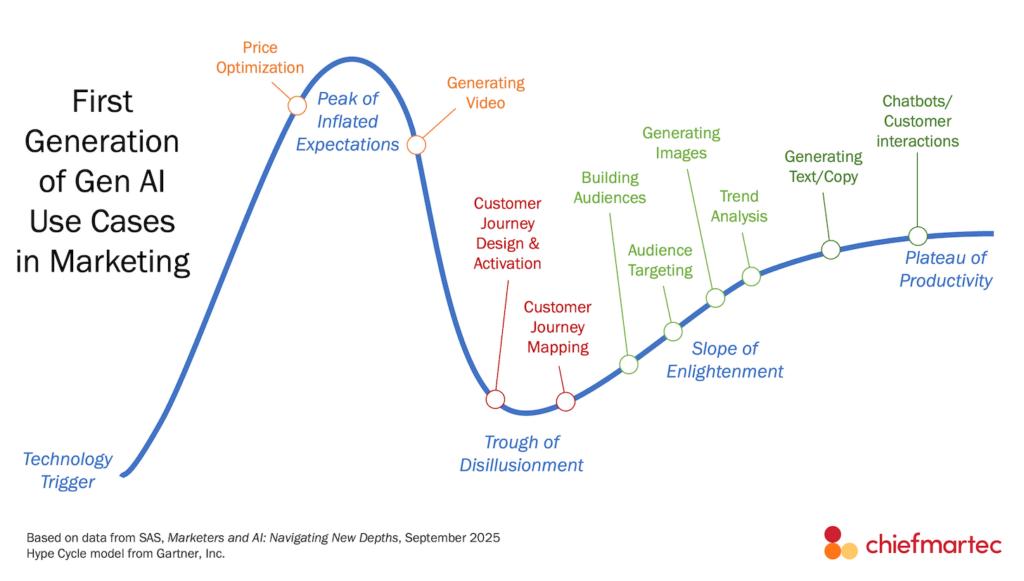

- AI. Advanced and ubiquitous machine learning, generative AI (such as ChatGPT and Stable Diffusion), and a steady climb to general AI will radically change what machines can do at our bidding — for both marketers and consumers.

- AR/VR. The ability to project ourselves into realistic, immersive digital environments for work and entertainment — which will completely reshape what is possible with customer experiences. Remember the rise of websites? Imagine that phenomenon multiplied in 3 dimensions, untethered from screens as we think of them today.

- Composability. Through APIs and no-code interfaces, software will become much more malleable and permeable, while data becomes far more fluid and portable, enabling businesses and individuals to easily “compose” tailored solutions or experiences on-the-fly. This is true cloud-native software.

- Web3. Decentralization and permanent, non-replicable digital assets will enable very different kinds of organizations, business models, communities, and economies that are natively aligned with the rise of AR/VR and Composability.

I know, the above might come across as futurism. But all four of these technologies are in the market today and are on unmistakable — albeit early — upward trajectories.

New S-Curve #1: AI

AI is the furtherest along, even though it’s still near the bottom of its S-curve of the growth it will experience ahead. But last year was a notable inflection point, with multiple generative AI implementations transitioning from science fair projects to genuinely useful commercial tools. ChatGPT triggered a pivotal ah-ha moment, where almost everyone recognized that a major disruption had begun.

We’ll see serious acceleration of that disruption this year. (In last month’s Martech for 2023 presentation that Frans Riemersma and I gave, which you can watch the free recording of, we touched on some of the immediate use cases and near-term implications generative AI will have for marketing and martech.)

New S-Curve #2: AR/VR

AR/VR is further behind, but not by much. 2023 will not be the Year of the Metaverse. But 2024 may be the start of exponential growth.

What’s holding it back is hardware. AR/VR devices have been clunky, low-grade, and expensive. These platforms today don’t yet have the capabilities or ubiquity to enable explosive growth of industries and ecosystems around them.

If you remember the Motorola flip-phones from the 90’s, it would be like trying to imagine the Apple/Android app economy happening on those devices. It just couldn’t. But then the iPhone arrived, and the mobile technology S-curve hit its exponential leg of hockey-stick growth.

Apple’s mixed reality headset, expected to arrive this year, could be the inflection point of enabling hardware. And there are many other contenders in the pipeline.

To be sure, the world won’t change overnight. From the iPhone’s launch in early 2007, it took a decade to achieve the ubiquitous mobile experiences that reshaped mainstream marketing and customer experience. Many iterations in hardware and software. Many, many startups — with a spectrum of outcomes from spectacular successes to dismal failures.

