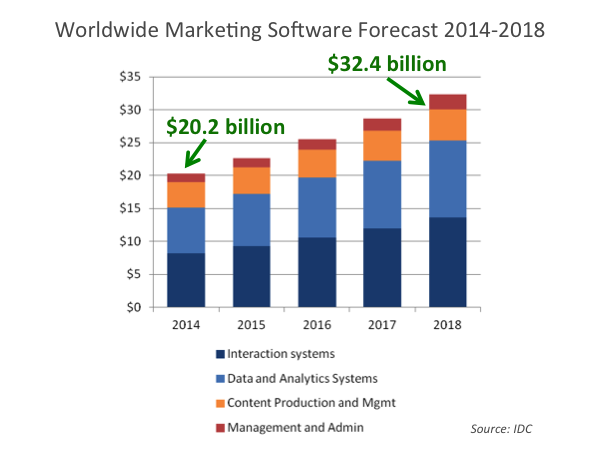

$20 billion global market for marketing software today

How big is the market for marketing software today? Gerry Murray at IDC has an answer to that question, which he announced in a blog post last week: $20.2 billion here in 2014. He expects that the market will have a compound annual growth rate (CAGR) of 12.4% for the next five years, resulting in a $32.4 billion market by 2018. IDC breaks that market down into four broad categories: Interaction Systems — the majority …

$20 billion global market for marketing software today Continue Reading »