A couple of weeks ago, I met with Stuart Williams and Seth Ulinski, analysts at TBR, who shared some of their latest digital marketing technology research with me. Many fascinating findings — including the stat that I shared at MarTech in Boston, that over 75% of enterprises now have an executive explicitly responsible for leading adoption of marketing technology.

But as they walked me through their deck, there was another finding of theirs that made me almost fall out of my chair: Amazon and Google have now each jumped into the lead of major martech categories.

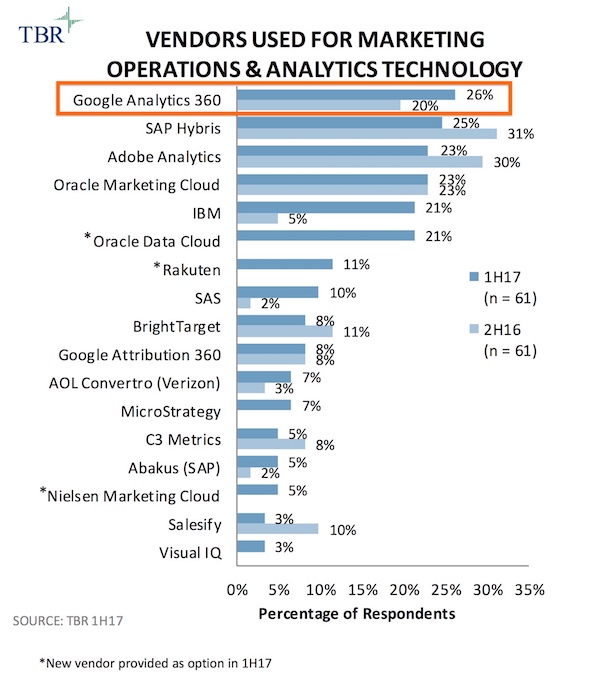

As you can see from TBR’s chart at the top of this post, in 2017, Google Analytics 360 was reported as the most frequently used vendor in the category of marketing operations & analytics technology.

Google Analytics 360 was adopted for marketing operations and analytics by more of the companies TBR surveyed than competitive products from SAP, Adobe, Oracle, IBM, and SAS. And when you look at the year-over-year data, from 2016 to 2017, Google is gaining in share of adoption, while SAP and Adobe — the two previous leaders in this study — have their share shrinking.

Now, as a caveat, Stuart from TBR commented, “Firms are adopting more than one platform in nearly every category. It’s not a zero-sum game. So the conclusion is that Amazon and Google are now also in the same environments as the traditional vendors. They are doing things the traditional vendors aren’t doing or can’t do — online commerce, search, content, etc.”

Although this phrase stood out to me:

[Amazon and Google] are doing things the traditional vendors aren’t doing or can’t do.

It’s also worth qualifying that TBR’s research was mostly conducted with large firms — the majority of the companies who participated in their study have more than 1,000 employees and more than $100 million in annual revenue — and these are samples subject to margins of error.

But still, even given those caveats and qualifications, you have to accept that Google is now a major enterprise marketing technology vendor.

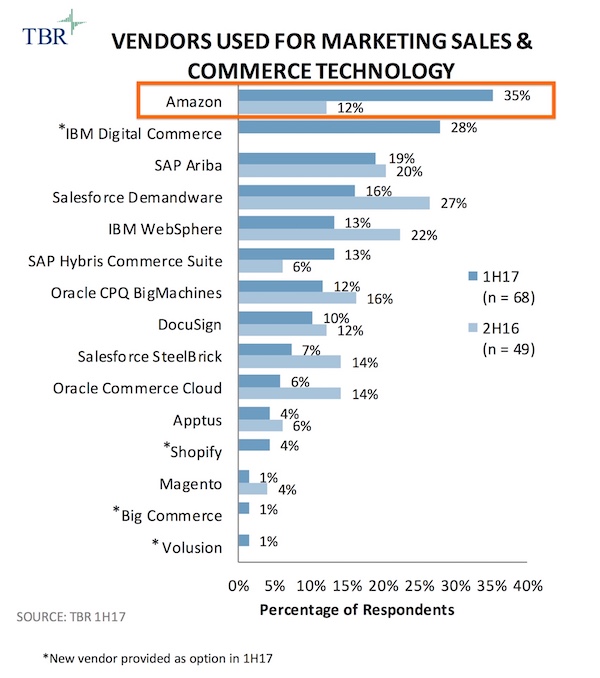

And if you think that’s remarkable, look at what’s happening in marketing sales and commerce technology:

The headline TBR put on their slide where the above chart appeared sums it up:

Amazon is a surprise leader as enterprises move to adopt its commerce platform; traditional vendors fight for legacy business.

Keeping in mind the same caveats noted for the marketing analytics category, the adoption of Amazon’s commerce solutions compared to those “traditional vendors” is nonetheless simply stunning:

- Amazon has 25% greater adoption than IBM Digital Commerce

- Amazon has 119% greater adoption than Salesforce Demandware

- Amazon has 169% greater adoption than SAP Hybris Commerce Suite

- Amazon has 483% greater adoption than Oracle Commerce Cloud

And all of those solutions dropped in relative incidence of adoption from 2016 to 2017 — except for Amazon, which gained a jaw-dropping 192% over that period. (There’s a little fuzziness around IBM, between their WebSphere and Digital Commerce solutions, which were surveyed differently by TBR year-over-year.)