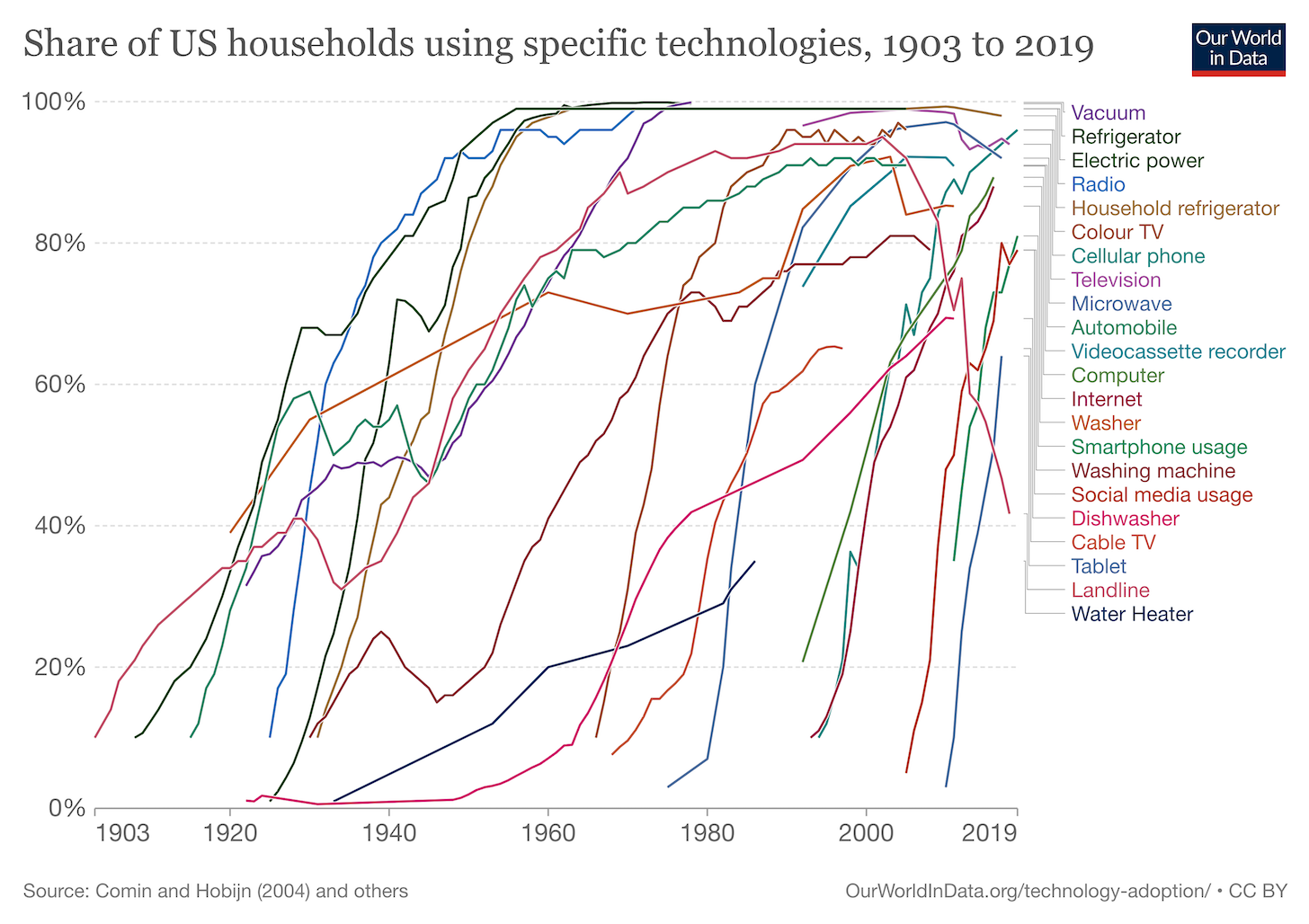

But the rate of adoption of major new technologies — the speed by which they run up the slope of their S-curve — has generally been accelerating over the past century. You’ve probably seen this chart before of how long it took different technologies to achieve ubiquity:

Those lines are the S-curves. I know, I know, you have to squint and imagine really bad handwriting to see them as S’s. As the time for mass adoption compresses, they almost look more like italicized I-curves. (I’m just making up the name I-curve in this context, not referring to obscure Treasury derivatives.)

The point is that even though it will take AR/VR many years to change the world on a large scale, once it hits its exponential inflection point, it will move quickly. Given that it will inherently produce “experiences” delivered through a new wave of “channels,” it will be a really big deal for marketing — and for martech.

New S-Curve #3: Composability

There’s a story that’s stuck with me for years as an influential epiphany.

Long ago, factories were built next to rivers, and their machinery was powered by water wheels. To use that hydraulic power directly, machines had to be close together, connected with one big lineshaft driving all of them in a row. Businesses were constrained in how they configured the layout of their production floor — which constrained how they operated — around that lineshaft.

When electricity arrived, available from a power grid, along with electric motors capable of letting machines operate in different locations independent of each other, many factories still kept their old lineshaft-legacy configuration. After all, that’s how production had always been done. It took decades for businesses to realize they didn’t have those constraints any more.

