Congratulations on making it to the end of 2021.

It’s been a long year for everyone as we navigated the ongoing pandemic saga. From the perspective of advancing digital business, these past 21 months have seen leaps and bounds forward. But the circumstances that catalyzed this punctuated equilibrium of marketing’s evolution have been hard for so many in so many ways.

I’m not going to subject you to the phrase “the new normal” again — well, aside from that disclaimer, a “this statement is false” kind of liar’s paradox. But I think I speak for most of us that we’re looking forward to a return to some equilibrium after two years of being repeatedly punctuated in the face.

I’ve got some thoughts on what that might look like, which I’ll share in January.

But here for the holidays, I thought I’d take a leisurely look back at the topics and trends that shaped 2021 in martech. So pour yourself a glass of your preferred holiday beverage and walk with me down memory lane…

The Martech Landscape Did Not Shrink

I know, I didn’t publish a 2021 version of the marketing technology landscape. The scale of that enterprise has become enormous, and I needed to take a break and rethink how to tackle it more effectively and bring more value to people than a shock-and-awe slide.

The good news is that I have formed a partnership that will bring a whole new, fascinating approach to the landscape, and we’ll be unveiling a grand 2022 incarnation by spring. Stay tuned for an upcoming announcement on that partnership and how you can participate at the start of the year.

So how do I know that the martech landscape didn’t shrink this year?

Because I’ve been collecting the data. And, my lord, the number of ventures in the martech space has multiplied and scaled. Here are some anecdotal data points:

- There Are As Many European-Based Martech Products Today (3,647) As There Were Globally In 2016

- 212 Event-Related Martech Companies. Make That 268. Wait, No, 316…

- 47 New Martech Companies From Latest Y Combinator Cohort — The Counter-Consolidation Narrative Lives On

- 35 of the Forbes Cloud 100 companies are in martech

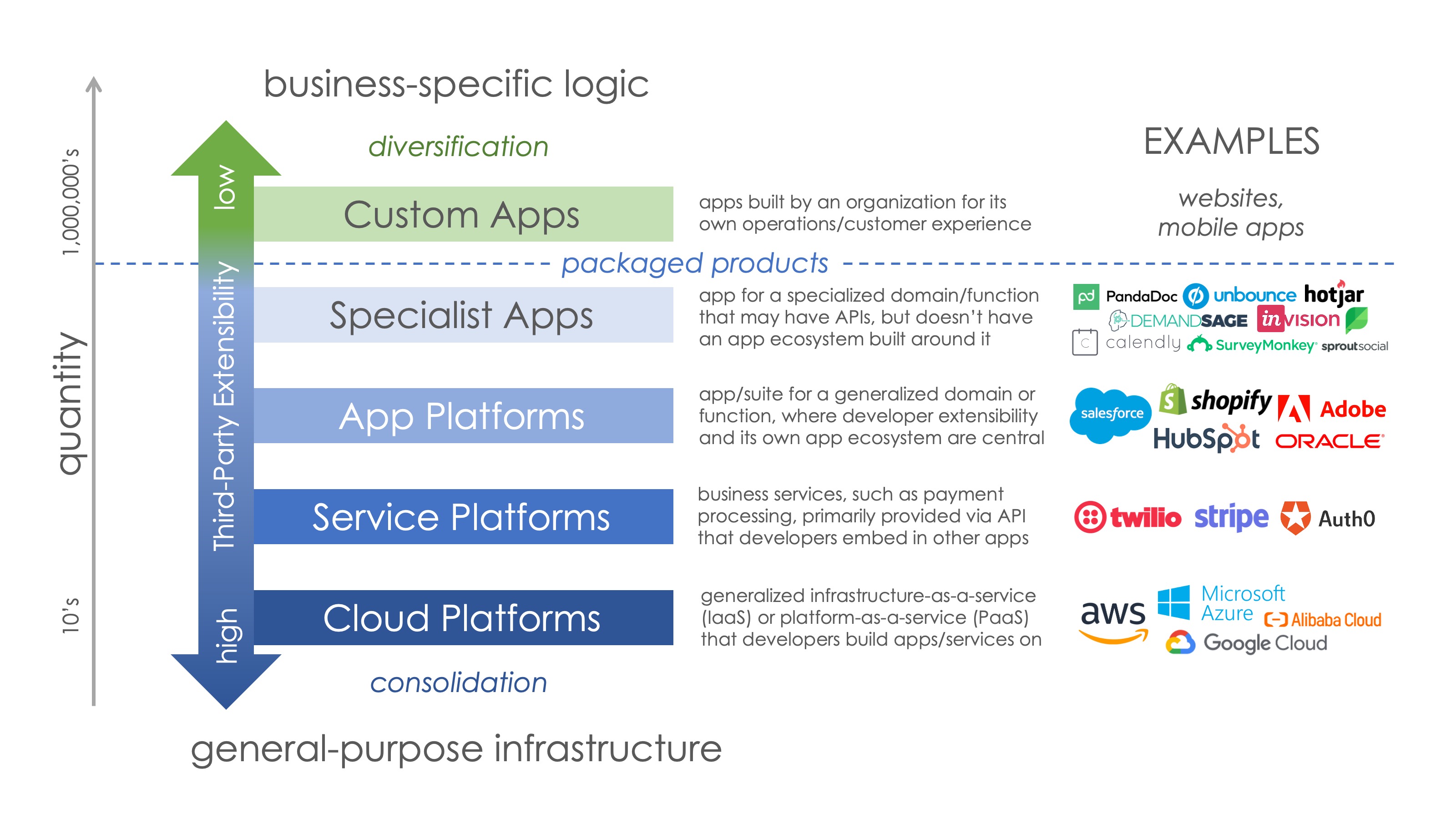

Of course, there have been a ton of acquisitions this year too. But the model of platform dynamics driving simulataneous martech expansion and consolidation that I described a couple of years ago continues to hold true. It’s a long tail with consolidation at the head and continuous invention (and reinvention) stretching far into the tail.