Again, as Stuart noted earlier, this isn’t necessarily a zero-sum game, and the overall pie continues to get bigger, even as vendors jockey for the relative size of their slice. “The overall market continues to grow and each of the vendors who are declining in percent incidence are also growing their businesses.”

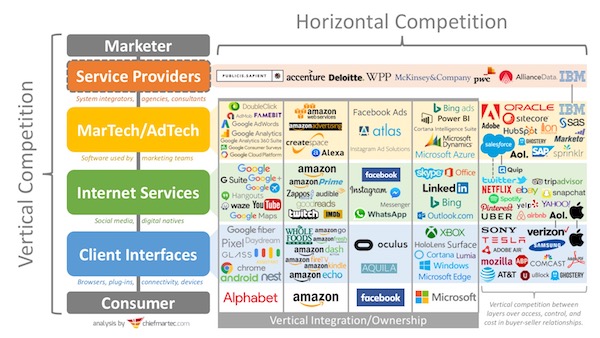

Still, as horizontal competitors in the martech space — Amazon and Google are in a very real sense competing fiercely against the classic enterprise provides like Adobe, IBM, Oracle, and Salesforce. It’s a game-changing shakeup in the market.

But what’s likely driving a big part of that disruption are the dynamics of vertical competition. Particularly in the context of commerce, Amazon is a uniquely powerful vertical competitor — through Amazon.com, Alexa, and now even Whole Foods, they have a growing portfolio of proprietary touchpoints with consumers.

This is “doing things the traditional vendors aren’t doing or can’t do.”

Amazon Advertising increasingly offers ways for marketers to tap into those exclusive channels. And makes it increasingly attractive for marketers to adopt more of Amazon’s solutions higher up in their martech stacks.

As TBR noted in their analysis, “Amazon rapidly increased in adoption as brands begin to leverage the growing connection between the commerce vendor and its Amazon Advertising platform.”

That’s vertical competition at work.

But there’s an upside for classic enterprise software giants too. As Seth commented to me, “[As the] Google-Amazon-Facebook triumvirate is capturing upwards of 90% of each incremental advertising dollar, the need for platforms, data management, and analytics is fueling opportunities in the ad tech sub-segment. [It’s an] adjacent market with a sub-market, but similar storyline: a big pie where heavyweights are capturing/eating massive pieces, but the pie is getting bigger.”

And as Stuart added in a parting remark, the multi-platform approach still continues to have challenges around the integration of data and processes. “This, in turn, is bringing the CIO and IT back into conversations as enterprises scale up all these solutions.”

It will be interesting to see how this plays out in 2018.

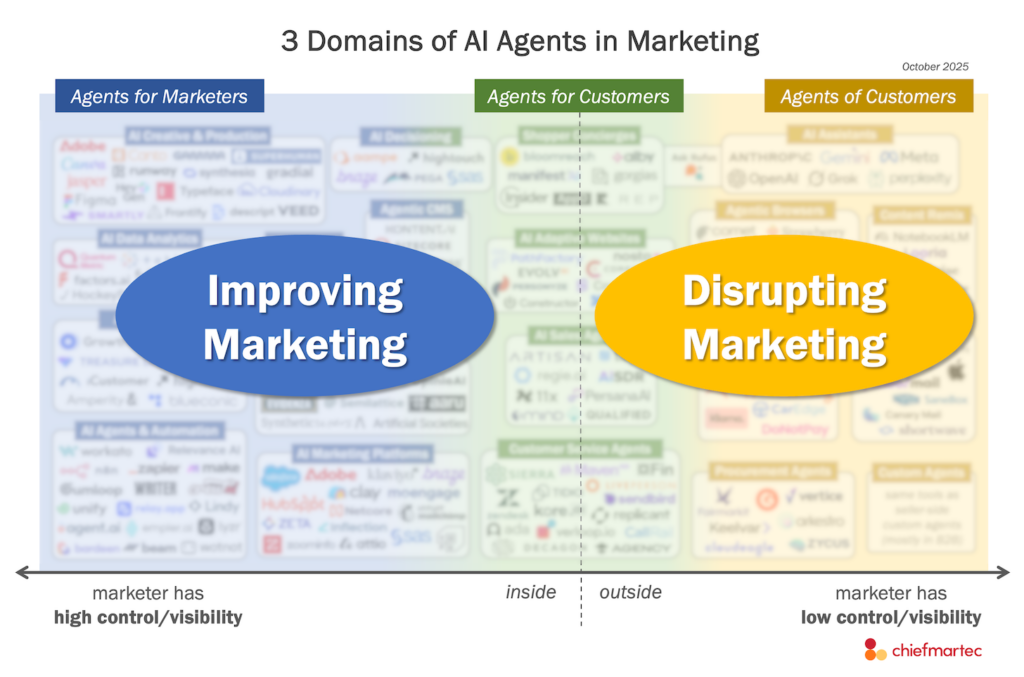

Important, yes. Surprising, no. Each of these vendors controls access to an important audience and proprietary data about that audience. This positions them to sell tools using that data. The real question is whether the same marketer can use multiple vertical stacks, which creates real competition, or whether marketers have to commit to a single stack, which puts the vendor in a near-monopoly position within those accounts. So far it seems companies can use multiple vertical stacks, although coordinating the experience of individual customers across stacks would be challenging.

There’s a separate question of whether consumers will also use multiple stacks or be trapped inside a single vendor’s walled garden ecosystem (see ‘personal network effect’). If the consumer market really splits into those sorts of tribes, then coordinating experience across vertical stacks becomes less of an issue because individual consumers will only exist within a single stack.

These are good questions.