When that light bulb turned on (metaphorically and literally), a new wave of innovation was unleashed that drove the modern industrial era of the 20th century.

There is a parallel paradigm shift happening in software now.

In the late 20th century, the way software was written, distributed, and operated required programs to be largely self-contained packages. They were constrained by having to run on one computer, or a little later, connected in the same on-premise data center. These constraints dictated how software was designed — and how it was sold.

When software moved into the cloud, the constraints of physical adjacency vanished. Software started to use more APIs and cloud-based components, from new kinds of software supply-chain providers such as AWS and Twilio, albeit entirely under the hood.

Yet while moving to the cloud quickly created the technology innovation of software-as-a-service — the SaaS S-curve we’ve been riding for two decades — the “shape” of software for users largely remained the same. We buy (or build) packaged software apps that have mostly remained self-contained.

I emphasize “mostly” because this is the root of the integration challenge that has plagued martech for years. Business don’t want dozens or hundreds of apps in their own silos. They want them connected and orchestrated together. The SaaS industry has steadily pursued integration as a first-class feature to address that demand, and it’s getting a lot better. But it’s still been integrations between packages.

As with water wheels and fixed lineshafts, businesses have been constrained in how they configure their digital operations around these large, fixed-position “machines.”

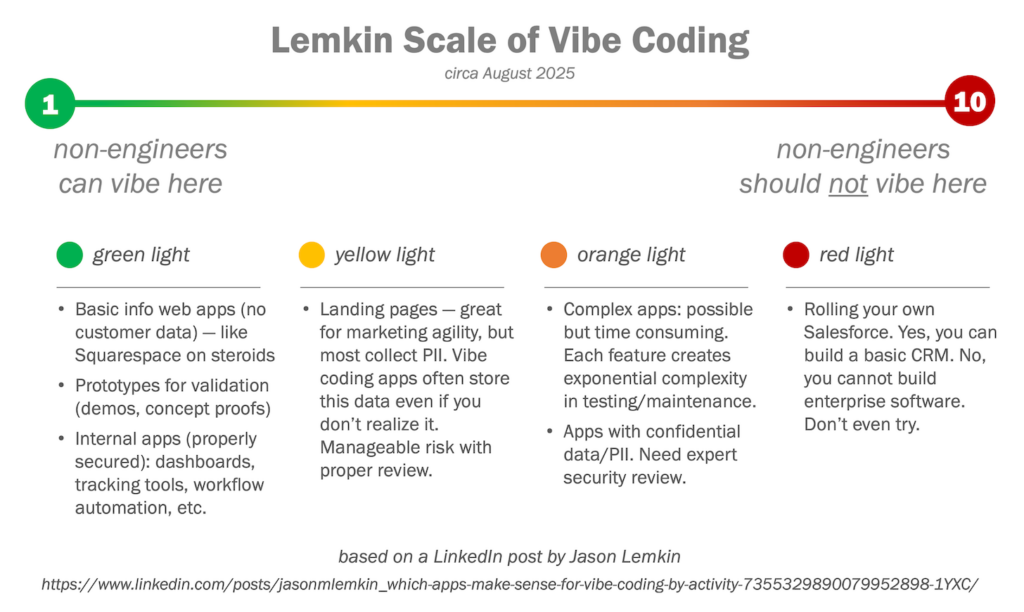

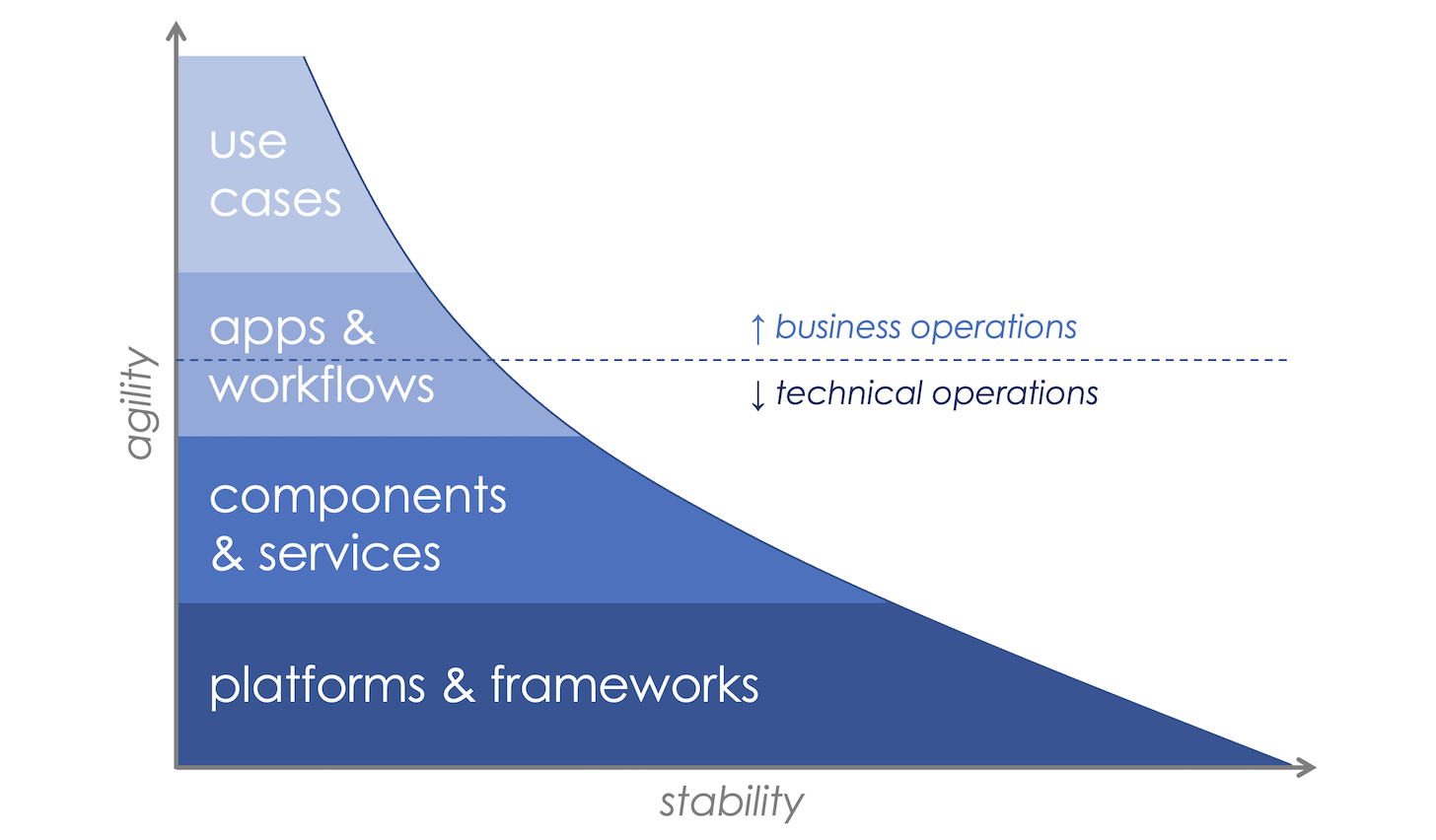

But that’s changing. The idea of “composable software” is that smaller software building blocks — API services, functions, data sources, UI elements, etc. — can be assembled together like Lego pieces to craft tailored digital processes, employee experiences, and customer experiences that are unique to your business. They can be easily rearranged as needs shift and opportunities arise.

Platforms will serve as stable foundations and cohesive frameworks for composing these apps, workflows, and use cases. There will still be commercially packaged apps. But they will expose more of their functionality and data as composable blocks, so businesses can synthesize their own processes and experiences with them.