And it’s not just martech. Our first cousin the salestech landscape has grown exponentially over these past couple of years, prompting the click-baity-but-true headline, salestech is the new martech. And it is bringing the two professions closer together.

It’s all part of what is expected to be a half $1 trillion cloud software industry in 2022. And still growing at a double-digit rate in every category.

Did somebody say The Great App Explosion?

Martech Stacks Are Growing Too, But Evolving

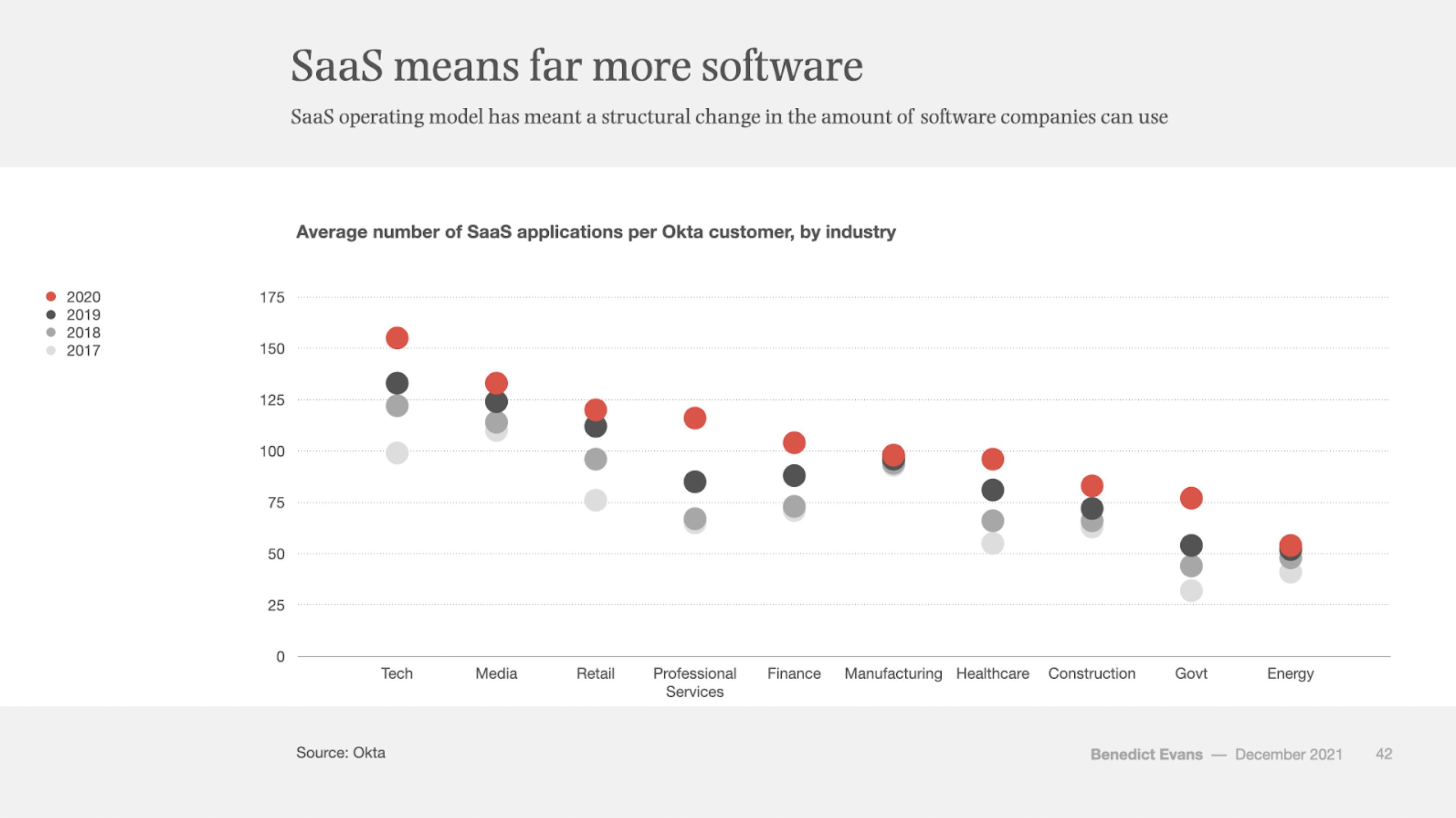

It stands to reason, if there are more software vendors, there’s more adoption of software in companies’ tech stacks. The latest presentation from Benedict Evans featured the slide above with data from Okta showing how year-over-year the average number of apps in tech stacks continues to grow.

