UPDATE: Okay, okay, the jig is up. Way too many people have been genuinely congratulating me on this “acquisition.” Apparently, I am terrible at this whole April Fool’s thing — or too good at it? — as it’s not supposed to be that believable. Anyway, I’ll leave this up for posterity’s sake, but just to be completely blunt: everything below was completely made up. I love the good folks at Microsoft, but we’re not married. 🙂

Wow, this is surreal. I’m trilled to announce that, yes, Microsoft has acquired chiefmartec.com, as of this morning. I shared the good news with the attendees at the MarTech Conference just moments ago.

Some of you may remember a blog post I wrote last November on what will happen with marketing technology in 2015? I made the bold prediction that Microsoft would make one or more major acquisitions in the marketing technology space this year, spending more than $1 billion in M&A.

However, I never expected that to include my humble, little blog.

While I’ve been asked not to disclose the acquisition price of my blog, I will note that they still have quite a bit of that $1 billion left for other acquisitions. I also scored an Xbox One and a new Surface Pro 3 as a signing bonus.

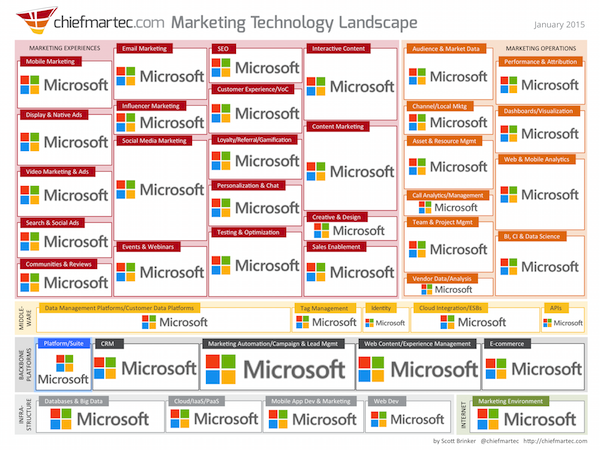

Microsoft has assured me that I will “mostly” maintain editorial control over this blog and the marketing technology landscape graphic that I produce. There are a few suggestions that they’ve already floated, include a greatly simplified marketing technology landscape:

I’m joking, of course. We’re not going to reduce the landscape down to a single vendor. At least that’s what I was told before signing the letter of intent.

But in all seriousness, Microsoft does believe that this landscape needs to be consolidated. Apparently, the decision to make this deal was directly encouraged by Microsoft founder Bill Gates — a pioneer in software platform ecosystems — who has suggested that we cut down the number of companies included by about 2/3. He stated:

640 marketing technology companies ought to be enough for anybody.

– Bill Gates, Microsoft

I’m also incredibly appreciative of the other luminaries in the industry who offered supportive commentary on this deal:

Technology blog investments are pretty much a no-lose proposition.

– Om Malik, Gigaom

In my experience, the acquisition of tech blogs by major corporations always leads to harmonious outcomes.

– Michael Arrington, TechCrunch

This breakthrough deal significantly consolidates our LUMAscape of tech logo landscapes.

– Terence Kawaja, LUMA Partners

Indeed, Terry and the LUMA team, who served as advisors to this deal, wasted no time in publishing an updated LUMAscape with chiefmartec.com denoted as an acquired company with a dotted red box:

This deal is expected to close by end of today, April 1.

Get chiefmartec in your inbox

Join 42,000+ marketers and martech professionals who get my latest insights and analysis.