No-code interfaces will enable much of this composition of workflows, simple apps, and use cases to happen in the hands of business teams, rather than technical teams. There will be many more marketing makers than marketing technologists.

New S-Curve #4: Web3

I have been — and still am — skeptical of NFTs and other crypto plays for marketing here in the short-term. And I think I hate myself a bit already for using the label Web3.

But blockchain technology and other mechanisms for decentralization and digital ownership and provenance are paradigm-changing innovations. They have the potential to alter some of the fundamental Information Rules that have governed the dynamics of the Internet for the past 25 years.

I’m adopting the term Web3 here, albeit reluctantly, because even its advocates readily acknowledge that its exact form is still evolving. The phrase is used as a placeholder to represent a new generation of online products and services — and the new kinds of organizations, communities, ecosystems, and economies that can emerge around them — enabled by these new technologies.

I believe this S-curve will trail behind AI, AR/VR, and composability. But the growth of those other technologies will be big catalysts for Web3 innovation. Richer virtual worlds — even digital overlays on our physical world — will drive demand for digital ownership.

More distributed digital business operations enabled by composability — as well as more distributed contributions of composable “components” to those businesses — will set the stage for decentralized business models. In a way, you could think of decentralization as composability for organizations and communities.

And all of this will change the playing field — and the players — in marketing.

Both this technology and the regulation around it need to mature. But they will. Probably sooner than most of us skeptics think.

Too Many Martech Startups? You Ain’t Seen Nothin’

Startups multiply like wildflowers in the first half of an S-curve.

All four of the S-curves I’ve identified here will be giant Petri dishes for new companies that will contribute to these waves and ride them up their exponential growth trajectories.

I’ll stand by my opening prediction: the next 7 years of expansion in the martech industry and profession will dwarf the past 7 years.