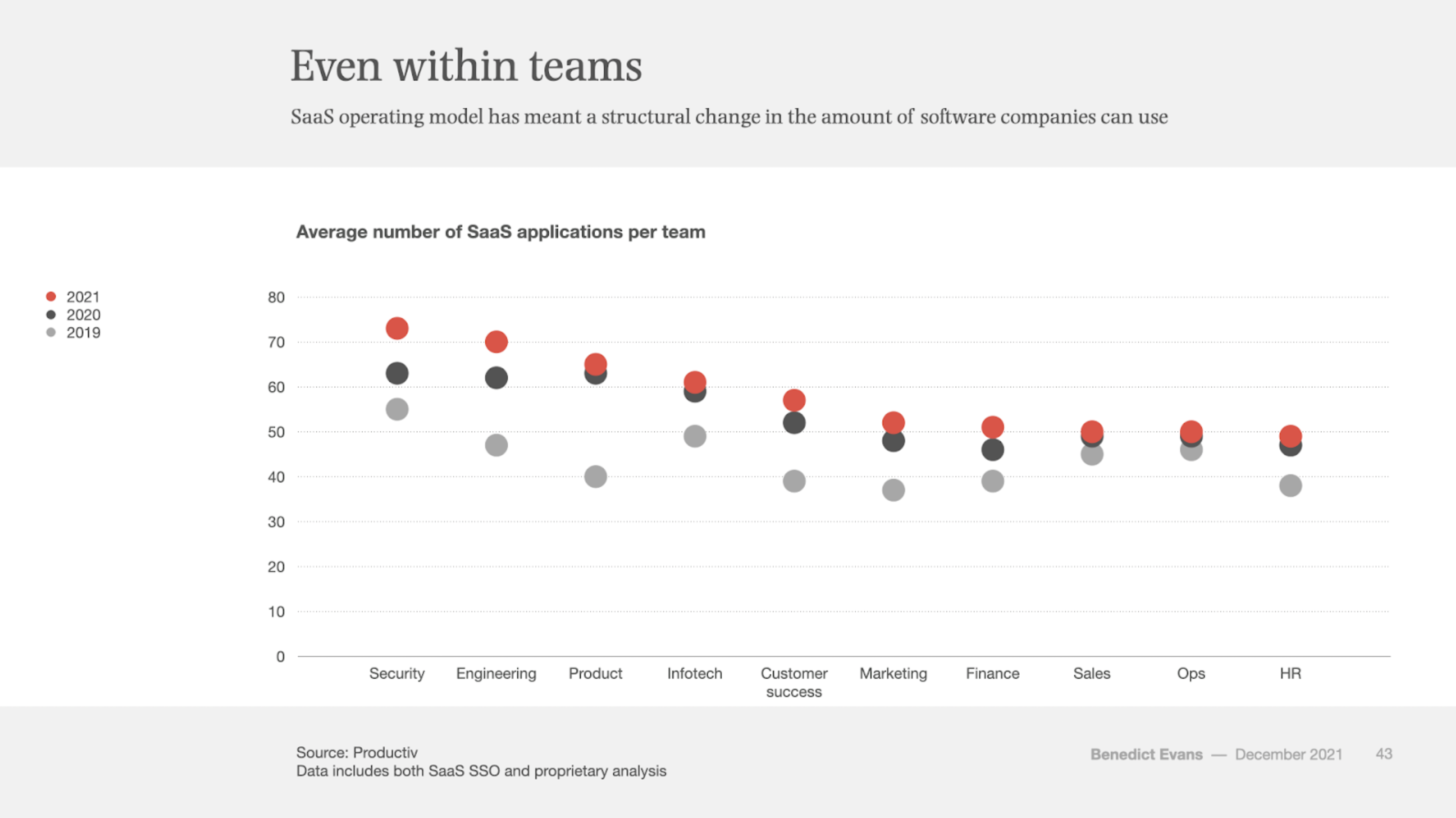

And in every team too:

Marketing and sales aren’t even the most app-laden teams. There’s a certain irony to security teams being identified as the source of greatest SaaS sprawl in the above data set from Productiv, a SaaS management platform. That same report from Productiv revealed that the average mid-size business now has 238 SaaS subscriptions.

And it’s not only commercial software that’s growing. A study from my friends at MarTech Alliance earlier this year revealed that the majority of marketing data platforms at companies have some custom-built elements of their stack, with hybrid combinations of in-house and vendor solutions now the most common.

If you want to see some examples of current martech stacks, the 29 entries from this year’s Stackie Awards include several terrific models and illustrations.

Martech: From Integration to Aggregation

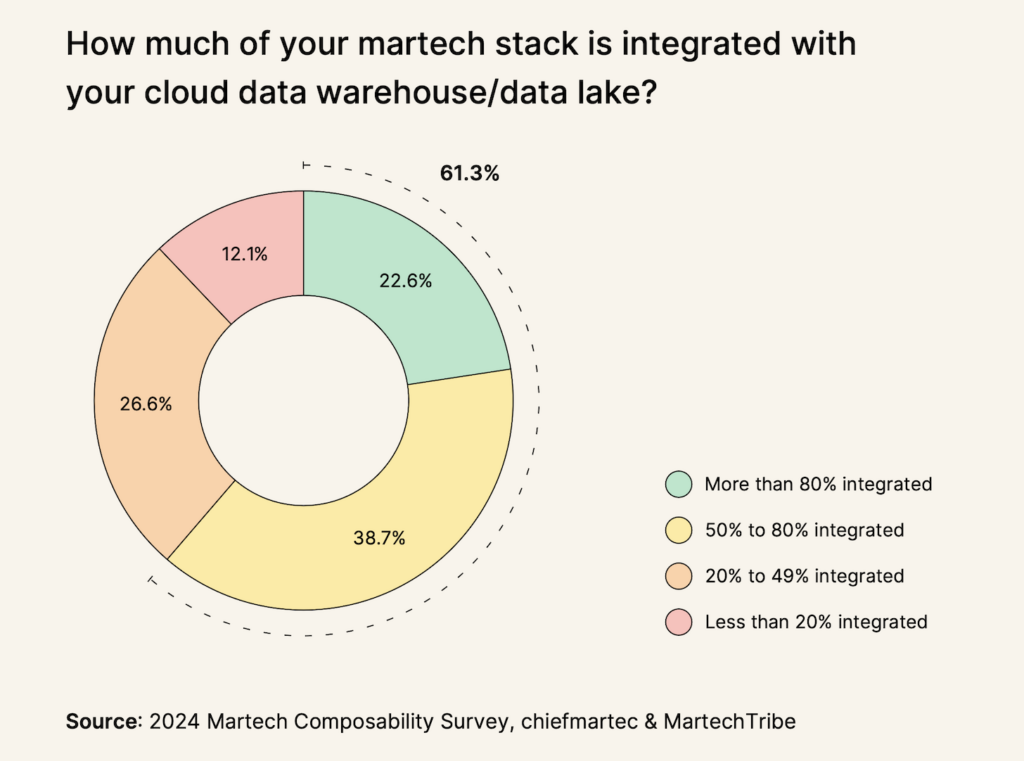

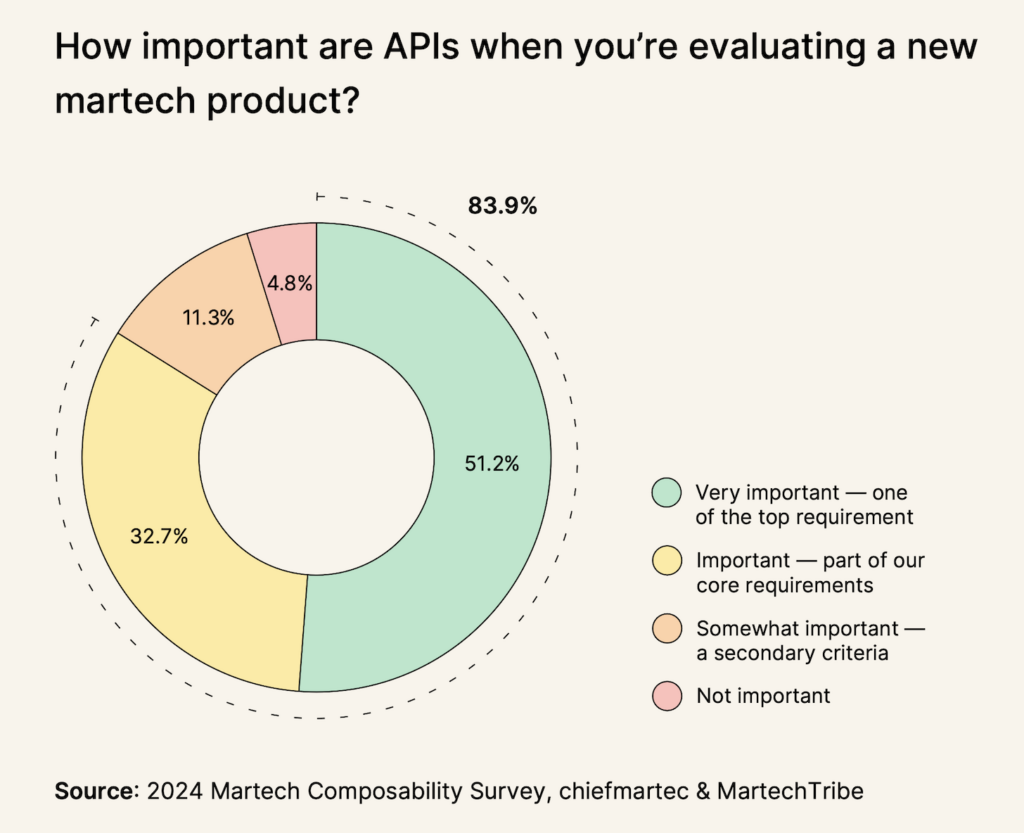

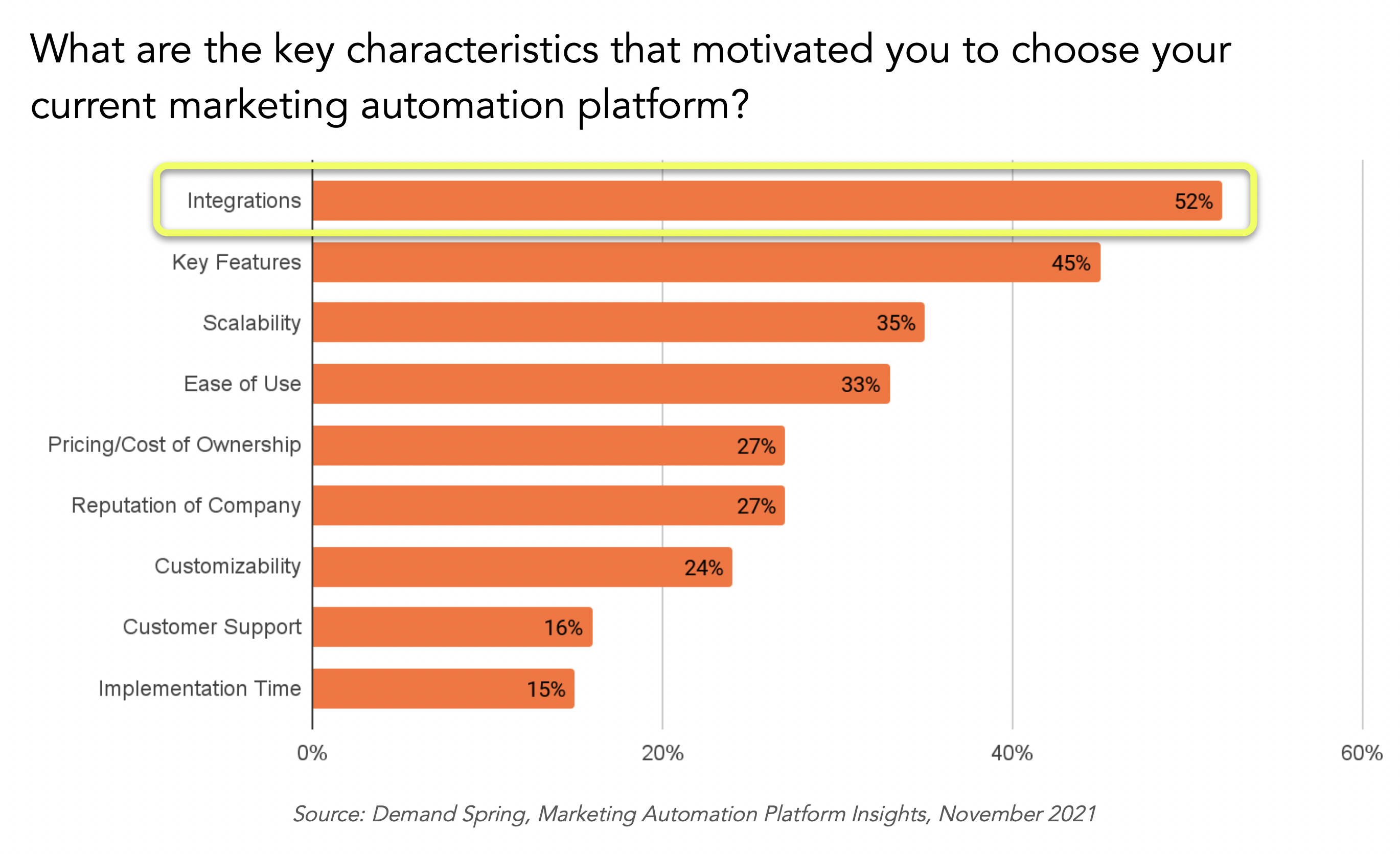

With all the heterogeneous software inside business tech stacks, including custom apps and growing adoption of external API service providers, it’s no surprise that integration remains at the top of marketers’ evaluation criteria when selecting new martech apps and platforms:

And most vendors have, at long last, started listening to this great booming voice from the sky: Arthur! Integrate thy software!

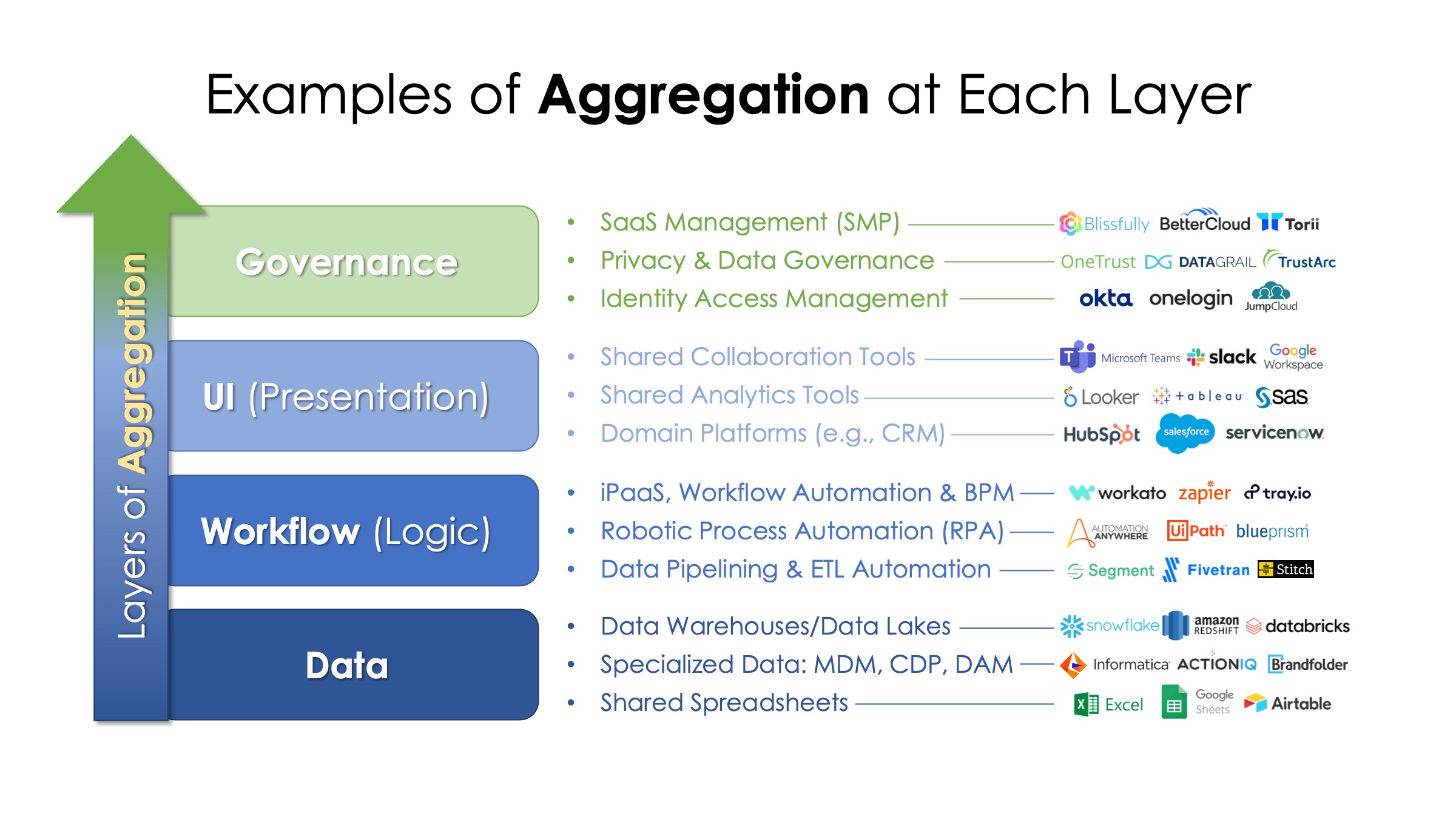

But there’s been a couple of interesting shifts. The first was a pattern that I recognized earlier this year of aggregation over consolidation. What’s the difference? Instead of products fighting to consolidate tech stacks to a small number of apps, many market leaders have adopted a strategy of embracing app diversity and serving as aggregation platforms instead.

It’s analogous to how B2C platforms such as marketplaces and social media networks aggregate creators, merchants, and providers — with a nod to Ben Thompson’s aggregation theory model. But in this case, it’s apps and data within an organization’s tech stack that are being aggregated.

So you could have a large number of disparate apps in your stack, but an aggregation platform unifies them virtually at the data layer (e.g., Snowflake), workflow layer (e.g., Workato), UI layer (e.g., Slack), and governance layer (e.g., Blissfully). Here are some more examples:

I’d go so far as to say this is an antifragile pattern. With solid aggregation platforms in place, tech stacks actually grow stronger with changes to apps and data, in contrast to fragile stacks that would easily break when something changed.

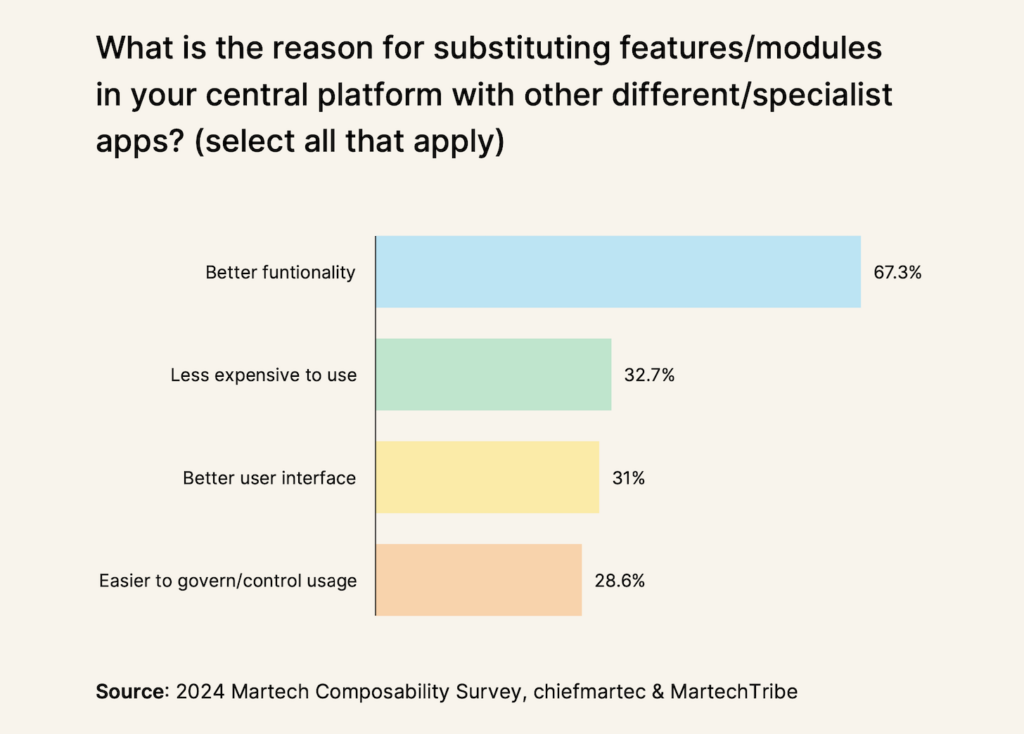

The latest Martech Replacement Survey from my friends at MarTech.org provided more empirical evidence for this shift with results that indicated that aggregation was the reason 67% of marketers replaced a martech tool in the past year.

The second shift in martech stacks was related to aggregation: the reintegration of martech into the broader tech stack of the business overall. You’ll notice that a lot of these aggregation platforms are not martech-specific. A huge part of their value is aggregating apps and data across all the different departments in an organization.

There will still be marketing-specific apps, for sure. But martech and marketing operations teams are increasingly leveraging data and services that span the entire business. This is game-changing — and if you’re a CMO, it’s likely crucial to your career to adapt accordingly.

No-Code & The (In-House) Creator Economy

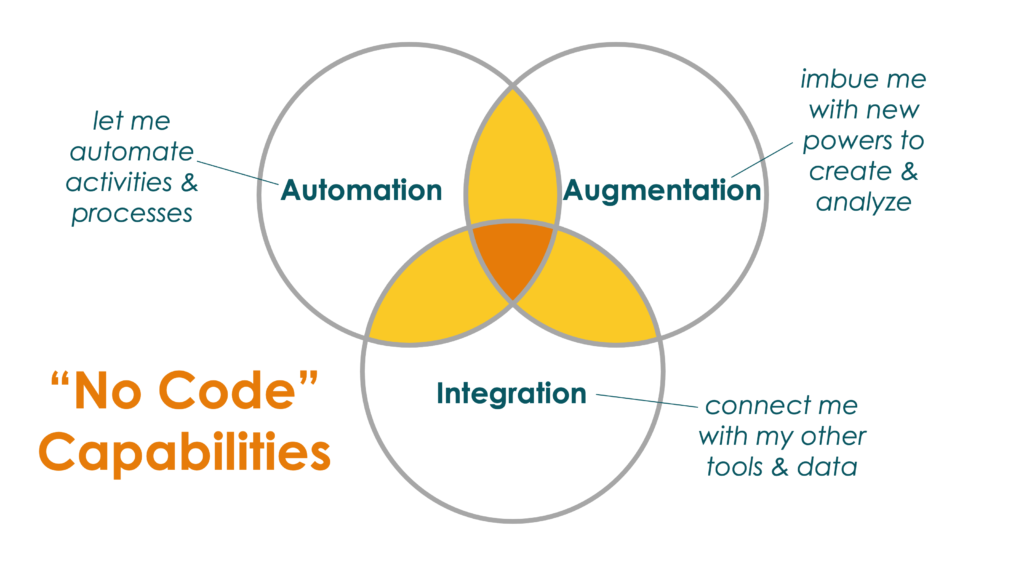

2021 also saw a huge acceleration of the no-code paradigm. It seems like nearly every product now is touting some kind of no-code capability. Honestly, that’s not entirely unreasonable if you interpret no-code broadly as empowering general business users (such as marketers) to self-service everything from generating creative assets to building simple machine learning models.

No-code isn’t just for apps. It’s all kinds of marketing superpowers.

While many no-code app building platforms were initially embraced by creators and early-stage entrepreneurs as a way to quickly turn their ideas into functional reality without much capital or specialized technical expertise, we’re starting to see these tools adopted by more mid-size and enterprise businesses now too.

It’s the blossoming of “in-house creators” — who I believe will thrive in 2022.

Gartner has characterized this as The Composable Enterprise, the idea that more and more apps and services will expose Lego-like building blocks that no-code/low-code users can mix-and-match and assemble into highly customized and adaptable employee experiences (EX) and customer experiences (CX).

This has already become quite popular in the category of workflow automation platforms such as Workato, Tray.io, Zapier, etc. What are we automating in marketing and sales? A lot.

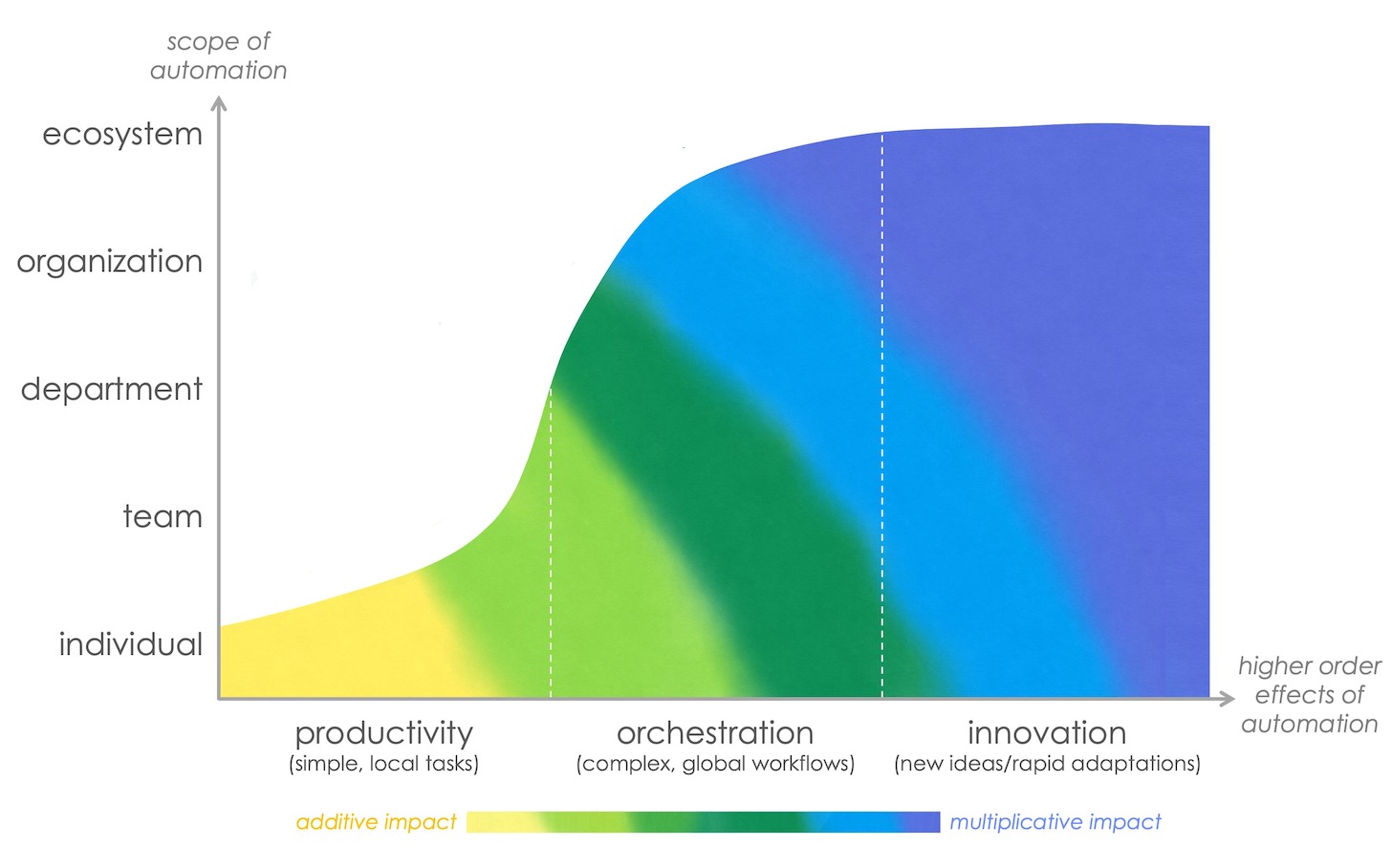

I’m pretty excited about the higher order effects of automation in Big Ops.

Agile Marketing Crossed the Tipping Point

Greater empowerment of individuals with no-code capabilities pairs beautifully with growing adoption of agile management methodologies. It was great to see in Agile Sherpa’s annual State of Agile Marketing report that in 2021, for the first time ever, more than half of marketing teams now reported using at least some elements of agile marketing in their organization.

And I’m still chuckling over my April Fool’s Day post about hyperagile marketing. (Hey, at least I amuse myself.)

A Martech Ecosystem Goes Mainstream

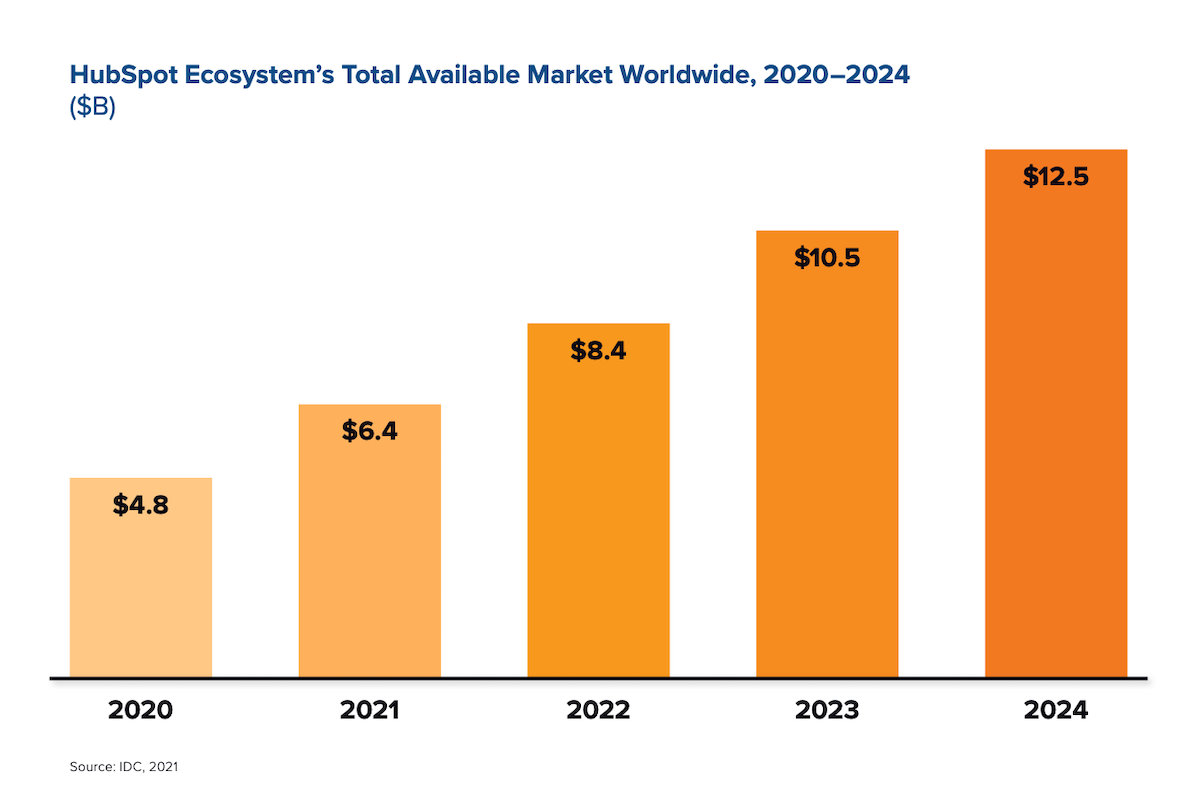

Finally, on a more personal note, 2021 was a remarkable year for HubSpot’s platform ecosystem. An IDC report at the start of the year sized the company’s ecosystem at $6.4 billion this year and predicted it will grow to $12.5 billion in 2024.

With more than 128,000 customers worldwide and over $1 billion in ARR, HubSpot has become a gravitational center for a blossoming app ecosystem in marketing, sales, and customer service. It’s attracted hundreds of leading SaaS companies in other categories to build deep integrations to the platform — and also inspired an emerging wave of entrepreneurs to create exclusive built-for-HubSpot apps.

I’m continually amazed by the combinatorial innovation these partners deliver to customers.

It’s been a real privilege to help shape the ecosystem of a major martech platform these past few years. I’ve always believed in the potential of an integrated martech ecosystem, but the journey of putting those ideas into practice has been a truly incredible experience. And in many ways we’re still just getting started. I’m super excited about what we have in store for the year ahead.

On that note, I hope you’re excited about the opportunities ahead in your work for 2022 too. It remains a truly remarkable time to be working in marketing and martech.

Best wishes to you for a Happy New Year!